cga education guide

advertisement

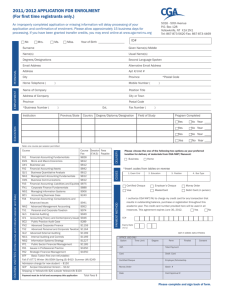

CGA EDUCATION GUIDE 2008 -2009 2 Fees and important dates 3 Board Chair’s message 3 President and CEO’s message 4 CGA Program of Professional Studies 5 CGA program components 5 Undergraduate degree 5 CGA exams 9 Short graduate program in professional practice 9 Practical Training 11 Official language proficiency 11 Obtaining a CGA permit 12 Additional information 14 Registering with the Ordre 16 CGAs in action 16 Scholarship Program 17 CGA Program for Master’s degree holders 19 Senior Academic Program 19 Doctoral scholarships 20 Former CGA program of professional studies (for candidates registered with the Ordre between January 1, 2000 and August 31, 2007) 21 CGA Program for Master’s degree holders (for candidates registered with the Ordre between January 1, 2000 and August 31, 2007) 23 CGA PROGRAM Table of contents Registration Form CGA Education Program 1 CGA EDUCATION GUIDE 2008-2009 Fees and important dates Fee schedule File review (page 14) Registration with the Ordre (page 14) Application for technical competency exam exemption FA4, FN2, TX2, AU2 and MU1 exams PA1 and PA2 exams Application to the Appeals Committee (page 12) Review of exam results (page 8) Review of PA1 or PA2 exam results Critical analysis of exam results (page 8) CGA permit* (page 11) Registration in the Professional Certification Program in Financial Performance (PAPPF) (page 20) $120 $145 $120 $290 $415 $95 $165 $240 $200 $410 $125 The abovementioned fees are non-refundable unless otherwise specified in this guide. All fees are subject to all applicable taxes (GST and QST) and are subject to change without notice. * When the permit is issued, an invoice will be sent out indicating the adjusted annual dues amount reflecting the change in membership status. 2008-2009 exam schedule December 2008 session: ISSUES IN PROFESSIONAL PRACTICE (PA1) Monday, Dec. 1, 6:30 pm-10:30 pm ADVANCED CORPORATE FINANCE (FN2) Monday, Dec. 1, 6:30 pm-10:30 pm STRATEGIC FINANCIAL MANAGEMENT (PA2) Tuesday, Dec. 2, 6:30 pm-10:30 pm FINANCIAL ACCOUNTING: CONSOLIDATION AND OTHER ADVANCED ISSUES (FA4) Tuesday, Dec. 2, 6:30 pm-10:30 pm ADVANCED EXTERNAL AUDITING (AU2) Thursday, Dec. 4, 6:30 pm-10:30 pm INTERNAL AUDITING AND CONTROLS (MU1) Thursday, Dec. 4, 6:30 pm-10:30 pm ADVANCED PERSONAL AND CORPORATE TAXATION (TX2) Saturday, Dec. 6, 9:00 am- 1:00 pm December 2008 exam session deadlines + Registration with the Ordre to be eligible for the December 2008 exams: September 5, 2008 + Exam registration : September 19, 2008 + Requests for reviews or critical analyses of exam results : February 21, 2009 March 2009 session: STRATEGIC FINANCIAL MANAGEMENT (PA2) Tuesday, March 10, 6:30 pm-10:30 pm March 2009 exam session deadlines + Registration with the Ordre to be eligible for the March 2009 exam: December 12, 2008 + Exam registration: January 9, 2009 + Requests for reviews or critical analyses of exam results June 5, 2009 June 2009 exam session: FINANCIAL ACCOUNTING: CONSOLIDATION AND OTHER ADVANCED ISSUES (FA4) Monday, June 8, 6:30 pm-10:30 pm ISSUES IN PROFESSIONAL PRACTICE (PA1) Monday, June 8, 6:30 pm-10:30 pm ADVANCED CORPORATE FINANCE (FN2) Tuesday, June 9, 6:30 pm-10:30 pm ADVANCED PERSONAL AND CORPORATE TAXATION (TX2) Thursday, June 11, 6:30 pm-10:30 pm ADVANCED EXTERNAL AUDITING (AU2) Saturday, June 13, 9:00 am-1:00 pm INTERNAL AUDITING AND CONTROLS (MU1) Saturday, June 13, 9:00 am-1:00 pm June 2009 exam session deadlines + Registration with the Ordre to be eligible for the June 2009 exam session March 20, 2009 + Exam registration: April 3, 2009 + Requests for reviews or critical analyses of exam results: August 21, 2009 BOARD CHAIR’S MESSAGE PRESIDENT AND CEO’S MESSAGE Danielle Hébert, FCGA Danielle Blanchard, CGA Dear Students, Dear Students, We are pleased to present the 2008-2009 guide to the CGA Program of Professional Studies, administered by the Ordre des comptables généraux licenciés du Québec. Feedback on previous editions was very positive, and we would like to thank all users of this guide, including CGA students and the various university and college stakeholders. Choosing a profession is certainly one of the most important decisions you will ever make. When you enrol in the CGA Program of Professional Studies, you know that a challenging and prestigious career awaits you. Recognized in Quebec and across Canada, the CGA designation also has an international dimension as a result of affiliation agreements between CGA-Canada and professional organizations in Australia, Bermuda, China, Hong Kong and the UK. In addition, the Ordre des CGA du Québec is currently negotiating a reciprocity agreement with the French authorities. Once again this year, the information in this guide has been updated to better support your efforts. More than ever, this edition aims to achieve its central goal of providing students with accurate and timely information on the CGA Program of Professional Studies. Advantages of the CGA designation As you prepare to embark on your professional career, you will be called on to display autonomy, initiative and critical thinking skills, backed by the relevant technical and academic knowledge. You will also be required to work flexibly within a variety of fast-changing professional environments. In this regard, the CGA Program of Professional Studies will provide you with all the tools you need. In keeping with the program’s emphasis on practical skills, the PA1 and PA2 exams both use a competency-based approach. The Ordre’s Program in Professional Practice (PPP) focuses on three main thematic areas: integrating, analyzing and synthesizing information. The PPP has a strong track record and is offered at a variety of post-secondary institutions, including McGill University, the University of Sherbrooke (which is set to launch its distance-learning option in September 2008), the University of Quebec in Outaouais (UQO), the University of Quebec at Trois Rivières (UQTR), the University of Quebec at Chicoutimi (UQAC), the University of Quebec at Rimouski (UQAR), the HEC School of Business and the University of Quebec at Montreal’s School of Management Sciences (ESG-UQAM). The Ordre is proud to offer a program of studies that is internationally recognized and continuously updated. It is specifically tailored to the needs of the employment market; it is also designed to help you achieve your personal and professional goals. With nearly 68,000 members and students, CGA-Canada is the fastestgrowing professional accounting association in the country, having garnered widespread acclaim and recognition in its sector. In Quebec, the Ordre des CGA has more than 10,500 members and students. Amid increasing globalization, the accounting profession continues to evolve. Recruitment is up, with employment at record levels. Current retirement patterns suggest that demand for accountants will remain high; for young people setting their sights on a professional career, the future is bright indeed. And demand is high not only in the service industry and in private firms, but also in the public and parapublic sectors: all businesses and organizations need qualified accountants! The accounting field offers a wide range of career opportunities. Positions include Chief Financial Officer; Financial Director; Controller; Compliance Analyst; Financial Management Officer; Chief Accountant; Logistics and Distribution Supervisor; Commercial Accounts Manager; Portfolio Manager; Auditor, etc. In addition, forensic accounting – an up-and-coming area of expertise – is attracting growing numbers of young professionals. Recognized and respected for their versatility and multi-disciplinary skills, CGAs are active in the areas of accounting, auditing, finance, management and taxation. Nearly 50% of CGAs in Quebec work in the corporate sector, with a further 30% in the public and parapublic sectors and 20% in private practice. I