Japanese Real Estate Investment Market 2012

April, 2012

Consulting Division

Marunouchi Kitaguchi Bldg. 1-6-5 Marunouchi, Chiyoda-ku,

Tokyo 100-0005, Japan

To create a transparent real estate investment market in Japan

This report has been produced by Nomura Research Institute solely for information purposes. It is not intended to be a

complete description of the markets or developments to which it refers. No warranty for representation, express or implied is

made as to the accuracy or completeness of any of the information herein and Nomura Research Institute shall not be liable

to any reader of this report or any third party in any way whatsoever.

whatsoever

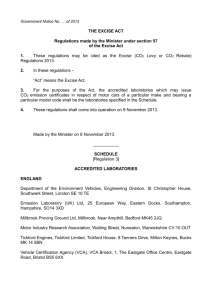

Research Framework and Perspectives

for this Report

p

Macrofundamentals

Financial and Capital Markets

GDP growth, corporate performance, demographic movements…

Interest rates, financial and other regulations, political trends…

Rental Market

Trading Market

Demand

Supply

Buyers

Lenders

Sellers

What are the key drivers of demand?

Which industries require more space?

Which districts are in demand?

…

How much floor space

is newly developed ?

How much ffloor space

p

is demolished?

…

What properties

interest buyers?

How strong is their

buying appetite?

What properties

are lenders willing

to finance?

What are the lending

conditions?

Who are the

potential sellers?

What assets are

likely to be sold?

Vacancies

Liquidity

Increase or decrease?

What kinds of properties are transacted successfully

andd what

h t are not?

t?

Rent and NOI

Cap Rate

Increase or decrease?

What cap rate level leads to successful transactions?

Will asset value rise or fall?

Times New Roman, size 8, color: Dark Gray

Asset Price Estimation

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

Ex)) Source: NRI based on IMF

2

Macro fundamentals of Japan

Overview of Real Estate Investment Market in Japan

Office market

Residential market

Retail property market

Operational asset market (logistics properties, hotels, and data centers)

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

3

Macro fundamentals of Japan

Overview of Real Estate Investment Market in Japan

Office market

Residential market

Retail property market

Operational asset market (logistics properties, hotels, and data centers)

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

4

Macro Fundamentals of Japan

Japan’s population is aging and shrinking due to low birth rate.

Total population peaked out in 2005

2005. The number of households is increasing for now

now, but it is

projected to decrease after 2015.

Population and Households in Japan

Population

(th

(thousand)

d)

← Actual

140,000

Forecast →

Households

(th

(thousand)

d)

70,000

120,000

60,000

100,000

50,000

80,000

40,000

60,000

30,000

40,000

20,000

20,000

10,000

0

0

1970 1975 1980 1985 1990 1995 2000 2005 2010 2015 2020 2025

65歳以上人口

O

Over

65 YRS

1515-64

15~64歳人口

64歳人口

15 64

YRS

0 0-14

0~14歳人口

0 14歳人口

14 YRS

世帯数

H

Households

h ld

Source: NRI based on National Institution of Population and Social

Security Research

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

5

Macro Fundamentals of Japan

Economic growth is weak and expected to remain so for the foreseeable future.

(%)

15.0 Real GDP Growth in Major Countries

←実績

←Actual

A実績 l

予測 → →

Forecast

F

China

10.0 India

Korea

5.0 US

UK

Japan

0.0 Japan

United States

United Kingdom

United Kingdom

Korea

China

India

‐5.0 ‐10.0 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

Source: NRI based on IMF

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

6

Macro Fundamentals of Japan

Despite the weak growth, Japan remains one of the largest economies in the world.

While Japan has fallen to third place after the US and China

China, it is expected to remain ahead of highgrowth countries including India, Brazil and Russia up to at least 2020.

Nominal GDP of Major Countries

((Billion USD))

25,000

←Result

←実績 Forecast

予測 →→

US

20,000

China

Japan

15,000

United States

United Kingdom

Korea

10,000

Japan

China

India

5,000

India

UK

Korea

0

Note:

Figures up to 2016 are IMF forecasts and those up to 2020 are

calculated with the assumption that the CAGR from 2011 to 2016 will

be maintained.

Source: NRI based on IMF

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

7

Macro Fundamentals of Japan

Post-earthquake

q

restoration has p

progressed

g

rapidly,

p y but corporate

p

earnings

g remain lackluster

due to the worldwide recession and a greatly appreciated yen.

The Industrial Production Index recovered more quickly after the Great East Japan Earthquake than after the Lehman

Ci i

Crisis.

Corporate earnings have picked up somewhat after falling steeply in the wake of the quake. They remain short of full

recovery, however, due to such factors as the European financial crisis, weak consumption in the US, and a strong yen.

Industrial Production Index

(Trillion yen)

110

Ordinary Income of Japanese Companies

16.0

14.0

100

12 0

12.0

Total

10.0

90

Non-manufacturing

8.0

6.0

Manufacturing

80

4.0

2.0

70

0.0

‐2.0

60

‐6 ‐5 ‐4 ‐3 ‐2 ‐1

0

1

2

東日本大震災(2011年2月=100)

Tohoku Earthquake

(Feb. 2011 = 100)

3

4

5

6

7

8

9 10 11 12

リーマンショック(2008年8月=100)

Lehman

Crisis

(Aug. 2008 = 100)

Source: NRI based on METI

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

‐4.0

1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q

CY08 CY08 CY08 CY08 CY09 CY09 CY09 CY09 CY10 CY10 CY10 CY10 CY11 CY11 CY11

全産業

Total

Manu製造業

非製造業

Non-manufacturing

facturing

Note: Except finance industry and insurance industry

Source: NRI based on MOF

8

Macro Fundamentals of Japan

A strong

g yyen has boosted Japanese

p

firms’ M&A activities abroad at the same time that it has

depressed manufacturers’ earnings and forced them to transfer production abroad .

Japanese Firms’ M&A Activities Abroad

Yen/Dollar Foreign Exchange Rate

(USDJPY)

140

(Billion yen)

12,000 60.0%

135

130

50.0%

10,000 125

40.0%

120

8,000 115

30.0%

110

6,000 20.0%

105

100

4,000 10.0%

95

90

2,000

2,000 0 0%

0.0%

85

80

0 ‐10.0%

75

70

金額

Amount

Source: NRI based on Bloomberg

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

Ratio

to total amount

全案件に占める割合

Source: NRI based on Recof

9

Macro Fundamentals of Japan

There are concerns about Japan’s huge fiscal deficit, which may drive up interest

rates in the future.

Currentlyy Japan

p keeps

p its interest rates at a lower level than that of countries rated higher

g

than Japan.

p

If the

irrational gap between the interest rate level and sovereign ratings is closed, Japan’s interest rates may raise.

Ratio of Government Debt to GDP

(%)

300

ÅActual

Long-term Interest Rates and Sovereign Ratings

(%)

7.0

ForecastÆ

Japan

250

6.0

5.0

US

AA+/Negative/A-1+

UK

AAA/Stable/A-1+

200

4.0

150

100

US

3.0

UK

2.0

Germany

50

1.0

Germany

AAA/Stable/A-1+

Japan

AA-/Negative/A-1+

0.0

0

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

Source: NRI based on IMF

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

Note: Ratings are as of Nov. 2011.

Source: NRI based on IMF and S&P

10

Macro Fundamentals of Japan

A financial collapse

p is unlikely

y as long

g as domestic capital

p

remains in Japan

p and

continues to circulate.

Household’s financial assets,, which had been decreasing

g since 2006,, posted

p

an increase in 2009 for the first time

in three years.

The possibility of Japanese government bonds collapsing is seen to be small, as more than 90 percent of the

bonds are held by domestic investors.

