ECONOMICS 1A: PROBLEM SET 10 The Role of Government

advertisement

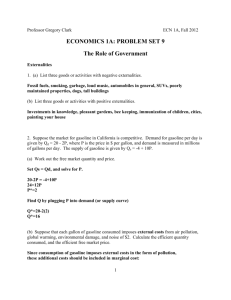

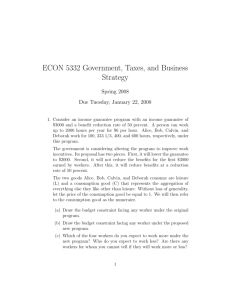

Professor Gregory Clark ECN 1A, Spring 2003 ECONOMICS 1A: PROBLEM SET 10 The Role of Government Externalities 1. (a) List three goods or activities with negative externalities. Smoking, garbage, air conditioners which use CFC’s, playing loud music, using congested highways and public areas (b) List three goods or activities with positive externalities. flower gardens, orchards ( from the point of view of a beekeeper), immunization, cities, painting your house 2. Suppose the market for gasoline in California is competitive. Demand for gasoline per day is given by Qd = 20 - 2P, where P is the price in $ per gallon, and demand is measured in millions of gallons per day. The supply of gasoline is given by Qs = -4 + 10P. (a) Work out the free market quantity and price. Set Qs = Qd, and solve for P. 20-2P = -4+10P 24=12P P*=2 Find Q by plugging P into demand (or supply curve) Q*=20-2(2) Q*=16 (b) Suppose that each gallon of gasoline consumed imposes external costs from air pollution, global warming, environmental damage, and noise of $2. Calculate the efficient quantity consumed, and the efficient free market price. Since consumption of gasoline imposes external costs in the form of pollution, these additional costs should be included in marginal cost: New Qs = -4 +10 (P - external cost) = -4 + 10(P - 2) 1 New Equilibrium: -4 + 10 (P - 2) = 20 - 2P -4 + 10P – 20 = 20-2P P* = 44/12 = 11/3 Plug P* into demand curve to get: Q* = 20-2( 11/3) = 38/3 (c) What is total social surplus at the free market price, and at the efficient level of production? Social Surplus at free market price: CS = (10 – 2) x (16) x ½ = 128/2 = 64 PS = (2 - .4) x (16) x ½ = 25.6/2 = 12.8 Total Social Surplus = CS+ PS – external costs = 64 + 12.8 – (16 x 2) = 76.8 – 32 = 44.8 Social Surplus at efficient level of production CS = (10-3.66) x (12.66) x ½ = 40.13 PS = (3.66- 2.4) x (12.66) x ½ = 7.97 TS = 40.13 + 7.97 = 48.1 (d) Show that a tax of $2 on gasoline consumption will lead to the efficient outcome. If we impose a tax on consumers, then the amount consumers pay for gasoline is (P + tax) = (P + 2). New Qd = 20-2 (P + 2) Equilibrium with tax: 20-2(P + 2) = -4 + 10P 20 - 2P – 4 = -4 + 10P P* = 20/12 = 1.66 Note: since P+2 = 3.66 is how much consumers pay then plug P+2 into Qd: Q* = 20 – 2(3.66) = 12.66 If you want to use Qs, then note that P is how much suppliers receive (T goes to government). Q* = -4 + 10P = -4 + 10 (1.666) = 12.66 Notice that quantity produced with a $2 tax is exactly the efficient production level. 2 (e) Explain why other measures to limit gasoline consumption such as fuel economy requirements or emission controls will be less efficient than a gasoline tax. Other measures like limiting gasoline consumption will not be efficient because agents will not consume gasoline until their marginal benefit = social marginal cost. High demanders are asked to limit their consumption even though they are able and willing to pay for gasoline and the associated external costs. Low demanders, who cannot afford to pay gasoline and the external costs, are using gasoline because no taxes are imposed, so the prices are kept low. 3. It is 75 miles from Davis to SF on highway 80. Suppose demand for travel in cars per hour is given by Q = 10,000 – 1,000T Where T is the length of the trip in hours. The length of the trip depends on traffic congestion and is T = 1 + Q/1000 (a) Draw a graph with the time of travel on the vertical axis and the number of trips on the horizontal, showing the demand curve for travel and the average cost in terms of time. 3 (b) Calculate the number of trips per hour that are made with free access to the road. Demand : T= 10-Q/1000, Average cost: T= 1+Q/1000 Equilibrium Condition: Qs= Qd 10- Q/1000 = 1 + Q/1000 2Q/1000 = 9 Q*= 4500 AC = 5.5 hours = $55 (c) The total time cost for Q cars on the trip is T.Q = Q(1+Q/1000) = Q + Q2/1000. This means that the marginal cost (in time) of another car making the trip is 1 + 2(Q/1000). Graph this marginal cost on your diagram. Explain why at any number of cars Q the marginal cost is higher than the average cost. (see picture above). 