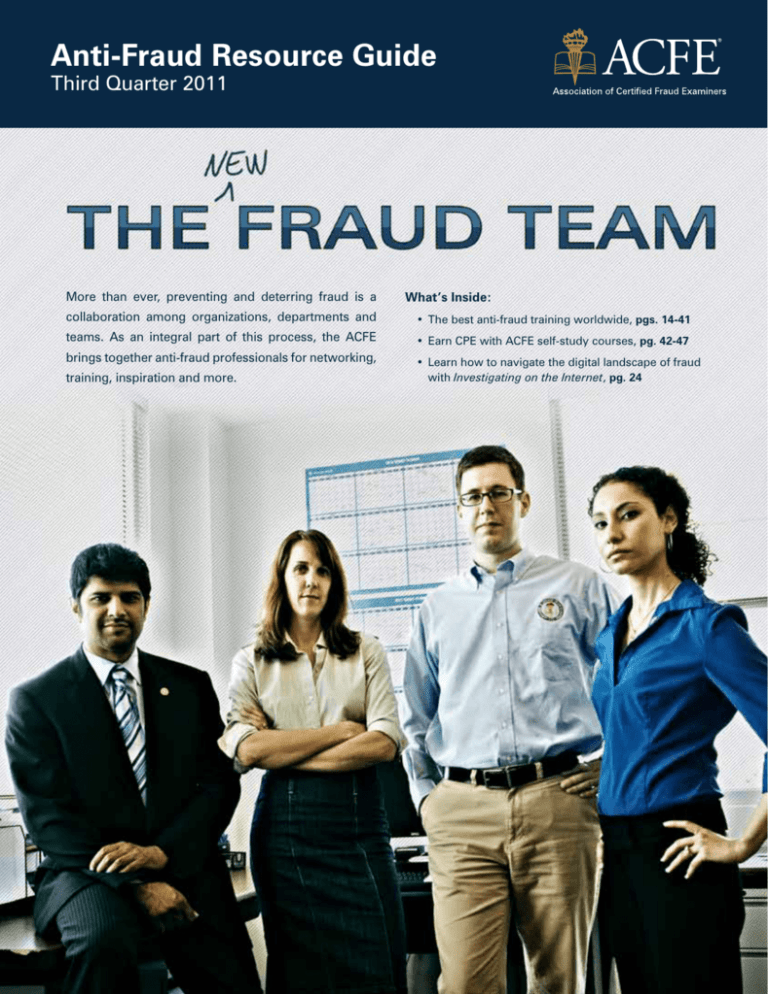

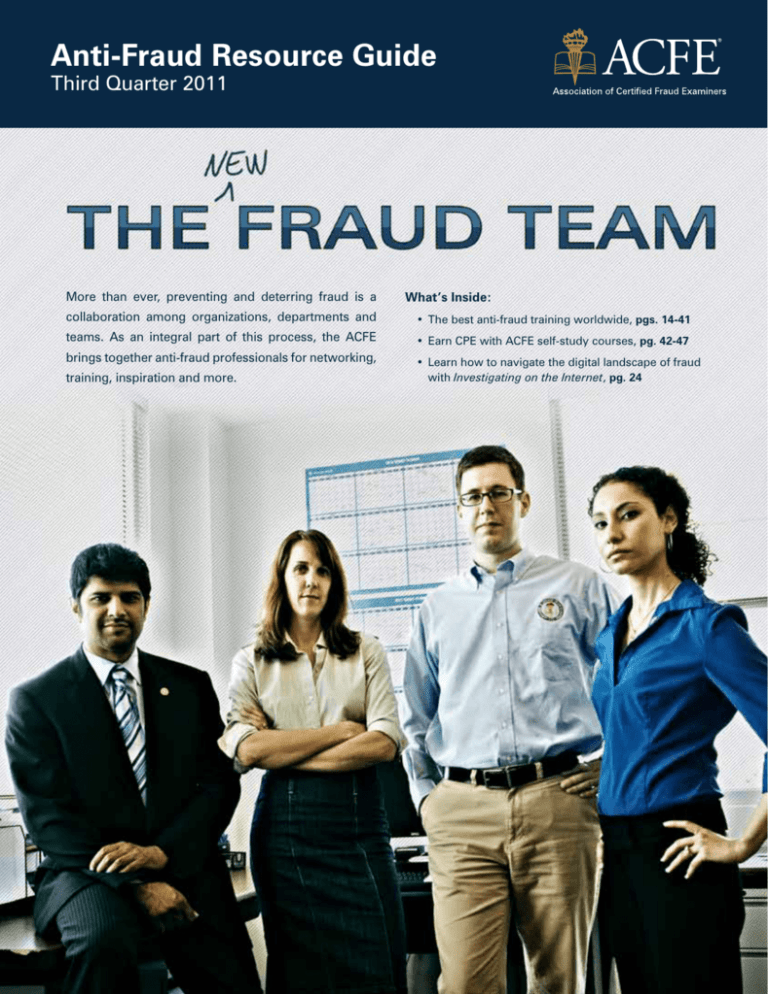

Anti-Fraud Resource Guide

Third Quarter 2011

More than ever, preventing and deterring fraud is a

What’s Inside:

collaboration among organizations, departments and

• The best anti-fraud training worldwide, pgs. 14-41

teams. As an integral part of this process, the ACFE

• Earn CPE with ACFE self-study courses, pg. 42-47

brings together anti-fraud professionals for networking,

• Learn how to navigate the digital landscape of fraud

with Investigating on the Internet, pg. 24

training, inspiration and more.

