Dating and New Relationships - Older Adult Knowledge Network

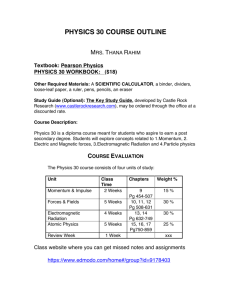

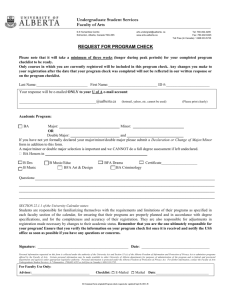

advertisement

Daily Life Series June 2011 Dating and New Relationships for Older Adults You are never too old to fall in love! However, if you are widowed or divorced and seeking new companionship, you may find yourself with many questions. The world of dating is different than it used to be. Also, unlike when you were younger and first starting out, you may now have family members and assets to think about and You should not rely on this booklet for legal advice. It provides general information on Alberta law only. Legal Resource Centre of Alberta Legal Resource Centre of Alberta #201 10350 – 124 Street Edmonton, AB T5N 3V9 Phone: 780.451.8764 Fax: 780.451.2341 info@legalresourcecentre.ca www. legalresourcecentre.ca protect. You know that, now more than ever, you should not be blinded by love: you want to be careful and you want to be informed. This booklet will help. It provides important information about legal issues related to new relationships. Why should I be concerned? It’s just dating and I’ve dated before. While dating and meeting new people is fun, there are people who are not what they seem. You need to be wary of fraudsters who may see your trust and desire for companionship as a way to get close to you and then try to scam you financially. Although you need not let this possibility stop you from dating, you should keep it in mind and protect yourself as best as you can. If I want to date someone, what safety steps should I take to protect myself? Here are some things you can do to protect yourself if you start dating: • Personal Information –– Do not reveal too much personal information until you get to know the person better. If you provide someone with your full name and phone number, it would be easy for that person to find out where you live.You may want to wait until you know someone really well before sharing any personal information. Consider getting a separate cell phone for talking to your new friend. If you have a separate cell phone number, then you can protect your home address and other personal information. • Personal Safety –– Consider going out with a group of friends. There is often more safety in numbers, and your friends may notice something about your new friend that you miss. Arrange to meet in public places, such as a café. –– Do not offer to pick the person up in your car, and do not arrange to have them pick you up at your home. –– Tell a trusted friend where you are going, as well as details about the person you are meeting, and arrange to call that friend when you get home. • Financial Safety –– Do not tell your new friend about your finances. –– Do not agree to lend the person money. –– Be wary if the person tries to talk you into investing in a business or other scheme. I have heard about internet dating and am thinking of trying it. What should I know about safety when using chat rooms or an online dating service? There are many internet chat rooms and dating sites. Each has its own rules and characteristics. Some safety tips include: • If you are not very experienced at using the internet, you may want to take a computer course to learn more about the do’s and dont’s of using one. • Find out if the website has a strict privacy policy. You want to be sure that the people you chat with cannot find out your name or where you live. • Do not use your real name or give your address, workplace, phone number, or any other information that could identify you. • Be cautious about providing information on your hobbies, interests, and hometown as it could reveal your identity. • Some people include a photograph, but many do not share a photo until they find someone they want to meet. • Usually the online dating service will provide you with an anonymous email feature, which means that you receive emails through the dating website. If you decide to use your own email address instead of using the anonymous email option, you should provide an email address that is not your regular, work or personal email address. You can sign up for a free Yahoo, Hotmail, or Gmail account that you can use just for online dating. 2 • Don’t put your full name in the email address you choose or in the “from” field - only your first name or something else. You can send yourself a test email (to your regular email address) to ensure that your real name does not appear anywhere. • If you decide to talk on the phone with someone you meet online, never give out your home phone number. Instead, provide a cell phone number, use Skype, or use an anonymous phone service. If someone has your home number, then that person can find out your address. • If you decide to meet in person, follow the safety tips outlined above. If we decide to live together, does that make us “common-law” and will my rights change? The term living “common-law” is often used in everyday language to describe a couple that lives together, with or without children, but is not married. At