wish you much success in the CGA Program of Professional Studies. Please remember that the Ordre is always available to provide support and assistance. I wish you much success in your studies! Danielle Hébert, FCGA Board Chair Ordre des CGA du Québec Danielle Blanchard, CGA President and CEO Ordre des CGA du Québec 3 CGA PROGRAM OF PROFESSIONAL STUDIES Program leading to the CGA designation Two technical competency exams (exemptions may be granted) Short graduate program in professional practice (PPP) Two professional competency exams PA1 – PA2 24-month practical training program French language proficiency Individuals who registered with the Ordre between January 1, 2000 and August 31, 2007 (unless they selected the program track described below) should refer to p. 20 of this guide for information on the requirements for their program track. TECHNICAL COMPETENCY EXAMS Candidates must successfully complete two of the following technical competency exams : + Advanced Personal and Corporate Taxation (TX2); + Advanced External Auditing (AU2) or + Internal Auditing and Controls (MU1). You may be exempted from taking either of these technical exams if all prerequisite courses were completed within the prescribed timeframe. Please refer to p. 6 of this guide for further information. THE PPP The PPP is offered in a classroom format on a full-time or part-time basis at most universities in Quebec. It consists of five or six courses (depending on the university) totalling 15 credits. Please refer to p. 9 of this guide for details on the PPP, together with a list of the universities offering the PPP and the Internet links providing access to detailed descriptions of their respective programs. PROFESSIONAL COMPETENCY EXAMS CGA PROGRAM The two required professional competency exams test students’ skills within a professional context. Focusing on the integration of knowledge across various subject areas, the exams require students to combine their knowledge of material relating to multiple areas or multiple topics within a specific area. Students are evaluated on their ability to apply their overall knowledge to the problem solving process. The Issues in Professional Practice (PA1) exam tests professional skills from the perspective of an external accountant providing audit, tax, consulting or other client services. The Strategic Financial Management (PA2) exam tests students’ strategic financial management skills from the perspective of an accountant or manager working in a business or organizational context. PRACTICAL TRAINING PROGRAM 4 All prospective CGAs must complete 24 months of practical training. Please refer to p. 9 of this guide for further information. CGA program components UNDERGRADUATE DEGREE + Bachelor of business administration (BBA), accounting major, or + Bachelor of accounting sciences, or + BBA program courses (accounting major) or certificate programs for holders of another undergraduate degree, or + Undergraduate degree completed by accumulating certificates in accordance with the CGA-Canada program and with the university as regards certification. The degrees that meet the requirements of the first stage of the CGA program track are posted on the CGA website. The degrees are in accordance with the Ordre’s regulation concerning degrees granted by designated educational institutions and are subject to change without notice by the universities or by the Ordre. CGA EXAMS GENERAL INFORMATION The prerequisite courses for each exam (listed by university) are posted on the CGA website. + Students may take the exams at their own pace. Exams do not have to be taken all at the same time. + There are three exam sessions per year, in December, March (PA2 only) and June. Please refer to the exam schedule on p. 2 of this guide or on the CGA website. + The minimum passing grade for the FA4, AU2, MU1, TX2 and FN2 exams is 65%. + The PA1 and PA2 exams are graded on a Distinction, Pass or Fail basis. + The PA1 and PA2 exams must be taken upon completion of the CGA program. + The PA1 and PA2 question sheets and students’ answer booklets are not available for consultation by students after the exam session. CGA PROGRAM RECOGNIZED IN QUEBEC AND ACROSS CANADA, THE CGA DESIGNATION ALSO HAS AN INTERNATIONAL DIMENSION as a result of affiliation agreements between CGA-Canada and other professional associations around the world. 5 TECHNICAL COMPETENCY EXAM EXEMPTIONS EXAM REGISTRATION CRITERIA + Candidates may be exempted from taking the taxation (TX2) and auditing (MU1 or AU2) technical competency exams if they have successfully completed ALL CGA-Canada prerequisite courses in their program track. The prerequisite courses for each exam are posted on the CGA website (listed by university). To be granted an exemption, candidates should complete and submit the appropriate form to the Ordre. Candidates must be members in good standing of the Ordre, i.e.: + No exam exemptions will be granted if the prerequisites were completed more than five years previously. + Exemption criteria for technical competency exams: Candidates must be members in good standing with the Ordre, i.e.: - must have paid their annual dues; - must comply with the Ordre’s policies and regulations; - must ensure that they have completed all prerequisite courses and all required credits before submitting their application; - must complete and submit an exemption request form, together with the required information, documents and payment. The form is available on the CGA website; - must provide proof of successful completion of the prerequisite courses by the prescribed deadlines. PROFESSIONAL COMPETENCY EXAMS The two required professional competency exams (PA1 and PA2) test students’ skills within a professional context. Focusing on the integration of knowledge across various subject areas, the exams require students to combine their knowledge of material relating to multiple areas or multiple topics within a specific area. Students are evaluated on their ability to apply their over- all knowledge to the problem solving process. + must have paid their annual dues; + must comply with the Ordre’s policies and regulations; + must submit their exam registration applications online only via the CGA website; + must provide proof of successful completion of the prerequisite courses, or + must provide proof of registration in the final prerequisite courses, or + must provide proof of course equivalency; + must submit their academic transcripts and/or other documents by email (formation@cga-quebec.org), fax or regular mail (please include the file number); + must pay all fees in full for each exam. Post-dated cheques are not accepted; + must notify the Ordre in writing within the prescribed timeframe with respect to any exam registration cancellations; + candidates who wait until the deadline to register with the Ordre prior to an exam session may experience lengthy file processing delays. Candidates admitted to take the CGA exams upon providing proof of registration in the prerequisite course(s) are required to pass the course(s) in question, even if they have passed the corresponding CGA exam. Please note that incomplete exam registration applications will not be processed. EXAM PREPARATION MATERIALS The CGA exams are given nationally and test students’ knowledge of the CGA-Canada program. By establishing a list of course prerequisites for each university (available on the CGA website), the Ordre ensures that the university programs and the CGA program are equivalent. + To maximize their chances of success on the exams, candidates may purchase course materials, in addition to the course notes on which the exams are based, from the Ordre. CGA PROGRAM + The official course notes are sold in CD-ROM format. In certain cases, they are accompanied by additional notes in hard copy format. For price information and to order materials on line, please consult the list of required exam materials on the CGA website. 