Burger King Corporation (BKC)

advertisement

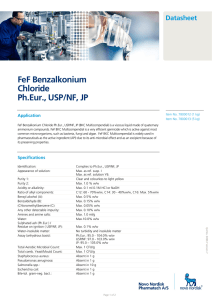

Burger King Corporation (BKC:US) Key Transaction facts Client: Deal size: Description: Settlement date: Rabobank role: Overview: Burger King Corporation (BKC) USD 250 million Franchisee Loan Securitisation May 2011 Structuring and Administrative Agent USD 250 million franchisee finance program, structured and arranged by Rabobank for a store reimaging program to achieve Burger King’s new “20/20 Design”. Client BURGER KING® is a global chain of hamburger fast food restaurants, founded in 1954, and currently the second largest fast food hamburger chain in the world. Every day, 11 million guests visit one of the chain’s more than 12,300 outlets in 82 countries and U.S. territories. Transaction Highlights With this transaction, Rabobank helped BKC implement a store remodel and reimage program for its domestic (U.S.) franchisee base. To finance the remodelling program, Rabobank executed a USD 250 million franchisee loan securitization facility for BKC, secured by loans to the franchisees. The transaction provided BKC with the following: - Availability of financing at attractive and standardized terms for BKC franchisees through a nationally promoted program; Close cooperation with the franchisor to monitor and discuss origination and feedback from franchisees; The ability to make adjustments to the program post-closing in order to improve the roll-out of the remodelling based on applicant requests; and A timely solution (4 weeks from term-sheet to closing) that allowed the presentation of the financing program at BKC’s first combined national franchisee convention. The transaction resulted in Rabobank being presented the “Best Newcomer 2011” award by leading BKC franchisees.