2011 - Investor Relations Solutions

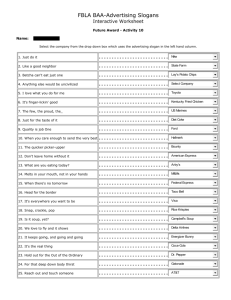

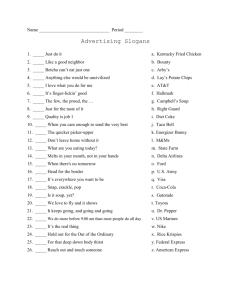

advertisement