6 The exam schedule is tailored to your lifestyle. With three exam sessions per year, the CGA program gives you all the flexibility and the tools you need. The professional competency exams are designed to prepare students for careers in a wide range of businesses, public organizations and accounting firms. + Technical competency exams from previous years are available free of charge at: www.cga-canada.org, under Programs, Education, Assessment. EXAM REGULATIONS EXAM RE-REGISTRATION CRITERIA + Candidates must bring the eligibility card issued by the Ordre, in addition to an official photo ID (e.g., health insurance card, driver’s licence, passport, citizenship card). Candidates who fail any of the Ordre’s exams and prerequisite courses may re-register provided that they: + The following materials may be used by candidates during exams; - a silent pocket calculator (maximum one-line display) with no printer or alpha keys; - for the Taxation 2 (TX2) exam, a copy of the Income Tax Act published by CCH. The year of the edition must correspond to that used in the course notes. The Act may be annotated, underlined and highlighted, although any annotations must be in the candidate’s own handwriting (pencil or pen). Original or photocopied pages from any other sources may not be inserted or appended to the Act. However, standard-size annotated tabs or removable “post-it” notes (one per page) may be used; they may not exceed 4 cm × 5 cm (1.5 inches × 2 inches). Larger post-it notes (or the use of more than one tab or post-it note per page) are considered additional pages and are prohibited; - before the exam begins, the invigilators will ensure that the copy of the Act used by each candidate complies with the regulations governing authorized exam materials. Candidates who use a CCH edition of the Act that differs from the recommended edition must include an indication to that effect in their exam booklet. + Any individuals in violation of the regulations governing exam materials will have any unauthorized materials confiscated. + The following materials are not authorized in the examination room; - course notes, personal notes or reference books; - pencil cases, eyeglass cases or hats; only the candidate’s wallet may be placed on the desk - once candidates have handed in their exam booklet to an invigilator, they may not have further access to it. Any individual in violation of these regulations will be penalized. GROUNDS FOR EXCLUSION FROM AN EXAM, WITHHOLDING OF EXAM RESULTS, ASSIGNMENT OF FAILING GRADE OR MEMBERSHIP REMOVAL + retake the prerequisite courses; + provide further proof of successful course completion or registration. CANCELLATION OF EXAM REGISTRATION + Candidates must sign and submit a written registration cancellation notice to the Ordre’s head office by mail, courier, email or fax before 4:30 p.m. on the day of the exam if the exam is held on a weekday evening and before 4:30 p.m. on the preceding Friday if the exam is held on a Saturday. + The cancellation notice must specify the exam in question and must include the candidate’s name, address and file number. If these conditions are met, the cancellation will not be deemed to constitute failure of the exam. + Candidates who are absent from an exam without notifying the Ordre thereof in advance will be automatically assigned a failing grade for the exam. EXAM FEE REFUNDS + Exam registration fees will only be refunded in the following cases: - death of a close relative (father, mother, brother, sister, child, grandfather, grandmother, father-in-law, mother-in-law, daughter-in-law or son-in-law); - Illness, with supporting medical certificate stating the diagnosis. In such cases, candidates must submit the original supporting document to the Ordre within 30 days following the exam. + Exam registration fees will not be refunded in any other circumstances. This also applies to candidates who register for exams for which they are ineligible under the Ordre’s regulations (please refer to “Exam registration criteria” for further details). + Applications to defer registration until the next exam session will not be accepted. MAXIMUM NUMBER OF ATTEMPTS + Candidates who violate any of the above regulations may be prohibited from registering for an exam. Candidates may not take a given exam more than four times. + Candidates who register for an exam under false pretences, submit false documents, commit plagiarism or take part in plagiarism during an exam will be assigned a failing grade on the exam and will have their file closed by the Ordre. + Candidates who refuse to stop writing when the head invigilator announces that the exam is over will be subject to disciplinary action by the Ordre. CGA PROGRAM + Candidates who fail to pay their annual dues will have their exam results withheld until payment in full is received. 7 REVIEWS AND CRITICAL ANALYSES OF EXAM RESULTS During reviews of exam results, a second examiner checks the exam booklet to ensure that it was graded fairly and accurately. Such reviews result in either a confirmation or an adjustment of the original grade, as applicable, and are accompanied by a report indicating the grade obtained on each question and sub-question. As regards the Issues in Professional Practice (PA1) and Strategic Financial Management (PA2) professional exams, such reviews ensure that the grading process was carried out properly. Critical analyses of exam results involve providing a list of the marks assigned, together with general and specific comments on each of the candidates’ answers. Critical analyses are designed to help students prepare for retests. Please note that critical analyses are not available for the PA1 and PA2 professional exams, for which a competency report is sent to unsuccessful candidates. All applications for reviews or critical analyses of exam result must be : + submitted in writing by the deadline indicated on p. 2 of this guide; + addressed to the Ordre; + submitted together with payment in full. Subsequently: + The candidate will complete the review or critical analysis within 75 days of the date the application is received and will submit his/her decision to the candidate. CGA PROGRAM + Grades assigned during the review process are final. 8 VALUE-ADDED : The PPP’s flexible structure makes it easier to balance the demands of work and student life. Using a competency-based approach, the PPP is available provincewide and is a key source of information on ethics, governance, accounting, auditing, finance, management and taxation. Short graduate program in professional practice (PPP) The new graduate program in professional practice is designed to foster CGA candidates’ ability to analyze, integrate and synthesize information. Thanks to the program’s emphasis on practical techniques and competency-based approach, students acquire skills in the fields of ethics, governance and integrity, accounting, auditing, finance, management and taxation. The new program focus reflects the wide range of businesses, public organizations and accounting firms in which CGAs find career opportunities. Practical training Procedure 1 Find a professional-level job in the accounting field or a related field. 2 Find a training supervisor (CGA). 3 Obtain authorization for the foregoing from the Ordre by submitting the required documents. 