What Is Investing? - Brooklyn Public Library

advertisement

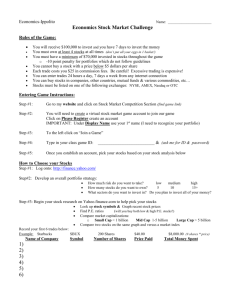

Brooklyn Public Library Mina Ennin Black About Me • Former Merrill Lynch Financial Advisormanaged over half a billion in assets • Almost 10 years experience in Wealth Management • Licensed Investment Manager • Creator of the FinancialPhytness Iphone app • Currently teaching financial & investment management to groups, companies and organizations • http://about.me/minablack/# • Follow me: @wealthwithmina AGENDA • SAVING VS. INVESTING • WHY INVEST • INVESTMENT TYPES • INTRO TO STOCKS • STOCK EXCHANGES • HOW DO I MAKE MONEY? • CHOOSING STOCKS AND TRADING • HOW DID YOU DO? EVALUATE YOUR PERFORMANCE • INTRO TO STOCK MARKET GAME What Do They Have In Common? All Are Investors If you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes – Warren Buffett 4 WAYS TO MAKE MONEY Money Made By Selling Your Time You Work For Your Money Interest Income on Money Lent Dividend Income from Profits on Businesses Owned Capital Gains Income Money that other Profits of a company people pay you to in which you bought “borrow” your money an investment. Buy an investment at one price and sell it higher 4 Ways To Make Money Money Made By Selling Your Time How most people make money Interest Income on Money Lent Example: A certificate of deposit Capital Gains Example: Dividend Income from Profits on Businesses Owned Capital Gains Income Your Money Works For You Ex. You bought Apple for $195 a share. You sell it for $400 a share. The $305 difference is your capital gain. 2 Ways To Grow Your Money Savings Accounts Investment Account What Is Investing? Investing is putting your money to use to make money on it. Some examples of investments are stocks, bonds, mutual funds, and real estate. WHAT’S THE DIFFERENCE? Savings Investments Goal Short-term needs or emergencies Long-term growth Products Savings Account, money- Stocks, Bonds, Mutual market account, CD Funds Risks None if FDIC insured Varies depending on product Source of Return Interest you receive from money you deposited Interest, Dividends, Capital Gains, Capital Losses Key Advantage Money is safe and easily Accessible Your return outpaces inflation over long term Key Disadvantage Returns usually don’t outpace inflation Risk of losing money Source: IPT 3 Things You Should Know: Understand Your Current Situation Never Invest Money You Need Pay off any high interest debt first Before You Invest Set Your Goals: Be Specific (ex. Save for a child’s college education in 16 years) Pick A Date: When will you need the money? – Time Horizon Rules for Successful Investing: Determine Your Objectives Evaluate The Risk Diversification & Asset Allocation KEY CONCEPTS & TERMS Time Value Of Money Dividend Investment Income Asset Allocation Risk & Return Rule of 72 Dollar Cost Averaging Risk Tolerance Compound Interest Stock Market Rate of Return Leverage Diversificati on Equity TIME VALUE OF MONEY A dollar today is worth more than dollar Youa Try It: tomorrow due to its potential to earn interest Example $100 received today and invested at 5% will be worth $105 in a year How to calculate: FV=PV (1+i)N FV=Future Value; i=interest rate PV = Present Value; N = years What is the FV of $500 invested today at a rate of 6% in 1 year? FV = $100(1+.05)1 How to calculate: FV=PV (1+i)N FV = $500(1+.06)1 = $530 RULE OF 72 A simple way to determine how long it will take for an investment to double in value Example $100 invested at 5% will double in 14.4 years How to calculate: # of years to double = (72/i) I = interest rate How long will it take for $1,000 invested at 10% to double? Answer: 7.2 years The Stock Market An everyday term used to talk about a place 1 “traded” where stocks and bonds are Companies use the stock market as a way to raise money Did You Know? Size of the world stock market is $36 trillion? Slide 17 1 Need to insert examples Mina Black, 10/11/2012 Diversification Reducing risk by investing in different kinds of securities Limit your risk exposure to a specific investment – choose stocks that are made up of different industries A portfolio with all technology stocks is not diversified A portfolio: a collection of investments INVESTMENT INCOME Income from interest payments, dividends, capital gains