Tokyo Stock Exchange Index Guidebook

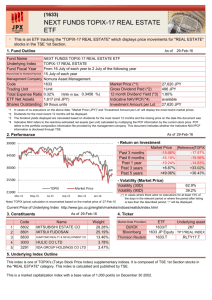

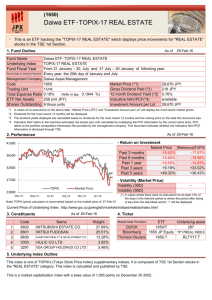

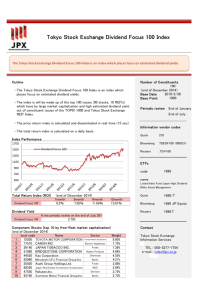

advertisement