law, however, the term is more complicated. In Canada, all levels of government make laws. Some laws use the term common-law, some do not. In addition, not all laws give that term the same meaning. For example, federal law uses the term “common-law” for various purposes, including income tax law. Under the federal Income Tax Act, you can be found to be living common-law with someone if you have lived with them for one year. Alberta provincial law does not recognize the term “common-law”. Instead, in 2003, Alberta introduced the concept of “Adult Interdependent Relationships,” a term which replaces “common-law” in Alberta legislation. Your rights can indeed be different depending upon whether you are, or are not, in an Adult Interdependent Relationship. Simply moving in together does not automatically result in your becoming part of an Adult Interdependent Relationship. You must meet certain requirements set down in law in order to become someone’s Adult Interdependent Partner (see question below for legal requirements). My son is very upset that I am dating and he is pressuring me to break things off. What can I do? Seeing a parent start to date can be very upsetting; many adult children react negatively. Dealing with this issue early on can help to prevent problems, including legal ones, at a later time. Consider talking to your children about the issues as they come. Try to keep the lines of communication open. See if you can understand what your child’s concerns are, and try to explain how you see things. If you need additional help, you can seek out the help of a mediator. For mediation resources, see the back of this booklet. If I have been dating someone for a long time, do they have a right to my property or money? No. Just dating for a long time does not give your friend the right to your property and assets. You do not have to support each other financially. If you plan to move in with your friend, then your property and money may ultimately be affected. Consider talking to a lawyer about how this might change your situation. Seeing a parent start to date can be very upsetting; many adult children react negatively. Dealing with this early on can help to prevent problems. 3 What is the significance of being, or not being, in an Adult Interdependent Relationship? The significance of a relationship being recognised as an Adult Interdependent Relationship is the rights, benefits and responsibilities that you and your partner will receive under other laws. Those rights, benefits and responsibilities will be similar to, and in some cases, the same as, those extended to people who are married. For example, the Family Law Act will allow adult interdependent partners to apply for a support order (sometimes referred to as “alimony”) where the relationship has broken down. If you are involved in an Adult Interdependent Relationship, then you may have rights when your partner dies. If your Adult Interdependent Partner did not leave you anything under his/her Will, then you have the right to ask a judge to re-distribute your partner’s property so that you receive some of the estate. If your Adult Interdependent Partner dies without a valid Will, you also have the right to a portion of the partner’s estate. For more information on the Adult Interdependent Relationships, see the list of resources at the back of this booklet. What exactly is an “Adult Interdependent Relationship”? An Adult Interdependent Relationship (AIR) is a legal recognition of a relationship between two people who are not married. This relationship does not have to be conjugal (sexual): it can be platonic. In order for the relationship to be recognised as an AIR, the relationship must have certain characteristics. Specifically, it must be a relationship of interdependence, outside of marriage where two people: • share one another’s lives; • are emotionally committed to one another; and • function as an economic and domestic unit. There are two possible ways for an AIR to exist: 1. If you have made a formal and valid adult interdependent partner agreement with the other person. Two people that are related by either blood or adoption must enter into such an agreement in order to be considered adult interdependent partners. OR 2. If you are not related by either blood or adoption and if you have: –– lived with the other person in a “relationship of interdependence” for at least three continuous years (in other words, you become an Adult Interdependent Partner automatically at the three year mark); or –– lived with the other person in a “relationship of interdependence” of some permanence where there is a child of the relationship (either by birth or adoption). So “common law”, “Adult Interdependent Relationship” and “marriage” are three different things? Yes. Although many people may think common law marriages and Adult Interdependent Relationships are equivalent to a legal marriage, in law they are treated differently. In a marriage, rights and obligations start immediately once the couple is married. In contrast, people of any age who are either common law or adult interdependent partners must have lived together for a specified period of time before their rights and obligations come into effect. Often people who are not married but who live together have less or weaker rights than those of married couples and the processes for dissolving these relationships are different from a marriage as well. Lastly, remember that an Adult Interdependent Relationship does not have to be conjugal (sexual). 