(Trillion yen)

Household’s Financial Assets in Japan

Government Bond Investors by Country

2,000

100%

1,500

75%

1,000

50%

500

25%

0

0%

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009

Japan

US

UK

Domestic Investors

Germany

Greece

Foreign Investors

Note: As of Dec. 2010

Source: NRI based BOJ

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

Source: NRI based on BOJ, FRB, ONS, Bundesbank, Bank of Greece

11

Macro Fundamentals of Japan

Tokyo remains the world’s top metropolis in terms of population and GDP.

Population and GDP in 2020 by City

GDP size in 2020

(Billion USD)

1,800

Tokyo

New York

1,600

1,400

1,200

1,000

Los Angeles

800

London

Mexico City

Paris

Osaka/Kobe

Sao Paulo

B

Buenos Aires

Ai

Shanghai

Seoul

Mumbai

Chicago

600

400

200

0

0

5,000

10,000

15,000

20,000

25,000

30,000

35,000

Population in 2020

(thousand)

40,000

Source: NRI based on PricewaterhouseCoopers and UN

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

12

Macro Fundamentals of Japan

Tokyo is the most popular headquarter location for Fortune Global 500 companies.

Fortune Global 500 Companies in Tokyo

Ranking among the Top 200

Number of Fortune Global 500 Companies by City (2011)

Rank

Tokyo, 47

Beijing, 41

Paris, 23

Ne York 18

New York, 18

London, 17

Others 327

Others, 327

Seoul, 12

Osaka 8

Osaka, 8

Toronto, 7

Company

9

Japan Post Holdings

31

Nippon Telegraph & Telephone

40

Hitachi

45

Honda Motor

58

JX Holdings

73

Sony

89

Toshiba

118

Tokyo Electric Power

125

Mitsubishi

131

Seven & I Holdings

141

Meiji Yasuda Life Insurance

148

Mitsui

153

Dai-ichi Life Insurance

157

Mitsubishi UFJ Financial Group

158

Fujitsu

173

Nippon Steel

189

Sumitomo Mitsui Financial Group

199

Marubeni

Note: Numbers indicate Global 500 ranking.

Source: NRI based on Fortune Global 500 2011

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

13

Macro Fundamentals of Japan

Population continues to increase in Greater Tokyo while declining in Japan overall.

The growth of Tokyo

Tokyo’ss population and households is expected to continue over the long term on the

strength of both natural and social increases.

Net Population Inflow into Greater Tokyo

Kanagawa

200,000

Tokyo

Chiba

Saitama

Total

150,000

Inflow

100,000

50,000

0

O tfl

Outflow

50 000

‐50,000

2010

2009

2008

2007

2006

2005

2004

2003

2002

2001

2000

1999

1998

1997

1996

1995

1994

1993

1992

1991

1990

‐100,000

Source: NRI based on Basic Resident Register Population Migration Report

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

14

Macro fundamentals of Japan

Overview of Real Estate Investment Market in Japan

Office market

Residential market

Retail property market

Operational asset market (logistics properties, hotels, and data centers)

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

15

Overview of Real Estate Investment Market in Japan

Japan has the second largest real estate investment market in the world.

Estimated Size of Institutional-Grade

Institutional Grade Real Estate by Country

New Zealand

Thailand 0.3%

Indonesia 0.3%

Estimated Size of Institutional-Grade

Institutional Grade Real Estate by Country in Asia-Pacific

Asia Pacific

Philippines Vietnam

0.2%

0.1%

0

Taiwan0.6%

0.7%

Hong Kong

0.8%

Singapore

0.9%

500

1,000

1,500

(US$B)

2,500

2,000

Japan

2,484

China

Turkey

1.0%

India

1.1%

M i

Mexico

1.3%

1,424

Australia

United States

27 5%

27.5%

Netherlands

1.5%

559

South Korea

South Korea

415

India

South Korea

1.7%

Russia

2.0%

23,879

US$B

Australia

2.3%

Spain

2.7%

Brazil

2.8%

Japan

10 4%

10.4%

Canada

2.9%

Italy

3.9%

France

4.9%

United

Kingdom

5.4%

Germany

6.3%

China

Chi

6.0%

271

Singapore

204

g

g

Hong Kong

98

198

Taiwan

173

Indonesia

155

Thailand

81

Malaysia

73

New Zealand

63

Philippines

39

Vietnam

17

Gulf Cooperation

Council

2.0%

Latin America

5.8%

Asia

Pacific

25.8%

Europe

36.0%

23,879

US$B

US/Canada

30.4%

Source: NRI based on PwC and ULI “Emerging Trends in Real Estate 2011”, Pramerica Real Estate Investors Research “A Bird‘s Eye View of Global Real Estate Markets: 2011 Update”

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

16

Overview of Real Estate Investment Market in Japan

Real Estate and Financial Assets and Real Estate Investment Market in 2010.

FINANCIAL ASSETS

5,715

Cash & deposits

Note: figures are trillions of yen

REAL ESTATE ASSETS

2,489

Land

B ildi

Buildings

: 1,205

: 1,284

1 284

1,288

Including 24 in foreign-currency deposits

821

(55%)

Investment assets

4 traditional assets:1,824

52

(3%)

Domestic equities (listed):320

Domestic bonds:1,148

Foreign equities & bonds:356

19

(2%)

Households

1,488

Private corporations

(non-financial)

786

Institutional investors

Alternative assets

<Income Property>

Corporate-owned Securitized Assets

C

rental properties

approx. 31

(ex. housing)

(J-REIT

96

approx. 8)

Equity

fi

financing

i

approx.12

Rental housing

28

Natural resources

Intellectual properties

& other assets

Investor Sector

Real estate related assets

Investment trusts:87

Structured-Financing Instruments:24

(CMBS: approx. 7)

Domestic equities (unlisted) & investments: 233

Derivatives:91

Debt financing

approx. 20

(NRL approx. 16)

8

(7%)

16

(4%)

Pension

P

i ffunds

d

122

Insurance Companies

373

13

(1%)

Other assets

Private financial institution lending:682

g

Insurance & pension reserves & Deposits

592

(39%)

Banks

1 523

1,523

Source) NRI Based on MLIT, CAO, BOJ, JASDA, ARES, Statistics Bureau, Trust Banking Association, STBRI

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

17

Overview of Real Estate Investment Market in Japan

Japan’s securitized real estate market has grown to 48 trillion yen since 1997.

Although the amount of acquisitions has dropped steeply since 2008

2008, assets worth 2

2.2

2 trillion yen were acquired for

securitization in 2010.

Acquisitions of Securitized Real Estate

(¥bn)

(No. of Transactions)

1,800 10,000

9,000

1,582

1,642

8,884

8,273

1,523

1,600 8,000

1,400 6,930

7,000

1,200 1,119

6,000

5,335

6,242

5 000

5,000

800 5,158

3,984

4,000

620

2,778

3,000

2,000

2,167

1,167

1,000

62

0

316

9

26

1997

1998

269

343

2,210

1999

2000

2001

J‐REIT (Left Axis)

275

2,236

2,031

1,772

611

2 195

2,195

1,798

161

74

518

456

3,308

1,867

600 2,838

4,440

2,541

1,000 7,205

305

2002

676

895

2003

2004

Non J‐REIT (Left Axis)

2005

2006

1,591

200 1,359

1,679

2007

628

439

604

2008

2009

2010

No. of Transactions (Right Axis)

400 0 ( FY)

Source: NRI based on MLIT

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

18

Overview of Real Estate Investment Market in Japan

The office sector accounts for 38 percent of the total amount of securitized real

estate.

Residential properties comprise 18 percent and retail 15 percent,

percent so that office

office, residential and retail combined

constitute 70 percent of securitized real estate.

Acquisitions of Securitized Real Estate by Asset Class

(¥bn)

8,000

7,000

Other

23.7%

Office

37.6%

6,000

Industrial

2.5%

Retail 14.8%

4,000

359

1,472

Residenti

al

18.1%

291

1,107

981

790

902

77

34

12

300

71

1,000

4

49

1997

805

166

19

59

211

597

746

1998

1999

2000

1,293

1,589

61

25

808

418

38

686

270

1,611

2,194

552

1,516

1,728

2,124

2,503

Office

2002

Residential

479

365

348

167

289

235

891

710

2001

493

130

565

145

79

160

97

161

267

1,321

835

404

512

0

259

193

263

120

122

67

3,000

2 000

2,000

1,398

1,706

Approx.

