A Bit Rich - Armutskonferenz

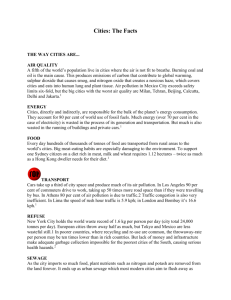

advertisement