Table of Contents

Membership and Certification (pgs. 3-11)

Introduction............................................................................................................................................ 3

Membership Benefits and Referral Application................................................................... 6 and Insert

Becoming a CFE..................................................................................................................................... 7

CFE Exam Review Course...................................................................................................................... 8

CFE Exam Prep Course........................................................................................................................ 10

ACFE Learning Events (pgs. 12-41)

Calendar of Events............................................................................................................................... 12

Conferences (pgs. 14-16)

23rd Annual ACFE Fraud Conference and Exhibition in Orlando, FL��������������������������������������������������� 14

2011 ACFE Asia-Pacific Fraud Conference........................................................................................... 15

17th Annual ACFE Canadian Fraud Conference and Exhibition in Toronto������������������������������������������ 16

Seminars (pgs. 17-41)

Principles of Fraud Examination........................................................................................................... 17

Auditing for Internal Fraud................................................................................................................... 18

Conducting Internal Investigations...................................................................................................... 19

Professional Interviewing Skills........................................................................................................... 20

Legal Elements of a Fraud Examination.............................................................................................. 21

Introduction to Digital Forensics.......................................................................................................... 22

Fraud Prevention.................................................................................................................................. 23

UPDATED! Investigating on the Internet: Research Tools for Fraud Examiners��������������������������������������� 24

Interviewing Techniques for Auditors: Eliciting Information............................................................... 25

Contract and Procurement Fraud......................................................................................................... 26

Money Laudering: Tracing Illicit Funds................................................................................................ 27

Financial Statement Fraud.................................................................................................................... 28

Investigating Conflicts of Interest........................................................................................................ 29

Digital Forensics Tools and Techniques............................................................................................... 30

How to Testify...................................................................................................................................... 31

Mortgage Fraud.................................................................................................................................... 32

Building Your Fraud Examination Practice........................................................................................... 33

Healthcare Fraud.................................................................................................................................. 34

Financial Institution Fraud.................................................................................................................... 35

NEW! Fraud Risk Management................................................................................................................ 36

NEW! Fraud-Related Compliance............................................................................................................. 37

Advanced Fraud Examination Techniques........................................................................................... 38

Advanced Interviewing Techniques Workshop.................................................................................... 39

ACFE Faculty........................................................................................................................................ 40

On-Site Training.................................................................................................................................... 41

ACFE Bookstore (pgs. 42-50)

Self-Study CPE..................................................................................................................................... 42

Books and Manuals............................................................................................................................. 48

ACFE Merchandise.............................................................................................................................. 50

2

|

VISIT ACFE.com

CALL (800) 245-3321 / +1 (512) 478-9000

The Association of Certified Fraud Examiners,

Inc. is registered with the National Association

of State Boards of Accountancy (NASBA) as a

sponsor of continuing professional education

on the National Registry of CPE Sponsors.

State boards of accountancy have final authority on the acceptance of individual courses for

CPE credit. Complaints regarding registered

sponsors may be addressed to the National

Registry of CPE Sponsors, 150 Fourth Avenue

North, Suite 700, Nashville, TN, 37219-2417.

Website: www.nasba.org.

DISCLAIMERS

*Reservations subject to availability. I understand if I reserve a room at the course hotel,

the hotel may disclose to ACFE non-financial

reservation information, (name, dates of stay),

for the purpose of updating and confirming

the event room block. By registering for this

event, I grant the ACFE or anyone authorized

by the ACFE, the right to use or publish in print

or electronic format, any photographs or video

containing my image or likeness for any promotional purpose, without compensation.

†

Payment must be received by Early Registration Deadline to obtain savings.

Association of Certified Fraud Examiners, ACFE,

the ACFE Seal, ACFE Logo, Certified Fraud

Examiner (CFE), CFE Exam Prep Course® and

Fraud Magazine® are trademarks owned by the

Association of Certified Fraud Examiners, Inc.

©2011 by the Association of Certified Fraud

Examiners, Inc.

Developing your skills is essential

to your professional success.

Do you have the tools you need?

The ACFE is committed to arming anti-fraud professionals with the skills and knowledge you need to fight fraud more effectively. Whether your career is focused exclusively on fraud detection or prevention, or you just want to know more about fraud,

the ACFE is your source for information and support.

Sharpen your skills and stay informed by becoming a member today.

Complete the application on the reverse side and fax or mail to:

716 West Ave • Austin, TX 78701-2727 • USA

Fax: +1 (512) 478-9297

Become a member online by visiting

ACFE.com/Join

Or call us M–F, 7:30 a.m. – 6:00 p.m. Central Time

(800) 245-3321 / +1 (512) 478-9000

associate member application

I. QUALIFICATIONS FOR MEMBERSHIP

VII. PAYMENT (Payment must accompany application.)

There are two categories of membership: Associate (non-certified) and Certified Fraud Examiner (CFE). This

application is for Associate Membership only. After being approved as an Associate, you may complete a

separate application to become a CFE if desired. The application fee is non-transferable and is non-refundable

once approved. Annual membership dues include $20 for a one-year subscription to FRAUD MAGAZINE®.

Automatic Dues Renewal (selection required):

qq Option 1: Enroll in Automatic Dues and save 10% on your annual dues (card billed automatically

each year)

qq Option 2: Do not enroll in Automatic Dues (charge my card for this charge only)

ASSOCIATE MEMBERSHIP FEES (incomplete applications will not be processed)

qq Associate (U.S./Canada)............................................................................................................. $150*

qq Charge my (Check one. Card charged in U.S. $):

*Application fee and membership dues rate as of 10/2010. All fees and dues are non-refundable. Rates subject to change.

Card Number

Card Expires (month/year)

II. PERSONAL

V-Code (on back / front of AMEX)

Cardholder Name (as shown on card, please print)

q Dr. q Mr. q Mrs. q Ms.