43Trillion

Yen

Hotel

3.3%

5,000

1,644

2003

2004

Retail Industrial

2005

Hotel

2006

2007

2008

32

556

2009

48

63

252

441

768

2010

Other

Source: NRI based on MLIT

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

19

Overview of Real Estate Investment Market in Japan

Japan’s securitization market was dominated by office properties at first, but various

other types of real estate have been securitized in recent years.

Manufacturing facilities,

facilities logistics facilities and hotels are being securitized in addition to office

office, residential

residential, and retail

properties.

Net Asset Amount of Securitized Real Estates by Asset Class

100%

7 2%

7.2%

6.1%

12.4%

90%

13.3%

18.8%

6.8%

80%

7.7%

16.1%

3.8%

1.0%

19.9%

24.8%

33.2%

0.5%

0.7%

6.2%

2.1%

1 3%

1.3%

8.1%

70%

13.7%

10.4%

2.5%

1.1%

30.3%

60%

11.1%

2.4%

1.6%

16.5%

11.1%

8.3%

4.0%

4

0%

3.0%

12.3%

24.0%

20.4%

18.1%

5.2%

1.7%

5.4%

3.8%

1 8%

1.8%

4 2%

4.2%

16.2%

14.3%

22.2%

2.0%

10.1%

23.9%

2.3%

3 1%

3.1%

12.2%

20.8%

17.6%

18.9%

50%

8.9%

40%

29.2%

26.5%

23.2%

34.2%

34.1%

31.0%

2003

2004

2005

2006

Retail

Industrial

16.0%

22.7%

79.4%

67.0%

19.3%

20.1%

21 3%

21.3%

15.1%

14.3%

62.4%

30%

51.2%

20%

41.7%

39.9%

29.3%

36.5%

38.7%

2007

2008

33.8%

37.1%

10%

0%

1997

1998

1999

2000

2001

Office

2002

Residential

Hotel

2009

2010

Other

Source: NRI based on MLIT

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

20

Overview of Real Estate Investment Market in Japan

Securitized real estate markets outside Tokyo have shrunk, causing 78 percent of securitized

real estate acquisitions in 2010 to be concentrated in the Tokyo Metropolitan Area.

Most of the securitized properties were in the Tokyo Metropolitan Area

Area, with only 8 – 10 percent in the Osaka

Metropolitan Area.

Number of Properties Securitized by Prefecture

0%

10%

20%

30%

2010

40%

50%

60%

66.0%

70%

6.2%

80%

2.9% 2.7%

90%

6.9%

100%

1.5%

1.2% 1.2% 1.7%

2.1%

7.5%

Greater Tokyo Area: 77.8%

2009

53.0%

2008

2007

4.0%

51.9%

5.1%

41.9%

Tokyo 6.4%

Kanagawa

Chiba

Saitama

Osaka

3.3% 2.4%

Hyogo

Aichi

4.0% 2.5%

3.1% 4.5%

10.5%

Fukuoka

8.4%

8.8%

6.4%

Hokkaido

2.2%

6.9%

4.0% 2.8%2.2%

1.4% 5.5%

6.0%

Miyagi

3.7% 2.6%2.0%

4.6%

3.1%

10.0%

11.4%

15.3%

Others

Source: NRI based on MLIT

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

21

Overview of Real Estate Investment Market in Japan

The Japanese

p

real estate market experienced

p

a speculative

p

bubble and collapse

p

around 1990.

Land prices rose and fell steeply in the late 1980’s

1980 s and early 1990’s

1990 s, especially in the commercial districts of

metropolitan areas.

Long-Term Trend of Japanese Land Prices

600

500

400

300

200

100

0

Average of Three Categories

Commericial

Residential

Industrial

* Index: The end of March of 2000 =100 , Data of six major cities of Tokyo, Yokohama, Nagoya, Kyoto, Osaka and Kobe

Source: NRI based on Japan Real Estate Institute

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

22

Overview of Real Estate Investment Market in Japan

Total return has recovered to the p

plus level,, and capital

p

return is showing

g signs

g of

following suit.

After the summer of 2009,

2009 capital return finally ceased declining and reversed trends upwards

upwards. Meanwhile

Meanwhile, income

return remained stable at around 5 percent even during the turmoil period following the Lehman Shock.

Performance Trend in Japan

20.0%

15.0%

10.0%

5.0%

0.0%

‐5.0%

‐10.0%

‐15.0%

Total Return

Capital Return

Income Return

Source: IPD Japan

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

23

Overview of Real Estate Investment Market in Japan

Cap rates have leveled off since returning to the 2005 level.

Cap rates declined steadily up to the end of the second quarter of 2008

2008, after which they headed upwards for a

while. They are on a plateau at present, and this trend is expected to continue for a while.

Cap rate gaps between regions and between asset classes remain more or less unchanged.

Cap Rate Trend in Japan

8.0%

7.0%

6.0%

5.0%

4.0%

3.0%

Office Tokyo CBD

Office Osaka CBD

Retail Tokyo

Residential Tokyo

Source: NRI based on Japan Real Estate Institute

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

24

Overview of Real Estate Investment Market in Japan

The J-REIT market,, which was formed in September

p

2001,, has shrunk by

y half from

its peak, with capitalization at approximately 3.0 trillion yen.

The JJ-REIT

REIT market started in September 2001 with two listings and a market capitalization of approximately 25

billion yen.

Currently, there are 34 listed J-REITs with a total share value of approximately 3.0 trillion yen.

J-REIT Market Capitalization

(¥bn)

7,000 6,000 5,000 4,000 3,000 2,000 1,000 0 Office REITs

Residential REITs

Other REITs

Source: SMTRI “SMTRI J-REIT Index”

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

25

Overview of Real Estate Investment Market in Japan

More than 70 percent of J-REIT assets are located in the Tokyo Metropolitan Area,

and approximately 55 percent of J-REIT assets are office properties.

Asset Mix of J-REITs by Area and Asset Class

Others

7.9%

Other Areas

7.6%

Kinki Area

12.3%

Chubu Area

3 6%

3.6%

Approx.

Approx

8.2

Trillion

Yen

Retail

18.4%

5 Central

Wards of

Tokyo

43.7%

Approx.

Approx

8.2

Trillion

Yen

Kanto Area

15.7%

Office

55.2%

Residential

18.5%

23 Wards of

Tokyo

y

17.1%

G

Greater

t Tokyo

T k Area

A

76.5%

* As of the end of October of 2011

Source: NRI based on ARES

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

26

Overview of Real Estate Investment Market in Japan

The Tokyo Stock Exchange (TSE) REIT Index has moved more or less in tandem

with TOPIX and the listed Real Estate Industry Index.

The TSE REIT Index has dropped sharply from its peak in May 2007

2007.

(Index:Feb‐10=1,000)

3,500

TSE REIT Index, TOPIX, and the Listed Real Estate Industry Index

3,000

2,500

2,000

1,500

1,000

500

0

TOPIX

TOPIX Real Estate Index

TSE REIT Index

TSE REIT Office Index

TSE REIT Retail & Logistics, Others Index

TSE REIT Residential Index

Source: NRI based on Bloomberg

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

27

Overview of Real Estate Investment Market in Japan

CMBS issuance has decreased drastically since 2008,

and at present only RMBS is issued at a constant pace.

Most recently,

recently about 90 percent of residential mortgage-backed

mortgage backed securities were originated by the Japan Housing

Finance Agency.