4 After each 12-month period of work experience or following a change of employer or significant change of position within a given organization, complete the evaluation form (which must be reviewed by your training supervisor) and submit it to the Ordre. The PPP is offered on a full-time or part-time basis at most universities in Quebec. It consists of five or six courses (depending on the university) totalling 15 credits. The universities offering the PPP, together with the hyperlinks providing access to a detailed description of the various programs, are listed below. The PPP is offered in a classroom format at the following institutions: + HEC Montréal Microprogramme en expertise professionnelle – CGA http://www.hec.ca/programmes/mep/ + Université de Sherbrooke Microprogramme de 2e cycle en expertise professionnelle préparatoire au titre CGA http://www.usherbrooke.ca/programmes/micro/expertise_prof.html + Université du Québec à Chicoutimi (UQAC) Programme court de 2e cycle en expertise professionnelle http://www.uqac.ca + Université du Québec à Montréal (UQÀM) Programme court de deuxième cycle en pratique comptable - CGA http://dsc.esg.uqam.ca/formations/formation_pratique_comptable_cga.asp + Université du Québec à Rimouski, campus de Lévis (UQAR-Lévis) Programme court de 2e cycle en expertise comptable professionnelle http://www.uqar.qc.ca/programmesFormation/description/prg/0645.asp PRACTICAL TRAINING REQUIREMENTS + Candidates must have completed at least 45 undergraduate credits (or equivalent). The Ordre may recognize up to six months of practical experience acquired during the candidate’s undergraduate studies (or equivalent). The Ordre may also recognize the practical training of individuals enrolled in coop programs administered by the University of Sherbrooke, the University of Quebec in Outaouais or the University of Quebec at Trois Rivières, based on the criteria established by the Ordre and those institutions. + Candidates must acquire at least two years of: + Université du Québec à Trois-Rivières (UQTR) Programme court de 2e cycle en expertise professionnelle CGA http://oraprdnt.uqtr.uquebec.ca/pls/public/pgmwgo/?owa_cd_pgm=0471 a) full-time practical experience at a minimum rate of 30 hours/week; or + Université du Québec en Outaouais (UQO) Programme court de deuxième cycle en expertise comptable professionnelle http://services.uqo.ca/ConsultationBanquePrgrammes/programmes/0645.html b) part-time practical experience at a minimum rate of 20 hours/week with the same employer for a total of at least 3,000 hours completed over at least two years. + Université McGill Graduate Certificate in Accounting Practice http://www.mcgill.ca/conted-cms/programs/grad/accounting/gradcert/ CGA PROGRAM New The PPP is now being offered in a distance-learning format at the Université de Sherbrooke. http://www.usherbrooke.ca/programmes/micro/expertise_prof.html 9 + Candidates must perform one or more of the functions pertaining to the accounting profession and/or to related activities (as set out in the CGA Code of Ethics and Rules of Professional Conduct) in the private, public or parapublic sectors. + In addition to accounting, the Code covers the following: - industrial and commercial accounting; - business consulting; - tax services; - data processing; - IT consulting and computer programming; - business brokerage; - estate administration and settlement; - investment, financial and insurance advisory; - etc. + Candidates’ practical training must be overseen by a CGA supervisor providing guidance with respect to the relevant experience to be acquired in accordance with the Ordre’s requirements. The supervisor will also provide advice and answer any questions about the practical training process and the CGA profession. Practical training advantages: Selecting a job in line with your ambitions and in the economic sector of your choice enables you to hone the skills you develop in the academic component of the program. Accounting is a fast-changing profession and recruitment is ongoing. Becoming a CGA means embarking on a forward-looking career tailored to your skills. + submit a letter of attestation signed by their employer together with their application. The letter must be printed on the employer’s letterhead and must include the following information: - title of position held; - hiring date; - number of hours worked per week; - detailed description of duties indicating the percentage of time spent on each. Please note the following: + authorized practical training is deemed to begin on the date the Ordre receives the candidate’s training authorization form; + within 30 days following receipt of the registration documents, the Ordre will provide candidates with notification as to whether the practical training has been accepted or not; + the practical training guide, training authorization form and training evaluation form are available on the CGA website; + authorized practical training will be deemed to begin on the date the Ordre receives the candidate’s training authorization form. + candidates are responsible for seeking eligible training opportunities; + the Ordre assists candidates seeking eligible training opportunities through its job placement service (free of charge). New jobs are posted every week; + if candidates complete a coop or practical training program lasting no more than six months during their undergraduate studies (45 credits), they must obtain authorization before continuing their training and must submit a new training authorization form to the Ordre for approval, together with a letter of attestation from their employer. This provision applies regardless of whether or not there is only one employer. If the documents are not submitted, the candidate’s experience may not be taken into account for practical training purposes; + résumés (CVs) do not constitute satisfactory proof of employment. PRACTICAL TRAINING REGISTRATION CRITERIA PRACTICAL TRAINING EVALUATIONS For practical training evaluation purposes, candidates must: + complete the practical training evaluation form and submit it to their CGA supervisor at the conclusion of each training year and/or each job. The CGA supervisor will review the job duties with the candidate based on the practical training requirements; + submit an updated letter of attestation signed by their employer together with their application. The letter must be printed on the employer’s letterhead and must include the following information: - title of position held; - hiring date; - number of hours worked per week; - detailed description of duties indicating the percentage of time spent on each. + Provide the Ordre with completed documents signed by the trainee, the employer and the CGA supervisor. When they deem it appropriate, candidates must: The Ordre will proceed as follows: CGA PROGRAM + register for practical training by completing and submitting the training authorization form to the Ordre; 10 + upon receipt of the practical training documents, the Ordre will evaluate the experience acquired; + within 30 days of receiving the documents, the Ordre will notify the trainee of its decision concerning the approval or rejection of the practical training; + if the trainee has not met the practical training requirements, the Ordre will indicate which requirements must be completed and will provide the necessary instruction; + The Ordre has 60 days following the date the request is received to hear the trainee’s appeal. + If they so desire, trainees may appeal the Ordre’s decision by submitting a written request to the secretary of the Ordre within 30 days of receiving the decision. + The resulting decision is final. CRITERIA IN THE EVENT A CANDIDATE CHANGES EMPLOYERS OR IS ASSIGNED TO A DIFFERENT POSITION WITH THE SAME EMPLOYER If candidates change employers or are assigned to a different position with the same employer, they must have their former position evaluated and must complete a new training authorization form for the new position. OFFICIAL LANGUAGE PROFICIENCY Under Quebec’s Charter of the French Language, anglophones and allophones who wish to obtain a permit issued by a professional order must demonstrate proficiency in the official language (i.e., French) to exercise their profession. Individuals are deemed to be proficient in French if: + they received at least three years of full-time secondary or postsecondary instruction provided in French; + they passed the fourth or fifth-year secondary-level exam in French as a first language; + they obtained a secondary school certificate