NEWS RELEASE OLAM INTERNATIONAL ANNOUNCES A THREE

advertisement

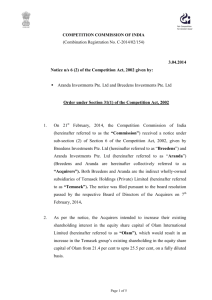

Olam International Limited 9 Temasek Boulevard #11-02 Suntec Tower Two Singapore 038989 Telephone 65 63394100 Facsimile 65 6339 9217 website www.olamonline.com Regn. No. 199504676-H NEWS RELEASE OLAM INTERNATIONAL ANNOUNCES A THREE-TRANCHE EQUITY FUND RAISING AND SUBSCRIPTION TO RAISE S$740 MILLLION • Fully underwritten Equity Fund Raising • Tranche One: Successful placement of New Shares to over 100 institutional and other investors raising approximately S$245.46 million gross proceeds demonstrates broad-based and continued investor support for Olam’s growth plans and prospects. • Tranche Two: Preferential Offering to entitled shareholders at an issue price of S$2.56 per Preferential Offering Share to raise gross proceeds of approximately S$249.07 million • • Guaranteed take-up of no less than 39.84% of the Preferential Offering by Kewalram Singapore Limited, Breedens Investments Pte. Ltd. (“Breedens”) and Aranda Investments Pte. Ltd., both indirect wholly owned subsidiaries of Temasek Holdings (Private) Limited and Sunny George Verghese, Group MD & CEO of Olam. Tranche Three: Proposed Subscription of 94,408,000 Subscription Shares by Breedens to raise gross proceeds of approximately S$245.46 million, subject to the approval of shareholders at an EGM to be convened. The Proposed Subscription by Breedens, a key shareholder, demonstrates strong support for Olam’s differentiated strategy and execution capabilities. Singapore, 7 June 2011 – Olam International Limited (“Olam” or “the Company”), a leading global, integrated supply chain manager and processor of agricultural products and food ingredients, had on 6 June 2011 launched an equity fund raising exercise (the "Equity Fund Raising") and proposed subscription to raise a Page 1 of 6 total of approximately S$740 million by way of a combination of 3 equal tranches of approximately S$250 million each comprising of (i) a private placement of up to 94,408,000 new ordinary shares (the "Placement Shares") in the capital of the Company to institutional and other investors (the “Placement”) and (ii) a pro rata and non-renounceable preferential offering (the "Preferential Offering") of up to 97,292,951 new ordinary shares in the capital of the Company to entitled shareholders, and (iii) the proposed subscription (the "Proposed Subscription") of up to 94,408,000 new ordinary shares in the capital of the Company by Breedens, an indirect wholly-owned subsidiary of Temasek Holdings (Private) Limited. The Proposed Subscription is subject to the approval of shareholders at an EGM to be convened. Tranche One: Placement Olam has successfully launched the Placement tranche through an accelerated overnight bookbuilding process, raising gross proceeds of approximately $245.46 million. Notwithstanding the absence of participation by North Asian markets on account of public holidays and the weaker equity market sentiments felt globally, the book saw a build up of demand momentum in Asia and US with several existing shareholders adding to their holdings in Olam. Driven by strong and broad-based demand from institutional investors, amongst who include existing shareholders and Long-Only investors from all key regions, the Placement was 6 times oversubscribed with the book covered within an hour of the launch of bookbuilding. Tranche Two: Preferential Offering The Preferential Offering issue price of S$2.56 per Preferential Offering share, raising gross proceeds of approximately $249.07 million is at a discount of approximately 1.54% to the Placement issue price of S$2.60 per Placement Share. The Preferential Offering will be made on the basis of one (1) Preferential Offering share for every 22 existing ordinary shares in the capital of the Company held as at 5.00 p.m. (Singapore time) on 15 June 2011, fractional entitlements to be disregarded. Placement Shares received under Tranche One do not qualify for participation in the Preferential Offering. Page 2 of 6 Undertakings in Support of the Preferential Offering Kewalram Singapore Limited, Sunny George Verghese, Breedens and Aranda Investments Pte. Ltd.. (together, the "Undertaking Shareholders") have given irrevocable and unconditional undertakings (“Undertakings”) in support of the Preferential Offering, As a result of the Undertakings, Olam will achieve a take-up ratio of no less than 39.84% of the total number of Preferential Offering shares offered to entitled shareholders, in the event that no other shareholder of Olam takes up its entitlements or applies for excess shares. The Joint Lead Managers, Bookrunners and Underwriters for the Placement and the Preferential Offering are Credit Suisse (Singapore) Limited, J.P. Morgan (S.E.A.) Limited, Standard Chartered Securities (Singapore) Pte. Limited and The Hongkong and Shanghai Banking Corporation Limited, Singapore Branch. Tranche Three: Proposed Subscription Concurrent with the Equity Fund Raising, Olam has entered into