Backed Securities Breakdown by Type of Backing and RMBS Breakdown by Originator

0%

(¥100m)

60,000

2004FY 1H

2004FY 2H

2005FY 1H

2005FY 2H

2006FY 1H

2006FY 2H

2007FY 1H

2007FY 2H

2008FY 1H

2008FY 2H

2009FY 1H

2009FY 2H

2010FY 1H

2010FY 2H

2010FY 2H

2011FY 1H

50,000

40,000

4,370

7,418

30,000

20%

40%

60%

80%

100%

15.5%

14.2%

44.8%

39.6%

39.8%

46.4%

66.7%

71.6%

79.7%

65.9%

85.1%

88.4%

87.6%

93 7%

93.7%

89.8%

7,679

8,755

6,937

20,000

32,311

1,994

Japan Housing Finance Agency

10,338

3,511

Nonbank

Others

563

980

20,955

14,815

Local bank

30,260

2 038

2,038

10,000

City bank・Trust Bank

16,935

16,276

1,701

16,352

12,143

9,702

11,113

7,537

413

341

138

8,491

8,341

2009

2nd Half

2010

1st Half

15,064

11,132

0

2004

1st Half

2004

2nd Half

RMBS

2005

1st Half

CMBS

2005

2nd Half

CDO

2006

1st Half

Lease

2006

2nd Half

2007

1st Half

Consumer Loan

2007

2nd Half

2008

1st Half

Shopping Credit

2008

2nd Half

2009

1st Half

Receivable・Commercial bill

2010

2nd Half

2011

1st Half

Others

Source: NRI based on Japan Securities Dealers Association

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

28

Overview of Real Estate Investment Market in Japan

Lenders’ liberal attitude has slightly increased despite the Great East Japan

Earthquake.

Local financial institutions’ willingness to extend real estate loans has gradually improved, but foreign-based

institutions have become less willing, especially in mezzanine financing,

f

so that the average gearing off real estate

players runs at 50 – 70 percent. Gearing as high as 90 percent has virtually disappeared.

Financial Institutions’ Lending Attitude toward Real Estate Industry

100

00

80

60

Loose

40

20

0

‐20

Tight

‐40

‐60

‐80

‐100

Total Enterprise Middle market enterprise

Minor enterprise

Source: NRI based on BOJ

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

29

Overview of Real Estate Investment Market in Japan

Japanese institutional investors still remain cautious about real estate investments

Pension funds are particularly reluctant to invest in real estate and are unlikely to become active investors for the

foreseeable future.

Pension Funds’ Interest or Involvement

in Real Estate Investment

Pension Funds Investment Trend on Real Estate

0%

100%

20%

40%

60%

80%

100%

90%

2006

80%

70%

23.8%

1.4%

20.3%

9.1%

39.9%

5.6%

44.4%

65.6%

74.6%

60%

75.0%

60.4%

67.7%

66.2%

63.8%

0.9%

2007

21.0%

2008

21.8%

2.8% 13.6%

12.5%

47.7%

2.3%

14.1%

46.5%

2.4%

11.4%

48.6%

1.9%

50%

40%

29.1%

0.6%

0.8%

30%

2.3%

20%

18.4%

10%

2.6%

4.0%

3.8%

13.9%

15.4%

23.1%

3.1%

10.3%

18.8%

5.2%

3.2%

6.3%

2006

2007

2008

2009

2006

In a year 4.3%

14.9%

11.7%

11.8%

5.3%

4.6%

5.3%

2007

2008

2009

In 3‐5 years

Increase investment Keep current investment

Decrease investment

Don't invest

7.1% 8.2%

21.2%

4 1%

4.1%

15.4%

8.8%

0%

2.6%

4.2%

6.4%

Change attitude as the market

2009

30.5%

3.8%

3.8%

Investing

Used to invest, but not any more

Used to invest, but not any more

Considering

Used to consider, but not any more Never having consider, neither will do No answer

Source: NRI based on MLIT

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

30

Macro fundamentals of Japan

Overview of Real Estate Investment Market in Japan

Office market

Residential market

Retail property market

Operational asset market (logistics properties, hotels, and data centers)

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

31

Office Market

Tokyo, Osaka and Nagoya account for 50 percent of Japan’s commercial real estate.

Commercial Real Estate Stock in Japan

New Construction of Office Space by Area

(million m2 )

25,000

Tokyo 16.0%

22,711

Tokyo Area

29 5%

29.5%

Other 27 Pref. 24.0%

20,099

20,000

Kanagawa 6.0%

15,000

Commercial

Real Estate

0.8 billion

m2

Tochigi 1.5%

Nagano 1.6%

Miyagi 1.8%

y g

13,857

Chiba 3.9%

12,262

11,602

1,777

11,337

Saitama 3.7%

1,803

,

10 132

10,132

10,000 3,352

Niigata 1.8%

8,699

2,506

Ibaragi 2.1%

9,001

8,345

8,496

8,369

7,670

6,955 6,880

Osaka 8.5%

Hiroshima 2.3%

8,659

7,852

7,053

6,941

6,350

1,134

959

Shizuoka 2.9%

1,803

5,000

8,344

Fukuoka 4.0%

Hokkaido 4.1%

Mie 1.4%

Aichi 6.3%

Gifu 1.6%

Hyogo 3.9%

Kyoto 2.0%

Nara 0.7%

Osaka Area

15.1%

1,002

583

838 472

701

651

729 1,028

768 975 751

1,092 654 390

937

934

7,616

1,754

879

664 768 691

1,397

1,029

1,221

1,450

1,354

844

953 835

1,184

4,249

3,798 3,495

3,491 3,921

3,094 3,460

2,934

2,878 2,443 3,019 2,885

2,736

2,4322,452

2,3652,331

2,195

929

838 2,248

0

Nagoya Area

9.2%

Note: Commercial Real Estate means offices, retails, and banks.

Source: NRI based on Ministry of Internal Affaires and Communications

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

Tokyo Area

Osaka Area

Nagoya Area

Source: NRI based on MLIT “Statistics of Building Construction Starts”

Other Areas

32

Office Market

Corporate-owned rental real estate is 96 trillion yen in 2008,

which is increased by 30 trillion yen over five years.

The asset value of corporate-owned rental real estate (excluding residential) increased by 30 trillion

yen over five years, from 68 trillion yen in 2003 to 96 trillion yen in 2008.

Asset Value of Corporate-Owned Rental Real Estate (excl. Residential)

(¥tn)

100

96

90

26

80

70

60

68

19

35

50

40

21

30

20

35

28

10

0

2003

Leasing Land

2008

Ground of Leasing Buildings

Leasing Building

Source: NRI based on MLIT “Basic Survey on Land”

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

33

Office Market

Tokyo accounts for 56 percent of Japan’s office market.

There are approximately 89 million square meters of rentable office floor space in Japan

Japan.

Tokyo has approximately 50 million square meters of office floor space, which represents 56 percent

of the overall Japanese market.

Office Floor Space Shares by Major City

100%

3.9%

90%

2.1%

80%

(1 9 milil sq.m))

(1.9

15.3%

70%

60%

1.1%

5.3%

(1.0 mil sq.m)

2.2%

(13.64 mil sq.m)

1.3%

5.8%

2.8%

(2.5 mil sq.m)

2.4%

(2.1 mil sq.m)

1.9%

(1.7 mil sq.m)

(3.4 mil sq.m)

(5.2 mil sq.m)

(1 1 mil sq.m)

(1.1

sq m)

Osaka Area

18.6%

(1.9 mil sq.m)

(4.7 mil sq.m)

Major

ajo 12 Cities

C t es

89.29 mil sq.m

50%

40%

30%

56.1%

Greater Tokyo Area

64.7%

(50.07 mil sq.m)

20%

10%

0%

T k

Tokyo

Y k h

Yokohama

S it

Saitama

Chib

Chiba

O k

Osaka

K b

Kobe

Source: NRI based on JREI

As of Dec .2010

The investigation focus on central area of each city.