in Quebec during the 1985-1986 academic year or later. In all other cases, individuals must obtain a certificate from Quebec’s French Language Office (OLF) or a certificate deemed equivalent pursuant to government regulations. To obtain a certificate, CGA candidates must take the exam developed and administered by the Office québécois de la langue française testing the following five criteria: + comprehension of spoken French; + comprehension of written French; + oral expression in French; For further information, please contact: Government of Quebec Office québécois de la langue française Service des relations avec les associations et les ordres professionnels 125, rue Sherbrooke Ouest Montréal (Québec) H2X 1X4 Phone: (514) 873-6565 Fax: (514) 873-3488 www.olf.gouv.qc.ca OBTAINING A CGA PERMIT To obtain a permit (licence) enabling them to use the CGA designation, candidates must: + hold a government-recognized undergraduate degree or a degree deemed equivalent by the Bureau of the Ordre, or must have completed a training program deemed equivalent by the Bureau of the Ordre; + pass the required professional exams; + meet the requirements of the graduate program required at the time of registration; + meet the practical training requirements; + provide the official transcript for the relevant training program and a copy of the degree obtained; + provide proof of official language proficiency, as applicable; + submit the comparative assessment of studies completed outside Quebec issued by the Quebec Department of Immigration and Cultural Communities, as applicable; + complete and submit the permit application form available on the CGA website, together with the required documents; + pay their annual dues and permit fee. The CGA graduation ceremony is held once a year in October. Candidates who become CGA members during the interim period will be issued an official certificate authorizing them to use the CGA designation until they officially receive their permit. Please allow six to eight weeks for permit application processing. + written expression in French; CGA PROGRAM + knowledge of French-language professional terminology and ability to use this terminology. 11 ADDITIONAL INFORMATION + enclose a cheque covering the administration fees (please refer to p. 2 of this guide); DEADLINE FOR OBTAINING THE CGA DESIGNATION + update their practical training file; CGA candidates have five years to complete the Ordre’s requirements, calculated as of the earliest of the following three dates: Please note that these fees are non-refundable. + the date on which the candidate registers for his/her first CGA exam. Please note that the five-year period begins on this date, even if the exam is cancelled or the candidate does not take the exam; COMPUTER EQUIPMENT + the date on which the candidate is granted an exemption for a technical competency exam; + Candidates preparing for the CGA exams are required to purchase a personal computer or to have access to university or office computer equipment. + enclose a copy of their current résumé (CV). Please note the following: + the date on which the candidate registers for practical training. USE OF THE CGA DESIGNATION + Personal computers may not be used during CGA exam sessions. However, candidates should prepare for the exams by focusing on the interpretation of computer data. Under Quebec’s Professional Code, use of the CGA designation is reserved for members of the Ordre, i.e., those individuals who have obtained their professional permit or who have received an official letter of attestation to that effect. The authorized designations for candidates and registered students are as follows: For information on the technical specifications concerning purchases of personal computers and printers by students preparing for the CGA program, please go to the CGA website (www.cga-canada.org/en-ca) and consult the following sections: Programs/Education/Student computer equipment) Candidate: candidate for admission to the practice of the CGA profession INTERPROVINCIAL TRANSFERS Registered student: student enrolled in the CGA program RE-REGISTRATION IN THE CGA PROGRAM Individuals who submit a new registration application less than two years following the closure of their file for non-payment of annual dues or of their own accord should be aware of the following: + their application will be treated as if it were a new registration, i.e., they will be subject to the requirements in effect on the date the new application is filed; + any CGA exams successfully completed prior to the closing of the file will be recognized only if they are still deemed relevant. In that case, the new five-year deadline period will begin on the date the exam in question was successfully completed; + the Ordre may require candidates to take additional courses or may disallow successfully completed exams in compliance with the program requirements in effect when candidates re-register; + individuals must pay the fee for submitting a new registration application, in addition to any unpaid dues for the years during which they are requesting the recognition of vested rights. In accordance with the Ordre’s regulations, all individuals who move to a province other than Quebec (except residents of border regions) must arrange to have their file transferred to the CGA association of that province (please refer to the list of Canadian and international CGA associations on the CGA website). To submit a file transfer application, candidates must: + have paid their annual dues; + complete the transfer application form (available from the Ordre’s head office) and submit it to the Education Department; + submit proof of provincial residency. ADDRESS OR EMPLOYMENT CHANGES It is important to notify the Ordre as soon as possible of any address or employment changes by submitting the online form available on the CGA website. Failure to notify the Ordre of such changes may have undesirable consequences, including the non-delivery of important documents. CGA PROGRAM COMPLIANCE CGA PROGRAM STUDENT APPEALS COMMITTEE The committee rules on appeals filed by CGA candidates who believe their rights have been prejudiced by the application of regulations governing the CGA program, exams and deadlines or for any other valid reason. To file an appeal, candidates must have passed at least one CGA exam. In addition, they are required to: + submit a written request to the committee clearly detailing the case, the reasons for the appeal and the proposed remedies 12 All individuals admitted into the CGA program must comply with all related regulations. Non-compliance will result in cancellation of registration. CGA PROGRAM THE CGA PROGRAM: AN AMBITIOUS PROGRAM DESIGNED TO DEVELOP STUDENTS’ SKILLS, PROFESSIONALISM AND VERSATILITY. The fast-changing CGA profession is internationally recognized. Since it is tailored to labour market requirements, you can achieve your personal and professional goals more easily. 13 REGISTERING WITH THE ORDRE REGISTRATION PROCEDURES FILE REVIEWS 1. Complete the CGA program registration form (available on p. 23 of this guide or on the CGA website). File reviews are part of the admissions process and are carried out for each applicant. However, individuals may have their documents evaluated prior to registration with the Ordre to ensure that their documents comply with the CGA program requirements. 2. Enclose the following: + a copy of all college and university transcripts; + a copy of all degrees held, as applicable; Immigrants to Canada should enclose: + a copy of their landed immigrant certificate; + a translation (in French or English) of all degrees and academic transcripts. Transcripts must be accompanied by a translation of the course descriptions issued by the relevant educational institution; + a comparative assessment of studies completed outside Quebec issued by the Quebec Department of Immigration and Cultural Communities (MICC): Phone: (514) 864-9191 Email: equivalences@micc.gouv.qc.ca Please note that to become a member of the Ordre, candidates must have obtained a document from the MICC attesting that their training is equivalent to three or more completed years of university studies (undergraduate level). 