4 If my partner moves in, who owns the things we buy together? If we live together, will I be responsible for my new partner’s debts? You both do. If you and your partner buy something together, such as furniture or a car, you both own it. If you bought something on your own, it remains your property. Make sure you keep proof of payments (such as receipts), and indicate who paid for the item. You may want to include all of the property in your cohabitation agreement (see below). You are only responsible for the debt of your new partner if: • you jointly entered into contracts, like car or apartment leases; • you co-signed a loan for your partner; • the debt is actually in your name; or • you signed a contract agreeing to pay the loan if your partner could not (this is known as a Guarantee). If you ever separate from your partner, your partner may apply to the court for a division of debts after you separate, and the court may order you to pay some of the debt if you can. How can I protect myself if my partner and I have a joint bank account? Many couples keep some of their money separate by having their own personal accounts as well as a joint account. They use the joint account to pay household bills and joint purchases. There are two types of joint accounts: tenancy in common and joint tenancy. • A joint account with tenancy in common is an arrangement where each person on the account has a share of the money in the account. The shares do not have to be equal. When you separate or divorce, your share is protected and is yours to take with you. If you die, your share is left to your beneficiaries in your Will. • The other type of joint account is a joint tenancy. This means the account holders each have an equal right to use and control the money in the account. If you have this type of bank account, both you and your partner have equal rights to use the money in the account. If you die, your share is automatically left to the other person named on the account. –– This type is the most common type of joint account for most couples. It can lead to problems when a relationship breaks up and if one of the account holders takes all the money out of the account. Account holders do not have to be related, but often they are spouses or partners, or a parent and child. I’m thinking about moving in with someone. How can I protect my property? A good way to protect your property if you move in together is to have a co-habitation agreement. This is a written agreement between you and your partner that sets out your rights and responsibilities to each other. This agreement can include terms about: • what responsibilities you each have to pay: rent, household bills, financing of holidays, bank accounts, and furniture and other property; • who owns the property; • how property will be divided if you separate, and • your support obligations. If you decide to get married, you could have a prenuptial agreement. This is an agreement between two married people that describes who owns what property. You need a lawyer to write your cohabitation or prenuptial agreement. Your lawyer will explain how your agreement or contract will affect your rights and responsibilities. You should each talk to a different lawyer. I moved in with my partner over a year ago and we do not have a co-habitation agreement. Can I get one now, or is too late? A good way to protect your property if you You can still get one, but there may be some complications if you already have joint property. Consult your lawyer. move in together is to have a cohabitation agreement. 5 My partner and I want to have a co-habitation agreement but we have been told that we each have to see separate lawyers. We don’t want to have to pay two lawyers. Is this a requirement? Some lawyers will advise you both, but most will not. Although having two lawyers is an additional expense, it helps to ensure that you both receive completely independent advice. That is, each of you has a trained professional looking out for only your interests. This, in turn, can help you and your partner, as well as your children, feel more secure in these new circumstances. able to apply to the courts to be declared a beneficial owner, and you may be ordered to pay some sort of compensation to your partner. This concept of law is called “constructive trust”. For more information, consult a lawyer. It is also important to remember that any rights arising under law may be different depending on whether or not you are/have married or have signed an AIR agreement. To ensure that your rights are protected and that you make the decisions that are best for both