a Subscription Agreement with Breedens (the "Subscriber"). Subject to and upon the terms of the Subscription Agreement, the Company proposes to raise gross proceeds of approximately S$245.46 million through the Proposed Subscription by issuing an aggregate of 94,408,000 new ordinary shares in the capital of the Company ("Subscription Shares") at an issue price of S$2.60 per Subscription Share which shall be equal to the final Private Placement issue price of S$2.60 per Placement Share. Pursuant to the listing rules of the Listing Manual issued by Singapore Exchange Securities Trading Limited (“SGX-ST”), Olam will be convening an extraordinary general meeting (“EGM”) to seek the approval of its shareholders for the Proposed Subscription. Kewalram Singapore Limited (“Kewalram”), a controlling Shareholder, Sunny George Verghese, the Group Managing Director and Chief Executive Officer of the Company and Sridhar Krishnan and Shekhar Anantharaman, the Executive Directors of the Company have undertaken to vote in favour of the relevant resolutions at the EGM. Additionally, the Subscriber and its associates will abstain from voting in the relevant resolutions. Page 3 of 6 Fund raising exercise with strong support from key shareholders will enhance execution of Olam’s well-differentiated strategy Olam announced its new 6-year corporate strategy for the period FY 2010 to FY 2015 in 2009. The Company is tracking well ahead of its milestones in the first two years of implementation of this new plan and has significantly exceeded expectation. This Equity Fund Raising and Proposed Subscription will help Olam enhance and accelerate its 6-year strategic plan, which will result in a differentiated business with a strong competitive position and a uniquely shaped portfolio. Sunny George Verghese, Group Managing Director and CEO of Olam, said: “With this Equity Fund Raising and Proposed Subscription, Olam will be well positioned financially to continue the execution and delivery of its 6 year strategic plan, and capitalise on the organic and acquisition growth opportunities available. The continued support from all our key investors including our major shareholders Kewalram and Temasek’s indirect wholly-owned subsidiaries, Aranda and Breedens will add to our ability to execute our differentiated and winning strategy. I hope that with the support from all our shareholders, we can continue building on our leading competitive position in an attractive industry with strong growth prospects.” The continued support of Kewalram, Temasek’s indirect wholly-owned subsidiaries, Aranda and Breedens and other key investors, is a clear vote of confidence in Olam’s differentiated and winning strategy, unique competitive position and its capacity to reliably execute this strategy.”, added Mr Verghese. Olam intends to use the proceeds to finance potential acquisition opportunities, fund capital expenditure and for general corporate purposes. Note This release should be read and understood only in conjunction with the full text of Olam International Limited’s announcements lodged on SGXNET on 7 June 2011 on the same subject. Page 4 of 6 About Olam International Limited Olam International is a leading global integrated supply chain manager and processor of agricultural products and food ingredients, sourcing 20 products with a direct presence in 65 countries and supplying them to over 11,100 customers. With direct sourcing and processing in most major producing countries for its various products, Olam has built a global leadership position in many of its businesses, including cocoa, coffee, cashew, sesame, rice, cotton and wood products. Headquartered in Singapore and listed on the SGX-ST on February 11, 2005, Olam currently ranks among the top 40 largest listed companies in Singapore in terms of market capitalisation and is a component stock in the Straits Times Index (STI), MSCI Singapore Free, S&P Agribusiness Index and the DAXglobal Agribusiness Index. Olam is the only Singapore firm to be named in the 2009 and 2010 Forbes Asia Fabulous 50, an annual list of 50 big-cap and most profitable firms in the region. It is also the first and only Singapore company to be named in the 2009 lists for the Global Top Companies for Leaders and the Top Companies for Leaders in the Asia Pacific region by Hewitt Associates, the RBL Group and Fortune. More information on Olam can be found at www.olamonline.com. Page 5 of 6 ISSUED ON BEHALF OF BY : : Olam International Limited Citygate Dewe Rogerson, i.MAGE Pte Ltd 1 Raffles Place #26-02 OUB Centre Singapore 048616 For Olam CONTACT : Ms Chow Hung Hoeng Associate General Manager, Investor Relations DURING OFFICE HOURS AFTER OFFICE HOURS EMAIL : : : + 65 6317-9471 (Office) + 65 9834-6335 (Mobile) chow.hunghoeng@olamnet.com For CDRi.MAGE CONTACT DURING OFFICE HOURS AFTER OFFICE HOURS EMAIL : : : : Ms Dolores Phua / Ms Pearl Lam + 65 6534-5122 (Office) + 65 9750-8237 / 9781 3518 (Mobile) dolores.phua@citigatedrimage.com / pearl.lam@citigatedrimage.com Page 6 of 6