collected upon the sale of a security and any other profit made through an investment Examples Dividends, interest and rent It is possible to live off your investment income RISK TOLERANCE The degree of uncertainty you can handle in regard to a negative change in the value of your investment What would you do if you woke up one day and your stock lost half its value? Don’t take unnecessary risk Take the Risk Tolerance quiz LEVERAGE Using borrowed capital to increase the potential return of an investment Example Margin: borrowing money from your brokerage firm to buy securities Margin is EXTREMELY risky DIVIDEND A distribution of a portion of a company’s earnings. Quoted in terms of dollar amount each share receives Dividends can be cash, stock or property. RISK & RETURN The potential return will go up with the more risk you take on Must know your risk tolerance Must take on some risk to achieve returns COMPOUND INTEREST Interest that is paid on both the interest and the principal of an investment Example If you got 15% interest on your $1,000 investment the first year and end up with $150 interest Example(cont..) If I didn’t take the money out, the second year I would get 15% interest on both the $1,000 and the $150 This is why it’s so important to let your money grow in your account EQUITY For us: a stock or any other security that represents an ownership interest Examples Apple, Google, Facebook There are almost 9,000 stocks in the U.S. ASSET ALLOCATION Balancing the risk vs. reward in your portfolio by adjusting percentages Example A third of your money in stocks, a third in bonds and a third in cash Invest across different categories of investments DOLLAR COST AVERAGING Invest an equal amount of money at regular intervals A good way to reduce market risk Instead of investing a lump sum of $1,000 now, you can invest $100 every month for 10 months RATE OF RETURN The amount of revenue an investment generates over a given period of time as a percentage of the original investment amount Example Earlier example, the $1,000 investment & $150 investment income 15% is the rate of return Total Return: actual rate of return of an investment. Includes interest, capital gains, dividends Real Return: return on an investment adjusted for inflation STOCKS Stocks: Shares of ownership in a company What Does Stock Ownership Mean? Voting Rights Owning shares in Apple doesn’t mean you can go help yourself to free Iphones at the Apple store. WHY DO COMPANIES ISSUE STOCK? To raise money to start a business or grow a business To help pay for ongoing business expenses They don’t have to repay the money WHY DO PEOPLE BUY STOCK? We get income from dividends (not always!) The stock price could go up 2 Types of Stocks Common Preferred Majority of stock issued No voting rights Ownership in company Claim on profits Investors guaranteed fixed dividend forever In bankruptcy, preferred shareholders are paid before common Closer to debt than stock One vote per share Highest return Most risk (bankruptcy) Variable dividends Never guaranteed How are stocks classified? BLUE CHIPS Stocks issued by well-established companies with sound financial histories; Dow Jones Growth Stocks Shares of companies with the potential to generate aboveaverage revenues and profit growth Income Stocks Pay out a relatively high percentage of their earnings in the form of dividends Value Stocks that are cheap in relation to profits, sales, cash flow or the value of the company’s assets How are stocks classified? Defensive Companies whose sales of goods and services hold up in bad economic times Cyclical Companies whose sales and earnings are highly sensitive to the ups and downs of the economy Foreign Shares of companies that provide exposure to overseas currencies Market Cap Large cap, Mid-cap, Small cap – refers to the overall value of all shares of the company’s stock HOW DO STOCKS TRADE? On the Stock Exchange Marketplace where brokers who represent investors meet to buy and sell securities. Two Primary Exchanges: New York Stock Exchange NASDAQ **We use indexes and averages to track overall direction of the market NEW YORK STOCK EXCHANGE New York Stock Exchange Founded in 1792 Face-to-face trading floor Broker to specialist to broker Stocks traded on NYSE: GE, McDonald’s, Coke, WM