Billing Address

Name

CityState

Other Designations

Zip/Postal CodeCountry

Home Address

Signature

City State/Province

Zip/Postal Code Country

qq Check or Money Order enclosed. Make checks payable to: Association of Certified Fraud Examiners.

Check or Money Order number: ________________________________________________

Home Telephone

Home Fax

VIII. JOB AND INDUSTRY (please select one)

Home Email Address

III. EMPLOYMENT

Employer Title

Address

City State/Province

Zip/Postal Code Country

Business Telephone Business Fax

Years Employed Business Email Address

Web Site Address

Job Function

qq Fraud Examiner

qq Fraud Investigator

qq Private Investigator

qq Special Agent

qq Internal Auditor

qq External Auditor

qq Forensic Accountant

qq CPA, CA or equivalent

qq Management Accountant

qq Controller

qq Other Accounting/Finance

qq Governance, Risk and Compliance

qq Corporate Management

qq Loss Prevention

qq IT Professional

qq Security Professional

qq Attorney/Legal Professional

qq Educator

qq Retired

qq Other:

Preferred Mailing Address: q Home q Business Preferred E-Mail Address: q Home q Business

IV. Character

Have you ever been convicted of a felony or misdemeanor involving moral turpitude (“moral turpitude”

means an offense that calls into question the integrity or judgment of the offender, such as fraud, bribery,

corruption, theft, embezzlement, solicitation, etc.)? q Yes q No If yes, please describe (attach

written statement if necessary).

V. CERTIFICATION

I certify that the above is true and correct to the best of my knowledge. Falsification of any information on

this application is grounds for denial or revocation of membership. If this application is accepted, I agree

to abide by the Bylaws and Code of Professional Ethics of the Association of Certified Fraud Examiners.

Membership is a privilege and not a right. Qualifications are established by the Board of Regents, whose

decisions are final. I consent to the storage of my personal data in the ACFE’s offices in the United States,

in its regional offices and by its local chapters.

Signature ATTN: Membership Admissions • ACFE • World Headquarters • The Gregor Building

716 West Ave • Austin, TX 78701-2727 USA • Fax: +1 (512) 478-9297

VI. SERVICES

qq Subscribe me to the free FraudInfo e-newsletter filled with fraud news, tips and resources.

qq Subscribe me to the CFE Exam Coach e-newsletter.

qq I am interested in becoming a CFE. Please send me information.

Join Today!

ACFE.com

FOR OFFICE USE ONLY

IX. MAIL OR FAX COMPLETED FORM TO

Date

qq I was referred by:

q ACFE Member: or Local Chapter:

q Other (please specify):

Industry

qq Education

qq Financial Institutions

qq Government

qq Healthcare

qq Insurance

qq Law Enforcement

qq Law/Legal Services

qq Management Consultants

qq Manufacturing

qq Public/Chartered Accounting

qq Real Estate

qq Services

qq Non-Profit

qq Other:

Interests (select all that apply)

qq Money Laundering (or AML)

qq Fraud Examination / Investigation

qq Loss Prevention

qq Legal Elements of Fraud

qq Insurance Fraud

qq Computer or Technology-based Crime

qq Issues Related to Sarbanes-Oxley

qq Risk Management

qq Healthcare Fraud

qq Ethics

qq Mortgage Fraud

qq Fraud Auditing and Forensic Accounting

qq Non-Profit Fraud

qq Corporate Security

qq Practice Management/Building your Fraud

Examination Practice

qq International Investigations and Global Issues

qq Identity Theft

qq Financial Institution Fraud

qq Interview Skills/Techniques

qq Tax Fraud

qq Fraud Prevention

qq Digital Forensics/Electronic Evidence

qq Internal Controls

qq Construction Fraud

qq Governance, Risk and Compliance

qq Contract and Procurement Fraud

qq Government/Law Enforcement

qq Fraud Hotlines

qq Other:

X. LOCAL CHAPTERS

Members of the Association of Certified Fraud Examiners are strongly encouraged to take advantage

of the many networking and training opportunities available to them by participating in their local ACFE

chapters (currently there are more than 135 worldwide). Local chapter membership is not a requirement

for ACFE members; however, members of local chapters are required to be members of the ACFE. To find

your local chapter, visit ACFE.com/Chapters.

(800) 245-3321 / +1 (512) 478-9000

+1 (512) 478-9297

Updated 6/11 • RG11Q3N

THE FRAUD TEAM

In the fight against fraud,

Corbett is a Bank Secrecy Act (BSA) Compliance Special-

no one can go it alone. Even

Certified Fraud Examiners (CFEs),

leaders in the anti-fraud profession, know that fighting whitecollar crime is a team effort.

ist and Director of Risk Management for Sun East Federal

Whether working with clients, co-workers, law en-

an investigation relevant to your current case and they may

forcement, security professionals, government officials or

be willing to help you. Most people are willing to share their

other fraud examiners, the successful fraud fighter needs

successes and failures.” Read Corbett’s profile on page 5.

to be able to communicate and collaborate effectively to

get the job done.

Credit Union, and she feels that “networking is key” to successfully fight fraud.

“Networking allows you to provide others with tips

on conducting an investigation or to just run a situation by

someone,” Corbett said. “They may have already conducted

Getting the right training and sharing the latest information on preventing and detecting fraud can help

Grace Corbett, CFE, had this in mind when she joined

fraud fighters both further the anti-fraud profession’s

the ACFE to build her network of anti-fraud professionals.

body of knowledge, and establish their own expertise and

VISIT ACFE.com

CALL (800) 245-3321 / +1 (512) 478-9000 | 3

Networking allows you

to provide others with tips on

conducting an investigation

or to just run a situation by

someone.”

credibility among their colleagues. This process

Denise R. Harding, CFE, CPA, an NCIS special agent,

starts with ACFE training opportunities, including

said that when she has questions about the latest

those online as well as in a live setting, from which

court findings in regard to fraud cases in different

participants can bring back real, practical methods

states, she consults her contacts in those areas —

for staying one step ahead of the fraudsters. They

and vice versa. The information sharing even cross-

are tools of the trade that can be passed along a

es international borders, providing Harding with “a

network to help an entire company or client base.

wide network of contacts and colleagues I can call

Take Principles of Fraud Examination, for in-

4

|

for suggestions and guidance.”

stance (July 18-21, 2011, in Austin, Texas, pg. 17).