of you, consult a lawyer. If my partner moves in with me, do I still own my house? It depends. Legal Ownership: • Usually the people who are listed on the title of the house (the legal owners) are the people who own the house. If your house is in your name only and your partner moves in with you, you could choose to change the legal ownership of the home. This means that you change who is the owner of the home on the title of the house. You could choose to add your new partner’s name onto the title, and then you both own the house together. If you do this, you will have to choose if you want to be “joint tenants” or “tenants in common”. –– You and your partner can own the property as joint tenants, which means that if you die, your partner will automatically receive full ownership of the home. –– If, on the other hand, you choose to be tenants in common, then if you die, your share of the home will go to your beneficiaries under your Will (so not automatically to the other person on title). Will my new partner be entitled to a share of my work pension? It depends. Pensions is a very complex area of law. The answer depends on factors, including: • whether or not your pension payments have already started; • whether you were together during any time that contributions were made to the pension; • the exact nature of your relationship (just living together, Adult Interdependent Partner, married); • the existence and content of any court orders related to your pension (for example: if you divorced your first spouse, there may be a court order about certain things pertaining to your pension); and • the exact terms of the pension plan. To determine the exact effect of your new relationship on your pension, consult the pension administrator and your lawyer. Beneficial Ownership: • If your partner moves in with you, and you do not put your partner’s name on title to your home, your partner may still ultimately have the right to a share of your house. For example, if your partner moves in with you and continues to live with you for a significant length of time and you are the sole owner of the home, and your relationship ends, then your partner may be 6 If I move in with or marry my new partner, will I be able to – or will I have to – split my Canada Pension Plan (CPP) with him/her? You or your spouse or common-law partner can only apply to receive an equal share of the retirement pensions you both earned during the years you were together. The amounts depend on how long you lived together and your contributions to the CPP during that time. If your respective CPPs were earned during a time that you were not together, you will not be able to split those pensions. For the purposes of the CPP, a “common-law partner” is a person who has lived in a conjugal relationship with a partner of either sex for at least one year. • Some benefits are based on earnings or events in the past and do not change. For example: the federal Old Age Security (OAS) pension, the War Veteran’s Allowance. Before moving in with or marrying your new partner, be sure contact to the various social agencies from which you receive funds or assistance. They are in the best position to answer your specific questions. You may also wish to consult your lawyer. I am currently receiving a CPP survivor’s pension based on my first husband’s CPP. Will this change if I remarry? No. Your CPP survivor’s pension will continue even if you remarry. A CPP pension includes the survivor’s pension and is based on earnings that were made in the past. This means that the pension was already earned and no change in current income can change that. Prior to 1987, the law was different. If you, or someone you know, previously lost a Canada Pension Plan survivor benefit because you remarried, contact the CPP to find out if you are now eligible. My children are very upset that I have a new partner and am considering marriage. My daughter, who is the Attorney under my Enduring Power of Attorney has said she won’t let me and she has said that she will talk to my doctor and my lawyer to get their help. Can she do this? How will moving in with, or marrying my new partner, affect my other social benefits? Probably not. The main issue is whether or not you still have mental capacity. An Enduring Power of Attorney does not come into effect until the person who wrote it (in this case, you) loses mental capacity. As long as you have not lost mental capacity, you make your own decisions – including the decision to make a new Enduring Power of Attorney, if you think that is necessary. You daughter can attempt to convince your doctor and your lawyer that you have lost capacity, but these professionals would not just take her word for it. They have their own sets of tests that they conduct. If you need help dealing with your daughter about these issues, you can consult your lawyer or seek out the help of a mediator. For mediation resources, see the back of this booklet. It depends on the exact benefit. Some may change, some won’t. For example: • Some benefits are based on income level. If