SOPs for Petty Cash Fund

advertisement

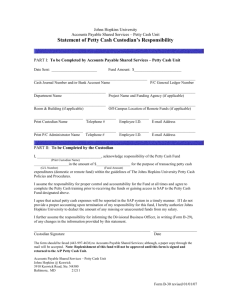

SOPs for Petty Cash Fund PLANNING AND DEVELOPMENT DEPARTMENT KHYBER PAKHTUNKHWA POST CRISIS NEEDS ASSESSMENT GOVERNANCE SUPPORT PROJECT IMPLEMENTATION SUPPORT UNIT STANDARD OPERATING PROCEDURES [SOPs] For Establishment and Management Of PETTY CASH FUND Financial Management Specialist Financial Management Specialist | 1. INTRODUCTION: 1 GSP-PCNA-ISU, Khyber Pakhtunkhwa 11/2/2012 SOPs for Petty Cash Fund Table of Contents 1. INTRODUCTION: .............................................................................................................................1 2. Definitions .....................................................................................................................................2 3.Purpose and Use of Petty Cash Fund: ...............................................................................................3 4.Establishing an Imprest Petty Cash Fund:- ........................................................................................4 5. Petty Cash Fund Administration:.....................................................................................................5 6. Petty Cash Replenishment: .............................................................................................................8 7. Record Retention ......................................................................................................................... 10 8. Roles and Responsibilities: ........................................................................................................... 11 Appendix A- Petty Cash Forms:......................................................................................................... 13 Form PCNA-PCF-01 ................................................................................................................................. 14 Form PCNA-PCF-02 ................................................................................................................................. 15 Form PCNA-PCF-03 ................................................................................................................................. 17 Form PCNA-PCF-04 ................................................................................................................................. 18 Form PCNA-PCF-05 ................................................................................................................................. 19 Form PCNA-PCF-06 ................................................................................................................................. 20 Appendix B- Petty Cash Process Snapshot ......................................................................................... 21 Financial Management Specialist | 1. INTRODUCTION: 0 SOPs for Petty Cash Fund 1. INTRODUCTION: All organizations/projects regularly incur small items of expenditure. Often these expenses are paid for by cash since the amount required may be too small for payment to be made by cheque. The Petty Cash Funds are therefore established and maintained by the organizations/projects for the purpose of paying for or reimbursing minor, incidental expenditures that are incurred outside the regular purchasing system or cycle. Petty Cash Funds are maintained on an imprest system (i.e. a system in which cash fund of a specific amount is established for appropriate use and is periodically replenished at any time. 1.1 Purpose of SOPs: These SOPs provide guidelines for establishment, management, operational procedures and termination of Petty Cash Fund. It applies only to the Petty Cash Fund operated by the Projects funded by Multi Donor Trust Fund including GSP ISU. It is intended to help the Project Staff to: Understand the Project rules on the use of Petty Cash Fund; Properly record and report transactions processed through imprest Petty Cash Fund; and Know the responsibilities of employees involved in the use and management of imprest Petty Cash Fund. Any transaction that involves use of Project Funds are subject to specific policies and requirements of the project. All individuals involved in any transaction related to Petty Cash Fund are required to know those procedures and understand the requirements that apply in particular to project expenses, purchasing and expense reimbursement. The Project Operations Manual and Financial Management Manual may also be consulted for guidance. 