Such a network must be cultivated and main-

The popular course provides fundamentals on the

tained, and an ACFE event provides the perfect set-

four basic areas of fraud examination: fraud preven-

ting for meeting new contacts, while reconnecting

tion and deterrence, legal elements of fraud, fraudu-

with old ones.

lent financial transactions and fraud investigation.

For those who consider becoming a CFE to

The three-and-a-half days of training include inter-

be a daunting task, getting into the team mentality

active discussions, video screenings and ample op-

could be just the trick to finally earning the valuable

portunities for networking — which help build the

credential. The CFE Exam Review Course puts pro-

basis for future teamwork. The connections made

spective CFEs in the same room, led by practicing

at an ACFE event can be used to everyone’s advan-

CFE instructors, to help master the concepts tested

tage afterward. A follow-up email to a computer fo-

on the CFE Exam. Your colleagues will benefit from

rensics specialist or interviewing guru, for example,

your questions and input in the class — and you

could help break that next fraud case.

will benefit from theirs. Best of all, you will have

Many ACFE members have a network of con-

the opportunity to participate in organized study

tacts with whom they communicate on a regular

sessions with your classmates, and will be provid-

basis. These networks and their flow of informa-

ed with tips and processes designed for the work-

tion are crucial to keeping anti-fraud professionals

ing professional’s busy schedule. Held in several

up to speed on the latest in fraud prevention and

locations throughout the year, the next CFE Exam

detection. As described in her member profile in

Review Courses (pg. 8) will take place in Chicago

the ACFE’s Second Quarter 2011 Resource Guide,

(Aug. 29-Sept. 1) and New York (Sept. 19-22).

VISIT ACFE.com

CALL (800) 245-3321 / +1 (512) 478-9000

There is an effective area of anti-fraud training that is custom-fit for the team mentality: ACFE

On-Site Training. With this option, industry-leading

faculty members come directly to a company, government agency or organization to provide crucial

anti-fraud training. The instructors bring their own

expertise as well as tried-and-true ACFE course

materials that have helped make the CFE the “gold

standard” in the anti-fraud profession.

An ACFE On-Site Training course presents an

interactive learning environment where issues are

addressed in a positive atmosphere, with all discussions focused on the team’s specific needs and

concerns. The shared learning experience provides a valuable opportunity for team building and

increasing staff motivation and morale. It is also a

sound economic decision: with no need to book

flights, hotels and rental cars for staff, clients can

hand-pick members of their team to participate in

the training — at a cost that is less than sending a

group of people to an off-site event.

Finally, there is no underestimating the use of

social media as well as good old-fashioned word-

Director Relies on ACFE

Network to Stop Fraud

Grace Corbett, CFE, enjoys her

job heading up fraud investigations and audits for Sun

East Federal Credit Union and

ensuring compliance with the

Bank Secrecy Act (BSA). But

she knows that to do her job

well, she needs a good network of fellow anti-fraud professionals. With new challenges like phishing schemes

plaguing her credit union and others, she knows every

second counts in a fraud investigation.

Describe your job function (a day in the life of):

I oversee BSA compliance, fraud investigations and

audits. Each day can bring on new challenges. I have

a small team under me that is dedicated to making

sure that the credit union is compliant in writing loans,

opening accounts and many other areas within its

operations. My team and I also conduct all of the fraud

investigations. I work with local, state and federal law

enforcement agencies. If an investigation makes it to the

prosecution, I also attend court as a witness. Not only do

I oversee those areas, I conduct branch cash audits and

work closely with senior tellers on hot fraud topics to

make sure they are aware of current trends.

of-mouth by anti-fraud professionals. The ACFE

helps facilitate this through our social media presence on Facebook, LinkedIn and other networking

sites (visit ACFE.com/socialmedia to learn more

about online social networking with the ACFE).

Along with our online Discussion Forums and

ACFE blogs, these outlets provide a timely means

to share the latest news tidbits, get relevant information or just drop in to say “hello” to colleagues

and friends.

Going it alone is for fraudsters and whitecollar criminals — at least until they are caught.

The professionals working to stop them know the

value of teamwork, and the successes that can be

achieved when working together toward a common goal. With this approach, “Together, reducing

fraud worldwide” is not just a slogan. It is a warning to fraudsters everywhere.

n

How important is networking to you as an anti-fraud

professional?

Networking is key. It allows you to share experiences,

both good and bad, with other anti-fraud professionals.

Networking allows you to provide others with tips on

conducting an investigation or to just run a situation by

someone. They may have already conducted an investigation relevant to your current case and they may be

willing to help you. Without networking skills, you can

add many hours to your investigation. Knowing that you

can pick up your phone and reach out to someone is all

a part of the game.

What advice would you give to someone hoping to

follow a similar career path as you?

Stay focused and take advantage of every learning opportunity that you can. You may never know when you

are going to have to use what you have learned. Make a

plan and incorporate goals, and test throughout to make

sure you are on the path to achieve those goals and/or

accomplish your plan. n

VISIT ACFE.com

CALL (800) 245-3321 / +1 (512) 478-9000 | 5

ACFE Membership and Certification

Today, more than 55,000 ACFE members are protecting our global economy and ensuring integrity in the marketplace

by leading the fight against fraud. Position yourself as a leader in your profession by joining the ACFE. Gain access to

comprehensive anti-fraud resources, expert training opportunities and valuable member benefits that will help you

reach your professional goals.