3. Pay the registration fees (non-refundable). CGA PROGRAM Please note that incomplete registration applications will not be processed. Each registration includes a file review. 14 Individuals are required to: + complete the CGA File review form; + submit a copy of their college and university transcripts; + immigrants to Canada should submit a comparative assessment of studies completed outside Quebec issued by the Quebec Department of Immigration and Cultural Communities, together with the relevant transcripts and a summary description of the courses taken (translated into English or French); + enclose the non-refundable application fee (see p. 2 of this guide). This fee will be deducted from the registration fee if the application is submitted within six months of the file review. Please note that incomplete file review applications will not be processed. FILE NUMBER The Ordre assigns a file number to each person enrolled in the program. This number should be quoted in all communications with the Ordre. GENERAL INFORMATION + Only the Ordre is officially authorized to confirm candidates’ program tracks. The program requirements in effect at the time of registration apply throughout the candidate’s course of studies, subject to amendments to the Ordre’s regulations. + When candidates register for the CGA program, the Education Department will confirm which courses they are required to take, as applicable. + Individuals registered with the Ordre should submit their transcripts to the Education Department at the end of each academic session. + The program track taken by students who switch universities will be subject to review. + Each university has a designated contact person available to answer students’ questions concerning successful completion of the CGA program. The contact persons are listed on the CGA website. STATUS + Active registered student. Individuals who register with the Ordre will be assigned active registered student status. However, candidates who have active status but who have not taken any courses aimed at completing the CGA program or who have made no progress in the program for more than 24 months will be assigned inactive status. Individuals may remain in inactive status for no more than 12 months, during which time they will be required to regularize their situation (i.e., by re-establishing active status); if they fail to do so, their file will be closed + Candidate. Active registered students will be assigned candidate status as soon as they register for an exam, a practical training program or the PPP, or as soon as they obtain an exemption for a technical competency exam. However, upon the expiry of the five-year deadline (see p.12 of this guide), candidates will be assigned “deadline expired” status. Individuals may remain in deadline expired status for no more than 12 months, during which time they will be required to regularize their situation (i.e., by re-establishing their candidate status); if they fail to do so, their file will be closed. ANNUAL DUES Individuals who register with the Ordre are required to pay annual dues, prorated on the basis of the number of months remaining until April 1. Dues are payable upon receipt of the invoice. Please note the following: + upon receipt of the dues payment, the Ordre will make an official receipt available on the CGA website; + candidates who apply for a CGA permit will still be required to pay the statement amount when they receive their annual dues notice. Their membership dues will be subsequently prorated based on the months remaining in the period and will take into account the amount of student dues paid. Status Category Dues Candidate or registered student Regular $220 plus taxes Any individuals registered with the Ordre whose program does not correspond to the “practical trainee,” “senior” or “pending issue of CGA permit” categories. Status Category Dues Candidate Practical trainee $325 plus taxes Any individuals currently enrolled in the Ordre’s practical training program or who have completed their practical training and whose program does not correspond to the “senior” or “pending issue of CGA permit” categories. The following individuals are not included in the “practical trainee” category: + anyone enrolled in a coop program administered by the University of Sherbrooke, the University of Quebec in Outaouais or the University of Quebec at Trois Rivières. These individuals may be included in the “senior” or “regular” categories; + anyone wishing to exercise their right to acquire six months of practical experience as part of their undergraduate studies. These individuals may be included in the “senior” or “regular” categories. Status Category Dues Candidate or registered student Senior $485 plus taxes Any individuals registered with the Ordre for at least seven years and whose program does not correspond to the “pending issue of CGA permit” category. Status Category Dues Candidate Pending issue of CGA permit $605 plus taxes Any individuals who have: + completed the CGA program and the practical training; + AND who have passed the required CGA exams, the required graduate program and the test administered by the Office québécois de la langue française (as applicable). These individuals are eligible for the CGA designation. The only file item required is the permit application form. CGA PROGRAM Annual dues 15 CGAS IN ACTION SCHOLARSHIP PROGRAM The following are important sources for individuals who are seeking information and would like to learn more about the CGA profession. UNDERGRADUATE SCHOLARSHIPS CGA STUDENT ASSOCIATIONS One scholarship of more than $2,000 is awarded annually to a student at each university in Quebec, in addition to the University of Ottawa. Each university has a CGA student association. These associations: To be eligible, students must: + promote the CGA designation among students and professors; + be enrolled full-time in a bachelor of accounting sciences program or equivalent (e.g., bachelor’s degree by accumulating certificates); + foster dialogue between prospective CGAs and the business community; + are responsible for organizing activities such as information sessions, conferences on topics of interest, debates, business visits, student meetings with employers/CGAs and proactive job search workshops; + have completed at least 45 credits; + be working toward their CGA designation, based on their completed courses; + have an excellent academic record; + encourage students to take on an active role within the associations in order to provide fresh perspectives and new ideas; + be dynamic and motivated (e.g., community involvement); + ensure that the Ordre remains responsive to students’ needs; + submit an application, including a letter of introduction explaining why they selected the CGA program, a copy of their résumé and their most recent academic transcript. The various student associations and contact persons are listed on the CGA website. NEED MORE INFORMATION ? UNIVERSITY CONTACT PERSONS One professor at each university serves as the CGA contact person. His or her role consists of providing students with information and advice on the CGA program and career opportunities and answering students’ questions on these topics. The university contact persons are listed on the CGA website. CGA ASSOCIATIONS IN CANADA AND ABROAD CGA associations are active in every Canadian province and territory, as well as in China and the Caribbean. CGA PROGRAM The various CGA associations are listed on the CGA website. 