UNIVERSITY OF SOUTHERN CALIFORNIA

MARSHALL SCHOOL OF BUSINESS

TERM I, 2007-2008, MBA.PM.LA 1&2

GSBA 511 – MANAGERIAL ECONOMICS

Instructor:

Office:

Office Hours:

Office Phone:

Professor Richard Eastin

ACCT 301-H

Tu., Th. 10-12, W 2-4 ABA

213-740-6493

E-mail:

FAX:

rich.eastin@marshall.usc.edu

213-740-6650

Online communication will be via Blackboard

COURSE OBJECTIVES

The purpose of GSBA 511 Managerial Economics is to refine our understanding of how markets

work and to explore the challenges and opportunities that markets pose for managers and firms.

The course applies basic economic principles to address issues that arise in a firm’s relationships

with customers, suppliers, competitors, employees, other organizations, and the regulatory

environment. Managerial Economics also provides some fundamental building blocks for other

courses in the core curriculum, including Marketing Management, Strategic Formulation for

Competitive Advantage, and Corporate Finance.

COURSE MATERIALS

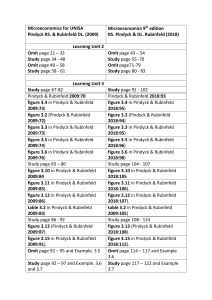

The required text for this course is Pindyck, R. and D. Rubinfeld, Microeconomics,

Pearson Prentice Hall, 2005 (Sixth Edition), and the Study Guide to accompany this text.

The Study Guide is for your optional use but will not be used for explicit assignments in

class.

EXPECTATIONS

An active and productive classroom is essential for the success of this course. Cultivating and

maintaining such an environment is the responsibility of the instructor and the students. This

responsibility imposes several obligations on all of you. First, it is very important that you

prepare yourself for each and every session. It is not necessary that you know the material “cold”

before each class, but it is important that you expend sufficient effort to gain some grasp of the

ideas we will be discussing. To be more specific, prior to every session, 1) you should read all of

the assigned materials, 2) attempt to address and answer some of the discussion questions found

at the end of each chapter, and 3) give some thought to the broader managerial implications of the

materials and your discussions.

Second, microeconomics is logical and seems quite apparent when material is being

presented in class. However, the arguments can be subtle and intellectually as well as

analytically challenging when the student attempts to reproduce the details of an economic

argument outside of class.

Further, microeconomic theory is cumulative, so that a

misunderstanding of some earlier argument can create an even deeper misunderstanding at some

later stage. It is important that you review your notes after each class and attempt to recreate the

same economic arguments on your own. Keep current with your understanding of the material by

reviewing your lecture notes soon after each class.

Third, microeconomics uses algebra, geometry and some notions from calculus as tools used

to summarize complex arguments that cannot be efficiently expressed in words. Most of this

mathematics is at the high school level, but it can be challenging if a lot of time has passed since

you last used it. I will briefly review these concepts as I use them to present economic

arguments, but I can only use a bit of our precious class time for this discussion.

1

And fourth, it is very important that you appreciate the interactive nature of the classroom

environment. Although I will typically lecture, that does not mean I discourage classroom

interaction. On the contrary, I encourage your active participation in the discussion through

observations and questions. When I ask a question, it is almost never rhetorical: I expect an

answer. And I encourage relevant questions from the class, as well.

EVALUATIONS

Your grade for this course depends on your individual performance on problem sets, a midterm, and the final examination, as well as the grading standards and policies of the Marshall

School of Business. In addition, we are all bound by the standards of academic integrity of the

University.

From time to time, I will post problem sets on Blackboard. You will also take comprehensive

mid-term and final examinations covering the concepts and materials introduced in this course.

The use of books, notes or aid from colleagues is not permitted in either exam. The Midterm will

be 1 hour, forty minutes long, and the final will last a maximum of two hours. The mid-term

exam will be held on, Monday, October 10th. The final exam is scheduled for Thursday,

November 8th. Make-up exams will not be administered.