MEMBERSHIP BENEFITS

Exclusive Member Resources

• Fraud Magazine®, the ACFE’s bimonthly publication

devoted to insightful feature articles, interviews and

columns exploring the latest trends and issues in fraud

examination.

• Fraud-Magazine.com, the Internet counterpart to our most

popular member benefit, Fraud Magazine. In addition

to highlighting articles appearing in the magazine,

Fraud-Magazine.com features exclusive, web-only content,

videos, archives and more.

• The Fraud Magazine e-newsletter, a monthly digital

newsletter packed with all the insight and cutting-edge

information that members have come to expect from the

print edition.

The CFE Credential

• The Fraud Examiner, a monthly e-newsletter created

exclusively for ACFE members, with timely and practical

anti-fraud articles and fraud-fighting tips, video clips and

other resources for anti-fraud professionals.

• Online Fraud Resource Center provides fraud investigation

checklists, sample forms, policies and reports to help you

do your job better.

• ACFE Article Archive connects you to informative anti-fraud

articles, white papers, presentations, case studies and

reports created by anti-fraud experts.

• Targeted Online Discussion Forums serve as a platform for

you to share your concerns and challenges with others who

can provide solutions and insights.

|

• Increase your earning potential — according to

the 2010/2011 Compensation Guide for Anti-Fraud

Professionals, CFEs earn nearly 22 percent more than

their non-certified colleagues.

• Improve your marketability and job security — Robert

Half International identifies the CFE as “in-demand…one of

the most marketable credentials today” and A.E. Feldman,

a leading executive search firm, states, “…the CFE has

emerged as the gold standard in the area of fraud.”

• Comprehensive Online Career Center featuring a targeted

job board, online resources, career path information and

advice from experts in the areas of career development,

human resources, self-employment and career transitions.

The CFE credential enhances my professional

credibility as an auditing professor.”

• Savings on anti-fraud training. Last year ACFE members

saved more than $2.6 million on the best anti-fraud training

available.

— Dr. William H. Svihla, CFE, DBA, CPA

Assistant Professor of Accounting,

Indiana State University

• Free quarterly webinars. Earn free CPE while staying

abreast of new topics with free, members-only webinars.

6

• Obtain the Certified Fraud Examiner (CFE) credential and

position yourself as an anti-fraud expert, helping to further

your professional growth and advance your career. Only

ACFE members may become CFEs.

VISIT ACFE.com/Membership

CALL (800) 245-3321 / +1 (512) 478-9000

As an ACFE member I am among some of the most

elite individuals in the anti-fraud profession.”

— Glyn M. Rogers, CFE, CCEP, CCA, MBA

how to become a cfe

How does the ACFE support me in my efforts to prepare for the CFE Exam?

That depends on your learning style.

If you prefer to work on your own, at your own

pace:

If you prefer the structure and interaction of a

classroom environment:

The CFE Exam Prep Course is a computer selfstudy program that helps prepare you for the CFE

Exam. The course provides you with questions and

gives you instant feedback on your answers, which

includes citations to reference material where you

can explore the topic in more depth.

The CFE Exam Review Course provides you with an

intense, 3½ day overview of the fundamental concepts covered in the CFE Exam. Expert instructors

can answer questions on the material and on how

best to prepare for and pass the CFE Exam itself.

Registration includes the CFE Exam Prep Course

software.

Features:

• 1,500 study questions similar to those

provided on the CFE Exam

• Timed simulated practice exams

• Review of results and progress

• Helpful checklist for obtaining the CFE

credential

• Fraud Examiners Manual on CD-ROM

More than 80 percent of people who complete the

CFE Exam Prep Course pass the CFE Exam on their

first attempt.

To learn more, see pgs. 10-11, or call an ACFE

Member Services Representative at (800) 245-3321

or +1 (512) 478-9000.

Features:

• Structured learning environment

• Guidance and coaching from experienced

instructors

• Interaction with peers

• Printed course materials that outline the exam

and make preparation easier

More than 92 percent of people who complete this

course pass the CFE Exam on their first attempt.

To learn more, see pgs. 8-9, or call an ACFE

Member Services Representative at (800) 245-3321

or +1 (512) 478-9000.

VISIT ACFE.com/Training

CALL (800) 245-3321 / +1 (512) 478-9000 | 7

CFE Exam Review Course

If you are pursuing the Certified Fraud Examiner (CFE) credential, the CFE Exam Review Course will help you master

the concepts tested on the CFE Exam: fraudulent financial transactions; legal elements of fraud; fraud investigation;

and fraud prevention and deterrence. The 3½-day, instructor-led course provides the essentials needed to prepare for

the CFE Exam and become a Certified Fraud Examiner. This course, in combination with the CFE Exam Prep Course

software (pg. 10), will provide you with an unbeatable combination for passing the exam. More than 92 percent of those

who have completed this course pass the CFE Exam on the first try.