1.2 Objectives: Upon completion of these SOPs Custodian will; Have an overview of Petty Cash management; Know why Petty Cash is necessary; Understand the key role and responsibilities in the management process; Understand the policies surrounding Petty Cash Fund; Know the documentation requirements of Petty Cash; and Understand how to manage the daily operations of Petty Cash Fund, including approval and Petty Cash replenishment. Financial Management Specialist |PCNA 1 SOPs for Petty Cash Fund 2. Definitions Please refer to the following definitions for clarification when reading the SOPs for Petty Cash Funds. Custodian: The individual responsible for controlling and safeguarding the Petty Cash Fund. The custodian is responsible for reviewing requests for reimbursement and/or compensation, disbursing funds, and approving all petty cash transactions. Documentation: Written records regarding the petty cash transaction, including, but not limited to: a completed petty cash voucher slip (with signatures); a detailed cash register receipt or invoice; documentation of the fund number; and approval. Imprest Account: An account into which a fixed amount of money is placed for the purpose of making minor disbursements. As disbursements are made, a voucher is completed to record the date, amount, nature, and purpose of the disbursement. At least monthly (or more frequently if the petty cash fund is low), a replenishment request is prepared with substantiating vouchers. The account is then replenished for the exact amount of the disbursements, charging the appropriate general ledger accounts. The total amount of cash and the substantiating vouchers should always equal the total fixed amount of money set aside in the Petty Cash Fund. For PCNA ISU KP, the limit of imprest account has been set at Rs. 100,000 (one hundred thousand). Approver (Project Coordinator/Director): The individual responsible for ensuring that all expenditures from Petty Cash Fund are in compliance with Project Petty Cash Policy and sponsor guidelines. This individual must have appropriate authorization. Financial Management Specialist |PCNA 2 SOPs for Petty Cash Fund 3. Purpose and Use of Petty Cash Fund: 3.1The use of an imprest Petty Cash Fund is regulated under Para 132 of the General Financial Rules Volume-I read with Para 10 of the Financial Management Manual Multi Donor Trust Fund. The Petty Cash Fund should be disbursed only for minor expenses that are valid and for which appropriate documentation is supplied. Expenses that may be reimbursed from the imprest Petty Cash Fund include, but are not limited to, the following: Small office supplies and repairs of vehicles with a total value of Rs.5,000 or less per order, provided the items are not obtainable through any of the Project’s regular procurement methods; Refreshments or meals in connection with business meetings or events; Travel expenses under Rs.5000 (e.g., taxi fare, parking fees, tolls, business mileage when personal vehicle is used) Note: Per diem allowances are not reimbursed through the imprest Petty Cash Fund. Small communication expenses; Trainings, Workshops and Conferences (minor expenses); and Other miscellaneous small cash expenses. Utility bills. 3.2 Expenses that may not be reimbursed from the Petty Cash Fund include, but are not limited to: Expenses that do not comply with the Project Financial Management Manual(e.g., personal expenses, any fraudulent and illegal expense, expenses that will be reimbursed from another source) Purchases in excess of Rs.5,000 per order (reimbursements for such purchases should be processed through Assignment Account) Travel expenses over Rs.5,000 (reimbursement should be processed through Assignment Account) Expenses related to travel for which a cash advance was previously requested, and issued, by submitting a Cash Advance Request Form to Assignment Account (reimbursement should be processed through Assignment Account in order for this cash advance to be cleared) The Petty Cash Fund may not be used to cash cheques of any kind or to grant salary advances to Project employees. Financial Management Specialist |PCNA 3 SOPs for Petty Cash Fund 4. Establishing an Imprest Petty Cash Fund:- 4.1To establish a Petty Cash Fund for MDTF funded Projects, the Custodian of the Petty Cash Fund shall adopt the following procedure: Complete a Request to establish a Petty Cash Fund Form (see “Forms” section of this document). Be sure to provide the following: Purpose for establishing the fund; The amount of the Fund being established; Maximum single Petty Cash transaction limit; Types of minor expenditure that the Petty Cash Advance can be used for; The names of the Custodian and the Alternate Custodian who shall be responsible for managing the fund; and, The approval of the Project Coordinator/Director. Note: Only employees of the Project may be designated as Custodian or Alternate Custodian. Submit the approved form complete in all respect to the Finance Unit of the Project. 