4 MC = 1 + 2Q/1000 (d) What is the efficient number of cars making the trip per hour to SF? Efficient quantity of cars: MSC = Demand 10-Q/1000 = 1+ 2Q/1000 9= 3Q/1000 Q*=3000 cars (e) If the value of time to motorists averages $10 per hour what congestion tax has to be charged for the trip to produce the efficient number of trips? The congestion charge is the monetary equivalent of the distance between the Average Cost and Marginal Cost curves at Q = 3000. At Q = 3000, MC = 1+2Q/1000 = 7, AC = 1+Q/1000 = 4 fl charge = 7 – 4 = 3 hours time = $30 in money (f) Show that Total Social Surplus is less with free access to the highway than with the congestion tax. With the congestion charge, TS (in $) = area between demand curve and MC curve = “A” on diagram = .5*(100-10)*3,000 = $135,000 Without the charge TS = area between demand curve and MC curve when Q = 4,500 = “A” – “B”, which is less than “A” = $135,000 - .5*(100-55)*(4,500-3,000) = $101,250 Note: The TS with the congestion tax is distributed $90,000 to the tax collector, and $45,000 ( = .5*(10-7)*10*3,000) to the road users. 5 4. Everyone wants to go see Yosemite! They want to experience the magnificence of nature in its unaltered primordial state. The problem is that the more people that come for this experience the less unaltered nature there is. Suppose that there are N visitors to Yosemite per day. Suppose also that the value of a visit to the park per person in $ is given by 100 - (N/100) Suppose also the explicit marginal cost per visitor is 0. (a) Draw a graph showing the value of a visit in $ as a function of N. (b) What number of people will actually come if the access price for the park is set to 0? N = 10,000 (c) How much consumer surplus will the park generate at this $0 price? CS = $0 (d) The total value of visits per day is given by 6 N*(100-(N/100)) Graph this total dollar value of visits. At what number of visits is the total value of the park to consumers maximized? N* = 5,000 (e) As a cost cutting move the new Bush Administration franchises Yosemite to the Disney corporation, and allows them to charge what they wish for admission. What fee would Disney charge? How many visitors would they allow? p = NâP = Nâ (100-(N/100)) (see figure above) Thus Disney would want to charge a fee that produces 5,000 visitors per day. This fee is $50 P = 100 - (N/100), P = 50 fi N = 5,000 7 (f) Is it more efficient to have Disney or the Park Service run Yosemite? Disney (g) Professor Swenson objects that this is rationing access to nature based on money. Instead she proposes that the park fee be set to zero, but access be limited by tearing out the access roads, cabins, restaurants, stores and bars. Visitors in future will be required to hike in for 20 miles with their own supplies. Show that Swenson’s solution will again destroy all surplus from the park. Swenson’s proposal involves reducing the demand curve for the park. Now the price people would be willing to pay for admission will be P = 100 - (N/100) - Z, where Z is the cost of the extra discomfort. But the Marginal Value still lies below the demand curve at MV = (100-Z) – 2âN/100 So people will still crowd in until P = MC = 0, and the total surplus is zero. Public Goods 5. Suppose the demand curve for Davis Public Radio Station KDAV is given per hour by Q = 1,000 - 100P Suppose the cost of being on the air per hour is a fixed $2,000. (a) Show that it is efficient for KDAV to be on the air. note: MC = 0 Total surplus = CS + PS– total cost = (10 x 1000 x ½) + 0 - 2000 = 3000 The radio station is efficient because by being on the air, the radio station maximizes total surplus = $3000 (b) KDAV funds itself by periodic fund raising drives where annoying appeals to people’s public spiritedness replace the regular programming. Explain why this is inefficient. It is inefficient because it shifts the demand curve down, hence generating a decrease in total surplus. 8 (c) The radio tries to promote giving by noting that if every listener were to refuse to donate, then there would be no service. What should a self-interested listener do? Give nothing. (d) What is an efficient way to fund KDAV? Subsidy from the general tax revenue. (e) Under the efficient fund raising scheme how can the value of KDAVs services be estimated? Listeners’ contributions in theory should be a good measure of the value of the station. Unfortunately, this does not work in real life, because listeners can free ride. People who are asked how much they benefit from the radio station would underestimate their benefits, if they know that they have to contribute this amount. If they know they will not have to contribute but still want to hear the station they will overestimate their benefits. 9