ACCT 430 - Kenya Methodist University

advertisement

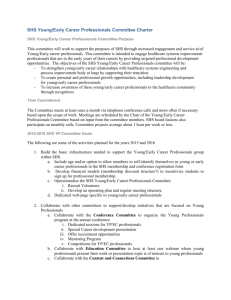

KENYA METHODIST UNIVERSITY DEPARTMENT COURSE CODE COURSE TITLE : : : ACCOUNTING AND FINANCE AND ECONOMICS ACCT 430 ADVANCED FINANCIAL ACCOUNTING I DLM ASSIGNMENT – JAN/APR 2016 eric.matu@kemu.ac.ke DUE DATE: 5TH MARCH 2016 1. Juma, Koko and Limo were in partnership, sharing profits and losses, Juma 60%, Koko 30% and Limo 10%. The partnership deed provided the following: (i) Interest at the rate of 10% per annum shall be allowed on fixed capital accounts balances. Interest will not be allowed on current accounts but 8% per annum is to be charged on any debit balance at the start of the year. (ii) Goodwill is to be valued at the average annual profits of the three years immediately preceding the balance sheet date. The following are particulars of partners' accounts: "Fixed" Capital At 31 Dec 1985 Shs Juma Koko Limo 180,000 90,000 30,000 Balances on Current account at 31 Dec 1985 Shs 50,000 Cr. 10,000 Cr 12,000 Cr The partners agreed to take Namu, a son of Juma, into partnership as on 1 January 1986 and on that day he introduced Shs.35,000 in cash which included his "fixed" capital of Shs.30,000. He is to receive a salary of Shs.15,000 per annum in addition to his share of the profit. Juma personally guaranteed that the aggregate of Namu's salary and share of profit shall be not less than Shs.30,000 per annum. Profit sharing ratios are to be Juma 30%, Koko 30%, Limo 30% and Namu 10%. Agreed profits for goodwill purpose for the past four years are as follows: 1985 DLM assignment Shs 163,370 matuwaithaka@gmail.com 1984 1983 1982 102,550 107,580 141,640 No account for goodwill is to be maintained in the books, adjusting entries for transactions between the partners being made in their current accounts. The draft accounts for the year ended 31 December 1986, before taking into account Namu's salary or interest on partners' accounts, show a profit of Shs.176,400. Partners' drawings during the year are Juma Shs.63,000, Koko Shs.49,000, Limo Shs.49,000 and Namu (including salary) Shs.21,930. Required: (a) (b) A statement showing the sharing of profit for the year ended 31 December 1986. The partners' current accounts for the year ended 31 December 1986, recording therein the entries necessary upon admission of Namu as a partner. (20 marks) 2. D Limited has a head office in Nairobi and a branch in Bungoma. The following information has been extracted from the head office books of account as at 31st March 20X6. Information relating to the branch Balances Branch bank account (positive balance) Branch debtors Branch stock (at transfer price) Transactions during the year Bad debts written off Branch general expenses (paid from bank branch account) Cash received from credit customers and banked Cash sale banked Cash transferred from branch to head office bank account Credit sales Discounts allowed to credit customers Goods returned by credit customers Goods returned from branch (at transfer price from head office) Goods sent to branch (at transfer price from head office) Opening Shs’000 30 660 750 Shs’000 150 420 3,900 1,200 4,590 4,370 90 80 300 6,000 Closing Shs’000 120 810 900 INFORMATION RELATING TO HEAD OFFICE Balances Stock DLM assignment Opening Shs’000 1,800 Closing Shs’000 2,200 matuwaithaka@gmail.com Transaction during the year Bad debts written off Cash sales Credit sales Discounts allowed to credit customer General expenses Goods returned by credit customers Purchases Shs’000 240 15,000 20,000 290 4,100 400 27,800 Additional information: 1. Most of the accounting records relating to the branch are kept by the head office in its own books of account. 2. All purchases are made by the head office, and goods are invoiced to the branch at selling price, that is, at cost plus 50%. Required: a. Write up the following ledger accounts for the year to 31st March 20X6, being careful to bring down any balances as at that date: 1. 2. 3. 4. 5. Branch stock account; Goods sent to branch account; Branch stock adjustment account; Branch debtors account; and Branch bank account. (30 marks) b. Compile D Limited’s Trading and Profit and Loss Account for the year to 31st March 20X6 showing the turnover, gross profit and net profit for the head office, the branch and the enterprise as a whole. (20 marks) 3. New Steel Ltd obtained a lease from Old Coal Ltd for a coal mine on 1st January, 1989 on the following terms and conditions: (1) (2) (3) (4) Royalty at £1 per tonne raised Minimum rent £24,000 per annum. Recoupment of shortworkings of each year during three following subject to a maximum of £5,000 p.a. In the event of strike, the minimum rent would be taken pro rata on the basis of actual working days but in the event of lockout, the lessee would enjoy a concession in respect of minimum rent for 50% of the period of lockout. Besides the above, New Steel Ltd have been granted a cash subsidy equal to 25% of the un-recoupable shortworkings by the Central Government up to the first five years of the lease. Workings up to first six years are as follows: £ 1989 Actual Royalty 14,000 1990 Actual Royalty 20,400 1991 Actual Royalty 32,200 1992 Actual Royalty 27,200 1993 Actual Royalty 21,600 (strike 2 months) DLM assignment matuwaithaka@gmail.com 1994 Actual Royalty 19,400 (Lockout for 4 months) Show the ledger accounts in the books of New