4.2 The Finance unit shall: Evaluate the purpose for which the Fund is being established, the appropriateness of the amount requested, measures taken to safeguard the fund, etc; Notify the name of the Custodian of the Petty Cash Fund; Notify formal sanction of establishment of Petty Cash Fund; and Issue cheque from the Project Assignment Account in the name of Custodian of the Petty Cash Fund. 4.3For PCNA ISU KP, the Project Accountant will be the Custodian of the Petty Cash Fund and shall: encash the cheque; maintain Petty Cash Book; and record all transactions in the Petty Cash Book as they occur and calculate a running balance of the remaining funds of the Petty Cash Advance. Financial Management Specialist |PCNA 4 SOPs for Petty Cash Fund 5. Petty Cash Fund Administration: Custodian of Petty Cash Fund: 5.1.1The imprest Petty Cash Fund is the property of the MDTF projects and must be used in accordance with its applicable policies. It should be under the control solely of the Custodian named on the request form or, in his/her absence, the Alternate Custodian also identified on the form. In the absence of both, any individual who assumes management of the fund on a temporary basis becomes the Fund Custodian. Changing the Custodian/Alternate Custodian: 5.1.2 In case of the Custodian’s absence, the individual named as Alternate Custodian on the Request to Establish a Petty Cash Fund form should take over management of the Fund. If a Petty Cash Fund is permanently transferred to a new Custodian, or when a new Alternate Custodian needs to be named, the Project Coordinator/Director should inform the Finance Unit in writing. Also, Project Coordinator/Director should immediately inform Finance Unit when a Custodian ceases to be a regular employee of the project. Increasing, Decreasing Petty Cash Fund:5.1.3 An imprest Petty Cash Fund may be decreased or increased at any time keeping in view requirements of the project. The procedures detailed for establishing a Petty Cash Fund shall apply: Terminating a Petty Cash Fund: 5.1.4 An imprest Petty Cash Fund may be terminated at any time by submitting a written notice to Finance Unit specifying that the Fund is being terminated. When terminating a Fund, the Custodian should ensure that the following are satisfied: outstanding requests are paid; receipts and cash on hand are reconciled; all logs and reconciliation records are on file in case of audit review; original amount of the fund in full is adjusted; and, Finance Unit is notified in writing and provided with the final reconciliation form and the record of the adjustment bill. Safeguard: 5.1.5 The amount of petty cash will be kept in a strong vault. Financial Management Specialist |PCNA 5 SOPs for Petty Cash Fund Lost or Stolen Petty Cash Fund: 5.1.6In the event of theft or loss of the Petty Cash amount, the Financial Management Specialist and Internal Auditors should be notified immediately. An investigation shall be conducted by the competent authority. 5.2Using Petty Cash: 5.2.1A Payment Voucher on prescribed form (see forms section) with supporting documents such as an original receipt or invoice must be signed and dated by the applicant requesting payment. 5.2.2The Custodian shall complete the payment voucher and shall: Check supporting documents, Budget availability, Signature of the Applicant requesting payment; Enter the correct object code(s), and sequentially number the Payment Voucher; Deduct income tax, sales tax wherever applicable 5.2.3The delegated officer (Project Coordinator/ Director) shall satisfy himself/herself about the appropriateness of the claim and approve the Petty Cash voucher. 5.2.4When approved, the payment from the Petty Cash fund may be made by the Petty Cash Custodian, who must obtain the signature of the recipient on the Payment Voucher as evidence of them receiving the cash. 5.2.5The Custodian of the Petty Cash Fund shall record the expenditure in the Petty Cash Book, and file the Payment Voucher. 