4 MORAL HAZARD

advertisement

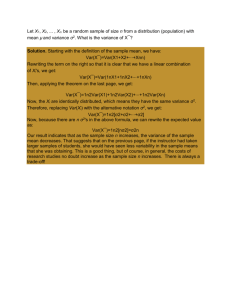

4 4.1 MORAL HAZARD Introduction In a typical moral hazard problem there are two individuals, the principal (she) and the agent (he). The agent can choose an action which in‡uences the principal’s pro…t. The relationship between that action and the level of pro…t is random. The principal cannot observe the action directly but can observe the level of pro…t. We assume that the principal has all the bargaining power. The problem is to …nd the best contract from the principal’s point of view. 4.2 Model 2 individuals a principal and an agent. e = e¤ort expended by agent. Not observable by the principal. z = output observable by the principal. z = e + x: x = random variable Ex = 0. y = random variable correlated with x: Ey = 0: w = wage paid to the agent by the principal. Assume that the principal uses a linear incentive scheme: w = + (z + y) = + (e + x + y): P (e) = expected gross pro…ts for the principal, (before paying the agent’s wages). The principal is risk neutral and maximises expected pro…t: = P (e) Ew = P (e) ( + e): The agent has utility U = Ew C(e) 12 r var(w) = + e C(e) 21 r 2 var(x + y); where C(e) denotes cost of e¤ort and r is a parameter measuring risk aversion. u = reservation utility of the agent. i.e. he will not work for the principal unless he receives at least utility u by doing so. 4.3 E¤ort Observable This is referred to as symmetric information or the …rst best solution. The principal will pay the lowest wage, which will induce the agent to work. Hence: w C(e) = u or w = u + C(e): Pro…t is given by = P (e) w = P (e) u C(e): The 1st order condition for pro…t maximisation is: P 0 (e ) = C 0 (e ): This equation determines the …rst best level of e¤ort. The …rst best pro…t level is: = P (e ) u C(e ): 4.4 E¤ort Not Observable: Risk Neutral Agent If the agent is risk neutral the principal may attain the …rst best pro…t level even if e¤ort is unobservable. The principal should hand the pro…ts over to the agent less a lump-sum K. Hence Ew = P (e) K: The agent’s expected utility is: P (e) K C(e): The agent chooses his e¤ort level to maximise his utility. The 1st order condition for choice of e¤ort is: P 0 (e ) = C 0 (e ). Hence the agent will perform the …rst-best e¤ort level. The principal will pay the agent the minimal amount to induce him to accept the job hence: P (e ) K C(e ) = u: The principal receives K = P (e ) C(e ) u; which is the …rst best pro…t level. 4.5 E¤ort Not Observable Risk Averse Agent In the following sections we explain the principles used for setting incentives for a risk-averse agent. Recall risk-aversion is the usual case. 4.5.1 The Informativeness Principle The Informativeness principle says that any variable which increases the accuracy with which performance can be measured should be used in determining the agent’s pay. Proposition 4.1 The optimal value of is given by = cov(x; y)= var(y). Proof. The principal should choose the contract so that + e C(e) 21 r 2 var(x + y) = u: Hence expected pro…ts are given by: = P (e) + e = P (e) C(e) 21 r 2 var(x + y) u: In particular should be chosen to minimise var(x+ y). Recall var(x+ y) = var(x)+ 2 var(y)+2 cov(x; y): The value of which minimises this is determined by: 2 var(y) + 2 cov(x; y) = 0: Hence = cov(x; y)= var(y). 1 4.5.2 Deductibles and Co-Payments The informativeness principle can be used to explain why deductibles are used in car insurance while co-payments are used in medical insurance 4.5.3 The Incentive Intensity Principle Proposition 4.2 Optimal incentive intensity is given by: = P 0 (e) : 1 + rV C 00 (e) Proof. The agent will choose the level of e¤ort e to maximise his utility: U = + e C(e) 12 r 2 var(x): The …rst order condition for this is: = C 0 (e): (1) Equation (1) is known as the incentive constraint. The principal pays the agent just enough to achieve his reservation utility: + e C(e) 21 r 2 V = u: Hence + e = u C(e) + 12 r 2 V , where V = var(x + y): The principal’s net pro…ts are given by: = P (e) e = P (e) u C(e) 12 r 2 V: Since = C 0 (e) 1 0 2 (from 1) we …nd: = P (e) u C(e) 2 rV C (e) : The 1st order condition for optimal choice of e is: d 0 C 0 (e) 21 rV 2C 0 (e)C 00 (e) = 0: Hence C 0 (e)[1 + rV C 00 (e)] = P 0 (e). Solving = C 0 (e) = de = P (e) 0 P (e)=[1 + rV C 00 (e)]: 4.5.4 The Monitoring Intensity Principle Now assume the principal may, at a cost, increase the accuracy with which the agent’s performance is measured. M (V ) = cost of reducing the variance to V; M 0 (V ) < 0, it costs more to achieve a lower variance. M 0 (V ) is increasing, hence the marginal cost of variance reduction is greater the lower the current variance. Proposition 4.3 The Monitoring Intensity Principle If an agent has higher incentives then his performance will be monitored more carefully. Proof. The principal’s expected pro…ts are given by: = P (e) C(e) 12 rV 2 M (V ). The 1st order condition for optimal choice of V is: M 0 (V ) = 12 r 2 : Since M 0 (V ) is increasing, this implies that the higher the lower will be the variance of the performance measure, V: 2 cost M 0 (V ) 2 1 2r 2 1 2r ............................................................................................... .. .. .. .. .. .. .. ............................................................................................... .. .. .. .. .. .. ... ... .. .. .. .. .. .. .. .. .. .. variance V V Figure 1: The monitoring intensity principle 3