16 Please contact our communications/marketing advisor: Ordre des CGA du Québec Phone: (514) 861-1823 or (800) 463-0163 Fax: (514) 861- 7661 Email: communication@cga-quebec.org Website: www.cga-quebec.org FINANCE (45 HOURS) CGA PROGRAM FOR MASTER’S DEGREE HOLDERS All topics in this seminar are approached from a corporate finance perspective. Topics include investment selection, approaches to risk, capital structures, business financial planning and special financial instruments (options/futures). TAXATION (45 HOURS) Program description Increasingly popular with administrators and business leaders, this program is open to holders of an MBA or a master’s in accounting, finance, taxation, administration or management. The program recognizes students’ acquired knowledge and skills. The program consists of six seminars, followed by four professional exams. A 24-month practical training program, completed in the candidate’s sector of choice, completes the requirements leading to the CGA designation. Master’s degree holders are exempt from the Short Graduate Program in Professional Practice (PPP). The following courses and professional exams must be completed: Program requirements Six seminars Professional exams Accounting (45 hrs) Auditing (60 hrs) AU2 or MU1 Finance (45 hrs) Taxation (45 hrs) FN2 or TX21 Professional practice (45 hrs) PA1 Strategic financial management (45 hrs) PA2 1 Students who elect to take the TX2 exam are required to take a second 45-hour block. Candidates who registered with the Ordre prior to September 1, 2007 are asked to refer to p. 22 of this guide for information on their program track. This seminar aims to familiarize students with the fundamentalconcepts and principles relating to Canada’s Income Tax Act. Topics covered include various types of income and taxability, capital gains and losses and calculations of taxable personal and business income. Business restructurings and tax planning will also be covered. Students who elect to take the TX2 exam are required to take a second 45-hour block to be eligible to take the exam. ISSUES IN PROFESSIONAL PRACTICE (45 HOURS) This seminar aims to apply the knowledge acquired in the CGA program for master’s degree holders in a concrete and practical way. It also aims to develop students’ advisory and public accounting skills. It addresses the ethical and moral aspects of public accounting, in addition to the concepts underlying audit risk/strategy assessment, financial reporting needs and new developments in GAAP and GAAS. The seminar essentially covers the competencies tested by the PA1 exam, focusing on general accounting, taxation, assurance and leadership. The perspective adopted is that of an external accountant providing auditing, tax and other business consulting services. STRATEGIC FINANCIAL MANAGEMENT (45 HOURS) This seminar aims to apply the knowledge acquired in the CGA Program for Master’s Degree Holders in a concrete and practical way. It also addresses key aspects of financial accounting, management accounting and corporate finance from a strategic decision making perspective. The seminar essentially covers the competencies tested by the PA2 exam (strategic financial management), focusing on the skills needed by financial managers working in an organizational context. PA1 and PA2 are the last seminars that students are required to enrol in. Seminar descriptions The content of each seminar is based on the CGA-Canada course notes. FINANCIAL ACCOUNTING (45 HOURS) This seminar aims to familiarize students with fundamental financial accounting concepts and with the conceptual framework governing financial reporting in Canada. The seminar also focuses on fundamental concepts relating to main balance sheet items, income statements and other financial statements. In addition, students will gain an understanding of the principal Canadian accounting principles. AUDITING (60 HOURS) This seminar aims to familiarize students with fundamental management auditing and external auditing concepts. Concepts, principles and techniques relating to business management auditing, including risk management, will be covered initially. Subsequent topics will include fundamental external auditing concepts and processes. Professional, legal and ethical considerations relating to assurance engagements will also be addressed. CGA PROGRAM This is the first seminar that students are required to enrol in. 17 Seminar information All seminars are usually given in Montreal every two weeks on Saturdays or Sundays. The language of instruction is French; seminars may be conducted in English if student demand is sufficient. Seminars are subject to change without notice by the Ordre. CGA EXAMS Exam information is presented on p. 5 of this guide. Please note, however, that although the first attempt at taking the CGA-Canada final exam is included in the registration fee for each seminar, candidates are responsible for registering for the exam they wish to take by the prescribed deadline. To do so, they must complete the exam registration form available on the CGA website; registration is on-line only. The exam cancellation policy is presented on p. 7 of this guide. All individuals who are registered in the CGA program for master’s degree holders are required to pay the exam fees when they register for the exam. PRACTICAL TRAINING The requirements and criteria for the 24-month practical training program are described on pp. 9 to 11 of this guide. Candidates must register on-line via the CGA website. + The fees for the CGA-Canada course notes and the final exam (first attempt) are included in the above prices. However, additional course materials may be required. + Candidates who cannot complete the seminars in accordance with the proposed criteria can meet the training requirements by taking programs currently offered at various universities. + Candidates who cancel their registration in a seminar will be charged a $150 fee and will be required to pay the prorated amount of the classes taken, calculated from the beginning of the session until the date the notice of cancellation is received by the Ordre. Fees for CGA-Canada course notes and final exams are non-refundable. * Fees are subject to change without notice and do not include GST or QST. REGISTER ON-LINE! (www.cga-quebec.org - under Become a CGA, Education Program, Program for Master’s Graduates) Fall session Seminar registration deadline August 18, 2008 TERMS AND CONDITIONS + Candidates must submit a registration application and a file review application to the Ordre (a form is available on p. 23 of this guide and on the CGA website); + Registration fees:* December 2008 exam registration deadline September 19, 2008 Winter session Seminar registration deadline December 19, 2008 - $775 for the 45-hour accounting and taxation seminars; - $1,000 for 45-hour finance, professional practice and strategic financial management seminars; CGA PROGRAM - $1,450 for the 60-hour auditing seminar. 