5.3At regular intervals (daily or weekly), the Petty Cash Fund must be reconciled, and the expenditure posted to the General Ledger: The Petty Cash Book balance must be reconciled to the cash funds and Petty Cash Vouchers held. The petty cash expenses in the Petty Cash Book must be summarized by account and a posting summary must be prepared. If the balance of the Petty Cash Fund is less than the amount that has been determined by the Financial Management Specialist in the Petty Cash Instructions, then action should be taken to replenish the Petty Cash Fund (see below). Financial Management Specialist |PCNA 6 SOPs for Petty Cash Fund After review and approval of the reconciliation and the posting summary by the relevant delegated officer, the expenditure from the petty cash posting summary is posted to the relevant ledger accounts and Petty Cash Log. Financial Management Specialist |PCNA 7 SOPs for Petty Cash Fund 6. Petty Cash Replenishment: The Petty Cash Fund is required to be replenished at least once a month. It is important to replenish petty cash monthly to allow expenditures to be recorded in the month in which they occurred, regardless if funds are low. There are four phases to replenish Petty Cash Fund: documentation review and cash analysis; paperwork preparation; authorization from the Approver; and Pre-audit by Finance Unit. Documentation Review and Cash Analysis 6.1 The first step in replenishing the Petty Cash Fund is reviewing the petty cash documentation and counting the cash on hand. The review of the petty cash documentation provides the Custodian with the opportunity to verify that the information received at the time of reimbursement was correct. Below are the steps the Custodian must complete during the review phase of replenishment. Gather all petty cash voucher slips, supporting receipts, and the petty cash box for review. Perform a second review of all the petty cash expenditures verifying that all charges are reasonable, allocable, allowable, and consistent. Separate all of the expenditures by fund and object code. Complete a Petty Cash Replenishment form. Note: Transactions with the same object code and fund may be listed on a single line item on the request for replenishment form. Count the cash on hand. Sign, date, and copy the form and all supporting documentation for the department’s records. Submit the Petty Cash Replenishment form and supporting documentation to the Approver for review and approval. Note: The Custodian should obtain a copy of the approved front page of the Petty Cash Replenishment form and add to his record. 6.2 Authorization by Approver: Before the Approver can authorize the request for petty cash replenishment, he/she must complete the following steps: Perform a review of all the petty cash expenditures verifying all charges are reasonable, allocable, allowable, and consistent. Sign and emboss the Petty Cash Replenishment form to certify the accuracy of the charges and approve the request for cash. Sanction the expenditure included in the Replenishment form. Financial Management Specialist |PCNA 8 SOPs for Petty Cash Fund Sent the Petty Cash Replenishment form and supporting documentation including sanction to Finance Unit for PreAudit. 6.3 Pre-Audit By Finance Unit: 6.3.1Every claim voucher (bill) must be pre-audited by a certifying officer in the Finance/ Accounts section. The pre-audit process comprises two functions, namely a verification function and an audit function. The Certifying Officer shall: Ensure that the claim voucher has been approved by a delegated approving authority; Certify the validity of claim voucher; Ensure that it correctly identified the object code to which it will be charged; Check that funds are available under the relevant object to make payment; Check that sanction is accorded by the authority who has been delegated Financial Powers; Check that arithmetic calculations of the voucher are correct; Deduct income tax, sales tax where applicable; and Verify the actual payees receipts attached with the voucher. 6.3.2The claim voucher (bill) should be authorized for payment after it is pre-audited. 