In Tokyo, Osaka and Nagoya buildings which are smaller than 5,000 square meter are excluded

In other nine cities buildings which are smaller than 3,000 square meter are excluded

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

K t

Kyoto

N

Nagoya

F k k

Fukuoka

S

Sapporo

S d i

Sendai

Hi hi

Hiroshima

34

Office Market

There are five sub sectors in Tokyo’s CBD area.

Tokyo’s

Tokyo s office markets are mainly located in the five central wards: Chiyoda

Chiyoda, Minato

Minato, Chuo

Chuo, Shinjuku and Shibuya

Shibuya.

This small area contains most of the S class and A class buildings, and the 33 million people who live in Tokyo and

its satellite cities gather to this CBD area.

Comfortable residential areas in the suburbs and highly developed transportation systems enable the Tokyo

Metropolitan Area to function as a single mega city

city.

Adachi

Itabashi

Kita

Arakawa

Saitama

7.2 million people

Tokyo

13.1 million

Kanagawa

9.0 million

Chiba

6.2 million

Katsushika

Toshima

Bunkyo Taito Sumida

Nakano

Edogawa

Shinjuku

Chiyoda

Koto

Chuo

30 km

Shibuya

Minato

Setagaya

Meguro

Shinagawa

Ohta

30 km

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

35

Office Market

Office vacancy rates in Tokyo rise to 20-year high.

The so

so-called

called “Year

Year 2003 Problem”

Problem of offices in Tokyo

Tokyo, ii.e.

e that the market will be hit by excess supply in 2003

2003,

turned out to be a false scare, and office vacancy in Tokyo decreased significantly from 2005 to 2007. However, the

financial crisis in 2008 drastically altered the situation.

At present, office vacancy rates in Tokyo are at the highest level in 20 years.

Office Vacancy in Tokyo CBD

12.0%

10.0%

Shibuya

Minato

Shinjuku

Chuo

Chiyoda

8.0%

Minato

Shinjuku

Shibuya

Chuo

Chiyoda

6.0%

4 0%

4.0%

2.0%

0.0%

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Jan‐07

Jul‐07

Jan‐08

Jul‐08

Jan‐09

Jul‐09

Jan‐10

Jul‐10

Jan‐11

Jul‐11

Source: NRI based on Miki Shoji

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

36

Office Market

Rent has declined gradually due to the high vacancy rates.

Office rents have dropped to the lowest level in 10 years

years, and there are no signs that the decline with

stop anytime soon.

Office Rents in Tokyo CBD

(yen/tsubo per month)

26,000 24,000 22,000 20,000 Chiyoda

Shibuya

Minato

18,000 Chiyoda

Minato

Shibuya

Chuo

Chuo

16,000 Shinjuku

Shinjuku

14,000 ,

12,000 10,000 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 Jan‐07

Jan 07

Jul 07

Jul‐07

Jan 08

Jan‐08

Jul 08

Jul‐08

Jan 09

Jan‐09

Jul 09

Jul‐09

Jan 10

Jan‐10

Jul 10

Jul‐10

Jan 11

Jan‐11

Jul 11

Jul‐11

Source: NRI based on Miki Shoji

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

37

Office Market

Huge supply in the CBD will worsen market conditions.

There are 119 large

large-scale

scale office buildings (total floor space of 10

10,000

000 square meters or larger) slated for completion

between 2010 and 2015. The buildings altogether will provide 8.0 million square meters of new office space.

In 2012, when new supply will be at peak, there will be 32 completed buildings and 2.1 million square meters of new

office space in Marunouchi, Otemachi, Nakano, Odaiba and other districts.

Office Space Supply in Tokyo

Office supply area

(thousand sq.m.)

2,500

70

Office supply area

2,000

2,160

Number of

building supplied

60

Number of building supplied

1,810

50

1,500

40

1,170

850

1,000

870900

570

500

30

20

340

0

1

1986

1987

1

1988

1

1989

1

1990

1

1991

1

1992

1

1993

1

1994

1

1995

1

1996

1

1997

1

1998

1

1999

1

2000

2

2001

2

2002

2

2003

2

2004

2

2005

2

2006

2

2007

2

2008

2

2009

2

2010

2

2011

2

2012

2

2013

2

2014

2

2015

2

2016

2

0

10

Source: Mori Building

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

38

Office Market

Cap rates have risen but still remain below 5 percent.

Cap rates of office buildings in Tokyo fell steeply from 2000

2000. The drop was driven by the participation of many

foreign and domestic investors in the Tokyo market and the ease with which investors could procure cheap loans

and high LTV. From 2006 to 2008, the cap rate in Marunouchi ran at less than 4 percent. This means that there

were not enough investable buildings.

Cap rates rose approximately 100 basis points after the financial crisis

crisis. However

However, they remain at less than 5

percent, which is not very attractive for investors.

Cap

p Rate Trend of Tokyo

y Office Market

8.0%

7.0%

Marunouchi

6.0%

Nihonbashi

Roppongi

5.0%

Shinagawa

Shinjuku

4.0%

Sep‐11

Apr‐11

Nov‐10

Jun‐10

Jan‐10

Aug‐09

Mar‐09

Oct‐08

May‐08

Dec‐07

Jul‐07

Feb‐07

Sep‐06

Apr‐06

Nov‐05

Jun‐05

Jan‐05

Aug‐04

Mar‐04

Oct‐03

3 0%

3.0%

Source: NRI based on JREI

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

39

Office Market

Osaka struggles with constitutional weakness.

Huge supplies in 2008 and 2009 have boosted vacancy to over 11 percent

percent. Supply may remain unchanged in the

coming years, causing vacancy to rise still further.

Office workers and sales workers in Osaka have decreased since 1996. This movement is different from other cities

in Japan. Market observers predict that the increase of vacancy and decrease of rent will continue over the medium

to long term

term.

Office Space Supply and Vacancy in Osaka

Number of Office Workers and Sales Workers by Major City

Total Area

of office supply

pp y

(1000 sq.m)

35.0 Vacancy

y

10 thousand p

people

p

15.0%

1600

13.0%

1400

11.0%

1200

9.0%

1000

7.0%

800

5.0%

600

2006

3.0%

400

2011

5.0 1.0%

200

0.0 ‐1.0%

30.0 11.5%

24.1 25 0

25.0 23 4

23.4 20.0 16.8 10.0 1991

1996

15.8 2001

13.5 8.3 9.6 1992

2

1993

3

1994

4

1995

5

1996

6

1997

7

1998

8

1999

9

2000

0

2001

1

2002

2

2003

3

2004

4

2005

5

2006

6

2007

7

2008

8

2009

9

2010

0

2011

1

2012

2

2013

3

2014

4

2015

5

15.0 1986

2016

0

Sapporo

Sendai

Yokohama Nagoya

Osaka

Fukuoka

Forecast

Source:NLI Research

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

Source:NLI Research

40

Office Market

Cap rates in regional cities are currently on a plateau after having risen steeply.

In Tokyo

Tokyo, cap rates have remained at the same level since 2009

2009. Similarly

Similarly, cap rates in regional

cities such as Sapporo, Nagoya and Osaka have leveled off.

Office Cap Rates in Major Regional Cities

8.0%

7.0%

Sapporo

Sendai

6.0%

Nagoya

g y

Osaka

5.0%

Fukuoka

4 0%

4.0%

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

Sep‐11

Apr‐11

Nov‐10

Jun‐10

Jan‐10

Aug‐09

Mar‐09

Oct‐08

08

May‐0

Dec‐07

Jul‐0

07

Feb‐0

07

06

Sep‐0

Apr‐06

Nov‐0

05

05

Jun‐0

Jan‐05

Aug‐04

Mar‐04

Oct‐03

3.0%

Source: NRI based on JREI

41

Macro fundamentals of Japan

Overview of Real Estate Investment Market in Japan

Office market

Residential market

Retail property market

Operational asset market (logistics properties, hotels, and data centers)

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

42

Residential Market

About 20 percent of all households in Japan are living in non-public rental

apartments, and the percentage is trending upwards.

