RESEARCH IN MOTION

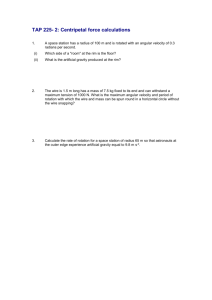

advertisement