Annual Report 1999

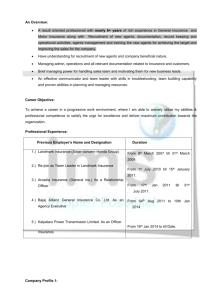

advertisement