Steel Ltd (i.e. the Royalty a/c, short-workings a/c and Landlord a/c) (25 marks) 4. The Trial Balance of Trust Life Assurance Company extracted on 31st December 1990 gave the following balances. Shs'000 Shs'000 Net premium income 350,000 Claims paid Death 26,000 Maturities 34,000 Surrenders 48,500 Bonuses 5,650 Commissions 29,700 Expenses of management 54,600 Other expenses 16,500 Life fund 1,150,000 Share capital 30,000 Profit and loss account 97,600 Land and buildings (cost) 260,000 Depreciation 14,850 Motor vehicles - cost 13,535 Depreciation 6,640 Computer equipment - cost 35,000 Depreciation 11,260 Furniture, fixture fitting and office equipment - cost 24,000 Depreciation 10,310 Investments 1,250,000 Cash and bank balance 2,350 Sundry debtors 5,165 Short term Investments 15,000 Sundry creditors 4,340 Investment income 145,000 1,820,000 1,820,000 Additional information (a) (b) (c) (d) An actuarial valuation was carried out as at 31st December 1990. The actuary recommends that Shs.25,150,000 be transferred to the profit and loss account. Outstanding claim are Shs 215,000 in respect of death claims and Shs.750,000 in respect of maturities. Expenses of management include Shs. 1,600,000 paid as director's fees. Depreciation is provided using the straight-line method at the following rates. Building 2% - the cost of buildings is Shs 200,000,000 Motor vehicles 20% DLM assignment matuwaithaka@gmail.com (e) (f) Computer equipment 15% Furniture fixtures and fittings 5% Transfer from retained earnings Shs 30,000,000. This amount together with the retained earnings for the year are paid out in full as dividends. Provisions should be made for actuary fees Shs.3,000,000 auditor's fees Shs.2,250,000, taxation Shs. 8,500,000. REQUIRED Prepare the Life Revenue Account and the Profit and Loss Account as at 31st December 1990. (25 marks) 5. Swastik Ltd forward on 1 January 1998, 100 bicycles to Alfred & Co. of Nairobi to be sold on behalf of Swastik Ltd. The cost of 1 bicycle was Sh2,500 but the invoice price was Sh3,000. Swastik Ltd incurred Sh10,000 on freight and insurance, and received Sh100,000 as advance from Alfred & co. Alfred & Co paid Sh5,000 for carriage inwards, Sh4,000 as rent and Sh3,000 as insurance; and by 30 th June 1998 had disposed of 80 bicycles for Sh250,000. Alfred and Co is entitled to a commission on sales at 5% of pro forma invoice price and 25% of any surplus price realised. Alfred and Co remitted the balance due from them by bank draft. Required: Write up the ledger accounts in the books of both parties. DLM assignment (20 marks) matuwaithaka@gmail.com KENYA METHODIST UNIVERSITY Programme: BACHELOR OF BUSINESS ADMINISTRATION Department: Accounting, Finance and Investment Course :ACCT 430: Advanced ACCOUNTING 1 Course Purpose This course is designed to provide students with adequate knowledge with regard to specialised skills in accounting for the various types of business and non-business organisations, including public sector accounting. Course Objectives At the end of this course, the students should be able to: prepare institutional Accounts prepare specialized accounts prepare and interpret public sector accounts prepare statements for Banks and Insurance companies. DLM assignment matuwaithaka@gmail.com Week Topics Content 1-2 Partnerships Accounting for partnerships Goodwill and Revaluations dissolution amalgamation conversion to a limited company Meaning of joint venture Joint venture and partnership Accounting records Drawer’s account Acceptor’s account Time (Hours) 3 3 Accounting for Joint ventures 4 Bills Of Exchange 5 Containers & Packages 6 Consignment accounts 7 Accounting for Royalties 8 9 CAT Hire purchases, lease, and Concept of hire purchase installment purchase Legal provision system Hire purchase contract Lease accounting Hire purchase system and installment systems 3 10-11 Branch accounting 6 12 Public Accounts DLM assignment 3 3 Accounts and returned containers Accounts for retained containers Introduction Meaning of consignment Features of consignment Books of consignor Valuation of unsold stock Loss of stock Books of consignee Important terms Account for Royalties Short workings 3 3 3 Types of branches Independent branches Foreign branch Accounting standards Income and expenditure accounts; Statement of assets and liabilities, 3 3 matuwaithaka@gmail.com General Accounts of Vote (GAV) The exchequer account Paymaster General Account (PMG) 13 Banks & Accounts Insurances Accounting of insurance companies Building societies accounting Accounting provision of the bank act Accounting for banks End of trimester exams 14 3 Recommended Reading: METHODOLOGY The course objectives will be achieved through lectures, class discussion presentation, and assignments. ASSESSMENT CAT & Assignment ……………………………………………………………30 Find exam………………………………………………………………………...70 Total…………………………………………………………………………….100 Required Text and Materials Students will receive all course materials including the textbooks in their course package. Hilton, Murray, and Darrell Herauf. Modern Advanced Accounting in Canada. Fifth edition. Toronto, ON: McGraw-Hill Ryerson, 2008. ISBN:-13: 978-0-07-097111-0. Financial Accounting: Consolidations & Advanced Issues. FA4 CD-ROM. Vancouver, BC: CGA- Canada, 2010. Ethics Readings Handbook. Third edition. ERH CD-ROM. Vancouver, BC: CGA-Canada, 2009 DLM assignment matuwaithaka@gmail.com