Households living in non-public rental apartments (excluding wooden apartments; hereafter the same

in this section), which numbered 3.32 million in 1988, increased by about 2.6 times to 8.77 million

(about 18% of all households) in 2008.

Number of Households by Housing Type 1988 - 2008

B kd

Breakdown

off All Households

H

h ld b

by H

Housing

i T

Type (2008)

Own House

63%

Number of House holds (unit: 10,00

00)

Private Rental House, Apartment House (non‐

House (non

wood)

18%

6,000 Company Housing

3%

20%

5,000 4,077 12%

4,000 3,741 15%

4,392 16%

4,686 ,

18%

4,960 18%

16%

14%

12%

3,000 3,000

9%

10%

0%

8%

2,000 1,401 1 000

1,000 332 1,569 502 1,673 647

647 1,717 747 1,777 877 6%

4%

2%

0 0%

'88

'93

'98

'03

Ratio of Households LLiving in Private R

Rental &

Apartment Houses (non‐wood)

Public Rental House

6%

Private Rental ate e ta

Housing, Others

10%

'08

Households Living in Housing

Households

Living in Housing

Households Living in Rental Houses

Households Living in Private Rental & Apartment Houses (non‐wood)

Ratio of Households Living in Private Rental & Apartment Houses (non‐wood)

Source: “Housing and Land Survey”, Ministry of Internal Affairs and Communications of Japan. Charts and graphs created by NRI.

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

43

Residential Market

The total number of moving households has decreased, but the number of

households moving to non-public rental apartments has remained fairly steady.

The number of moving households peaked out in 1994-98 and decreased to about 85 percent of the peak-time level

i 2004

in

2004-08

08 .

The number of households moving to non-public rental apartments remained steady, resulting in a higher proportion

of such households in the total number of moving households.

1,600

1,400

1,200

39%

1,103

600

50%

45%

44%

1,221

,

1 186

1,186

45%

40%

1,135

1,039

1,000

800

46%

45%

884

30%

868

782

532

35%

778

557

427

25%

698

502

466

400

20%

15%

10%

200

5%

0

0%

84‐88

89‐93

94‐98

99‐03

04‐08

Number of Moving Households in Past 5 Years

N

b

fM i H

h ld i P t 5 Y

Number of Households Moved into Rental Houses

Number of Households Moved into Private Rental (Apartment) Houses

Ratio of Households Moved into Private Rental (Apartment) Houses

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

Ratio off Households Living in Private Rental & Apartment Houses

Numbe

er of Moving Ho

ouseholds (Unitt: 10,000)

Housing Choices of Moving Households 1984 - 2008

Source: “Housing and Land Survey”, Ministry of Internal

Affairs and Communications of Japan. Charts and graphs

created by NRI.

44

Residential Market

The majority of households moving to non-public

non public rental apartments moved

within the same city.

Looking at the former locations of households moving into non-public rental apartments in seven major cities, those

th t moved

that

d within

ithi th

the same city

it were greater

t iin number

b th

than th

those th

thatt moved

d iin ffrom outside

t id th

the city.

it

Tokyo’s 23 wards and Osaka saw a decline in households moving into non-public rental apartments from outside

the city, while major regional cities saw no change.

Location Choices of Moving Households

Household moving in a city

Household moving out a city

450 400 350 300 266 207 197 250 200 150 105 Sapporo

Sendai

86 77 Tokyo 23 Wards

Nagoya

Osaka

Hiroshima

04‐08

99‐03

94‐98

04‐08

99‐03

94‐98

04‐08

99‐03

94‐98

04‐08

99‐03

94‐98

04‐08

47 49 45 47

45 49

36 37 32 73 61 53 56 57 57 27 27 23 47 46 41 99‐03

04‐08

99‐03

94‐98

04‐08

0 50 46 48 25 24 24 28 30 28 32 28 27 99‐03

50 165 157 148 58 54 54 94‐98

100 94‐98

Breakdow

wn of In‐Flow Ho

ouseholds Movved in Private Ren

ntal Houses (non‐wood) (Unit:: 1,000)

500 Fukuoka

Source: “Housing and Land Survey”, Ministry of Internal Affairs and Communications of Japan. Charts and graphs created by NRI.

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

45

Residential Market

The supply

pp y of non-public

p

rental apartment

p

units has increased more sharply

p y than

total housing stock.

The growth of rental apartments (public and non

non-public

public combined) outpaced the growth of overall housing as well

as the more modest rise of rental housing in general.

As a result, the ratio of rental apartments to total rental houses increased from 60 to 70 percent.

Housing Stock by Type 1988

1988-2008

2008

Housing Growth Rates by Type

130 70 120

120 44 39 16 18 22 21 20 15 14 12 10 Growth Rate (1

1988 = 100)

Housing Sttock (Unit: 1 million

n)

50

50 30 20 124 53 50 40 125 57 60 115 110 105 103 100 90 '88

'93

'98

'03

Number of Houses

Number of Rental Houses

Number of Rental & Apartment Houses (non‐wood)

'08

108 108 95 0 115 112 85 100 Number of Houses

Number of Rental Houses

Number of Rental & Apartment Houses (non‐wood)

80 98

'98

'03

03

'08

08

Source: “Housing and Land Survey”, Ministry of Internal Affairs and Communications of Japan. Charts and graphs created by NRI.

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

46

Residential Market

New rental housing starts have declined and are less concentrated in the Tokyo

Metropolitan Area.

New housing construction starts decreased drastically in 1997, 2007 and 2009. The ratio of rental housing dropped

sharply

h l iin 2009

2009, and

d new rental

t lh

housing

i starts

t t d

decreased

d significantly.

i ifi

tl

Looking at yearly breakdowns of new rental housing construction starts by region, the composition ratio of the

Tokyo Metropolitan Area has dropped sharply, while that of the Kinki region has increased.

Breakdown of New Rental Housing Construction by Region

50%

100%

1,800

45%

90%

1,600

40%

1,400

35%

1,200

30%

1,000

25%

800

20%

600

15%

400

10%

200

5%

0

0%

91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11

House Built for Sale

H

B ilt f S l

Own House

Company House

C

H

Ratio of Rental House

R t lH

Rental House

Note: Date for 2011 is up to November.

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

Ratio of N

New Rental Housing Construction Start s by Region

n

2,000

Ratio of Re

ental Houses

Numb

ber of Constructio n Starts (Unit: 1,00

00)

New Housing Supply Trend: 1991-2011

80%

35%

42%

46%

41%

38%

70%

60%

50%

12%

11%

40%

13%

13%

Regional Area

Regional Area

16%

12%

18%

42%

42%

Kinki Chubu 11%

30%

20%

20%

11%

38%

31%

26%

'01

'06

'11

10%

Metro Tokyo

0%

'91

'96

Source: “Survey of Construction Work Started”, Ministry of Land, Infrastructure,

Transport and Tourism of Japan. Charts and graphs created by NRI.

47

Residential Market

Vacancy rates trended downwards in central Tokyo and in Osaka.

Vacancy rates trended downwards in central Tokyo (23 wards) and Osaka but upwards in major regional cities.

Most recently in the Tokyo Metropolitan Area, vacancy rates have risen slightly in Kanagawa Prefecture and the

outlying areas of Tokyo.

Vacancy Rates of Rental Housing (non-wood) in Major Cities

'98

'03

17 '08

Vacanccy Rate of Rental Ho using (non‐wood) (U

Unit:%)

20%

15%

10%

5%

16 15 14 13 12 11 Total Area Tokyo

10 23 Wards Tokyo

9 Urban Area Tokyo

Kanagawa 8 0%

Sapporo

Sendai

Tokyo 23 Tokyo

23 Nagoya

Wards

Osaka

Hiroshima Fukuoka

Source: Data from “Housing and Land Survey”, Ministry of Internal Affairs and

Communications of Japan. Charts and graphs created by NRI.

