Has the Board developed a Petty Cash policy

advertisement

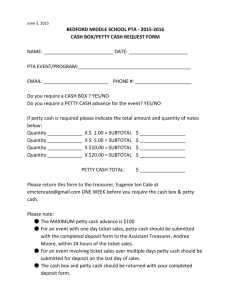

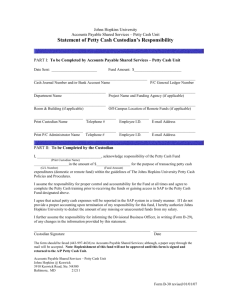

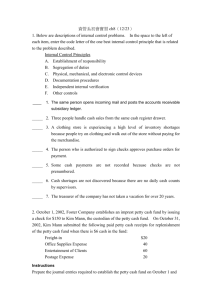

PETTY CASH POLICY DEVELOPMENT TOOL Developed by the City of Toronto – Social Housing Unit What is a petty cash policy? Petty cash refers to a fund of fixed amounts used for small expenditures. Petty cash funds should be between $200 and $400, depending on your corporation’s specific needs. A petty cash policy details how and when these funds can be used. Why is a petty cash policy important? Although petty cash amounts should be relatively small, they can be subject to theft if the proper controls are not in place. To prevent this, the Board should have a documented petty cash policy. Petty Cash policies/procedures must allow for adequate control over petty cash expenditures, ensure that petty cash payments are supported by proper documentation, and ensure that petty cash funds are protected from theft. Steps to develop a petty cash policy. 1. Determine the required amount of petty cash and the maximum expense amount. The amount should cover at least one month’s petty cash requirements. 2. Designate the petty cash fund custodian, and the alternate custodian during lengthy absences (e.g. vacation, sick leave etc.). A good business practice is to have only one person appointed custodian of the petty cash fund. 3. Ensure that your petty cash system has appropriate financial controls (i.e. voucher system). A petty cash voucher should be used for all disbursements. Ensure that vouchers have the following information: date amount purpose account to be charged name of person who disbursed petty cash signature of person receiving petty cash Each petty cash voucher should be supported by original receipts, where possible. Where this is not possible, this should be indicated on the voucher. 4. Maintain the security of the cash. Decide where cash will be kept. Keep petty cash locked in a metal cash box or drawer. 5. Monitor and replenish petty cash fund to avoid shortages, and record expenses within the fiscal period in which they were incurred. Petty cash and receipts should be reconciled at least monthly by someone other than the custodian. This step should be done in the presence of the petty cash custodian. Decide when cash will be replenished. Stamp vouchers and receipts “paid” when the fund is replenished. Cash shortages or excess cash should be reported immediately to the person with authority over the fund. Report thefts and/or attempted thefts to police. Petty Cash should be replenished when cash is nearly spent, allowing enough time to process a reimbursement request, e.g. 3 to 4 days. 6. Establish procedures for implementing the petty cash policy. Step One: Use Cash and Create Petty Cash Voucher Use cash to purchase small maintenance and office supply items. Keep receipts and details of purchase. Substantiate petty cash purchase with a voucher. Step Two: Reimburse Petty Cash Complete cheque requisition form. Complete expense details (voucher system) and attach receipts. Forward requisition to Board for approval. Perform petty cash reconciliation and file. Determine who does this step. Step Three: Approve cheque requisition Approve payment. Determine who approves payment (i.e. Treasurer). Step Four: Issue cheque Book expenses. Issue cheque. Forward to signing officers for signature. Determine who does this step (i.e. Bookeeper) Step Five: Sign Cheque Signing Officers sign cheque and return to property manager. Step Six: Cash Cheque Cash cheque and replenish petty cash float. Determine who does this step (i.e. Property manager) How can the Board of Directors ensure that the corporation’s petty cash policy is being followed? Some ideas: Have the Treasurer approve monthly payments to petty cash. Once a year have the Treasurer do the petty cash reconciliation.