Heightened fraud awareness combined with new laws and regulations have increased the already growing demand in

the workforce for professionals who are highly skilled at fighting fraud. The CFE credential is the premier certification for

anti-fraud professionals around the world. CFEs are specialists in the deterrence, detection and investigation of fraud,

and possess a broad range of skills that uniquely qualifies them to effectively combat fraud.

course Details

Benefits of Attending

Schedule

• Structured Learning Environment — Learn how to

prepare for the CFE Exam

• Fast Track — Participate in an intense, 3½-day preparation

period

Chicago, IL • August 29 – September 1, 2011

Omni Chicago Hotel

Room Rate*: $184 single/double

(limited gov’t rates available)

Hotel Phone: (800) THE-OMNI

Early Registration Deadline†: July 29

• Instructor-Led — Receive guidance from experienced

instructors

• Interactive Sessions — Participate in open discussions on a

variety of topics in fraud prevention

New York, NY • September 19-22, 2011

Executive Conference Center

Venue Phone: +1 (212) 903-8060

Early Registration Deadline†: Aug. 19

• Team Environment — Meet others preparing for the CFE

Exam and CFE instructors who will help you organize study

sessions to review materials, and provide you with tips and

processes designed for the working professional’s busy

schedule

Los Angeles, CA • October 24-27, 2011

Hyatt Regency Century Plaza

Room Rate*: $215 single/double

Hotel Phone: +1 (888) 421-1442 or (310) 228-1234

Early Registration Deadline†: Sept. 23

Who Should Attend

• Anyone who prefers learning in an instructor-led, classroom

setting

• Individuals who favor table discussions with peers and

experienced instructors

• Those who need extra encouragement to take the CFE

Exam

Austin, TX • November 14-17, 2011

AT&T Executive Education Conference Center

Room Rate*: $160 single/double

(limited gov’t rates available)

Hotel Phone: (877) 744-8822 or +1 (512) 404-3600

Hotel Website: www.meetattexas.com

Group Code: ACFEEX1111 (Internet reservations only)

Early Registration Deadline†: Oct. 14

Fees

$1,895**

What’s Included

• The CFE Exam Prep Course CD-ROM — a $945 value!

• Printed course materials that outline the exam and aid exam

preparation

• Essential knowledge from experienced instructors

CPE Credit

28

Course Level

Intermediate

Prerequisite

This course is designed to review material required to pass

the CFE Exam and assumes a base knowledge of fraud

examination principles. If you are unfamiliar with the basic

tenets of fraud examination, we recommend taking the

Principles of Fraud Examination course in advance.

8

|

VISIT ACFE.com/CFE-Review

CALL (800) 245-3321 / +1 (512) 478-9000

Dr. Wells Reflects on Life and

Career in Fraud Fighter

It’s a book unlike any you have read from Dr. Joseph

T. Wells, CFE, CPA. The Chairman of the ACFE provides a

frank and gripping memoir full of colorful life experiences, spanning a life that began in rural Oklahoma and led

to the founding of the world’s largest anti-fraud organization. The following is an excerpt from Fraud Fighter: My

Fables and Foibles, the fascinating behind-the-scenes

look at the life of one of the most influential white-collar

crime experts of our time:

Register early and

SAVE $100!†

ACFE.com/CFE-Review

Take the Exam at the Event

Sign up to take the CFE Exam immediately after the review

course and earn your CFE credential within days.

Visit ACFE.com/CFE-Exam for more information.

*Reservations subject to availability.

†

Payment must be received by Early Registration Deadline to obtain savings.

**Event price includes 2011 CFE Exam Prep Course. Participants who currently own an older version of the CFE Exam Prep Course can register for a discounted rate and get a free upgrade to the

2011 CFE Exam Prep Course.

This course was everything the ACFE said it would

be. Well-organized materials. On point. Wonderful

speakers. This is a high-impact, must-take course for

those individuals preparing for the CFE Exam.”

— John Heidebrecht, CFE, ASA

Berning & Heidebrecht, Ltd.

At last count, the ACFE had

138 chapters in 40 countries. Forty

percent of our more than 55,000

members are from outside the

United States, and we’ve established

anti-fraud relationships all over the

world. While we expect the ACFE

to continue growing slowly in North

America, our greatest growth potential is in the international arena.

That’s something we’ve put a considerable amount

of time and effort into fostering. Not long after founding

the ACFE, Jim (Ratley, ACFE President and CEO) and I

began traveling the world to spread the gospel of fraud

detection, deterrence, and prevention.

By the mid-1990s, we’d settled into a pattern. I

went east, and he went west. For me it was Canada and

Europe — Austria, Bulgaria, Denmark, Germany, Holland,

Hungary, Ireland, Luxembourg, Poland and the United

Kingdom. For Jim it was Mexico and the Asia-Pacific

region — that meant Australia, China, Indonesia, Japan,

Malaysia, New Zealand, the Philippines and Singapore.

Once I jokingly accused him of having his own fan

club in New Zealand because he’d been there so often.

On one of his trips, he and his lovely wife, Gloria, bungee-jumped off a bridge near Queenstown, where the

sport had been invented. Some enterprising fellow on

the other side of the gorge videotaped all the jumpers,

and then offered to sell them a copy. Jim bought his, and

proudly played it for us. On the video, Gloria went first

with no hesitation. When it was Jim’s turn, he wavered

but finally jumped. I laughed hard, but Jim’s braver than

me; I wouldn’t have done it at all.

To read the full chapter online and to order the book,

visit ACFE.com/FraudFighter n

VISIT ACFE.com/CFE-Review

CALL (800) 245-3321 / +1 (512) 478-9000 | 9

2011 CFE Exam Prep Course®

The most effective tool available to help you pass the CFE Exam and become a Certified Fraud Examiner (CFE) has been

redesigned with an all-new user interface and enhanced features to improve exam preparation and keep you on track

to earning your CFE credential. The 2011 CFE Exam Prep Course introduces new components that provide you with the

most effective exam preparation available, more efficient use of your study time and an intuitive, easy-to-use interface.

Details

Effective CFE Exam Preparation

• 1,500 study questions provide sample exam questions with an explanation of the correct

answer.

• Simulate the CFE Exam environment with timed practice exams.