Problem Sets and/or quizzes (lowest score will be dropped) total: …….….10 percent

Midterm..............................................................................................................40 percent

Final.................................................................................................................... 50percent

Total course……..............................................................................................100 percent

The Graduate School within the Marshall School of Business enforces a policy regarding the

distribution of grades for all required and elective courses. For required courses like GSBA 511

Managerial Economics, the policy is that the average grade be roughly a B+. There are no

specific policy guidelines with respect to the number or percentage of any specific grade given

(e.g., A, A-, etc.) or the number or percentage of passing or failing grades. Thus, considerable

discretion is given each course instructor regarding the exact assignment and distribution of

grades so long as the B+ average is attained. My policy is to comply with the grading policies of

the Marshall School of Business while recognizing and rewarding differences in performance

among students. I will also ensure that each student receiving a passing grade in this course has

demonstrated sufficient mastery of the materials to facilitate their successful performance in

subsequent courses.

The University, as an instrument of learning, is predicated on the existence of an

environment of integrity. As members of the academic community, faculty, students, and

administrative officials share the responsibility for maintaining this environment.

Students are obliged to engage in behavior that maintains the standards of academic

integrity so essential to a productive learning environment.

STATEMENT FROM DISABILITY SERVICES AND PROGRAMS

Any student requesting academic accommodations based on a disability is required to register

with Disability Services and Programs (DSP) each semester. A letter of verification for approved

accommodations can be obtained from DSP. Please be sure the letter is delivered to me as early

in the semester as possible. DSP is located in STU 301 and is open 8:30 a.m. - 5:00 p.m.,

Monday through Friday. The phone number for DSP is (213) 740-0776.

2

COURSE OUTLINE AND ASSIGNMENTS

Session

Date

1M

8/27

2W

8/29

3W

9/5

4M

9/10

5M

9/17

6W

9/19

7M

8M

9/24

10/1

9W

10 M

10/3

10/8

11 M

10/15

12 W

13 M

10/17

10/22

14 M

10/29

15 W

10/31

Thurs.

11/8

Topic

Introduction to Economics

I will introduce the course, give you some idea of what

to expect, and we may engage in a little market

experiment.

Here, we formalize the ideas of supply and demand that

we discovered through experiment last class. We will

need to review some quantitative methods, so brush off

your math skills!

Market demand in more depth: Isoelastic demand,

consumer surplus, network externalities, estimation

Production is studied as a foundation for the firm’s

costs

Cost theory: getting from production to cost. The basis

for the theory of the competitive firm’s supply

The Competitive Firm, Input and Output Markets:

putting revenue and cost together to determine the

firm’s behavior in competition. We’ll discuss how

accounting treats costs a little differently

***Midterm Exam ******

Applications of Perfect Competition: Efficiency,

equity, and policies that interfere with markets

Pure Monopoly, Regulation, and Monopsony: relaxing

the first assumption of perfect competition (single

seller; single buyer.)

Pricing Strategy: using market power to capture

consumer surplus. Price discrimination, peak-load

pricing, two-part tariffs, bundling, and advertising.

(continued)

Monopolistic competition and oligopoly. Cournot

duopoly, Stackelberg, Bertrand, and other oligopoly

models

Uncertainty: Getting ready for Finance, what is risk

aversion?

Asymmetric information: adverse selection, moral

hazard, principal-agent problems.

Pindyck & Rubinfeld

Familiarize yourself with the text by

reading all of chapter 1 and the first

couple of pages of each chapter

assigned below.

Ch 2

Ch 4 Sec. 3-6, only

Ch 6.

Ch 7

Ch 8

Ch 9

Ch 10

Ch 11

Ch 12

Ch 5 Sections 1-3

Ch 17

***Comprehensive Final Examination: Thursday,

November 8th, 6pm-8pm***

3