you move in with your partner, the household income may change and this can affect whether or not you are eligible to continue receiving these benefits. Examples of these kinds of benefits include: the federal Guaranteed Income Supplement (GIS), the federal Allowance, provincial benefit programs (including, for example: the Alberta Rent Supplement, Alberta Aids to Daily Living, Alberta Seniors Benefit, and the Seniors’ Lodge Program) 7 My new partner and I want to marry, but we don’t want to have the ceremony in a church. What are our options for a civil ceremony? If you do not want to marry in a religious ceremony, you must be married by a person known as a “Marriage Officiant.” There is a list of Alberta Marriage Officiants on the “Getting Married” page of the Service Alberta website. You can also ask a judge, a member of the Senate of Canada, an MP (member of Parliament of Canada) or MLA (member of the Legislative Assembly of Alberta) to be the officiant. However, they must apply for a temporary permit. Marriage ceremonies can take place anywhere that all the parties agree upon, but you must also ensure that you first have a marriage licence and properly signed a Registration of Marriage Form. In addition, depending on the location you choose, you may first need the permission of the land owner and there may be certain requirements and limitations (such as in a municipal park). A common option for getting married is what is known as the “destination wedding” – such as marrying in Mexico. If you plan to have your wedding outside Alberta, you must purchase your marriage licence, certificate and any other marriage documents from the province/ territory/country where your wedding will take place. The Alberta Government registers only marriages that occur in Alberta. If you are planning to marry in another country, you may wish to contact the consular office of that nation for information. You can find a list of consular offices on the webpage of Foreign Affairs and International Trade. Your travel agent may also have some information. For more general information on requirements for marriage, see the “Getting Married” page of the Service Alberta website. Will I need to change my Will if I decide to live with my partner? It depends. If you want your partner to have something of yours when you die, you will likely want to update your Will. But if you do not want to leave anything to your partner, then you may not have to change your Will. In addition, there a few legal realities to bear in mind: • if you enter into an AIR agreement with your partner, any previous Will that you signed (unless it was made “in contemplation” of the specific AIR agreement being entered into) will be void: so you may have to rewrite your Will; and • even if you do not enter into an AIR agreement, if your new partner meets the legal definition of an Adult Interdependent Partner, you may have a legal duty to support him/her after your death if s/he depended on you for support (so even if you leave him/her nothing in your Will, that can be challenged). S/he would have to apply to a court for support. For more information on Wills, see the list of resources at the back of this booklet and consult a lawyer. Will I need to change my Will if I marry my new partner? You should think very carefully about what Yes. Marriage revokes any previously made Will (unless that Will was made “in contemplation” of the marriage). It is also important to remember that marriage gives your new spouse some rights that exist no matter what you say in your Will (i.e.: if you try to leave him/her nothing, s/he may nonetheless be able to apply to a court to receive some of your property) . For more information on Wills, see the list of resources at the back of this booklet and consult a lawyer. you want to happen to your property before you change your Will. You should consult a lawyer to canvass the all of the options and tax implications and to determine what is best in your particular situation. 8 I want to change my Will, but my children from my first marriage do not want me to do so. Can they stop me from making the changes I want to make? I want to write a new Will that ensures that, should I die first, my new spouse is taken care of, but I don’t want my children to lose their inheritance either. Is there something I can do to achieve this? In general, no, they cannot. The only time that a surviving spouse is prohibited from changing his/her Will is if the spouses’ Wills were “Mutual Wills”. A Mutual Will contains a clause that specifically says that neither the husband nor the wife will change the Will should he or she become widowed. Your Will won’t have that clause unless you specifically directed your lawyer to include it when the Wills were drafted. Regardless of what the law says, you should think very carefully about what you want to happen to your property before you change your Will. Much of the time, the Wills made by two spouses are mirrors of each other, in the sense that the spouses leave everything to each other, then follow the same