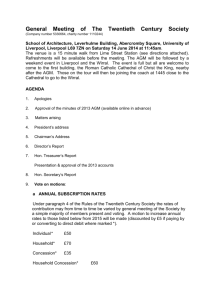

annual report

advertisement