6.3.3The payment is authorized by the authorizing officer by recording a ‘pay order’ on the claim voucher in writing, noting the amount for which the claim has been passed in figures and in words. All payments should be recorded in appropriation register as expenditure, classified as per Chart of Account, under appropriate object code. No payment exceeding the value of available funds can be passed for payment. Project Accountant shall issue the cheque in the name of Custodian of the Petty Cash Fund. Financial Management Specialist |PCNA 9 SOPs for Petty Cash Fund 7. Record Retention 7.1 The Project and both the Internal/External Auditors require that records related to the reimbursement of business expenses incurred by Project employees must be retained for a prescribed length of time. In case of audit, these records provide the materials that support the expenditures. 7.2 The Finance Unit is responsible for maintaining and retaining such records as those listed below for the period of time required by law, and for making them readily available for audit. Other records related to Petty Cash Fund transactions that are not submitted to the Finance Unit should be retained by Custodian. 7.3 Records related to Petty Cash Fund transactions that are retained by the Finance Unit include: Original receipts or other documentation that support the validity of the expenses being reported for reimbursement; Request for reimbursement forms; Attachments such as the Expense Breakdown Sheet; and, Any memo that may have been necessary to support the request for reimbursement from the Fund. 7.4Records related to Petty Cash Fund transactions that are not submitted to the Finance Unit and which local Custodian is advised to maintain include: Petty Cash Fund Log; Any petty cash voucher or form established for internal use by local units; Petty Cash Book; and Stock Register. 7.5 Accounting record for the petty cash needs to be maintained in Pak Rupees and US Dollars. Financial Management Specialist |PCNA 10 SOPs for Petty Cash Fund 8. Roles and Responsibilities: The major responsibilities each party has for management of Petty Cash Fund of the MDTF funded Projects are as follows: Project Review requisitions for appropriateness of expenses; Coordinator/Director: Know what expenditures are allowed for particular account; Approve establishment/Replenishment of Petty Cash Fund; and Sanction expenditure. Financial Management Specialist/ Finance officer of the Project: Project Accountant: Fund Custodians: Review requests to establish Petty Cash Fund. Ensure that appropriate accounts are used for the Fund. Train Project Staff on their responsibilities related to the Fund disbursement and maintenance. Ensure that employees understand and comply with rules, regulations, and policies governing project expenses and expense reimbursement. Review requisitions for appropriateness of purchases and of charges to specific accounts. Advise on proper charging of expenditures. Review and investigate when necessary to determine and ensure that project procedures related to imprest Petty Cash Fund are adhered to. Authorize payments. Ensure that expenses reported by Fund Custodian are supported by receipts or other appropriate documentation and that replenishment requests have appropriate approvals and are promptly responded to; Pre-audits all expenditures for payment; Enter the expenditure in the appropriation register; and Record pay order on the claim voucher noting the amount for which the claim has been passed in figures and in words. Ensure that Petty Cash is kept in a safe place, maintained properly, and disbursed appropriately; ensure that every requisition is supported by appropriate documentation; maintain the Petty Cash Fund Cash Book; Reconcile the Petty Cash Account monthly; Submit Replenishment requests to the Project Coordinator/Director at regular intervals; and Retain the record. Financial Management Specialist |PCNA 11 SOPs for Petty Cash Fund Internal Audit: Individual Requesting Reimbursement from the Petty Cash Fund: Review and investigate when necessary to determine and ensure that Project policies and procedures related to imprest Petty Cash Funds are adhered to. Ensure that expenses are valid and permissible; provide proper documentation for expenses incurred; and provide the correct object to which expenses should be charged; acknowledge the amount received from Petty Cash Custodian Financial Management Specialist |PCNA 12 SOPs for Petty Cash Fund Appendix A- Petty Cash Forms: Appendix A provides a copy of all the forms needed to manage the Petty Cash Fund. The forms noted in this document, listed below, are available at the Finance Section or PCNA website (pcna.gkp.pk) Form Use Request to Establish a Petty Cash Fund (PCNA-PCF01) To establish an imprest Petty Cash Fund; Expense Replenishment Form: (PCNA-PCF 02) To report all expenses paid through the imprest Petty Cash Fund and to request replenishment from the Project Assignment Account. Petty Cash Fund Transfer of Custodian Responsibilities (PCNA-PCF 03) To be used at the time of transfer of the Custodian of Petty Cash Fund. Petty Cash Fund Reconciliation Form (PCNA-PCF 04) To report the status of the fund by noting total cash on hand and total receipts paid from the fund. Petty Cash Fund Log (PCNA-PCF 05) To record Petty Cash Fund transactions. Petty Cash Voucher (PCNA-PCF 06) To be used for payment from the Petty Cash Fund. Financial Management Specialist |PCNA 13 SOPs for Petty Cash Fund PCNA GSP ISU P & D Department Khyber Pakhtunkhwa Form PCNA-PCF-01 PETTY CAHS FUND (IMPREST) START UP FORM Use this form when requesting to establish an imprest petty cash fund for your Project. 1. Submit completed form to the Finance Unit of the Project.. For guidance on the establishment, use and maintenance of imprest petty cash funds, refer to the Petty Cash Funds (Imprest)SOPs of the MDTF Projects available on (http/:pcna.gkp.pk) PETTY CASH FUND NUMBER(For General and Restricted Accounting use) PROJECT ASSIGNMENT ACCOUNT NO. AMOUNT PURPOSE OF THE FUND(Describe the nature of expenses that will be paid using the fund) ESTIMATED TWO-WEEK USE OF FUND IF APPLICABLE FUND END DATE AND PROJECT NUMBER JUSTIFICATION FOR ESTABLISHING THE FUND(Explain why Assignment Account cannot be utilized for Petty Cash requirements) MEASURES TAKEN TO SAFEGUARD THE FUND SIGNATURE OF CUSTODIAN SIGNATURE OF APPROVER OFFICE STAMP: For Use of Finance Unit Passed for Rs.___________________ (Rupees.____________________________________________) Signature of Project Accountant Signature of Financial Management Specialist Date Cheque issued No.______________________ date___________________ Rs.________________ Cheque acknowledge by :_________________________ Date:_____________________________ Financial Management Specialist |PCNA 14 SOPs for Petty Cash Fund PCNA GSP ISU P & D Department Khyber Pakhtunkhwa Form PCNA-PCF-02 Replenishment PETTY CASH FUNDS (IMPREST) This form is to be used by MDTF funded Projects employees to request replenishment for an existing petty cash fund. Submit completed form to the Finance Unit of the project For guidance, refer to the Petty Cash Fund SOPs of the MDTF funded Projects at (www.pcna.gkp.pk). PETTY CASH CUSTODIAN INFORMATION 1. CUSTODIAN’S FULL NAME 2. Voucher No. Dated: 3. PROJECT ADDRESS EXPENSE/ACCOUNT DETAILS REQUEST TO REPLENISH EXISTING IMPREST PETTY CASH FUNDS ASSIGNMNET ACCOUNT No. FUND PROJECT 6. AMOUNT Rs. 7. DESCRIPTION/Object Code. GROSS AMOUNT 8.DEDUCTIONS INCOME TAX SALES TAX TOTAL DEDUCTIONS 9. NET AMOUNT A03205 Courier service A03301 Gas A03303 Electricity A03603 Motor Vehicles Registration A03806 Transportation of Goods A03807 POL A03808 Conveyance charges A03809 CNG charges A03901 Stationary A03905 News papers, Periodicals, Books A06301 Entertainment A09802 Purchase of other assets A13001Repair of Vehicles A13101 Repair Machinery & Equipment A13201 Repair of Furniture and fixtures A13199 Repair others A13701 Repair of Computers A13703 Repair of IT Equipments A13801 Maintenance of Garden 10. TOTAL AMOUNT OF REIMBURSEMENT (IN WORDS) Financial Management Specialist |PCNA 15 SOPs for Petty Cash Fund 12. SIGNATURES/APPROVALS:I, the Petty Cash Custodian, certify that the charges reported here are correct and that I am not claiming SIGNATURE OF CUSTODIAN reimbursement from other sources for the same. EMAIL ADDRESS OF CUSTODIAN NAME OF APPROVER SIGNATURE OF APPROVER Official Stamp: Official Stamp: Finance/Accounts Section use only Appropriation for the year: Budget Allocation: ________________ Rs.________________ Expenditure including this bill: Rs.________________ Balance: Rs._______________ Passed for Rs.____________________ (Rupees.______________________________________) Project Accountant Financial Management Specialist/Finance Officer Cheque issued. No.