18 June 2009 exam registration deadline April 3, 2009 Please refer to the CGA website for complete schedule information. SENIOR ACADEMIC PROGRAM Senior academics can contribute to the CGA profession and CGA associations in a variety of ways. These include participating in accounting or public policy research projects, teaching, marking exams, taking part in committee activities and promoting the CGA designation. This program is specially designed for university professors and serves as a “fast track” to the CGA designation. The eligibility criteria are as follows: + candidates must hold a PhD and have at least two years of full-time teaching experience in a Faculty of Commerce or related department of a post-secondary institution; + candidates must have obtained their degree in accounting, commerce, finance, taxation, administration or administrative sciences. Candidates are required to pass the Issues in Professional Practice (PA1) and Strategic Financial Management (PA2) exams. For further information, please contact the Ordre’s Education Department. SCHOLARSHIP PROGRAM DOCTORAL SCHOLARSHIPS Need more information? To ensure that university teaching positions remain accessible to the Ordre’s members and to encourage them to obtain a PhD, the Ordre awards one $5,000 doctoral scholarship each year. This scholarship may be renewed for a second and third consecutive year provided that the recipient continues to meet the Ordre’s requirements. Phone: (514) 861-1823 or (800) 463-0163 Fax: (514) 861-7661 Please contact the Ordre’s Education Department: Email: formation@cga-quebec.org Website: www.cga-quebec.org To be eligible for a doctoral scholarship, candidates must: + be a Canadian citizen or landed immigrant (supporting documents are required); + be a member of the Ordre or be a CGA candidate and have passed two CGA exams; + be enrolled full-time or part-time in a PhD program in accounting, auditing, finance or taxation; + have completed approximately 30% of the program; + submit letters of reference from at least two professors; CGA PROGRAM + submit a career plan. 19 Former CGA program of professional studies for candidates registered with the Ordre between January 1, 2000 and August 31, 2007 CGA program track Undergraduate degree: bachelor’s in accounting sciences or equivalent Two technical competency exams (exemptions may be granted) Two professional exams FA4 & PA1 Professional Certification Program in Financial Performance (PCPFP) 24-month practical training program French language proficiency TECHNICAL COMPETENCY EXAMS Candidates must successfully complete two of the following technical competency exams: PROFESSIONAL CERTIFICATION PROGRAM IN FINANCIAL PERFORMANCE (PCPFP) The PCPFP is a 15-credit distance-learning graduate program offered by Télé-Université (Téluq). It consists of six courses divided into two components: finance and management/accounting. Student performance is evaluated by means of practical assignments. Candidates seeking admission to the PCPFP program must submit two forms: + the Ordre’s PCPFP program registration form, which must be submitted to the Ordre together with the fee payment; + the graduate registration and admission form, which must be submitted to Téluq together with the required documents and fee payment. All applicants for admission must at least register in FIN 6050. For further information on PCPFP admission and registration procedures and detailed course descriptions, please visit the Téluq website (www.teluq.uquebec.ca/cga) or call (888) 843-4333. PCPFP registration deadline + All candidates who are required to take the PCPFP to obtain the CGA designation must enrol in the program by January 1, 2010. + Advanced Personal and Corporate Taxation (TX2); and + Advanced External Auditing (AU2); or PRACTICAL TRAINING + Internal Auditing and Controls (MU1). All CGA candidates must complete 24 months of practical training. For further information, please refer to pp. 9 to 11of this guide. Candidates may be exempted from writing either of the two technical exams if they complete all of the prerequisite courses within the prescribed timeframe. Please refer to p. 6 of this guide for further information. PROFESSIONAL EXAMS Candidates must successfully complete two professional exams. + Financial Accounting: Consolidation and Other Advanced Issues (FA4) This exam tests students’ financial accounting skills and covers a range of specialized topics, including financial reporting in an international context, mergers and acquisitions, foreign exchange accounting, etc. CGA PROGRAM Students enrolled in the PCPFP program must register for the FA4 exam, the PA1 exam or the PCPFP program by January 1, 2010 to meet the program criteria. Individuals who registered with the Ordre prior to January 1, 2000 should contact the Ordre’s Education Department for information on their program track. + Issues in Professional Practice (PA1) DEADLINE FOR COMPLETION OF THE CGA PROGRAM This exam tests students’ professional skills from the perspective of a consultant or external accountant providing assurance, tax or other client services. CGA candidates have five years to complete the Ordre’s requirements, calculated as of the earliest of the following three dates : The PA1 exam must be taken last, upon completion of the CGA program. 20 DEADLINE FOR COMPLETION OF THE PCPFP PROGRAM + the date on which the candidate registers for his/her first CGA exam (or is granted an exemption for a technical competency exam). Please note that the five-year period is calculated as of this date, even if the exam is cancelled or the candidate does not take the exam; + the date on which the candidate registers for practical training; + the date on which the candidate registers for the PCPFP. CGA Program for Master’s degree holders for candidates registered with the Ordre between January 1, 2000 and August 31, 2007 Program track Required seminars Required professional exams Financial Accounting (90 hrs) FA4 Auditing (60 hrs) AU2 or MU1 CERTIFICATION REQUIREMENTS + Exams Please refer to pp. 5 to 8 of this guide. Finance (45 hrs) or Taxation (90 hrs) FN2 or TX2 Professional Practice (90 hrs) PA1 SEMINAR DESCRIPTIONS + Financial Accounting (90 hours) This seminar is offered in two consecutive sessions. Students initially explore fundamental financial accounting concepts. More advanced topics include consolidation, financial instruments, tax allocation, foreign currency translation and accounting for non-profit organizations. This is the first seminar that students are required to enrol in. + Issues in Professional Practice (90 hours) This seminar favours a case-study approach and covers finance, financial accounting, auditing and taxation. The use of case studies allows students to apply the knowledge and techniques they have acquired to various practical situations. Students can also hone their knowledge of the competency-based approach and of the study techniques for the PA1 exam. For descriptions of the auditing, finance and taxation seminars, please refer to p. 17 of this guide. + Practical training The 24-month practical training requirements and criteria are described on pp. 9 to 11of this guide. + Terms and conditions - Seminar registration fees: •$1,770 for the 90-hour financial accounting, taxation and professional practice seminars • $1,000 for the 45-hour finance seminar • $1,450 for the 60-hour auditing seminar - Candidates must register on-line via the CGA website. The fees for the CGA-Canada course notes and final exam (first attempt) are included in the above prices. However, additional course materials may be required. Candidates who cannot complete the seminars in accordance with the proposed criteria can meet the training requirements by taking programs currently offered at various universities. Candidates who cancel their registration in a seminar will be charged a $150 fee and will be required to pay the prorated amount of the classes taken, calculated from the beginning of the session until the date the notice of cancellation is received by the Ordre. Fees for CGA-Canada course notes and final exams are non-refundable. *Fees are subject to change without notice and do not include GST or QST. SEMINAR INFORMATION All seminars are usually given in Montreal every two weeks on Saturdays or Sundays. The language of instruction is French; seminars may be conducted in English if student demand is sufficient. CGA PROGRAM Seminars are subject to change without notice by the Ordre. 21 REGISTER ON-LINE! (www.cga-quebec.org - under Become a CGA, Education Program, Program for Master’s Graduates) Fall session Seminar registration deadline August 18, 2008 December 2008 exam registration deadline September 19, 2008 Winter session Seminar registration deadline December 19, 2008 June 2009 exam registration deadline April 3, 2009 CGA PROGRAM Please refer to the CGA website for complete schedule information. 22 23 CGA PROGRAM 24 CGA PROGRAM Ordre des CGA du Québec 500 Place d’Armes, suite 1800 Montreal, Quebec H2Y 2W2 (514) 861-1823 (800) 463-0163 www.cga-quebec.org