Floor of NYSE NASDAQ “Virtual” Over-the-counter -No central location -No floor brokers -Trading done through computers -Established in 1971 Tech-heavy listings – Example: Facebook Dow Jones & S&P 500 Dow Jones Industrial Index -Oldest and best known index -Index of 30 widely held stocks -All companies are major factors in their industries Standard & Poor’s 500 index -Leading companies from all sectors of the economy -Benchmark for majority of growth mutual funds WHERE DOES STOCK PRICE COME FROM? Stock price is Tied to how much investor’s perceive the entire company to be worth right now AND How much the company is going to EARN in the future Market Capitalization (market cap) = how much the total company is valued at Stock Price * Shares Outstanding Pay attention to this and NOT stock price WHAT CAUSES STOCK PRICES TO CHANGE? The easy answer… Supply and Demand More wanting to buy, less wanting to sell Less wanting to buy, more wanting to sell HOW DO YOU MAKE MONEY? Investors make money in stocks in two ways: Dividends Companies may make payment to shareholders as part of the profits. Capital Gains (CG) Investors purchase shares in companies with the expectation that the price of the shares will increase. This increase in share value is a capital gain Reading Stock Tables Ticker Symbol A unique identifier (usually letters) that represent a particular security on an exchange. Source: Yahoo Finance Price The current or price of the stock. Sometimes this will be listed as “Last Trade” to let you know the last price the stock traded at. Source: Yahoo Finance Change in Price StocktheTables TheReading difference between last trade price and the price before that Source: Yahoo Finance The Exchange You can identify which Tables exchange the Reading Stock stock quote you’re viewing is trading on Source: Yahoo Finance Previous Close The price that the last share of stock sold yesterday (or the last day of trading) sold at. Source: Yahoo Finance Open The open is the price of the first share of stock sold today Source: Yahoo Finance Bid & Ask A bid is the highest price that a principle brokerage firm has announced it’s willing to pay for a share of a specific stock at a specific time. The ask is the opposite: it’s the lowest price that a firm has said it’s willing to sell a particular stock at Source: Yahoo Finance 1Y Target Estimate An analyst’s projection of what the price for a single share of this stock will be one year from today Source: Yahoo Finance Beta Reading Tables The measure of how aStock particular stock’s price moves relative to the market as a whole. Beta = 1: means the stock’s price moves exactly with the overall market Beta > 1: means the stock’s price is more volatile than the market Beta < 1: means the stock’s price is less volatile than the market Source: Yahoo Finance Next Earnings Date: Expected date of when the company will release their next earnings Source: Yahoo Finance Day’s Range The day’s range gives you the range that a stock’s price has varied throughout the course of the day Source: Yahoo Finance 52wk Range Reading Stock Tables The range of prices a stock has sold for over the course of the last year Source: Yahoo Finance Volume A stock’s volume reflects the total number of shares of that stock that have been traded throughout a single day Source: Yahoo Finance Avg Volume (3m) The average volume over the past three months of a stock. Knowing the average volume can help you decide when the daily volume is active enough for you to take notice Source: Yahoo Finance Market Cap Market capitalization estimates the total dollar value of the company who’s stock is being traded Source: Yahoo Finance P/E (ttm) The price to earnings ratio reflects the relationship between the price per share and the income earned per share by the company in which the shares are held. A higher P/E points to a more expensive stock because an investor pays more per unit of TTM: trailing twelve months Source: Yahoo Finance EPS Earnings per share is the amount of money that you would have earned if you purchased a share of this stock last quarter and sold it today Source: Yahoo Finance Div & Yield The dividend is the payment the company pays to shareholders based on its profits. The yield is the dividend expressed as a percentage of the