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sept

Oct

Nov

Dec

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sept

Oct

Nov

Dec

Vacancy Rate off Rental Housing((non‐wood) (Unitt:%)

25%

Vacancy Rates of Rental Housing in Tokyo Metropolitan Area

2010

2011

Source: “Report on Rental Housing Market”, TAS Corp. (Analyzed by TAS Corp. Data

Supplied by At Home Co., Ltd.) Charts and graphs created by NRI.

48

Residential Market

The rent level of non-public rental housing continues to fall.

The rent level of non-public

non public rental housing rose steadily from 1990 to 2000

2000, after which it gradually declined

declined. The

rent level downward trend continued in 2011.

Rent in the Private Sector (Annual Average) – Nationwide and Central Tokyo

Private ((Annual Average)) Rent Index (Basse Year 2010)

108 0

108.0 106.0 104.0 102 0

102.0 100.0 98.0 96 0

96.0 94.0 92.0 Japan

90 0

90.0 Tokyo 23 Wards

88.0 86.0 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11

Source: “Consumer Price Index”, Ministry of Internal Affairs and Communications of Japan. Charts and graphs created by NRI.

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

49

Residential Market

Occupancy rates of REIT-owned properties are rising, while their rent levels remain

stable.

The occupancy rates of REIT-owned

REIT owned residential properties in Tokyo,

Tokyo excluding the three central wards of Chiyoda

Chiyoda,

Minato and Chuo, have increased since August 2009, while their monthly rents have remained stable.

Occupancy

p

y Rates of REIT-owned Properties

p

Monthlyy Rents of REIT-owned Properties

p

100%

5,000 23 Wards Tokyo

4,500 Nagoya

4 000

4,000 Monthly Rent ((Unit: yen/m3 )

Occupancy R

Rate (Unit: %)

98%

3 Central Wards Tokyo

Osaka

Fukuoka

96%

94%

3,500 3,000 2 500

2,500 2,000 3 Central Wards Tokyo

1,500 23 Wards Tokyo

1,000 ,

92%

Nagoya

Osaka

500 Fukuoka

0 90%

Jan

Apr

Jul

09

Oct

Jan

Apr

Jul

Oct

Jan

Apr

10

Jul

11

Oct

Jan Apr

Jul

09

Oct Jan Apr

Jul

10

Oct Jan Apr

Jul

Oct

11

Source: “ARES J-REIT Property Database”, Association for Real Estate Securitization of Japan. Charts and graphs created by NRI.

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

50

Residential Market

The rate of housing ownership, which has a negative impact on rental housing

demand, has reversed trends downwards.

Average annual income has decreased since 2007,

2007 and the housing ownership rate has declined since 2008

2008.

Housing Ownership Rate and Average Annual Income in Japan

90%

700

680

House Ow

wnership Rate

85%

660

650

645

645

80%

649

660

81%

80%

80%

640

81%

637

75%

77%

77%

77%

78%

78%

630

620

616

600

House Ownership

Annual Income

70%

Average

e Annual Income (Unit: 10,000 ye

en)

683

580

'02

'03

'04

'05

'06

'07

'08

'09

'10

Source: “Consumer Price Index (CPI)”, Ministry of Internal Affairs and Communications of Japan. Charts and graphs created by NRI.

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

51

Macro fundamentals of Japan

Overview of Real Estate Investment Market in Japan

Office market

Residential market

Retail property market

Operational asset market (logistics properties, hotels, and data centers)

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

52

Retail Property Market

Development of large-scale retail stores has started to recover since 2010.

Development of large-scale retail stores

stores, which fell steeply after Lehman shock

shock, bottomed out in

2009 and is now on the recovery path.

New Retail Space Supply vs. Number of Development Project Cases

Floor Space 5,000,000

(Sq.m)

4,500,000

900

800

786

738

726

4,000,000

751

730

728

Reported

Development

Projects

700

651

3,500,000

584

600

3,000,000

500

500

2,500,000

450

400

2,000,000

300

1,500,000

200

1 000 000

1,000,000

100

500,000

0

0

1

2

3

4

5

6

7

8

9

10

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Note: The reported numbers for the fiscal years 2002 and 2008 include stores without floor space indication.

Source: Ministry of Economy, Trade and Industry of Japan. Charts and graphs created by NRI.

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

53

Retail Property Market

The growth of retail floor space supply has slowed considerably.

The CAGR of retail floor space in eight years from 1999 to 2007 was only 1

1.4%.

4%

Retail Floor Space

(Mil sq.m)

160

160 CAGR 1.4%

1 4%

140 134 150 144 141 120 100 80 60 40 20 0 1999

2002

2004

2007

Source:”Census of Commerce”, Ministry of Economy, Trade and Industry of Japan. Charts and graphs created by NRI.

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

54

Retail Property Market

Total floor space of shopping centers appears to have reached saturation level.

The total floor space of shopping centers remained more or less unchanged over the past five years

at around 45 million square meters.

(Mil Sq.m)

50 45 Total Floor Space of Shopping Centers (Sq.m)

43 45 47

47 42 43 2008

2009

44 40 35 30 25 20 15 10 5 0

0 2005

2006

2007

2010

Source: “SC White Paper”, Japan Council of Shopping Centers. Charts and graphs created by NRI

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

55

Retail Property Market

Retail sales have dropped

pp steadily,

y, especially

p

y at department

p

stores after the

Lehman shock.

(%)

Year-on-Year Changes in Annual Revenues - Shopping Centers, Department Stores and Chain Stores

2

0

2000

‐2

‐4

‐2.2

‐0.4

2001

‐2.2

‐3.4

2002

‐2.1

‐2.3

2003

2004

‐1.6

1.6

‐1 7

‐1.7

‐2.8

‐3.2

‐2.8

‐3.5

0.3

‐0.2

2005

0.3

2006‐0.7

‐2.6

‐2.7

0

2007‐0.5

‐1.4

2008‐0.7

‐1.5

‐4.3

‐5.1

2009

2010

‐2

‐2.6

‐3.1

‐4.3

‐5.2

‐6

‐6.8

‐8

‐10

Shopping center

Department store

Chain Stores

‐10.1

‐12

Source:Japan Council of Shopping Centers. Charts and graphs created by NRI.

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

56

Retail Property Market

Consumer confidence has recovered to the level before the earthquake.

After Great East Japan Earthquake

Earthquake, consumption fell temporarily in a "mood

mood of voluntary restraint"

restraint . However,

However by

early summer, consumer confidence had recovered to nearly the same level as before the earthquake.

Consumer Confidence Index

60

50

▼ March 2011

Occurrence of Great East

Japan Earthquake

40

30

20

10

0

Jan Mar May Jul Sep Nov Jan Mar May Jul Sep Nov Jan Mar May Jul Sep Nov Jan Mar May Jul Sep Nov Jan Mar May Jul Sep

2007

2008

2009

2010

2011

Source: “Consumer Confidence Survey”, Cabinet Office, Government of Japan. Charts and graphs created by NRI.

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

57

Retail Property Market

Rent levels in regional

g

cities have declined steadily,

y and the rent level g

gap

p between regional

g

cities and downtown Tokyo (e.g. Ginza) has widened.

First Floor Monthly Rent Ranking of 13 Major Commercial Districts in Japan (Yen / Tsubo = Appox

First-Floor

Appox.3.3

3 3 Sq.m))

Sq m))

(Thousand 55

Yen)

50

1 銀座

1. Ginza

2 新宿

2. Shinjuku

45

3 表参道

3. Omotesando

T k CBD

Tokyo

40

Tokyo CBD

4 渋谷

4

渋谷

4

4.

Shib

Shibuya

Downtown

Tokyo

5 池袋

5. Ikebukuro

6 神戸

6. Kobe

35

7 心斎橋

7.Shinsaibashi

30

8 福岡

8. Fukuoka

9 京都

9. Kyoto

25

Regional Cities

10 札幌

10. Sapporo

Regional Cities

20

Regional

Cities

11 栄

11

栄 Sakae

11

11.