______________________ date:_______________ Amount:_____________ Project Accountant Acknowledgement/Receipt Received by:_____________________ Signature:_____________________ Date:_________ Financial Management Specialist |PCNA 16 SOPs for Petty Cash Fund PCNA GSP ISU KP PCNA GSP ISU Form PCNA-PCF-03 P & D Department Khyber Pakhtunkhwa Finance/Accounts Section PETTY CASH FUND TRANSFER OF CUSTODIAL RESPONSIBILITIES Petty Cash Fund Location: _______________________________ Effective Date: _________________ Amount Rs. _____________________________ Object: ____________________________________ Reference No. ________________ (Finance Unit use only) Former Custodian: _____________________________ _________________________________ PRINT NAME New Custodian: SIGNATURE _____________________________ _____________________________ PRINT NAME SIGNATURE Your signature indicates that you: 1. have confirmed the amount above 2. have acknowledged that the individual receiving the fund is authorized to manage the fund, and 3. understand that the site fund is subject to routine audits by the Internal/External Auditor. Project Coordinator/Director Approval: ________________________________ PRINT NAM E _____________________________ SIGNATURE Your signature indicates that you: 1. have witnessed the transfer of the above funds, 2. have acknowledged that the individual receiving the fund is authorized to manage the fund, and 3. understand that the site fund is subject to routine audits by the Internal /External Auditor. Finance Officer Approval: _______________________ ____________________ PRINT NAM E SIGNATURE ________________ DATE Financial Management Specialist |PCNA 17 SOPs for Petty Cash Fund PCNA GSP ISU P & D Department Khyber Pakhtunkhwa Form PCNA-PCF-04 PETTY CASH FUND RECONCILIATION FORM ____________________________ MONTHLYREPORT TO PROJECT Coordinator/Director DATE __________________________________ PETTY CASH FUND NUMBER TRANSFER OF CUSTODIANSHIP FROM: _________________________________ __________________________________ PROJECT TO: _________________________________ Description AMOUNT Cash on Hand Rs. Receipts on Hand Rs. Total Cash and Receipts Petty Cash Fund Original Amount Rs. Difference Rs. Rs. REASONS FOR DIFFERENCE (IF ANY): SIGNATURES I have verified fund status and agree to this Reconciliation report: I have verified fund status, agree to this reconciliation report, and assume management of the fund: _________________________________________ Project Coordinator/Director Signature ______________________________________________ Custodian Assuming Fund Management Financial Management Specialist |PCNA 18 SOPs for Petty Cash Fund Form PCNA-PCF-05 PETTY CASH FUND LOG ____________________________ PETTY CASH FUND NUMBER DATE NAME OF RECIPIENT ________________________________ PROJECT SIGNATURE OF RECEPIENT TYPE OF EXPENSE ________________________________ CUSTODIAN SIGNATURE AMOUNT DISBURSED Financial Management Specialist | Appendix A- Petty Cash Forms: _____________________________ DATE RANGE EXCESS CASH RECIPIENT INITIAL RETURNED (IF APPLICATBLE) (UPON RETURN OF EXCESS CASH) 19 OBJECT SOPs for Petty Cash Fund PCNA GSP ISU P & D Department Khyber Pakhtunkhwa Form PCNA-PCF-06 Petty Cash Voucher N0. Date: Description Amount in Rupees Total TOTAL AMOUNT IN WORDS RUPEES. SIGNATURE OF THE CLAIMANT:________________________________ CHECKED BY PETTY CASH FUND CUSTODIAN:_______________________________________ AUTHORIZED BY PROJECT COORDINATOR/DIRECTOR:_________________________________ PAYMENT ACKNOWLEDGED BY:__________________________________________________ Financial Management Specialist | Appendix A- Petty Cash Forms: 20 SOPs for Petty Cash Fund Appendix B- Petty Cash Process Snapshot Step 1 Claimant to fill the Form PCNA-PCF-06 (see page 23) and submit to the custodian (Project Accountant). Supporting documents should be attached with the Form. Step 2 Custodian will process the request and obtain approval of the Coordinator. Petty cash payments will usually processed within a day but in some cases it can take maximum of 3 days. Step 3 Custodian will make payment to the claimant and will obtain recipient acknowledgement. No other person can receive cash on behalf of the claimant. Step 4 In case of advance, the claimant shall submit adjustment of advance within 3 days including actual invoices/ bills for expenditure incurred and the remaining balance amount, if any, shall be refunded to the custodian. The custodian will provide the refund receipt in case of balance refunded. In case the actual expenditure is more than the amount of advance, custodian will pay the balance amount to the claimant after obtaining approval for the coordinator. Note: Form PCNA-PCF-06 will be used for reimbursement of expenditure already incurred by the claimant, advance requested by the claimant and the adjustment of advance received. Financial Management Specialist |PCNA 21