price per share Source: Yahoo Finance Chart Reading Stock Tables This is the information such as price; volume, trade history in a chart form Source: Yahoo Finance Exchange Traded Funds A security that tracks an index or a basket of assets but trades on an exchange Usually identified by 3 call letters for the symbol SELECTING STOCKS THINGS TO THINK ABOUT • • • • • NO ONE WAY TO PICK STOCKS! NO FOOL PROOF FORMULA COME UP WITH A STRATEGY: A method for picking your stocks; Are you interested in a specific industry? Sector? Don’t put all of your eggs in one basket “Buy what you know. Stock tips are all around us. You can spot a good stock before Wall Street does.” –Peter Lynch SELECTING STOCKS STRATEGIES FOR STOCK SELECTION 1. Go With What You Know: You see companies growing all around you. 1. Markets: Current and future – A project must have customers today and even more tomorrow or it isn’t growing. 3. Economic Cycle: Is the economy expanding or slowing? 3. Avoid Obvious Risks 3. Selecting Stocks for the Stock Market Game: STRATEGIES FOR STOCK SELECTION 1. Go With What You Know: You see companies growing all around you. • • • • What products do you really like? What is popular among your friends? Who makes it? Do you think it will continue to be popular? Make Sure To Do Your Homework: know what the company does and how it’s doing financially – look at news; their annual reports If You Can’t Explain What The Company Does, Then You Shouldn’t Buy It STRATEGIES FOR STOCK SELECTION 2. Markets: Current and future – A project must have customers today and even more tomorrow or it isn’t growing. • Does almost everyone own the product the company makes? • Stocks of a rapidly growing company is more likely to increase in price. • What are the prospects for the company overseas? Think McDonald’s, Starbucks. • Demographics also affects current and future markets: Will a large percentage of the population want this product? (ex. Facebook) STRATEGIES FOR STOCK SELECTION 3. Economic slowing? Cycle: Is the economy expanding or • How do you think the economy is doing? Is it Growing or slowing? • GROWING ECONOMY: People who want jobs , have them • SLOWING ECONOMY: High unemployment; Companies cut back • EXPANSION: Cyclical stocks in industries like cars, appliances, raw materials like aluminum, steel, cement, tools & equipment offer much higher returns and growth potential • Recession: stocks in DEFENSIVE industries: medicines, food, clothing, public utilities, etc) generally decline less than stocks in other industries. STRATEGIES FOR STOCK SELECTION Avoid Obvious Risks • Beware of front-page stories • When a stock or company gets the headline that means everyone else knows about it too • You may want to stick with boring stocks • Evaluate Current Industry Conditions: Industries include: transportation, automotive, food and beverage, retail/apparel, health care, entertainment, communication, utilities, financial and others Do current events affect the businesses in the industry you’d like to invest in? Will technology innovations affect your industry? STOCK MARKET GAME www.marketwatch.com/game/bpl---adult-investing-2014 pssword: bpl2014 BUYING STOCKS You buy stocks through a broker Markets are open from 9:30 to 4pm Full service or discount broker Commission: the fee you pay the broker to buy or sell the stock STOCK SCREENERS Use a stock screener to narrow your selection http://screener.finance.yahoo.com/stocks.html HOW TO PLACE AN ORDER • MARKET ORDER: You buy or sell the stock at its current price • LIMIT ORDER: you specify the price you will buy or sell the stock price at – when and if the market price reaches your limit-order price, the order is executed • SELL SHORT: borrow from the the brokerage house and sells to another; Buy To Cover: must buy those shares back at some point in time and return them to the lender. CREATE A WATCHLIST A way to keep track of stocks/securities you’re interested in EVALUATING PERFORMANCE Real Return & Total Return Real Rate of Return: Subtract inflation from nominal rate of return Total Return: Actual rate of return. Includes interest, capital gains, dividends and distributions WHEN TO SELL Must know when to get out Fundamentals change: Dividend is cut You reach your target price What Is Your Return? THE END