• Prepare for the CFE Exam with confidence knowing that the CFE Exam Prep Course is backed

by our Money-Back Pass Guarantee.

The 2011 CFE Exam Prep Course provides the most effective training available to prepare you for

the CFE Exam, allowing you to study on your own time, at your own pace from your home or work

computer. Featuring study questions and practice exams that simulate the actual CFE Exam experience, the CFE Exam Prep Course has been designed to prepare you to pass the rigorous CFE Exam.

More Efficient Use of Your Study Time

• The CFE Exam Prep Course streamlines CFE Exam

preparation. Use your time more efficiently by focusing on

the areas you need to study the most.

• NEW: Create a personalized study plan tailored to your

individual strengths and weaknesses with an optional

100-question Pre-Assessment.

An All-New User Interface

• An all-new user interface puts the most relevant information

at your fingertips. Quickly review your Prep Course progress

by subsection and topic, access on-screen help menus and

study tips, and stay on track to meet your target certification

date.

• NEW: Review your progress with a new streamlined design.

• NEW: Pick the sections and topics most relevant to your

exam preparation by creating custom review sessions.

• NEW: Get answers to your questions fast with Guides to

Success, on-screen FAQs and an improved help section.

• NEW: Learn more from your Practice Exam sessions by

reviewing the questions you missed, analyzing your results

by subsection and tracking your progress over time.

• NEW: Stay on track to earn your CFE credential by

measuring your progress towards your target dates for

certification and using helpful checklists within

the Prep Course software.

• NEW: Focus on the areas where you need the most work

with enhanced review of results and progress by exam

section, subsection and topic.

Establish yourself as an anti-fraud expert and advance your career by obtaining the CFE credential. The CFE Exam Prep Course is the

most effective tool available to prepare you to pass the rigorous CFE Exam.

CD-ROM or Electronic Download:

$745 Members / $945 Non-Members*

Members-Only Installment Plan

ACFE members have the option to participate in the Members-Only Installment Plan with only six monthly payments of $130 each for the CFE Exam Prep

Course or $150 each for the CFE Exam Prep Toolkit (Credit card only. Includes UPS ground shipping** and administration fee). For more information, call an

ACFE Member Services Representative at (800) 245-3321 or +1 (512) 478-9000. A member is not eligible to be certified until all installment plan payments

have been received after passing the CFE Exam.

*Additional 8.25% sales tax for Texas residents.

**There is an additional charge for shipping outside the U.S.

10

|

VISIT ACFE.com/Prep-2011

CALL (800) 245-3321 / +1 (512) 478-9000

The Prep Course is well worth the investment. It

crystallizes the major concepts of the immense

amount of data that candidates need to absorb,

and helps the material become second nature.

— Andrew Levine, CFE

CFE Exam Prep Toolkit

For an additional $100, purchase the CFE Exam Prep Toolkit,

including the ACFE’s most popular reference materials. A value of

more than $1,200, it includes:

• 2011 CFE Exam Prep Course — The latest edition of this

comprehensive tool to help you become a CFE. The updated

2011 CFE Exam Prep Course is a computer self-study course

that prepares you for the exam while letting you study at

your own pace.

• Corporate Fraud Handbook, Third Edition — Explore the

three main categories of occupational fraud and abuse:

asset misappropriation, corruption and fraudulent

statements. The book then explains, identifies and classifies

13 common fraud schemes.

• Encyclopedia of Fraud, Third Edition (CD-ROM) —

Written for practitioners, academics and anyone with an

interest in fraud, the Encyclopedia of Fraud provides the

user with easy access to the ACFE’s vast body of fraud

knowledge.

• 2011 Fraud Examiners Manual (printed) — The premier

reference guide for CFEs and other anti-fraud professionals.

This 2,000-page guide is divided into four sections: Financial

Transactions and Fraud Schemes, Investigation, Law, and

Fraud Prevention and Deterrence. Eighty-five percent of the

CFE Exam is based on information found in the Fraud

Examiners Manual.

Toolkit:

$845 Members / $1,298 Non-Members*

VISIT ACFE.com/Prep-2011

CALL (800) 245-3321 / +1 (512) 478-9000 | 11

2011 Calendar of Events

EVENTS BY DATE

Event Title

Dates

Location

CPE

Member

Price

Non-Member

Price

Page

#

Professional Interviewing Skills

July 11 – 12

Detroit, MI

16

$695

$845

20

Principles of Fraud Examination

July 18 – 21

Austin, TX

28

$1,195

$1,395

17

Mortgage Fraud

July 25 – 26

Denver, CO

16

$695

$845

32

August 8 – 9

San Francisco, CA

16

$695

$845

24

NEW!

Fraud Risk Management

August 11 – 12

Washington, DC

16

$795

$945

36

NEW!

Fraud-Related Compliance

August 15

8

$295

$395

37

16

$695

$845

25

updated!

Investigating on the Internet

Philadelphia, PA

Interviewing Techniques for Auditors

August 16 – 17

Advanced Fraud Examination Techniques

August 22 – 24

Austin, TX

24

$995

$1,195

38

CFE Exam Review Course

Aug. 29 – Sept. 1

Chicago, IL

28

$1,895*

$1,895

8

Money Laundering: Tracing Illicit Funds

September 8 – 9

Boston, MA

16

$695

$845

27

Financial Statement Fraud

September 19 – 20

Nashville, TN

16

$695

$845

28

CFE Exam Review Course

September 19 – 22

New York, NY

28

$1,895*

$1,895*

8

Contract and Procurement Fraud

September 22 – 23

Las Vegas, NV

16

$695

$845

26

Advanced Interviewing Techniques Workshop

October 3 – 6

Austin, TX

27

$1,395

$1,595

39

October 13 – 14

New York, NY

16

$795

$945

36

Auditing for Internal Fraud

October 17 – 18

Seattle, WA

16

$695

$845

18

Introduction to Digital Forensics

October 20 – 21

New Orleans, LA

16

$795

$945

22

2011 ACFE Asia-Pacific Fraud Conference

October 23 – 25

Singapore

4 – 20 TBD

TBD

15

CFE Exam Review Course

October 24 – 27

Los Angeles, CA

28

$1,895*

$1,895

8

Fraud Prevention

November 2

8

$295

$395

23

Healthcare Fraud

November 3 – 4

CFE Exam Review Course

November 14 – 17

NEW!

