Resume - Robert H. Smith School of Business

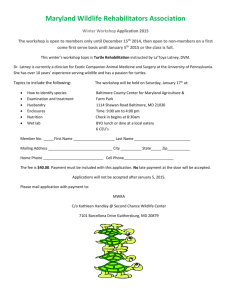

advertisement

TALEL AÏSSI 6240 Tamar Drive ▪ Columbia, MD 21045 ▪ 443.812.9490 ▪ talel.aissi@rhsmith.umd.edu https://www.linkedin.com/in/talelaissi ___________________________________________________________________________________________________ EDUCATION Robert H. Smith School of Business, University of Maryland, College Park, MD 2016 Master of Business Administration, Focus Area: Finance; GMAT: 710 Portfolio Manager, Mayer Fund – one of 10 students selected to manage the school’s $3.5M endowment fund President, Finance Association; VP of Finance, Professional Communications Club and Net Impact Completed, Wall Street Prep Course (Financial Statement, DCF, M&A, and LBO modeling) Voted Smith MVP, a peer-nominated award University of Maryland, Baltimore County, Baltimore, Maryland Bachelor of Science, Financial Economics; GPA: 3.63 Cum Laude; Dean’s List: 2010 – 2012 President, Omnicron Delta Epsilon Honor Society Member, Portfolio Management Team and Economics Council of Majors Recipient, President’s Scholar Merit Scholarship and Charles F. Peake Scholarship 2012 ___________________________________________________________________________________________________ PROFESSIONAL EXPERIENCE Lancaster Pollard, Columbus, OH 2015 Investment Banking Summer Associate Drafted management and board presentations, pitch books, and other material relevant to originating and executing private tax-exempt and taxable financing, M&A, and agency transactions for deals sized between $2M and $55M and totaling approximately $300M. Managed deals from engagement to closing, including interactions with clients and funding participants. Built the new Financing Company's cash flow model, using it to forecast the entire portfolio's reinvestment opportunities, P&L, and IRR. Morgan Stanley, Baltimore, MD 2012 - 2014 Settlements Analyst Managed operational workflow and led targeted training workshops for eight employees across three teams. Reduced risk indicators 90%+ and slashed team size 50% by reengineering entire cost center. Maintained accountability for $120B in daily trade clearance by facilitating deployment of nine-member Fedwire Securities settlement team from New York to Baltimore. Developed strategic relationships with custodians, directly leading to street-wide clearance improvements being executed over two years. Generated additional $10B+ in liquidity while introducing $5K+ operational cost savings per day by driving implementation of secured financing projects. T. Rowe Price, Baltimore, MD 2011 Trade Support Intern Designed tri-party repo reconciliation process to ensure compliance with multiple regulatory institutions. Created documentation for 70+ unique processes to combat key person dependencies after significant attrition. Directed IT development work into accounting functions, eliminating 200+ hours of annual workload for firm. ___________________________________________________________________________________________________ ADDITIONAL INFORMATION Eagle Scout Citizenships: United States, Switzerland, Algeria