12 仙台

12. Sendai

15

13 横浜

13. Yokohama

10

09年下半期

2009

2ndd half

10年下半期

2010

2ndd half

11年上半期

2011 2ndd half

Source: “Store Rent Trend”, Japan Real Estate Institute. Charts and graphs created by NRI.

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

58

Retail Property Market

Development and expansion of airport-vicinity outlet malls targeting visitors from

abroad as well as domestic shoppers have increased.

Outlet Mall Expansion & New Construction Projects in Tokyo Metropolitan Area in Recent Years

Karuizawa Prince Shopping Plaza

i

i

h

i

l

Opened in ’95, extended in ’98. Retail space 32,000 m2

Operator: Seibu Properties

Oarai Resort Outlet

Opened in ’06. Retail space 17,000 m2

Operator: Yatsugatake Mall Management

Sano Premium Outlet

Opened in Opened

in ’03

03, extended in extended in ’08

08. Retail space 37,000 m

Retail space 37 000 m2

Operator: Chelsea Japan

Lake Town Outlet

Ami Premium Outlet

Opened in ’11. Retail space 26,000 m2 Operator: Aeon Retail

Opened in ’09, extended in ’11. Retail space 21,000 m2

Operator: Chelsea Japan

p

p

Mitsui Outlet Park Iruma

Mitsui Outlet Park Iruma

Opened in ’08. Retail space 32,000 m2

Operator: Mitsui Outlet Park

Narita

Airport

Venus Outlet

Renovated and opened in ’09. Retail space 10,000 m2

Operator: Venus Fort Mitsui Outlet Park Tama Minami Osawa

Opened in ’00, extended in ’07. Retail space 21,000 m2

Operator: LaLaport Management

Haneda

Airport

Mitsui Outlet Park Makuhari

Opened in ’00. Retail space 16,000 m2

Operator: Mitsui Outlet Park

Mitsui Outlet Park Yokohama Bayside

Mitsui Outlet Park Kisarazu

Opened in ’96, extended in ’08. Retail space 15,000 m2

Operator: Mitsui Outlet Park

Opened in ’12. Retail space 28,000 m2

Operator: Mitsui Outlet Park

Gotemba Premium Outlet

2

Opened in ’96, extended in ’08. Retail space 45,000 m

p

,

p

,

Operator: Chelsea Japan

Highway

Highway (in planning)

Source: Homepages of outlet mall operating companies. Charts and graphs created by NRI.

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

59

Retail Property Market

Development of large-scale commercial complexes in conjunction with the

redevelopment of train stations have increased in recent years.

As railroad companies renovate their aged stations and station buildings, they are actively promoting the

development of commercial facilities where department stores and specialty shops would be leased

leased.

Recently Opened or Planned Station-Front Commercial Facilities

Station

Sendai

Station

Chiba

Operator

East Japan Railway

Operator

East Japan Railway

Project

Development of hotels, commercial facilities

and office buildings on the grounds of ca.

68,000 m2 with investment of 10 billion yen.

Project

Reconstruction of Station and Station

Building. Development of commercial

facilities with retail space of ca.50,000 m2.

Scheduled

to open

2017 - 18

Scheduled 2016 - 18

to open

Station

Osaka

Station

Tamachi – Shinagawa

Operator

West Japan Railway

Operator

East Japan Railway

Project

j

Reconstruction of North Station and Station

Building. Development of office and commercial

facilities with retail space of ca. 130,000 m2 to

house department stores and specialized

shops.

Project

Redevelopment of ca. 150,000 m2 vacant

l t off the

lot

th former

f

Tamachi

T

hi Depot

D

t Center

C t into

i t

offices and commercial facilities.

Opened

May 2011

Station

Scheduled To be decided

to open

Station

Yokohama

Hakata

Operator

East Japan Railway, Tokyu

Operator

Kyusyu Railway

Project

Project

Reconstruction of Station and Station Building.

Development of commercial facilities with retail

space off ca.180,000

180 000 m2 to

t house

h

d

department

t

t

store.

Reconstruction of South Station and

Station Building. Development of office and

commercial facilities with retail space of ca.

130,000 m2.

Opened

March 2011

Scheduled 2019

to open

Source: Newspaper articles

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

60

Macro fundamentals of Japan

Overview of Real Estate Investment Market in Japan

Office market

Residential market

Retail property market

Operational asset market (logistics properties, hotels, and data centers)

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

61

Logistics Property Market

The volume of motor freight

g has p

peaked out,, and the domestic transportation

p

market

is shrinking.

The

e volume

o u e of

o motor

oto freight

e g t ttransportation

a spo tat o iss on

o a declining

dec

g trend,

t e d, especially

espec a y p

private

ate motor

oto freight

e g t in recent

ece t yea

years.

s

Commercial motor freight had increased steadily until it reached a peak in around 2000.

Private motor freight had dropped particularly steeply after the financial crisis.

(mil. tons)

(

)

Motor Freight Transport

7,000

Private

Commercial

6,000

5,000

4,000

3,000

2,000

1,000

FY50

FY55

FY60

FY65

FY70

FY75

FY80

FY83

FY84

FY85

FY86

FY87

FY88

FY89

FY90

FY91

FY92

FY93

FY94

FY95

FY96

FY97

FY98

FY99

FY00

FY01

FY02

FY03

FY04

FY05

FY06

FY07

FY08

FY09

0

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

Source: MLIT Gov.

62

Logistics Property Market

New supply

pp y is smaller,, while the size of individual properties

p p

is larger

g due a rising

g

tendency for companies to consolidate their logistics functions.

While the number of newly developed warehouses has decreased in recent years, gross floor area per building has expanded.

Thi

This is

i attributable

ib bl to companies’

i ’ need

d ffor llarger, more hi

high-performance

h

f

warehouses

h

in

i conjunction

j

i with

i h their

h i adoption

d i off supply

l chain

h i

management and consolidation measures to save costs.

Both the number of buildings supplied and gross floor area per building reversed trends upwards in 2010.

Number of Warehouses Supplied and Gross Floor Area per Warehouse – All Industries

(units)

(㎡)

60,000

600

50,000

500

40,000

400

30,000

300

20,000

200

10,000

100

Warehouse

Copyright (C) 2012 Nomura Research Institute, Ltd. All rights reserved.

FY1

10

FY0

09

FY0

08

FY0

07

FY0

06

FY0

05

FY0

04

FY0

03

FY0

02

FY0

01

FY0

00

FY9

99

FY9

98

FY9

97

FY9

96

FY9

95

FY9

94

FY9

93

FY9

92

FY9

91

FY9

90

FY8

89

0

FY8

88

0

Gross floor space per warehouse

Source: MLIT Gov.

63

Logistics Property Market

Vacancy rates have dropped due to changes in supply and other factors.

Vacancy rates have been stalled at a high level since the first half of 2008, when a large number of new facilities became available in

the Tokyo

y Bayy area.

On the other hand, newly-developed warehouses have achieved comparatively high occupancy rate due to manufacturers’ demand for

high-spec, large-scale facilities in conjunction with their adoption of consolidation and supply chain management measures.

Vacancy rates headed downwards in 2011 owing to limited supply of newly-developed large-scale logistics properties, coupled with

increased demand in the wake of the Great East Japan Earthquake.

25.0%

Average Vacancy Rate of Logistics Properties*

in the Tokyo Metropolitan Area**

20.0%

15.0%

10.0%

5.0%

*Multi-tenant facilities with gross floor area of over 3,300 square meters

**Tokyo, Kanagawa, Saitama and Chiba

Mar‐04

Jun‐04

Sep‐04

Dec‐04

Mar‐05

Jun‐05

Sep‐05

Dec‐05

Mar‐06

Jun‐06

Sep‐06

Dec‐06

Mar‐07

Jun‐07

Sep‐07

Dec‐07