distribution for when both of them are gone (often to their children). However, once the first spouse passes away, there is nothing stopping the surviving spouse from changing his/her will – and this can include re-marrying and leaving everything to the new spouse. Family members are often surprised and dismayed at this possibility: the concern is that the new spouse will not be as interested in the children from the first marriage, and those children will never inherit any of their parents’ money. Instead, a completely different set of children (namely those of the new spouse) may inherit the money. Yes. There are numerous options, including: • leaving part of your estate to your children, and part to your new spouse; • leaving some, or all, of your estate in a trust that would last for the lifetime of your new spouse. Depending on how you set up the trust, you could choose to provide money for the spouse to live on, while keeping the capital of the estate intact. On the death of your new spouse, the capital would be divided among your children; and • transferring some assets to your children while you are still alive, unless you still need those assets yourself. You should consult a lawyer to canvass all of the options and tax implications and to determine what is best in your particular situation. Be very open with your lawyer about your concerns, fears and goals. Often there are ways of addressing all of these issues, but only if you tell your lawyer about them. I moved in with my new partner about a year ago. What can I do if I think that my new partner is stealing from me? Stealing is abuse. Research shows that older women and men are more likely to be abused by someone they are close to rather than by a stranger. Often people are ashamed to speak out or ask for help if their partner is stealing from them. Sometimes they think that no one will take the abuse seriously because it is happening in a relationship. But all abuse is wrong and unacceptable. If someone is abusing you, there are several things you can do to get help, including the following: • If you feel safe doing so, talk to the abuser about your feelings. • Talk to your doctor, counsellor, or someone in your faith community. • Talk to a close friend or a family member. 9 • Leave the abusive situation and go somewhere safe, such as the home of a family member or friend, a shelter or a transition house, or a hotel..legalinfo.org • If you have been harmed or threatened, or you are afraid, call your local police, tribal police, or the RCMP. If it is an emergency, call 911. Local resources and support are also available in some communities, including: –– Calgary Kerby Elder Abuse Line Phone: 403-705-3250 (24 hours) –– Edmonton Seniors Abuse Help Line Phone: 780-454-8888 (24 hours) –– Lethbridge Senior Citizens Organization Phone: 403-320-2222 (Ext 25) –– Medicine Hat Community Response to Abuse & Neglect of Elders (CRANE) Phone: 403-529-4798. –– Red Deer Seniors Outreach Abuse Resources (S.O.A.R.) - Seniors Abuse Resource Information Line (24 Hours) Phone: 403-341-1641 and ask to speak to an advocate. –– Alberta Family Violence Info Line Phone: 310-1818 toll-free (24 hours) for information, advice and referrals. • Learn more at the Older Adult Knowledge Network: My mother lives with her ‘friend’ in a publiclyfunded assisted living facility. I think that she is being financially abused by her partner. What can I do? Talk to your parent or relative. Let them know that you are available to help. Learn more about the topic and what you can do to help at the Older Adult Knowledge Network: www.oaknet.ca. In addition, the Alberta Protection for Persons in Care Act, makes it a requirement to report any suspicion of abuse by the staff in care facilities to a toll-free reporting line or local police authorities. Call: 1-888-357-9339. www.oaknet.ca 10 What Do the Words Mean? adult interdependent partner a person with whom you are in an adult interdependent relationship. adult interdependent relationship a term unique to Alberta and governed by the Alberta Adult Interdependent Relationships Act. It is a “relationship of interdependence” as a relationship outside of marriage where two people: share one another’s lives; are emotionally committed to one another; and function as an economic and domestic unit. To meet these criteria, the relationship need not necessarily be conjugal (sexual). It can be platonic. There are two possible ways for such a relationship to exist. • If you have made a formal and valid adult interdependent partner agreement with the other person (two people that are related by either blood or adoption must enter into such as agreement in order to be considered adult interdependent partners); or • If you are not related by either blood or adoption and if you have: –– lived with the other person in a “relationship of interdependence” for at least three continuous years; or –– lived with the other person in a “relationship of interdependence” of some permanence where there is a child of the relationship (either by birth or adoption). agent a person designated in a Personal Directive to make personal decisions on behalf of the maker. assets what you own. Assets can include things such as money, land, investments, and personal possessions such as jewellery and furniture. attorney a person who is empowered to act on behalf of the donor under a Power of Attorney. This person does not have to be a lawyer. beneficiary a person or organization that you leave something to in your Will. co-habitation agreement a written agreement between you and your partner that sets out your rights and responsibilities to each other. debts what you owe. These can also be called “liabilities” and may include credit card balances, loans, and mortgages. donor a person who gives a Power of Attorney. Enduring Power of Attorney covers your financial affairs and allows the person you name to act for you even if you become mentally incapable. It can either: • take effect immediately upon signing and continue if you become incapable of managing your financial affairs; or • take effect only upon you becoming incapable of managing your financial affairs, or some other specified event (this is also known as a “Springing” Power of Attorney”). executor the person you name in your Will who is responsible for managing your estate and for carrying out the instructions in the Will. joint tenancy a type of ownership where any two or more persons (related or not) may equally own property and the property passes to the survivor or survivors on the death of one (without flowing through the estate of the deceased). maker a person who makes a Personal Directive. Personal Directive a written, signed, dated and witnessed document that appoints someone else to look after your personal, non-financial matters (such as health). It allows you to determine in advance who will make personal (non-financial) decisions on your behalf if, due to illness or injury, you ever lose the mental ability to make these decisions for yourself. Power of Attorney a written, signed, dated and witnessed document that gives someone else the right to act on your behalf with respect to your financial affairs. This can include paying bills, depositing and investing money on your behalf, and even selling your house. The Power of Attorney may be for a definite, specific act, or it may be general in nature. It may take effect immediately (Immediate Power of Attorney), can continue upon mental incapacity (Enduring Power of Attorney), or can come into effect only upon incapacity or some other event (Springing Power of Attorney). spouse a person to whom one is legally married. tenancy in common a type of ownership where any two or more persons (related or not) own property, but, unlike joint tenancy, the shares need not be equal, and there is no right of survivorship (on the death of an owner, the share does not flow to the other tenant in common, but rather, flows through the estate of the deceased tenant). testator a person who has made a Will. Will the legal statement of a person’s last wishes as to the disposition of his or her property after death. 11 More Information The Legal Resource Centre The Legal Resource Centre is a non-profit organization whose purpose is to provide Albertans with reliable information about their rights and responsibilities under the law. Alberta Arbitration and Mediation Society: www.aams.ab.ca Alberta Seniors and Community Supports: www.seniors.alberta.ca/ Legal Resource Centre of Alberta Legal Resource Centre of Alberta Federal Allowance Program: www.servicecanada.gc.ca/eng/isp/pub/oas/allowance.shtml #201 10350 – 124 Street Edmonton, AB T5N 3V9 Phone: 780.451.8764 Fax: 780.451.2341 Email: info@legalresourcecentre.ca Government of Alberta: Getting remarried after Divorce: www.programs.alberta.ca/Living/5962. aspx?Ns=364+6229&N=770 www.legalresourcecentre.ca Health Canada – information sheets for seniors: www.hc-sc.gc.ca/hl-vs/iyh-vsv/seniors-aines-eng.php Old Age Security: www.servicecanada.gc.ca/eng/isp/pub/oas/oas.shtml#one The LRC gratefully acknowledges The Older Adult Knowledge Network: Alberta Law Foundation www.oaknet.ca This website offers planning booklets for Making a Personal Directive, Making a Power of Attorney and Making a Will. The People’s Law School, Vancouver, BC Pension benefits for Alberta: Legal Info Society of Nova Scotia jsp?cat=687&lang=eng&geo=109 Justice Canada http://www.seniors.gc.ca/s.2.1rchcat@. Royal Canadian Mounted Police – Seniors Guidebook to Safety and Security http://www.rcmp-grc.gc.ca/pubs/ccaps-spcca/seniors-aineseng.htm The Legal Resource Centre of Alberta has a number of other publications that may also be of interest: • Making a Will • Making a Personal Directive • Making a Power of Attorney • Being an Executor • Being an Attorney • Being an Agent • Grandparents’ Rights • Alberta Adult Guardianship and Trusteeship Act • Planning Your Own Funeral • Being a Guarantor To order our publications, visit our website at www.legalresourcecentre.ca You should not rely on this booklet for legal advice. It provides general information on Alberta law only. June 2011 12