Fraud Risk Management

Tampa, FL

Austin, TX

16

$695

$845

34

28

$1,895*

$1,895*

8

4 – 23 CAD 995 – 1,095

CAD 1,095 –

1,195

16

8

$295

$395

29

16

$695

$845

35

17th Annual ACFE Canadian Fraud Conference

November 27 – 30

Investigating Conflicts of Interest

December 5

Financial Institution Fraud

December 6 – 7

Interviewing Techniques for Auditors

December 5 – 6

Houston, TX

16

$695

$845

25

Principles of Fraud Examination

December 12 – 15

Austin, TX

28

$1,195

$1,395

17

Toronto

Las Vegas, NV

All prices listed in US dollars unless otherwise noted. Prices, events and locations subject to change. Prices valid through December 31, 2011.

*Event price includes the cost of the 2011 CFE Exam Prep Course software. Participants who own an older version of the Prep Course may register for a discounted fee. Visit ACFE.com for rates.

Kudos to the ACFE. Excellent conference — very informative, well planned

and energizing with an all-star line-up of keynote speakers. ACFE sets the

gold standard for a professional organization that serves its members.

— Ken Bosin, CFE, CPA

12

|

VISIT ACFE.com/Training

CALL (800) 245-3321 / +1 (512) 478-9000

EVENTS BY LOCATION

3 ways to save!

Event Title

Location

Dates

CPE

Member

Price

Non-Member

Price

Page

#

Principles of Fraud Examination

Austin, TX

July 18 – 21

28

$1,195

$1,395

17

Advanced Fraud

Examination Techniques

Austin, TX

August 22 – 24

24

$995

$1,195

38

Advanced Interviewing

Techniques Workshop

Austin, TX

October 3 – 6

27

$1,395

$1,595

39

CFE Exam Review Course

Austin, TX

November 14 – 17

28

$1,895*

$1,895*

8

Principles of Fraud Examination

Austin, TX

December 12 – 15

28

$1,195

$1,395

17

Money Laundering: Tracing Illicit

Funds

Boston, MA

September 8 – 9

16

$695

$845

27

CFE Exam Review Course

Chicago, IL

Aug. 29 – Sept. 1

28

$1,895*

$1,895

8

Mortgage Fraud

Denver, CO

July 25 – 26

16

$695

$845

32

Professional Interviewing Skills

Detroit, MI

July 11 – 12

16

$695

$845

20

Interviewing Techniques for

Auditors

Houston, TX

December 5 – 6

16

$695

$845

25

Contract and Procurement Fraud

Las Vegas, NV

September 22 – 23

16

$695

$845

26

8

$295

$395

29

Financial Institution Fraud

Las Vegas,

NV

December 5

December 6 – 7

16

$695

$845

39

CFE Exam Review Course

Los Angeles, CA

October 24 – 27

28

$1,895*

$1,895

8

Financial Statement Fraud

Nashville, TN

September 19 – 20

16

$695

$845

28

Introduction to Digital Forensics

New Orleans, LA

October 20 – 21

16

$795

$945

22

CFE Exam Review Course

New York, NY

September 19 – 22

28

$1,895*

$1,895*

8

New York, NY

October 13 – 14

16

$795

$945

36

August 15

8

$295

$395

37

August 16 – 17

16

$695

$845

25

UPDATED!

Investigating Conflicts of Interest

NEW!

Fraud Risk Management

NEW!

Fraud-Related Compliance

Interviewing Techniques for

Auditors

Philadelphia,

PA

Investigating on the Internet

San Francisco, CA

August 8 – 9

16

$695

$845

24

Auditing for Internal Fraud

Seattle, WA

October 17 – 18

16

$695

$845

18

2011 ACFE Asia-Pacific Fraud

Conference

Singapore

October 23 – 25

4 – 20 TBD

TBD

15

November 2

8

$295

$395

23

November 3 – 4

16

$695

$895

34

Toronto

November 27 – 30

CAD 995 –

4 – 23

1,095

CAD 1,095 –

1,195

16

Washington, DC

August 11 – 12

16

$945

36

Fraud Prevention

Healthcare Fraud

17th Annual ACFE Canadian Fraud

Conference

NEW!

Fraud Risk Management

Tampa, FL

$795

Early Registration

Savings

Find the events that

you want to attend.

Register and pay

before the Early Registration Deadline listed

for the event (generally one month before

event start date) and

SAVE $95 or more off

of the regular price for

the event.

Combo Event Savings

Register to attend

two events being held

consecutively in select

cities and receive $100

in savings! Combo

events are designated

with this icon:

Group Savings

Select the event that

best suits the learning

needs of your group.

Gather a team of at

least three or more

individuals to register

together. Call the ACFE

at (800) 245-3321 or

+1 (512) 478-9000

to determine your

savings.

All prices listed in US dollars unless otherwise noted. Prices, events and locations subject to change. Prices valid through December 31, 2011.

*Event price includes the cost of the 2011 CFE Exam Prep Course software. Participants who own an older version of the Prep Course may register for a discounted fee.

Visit ACFE.com for rates.

VISIT ACFE.com/Training

CALL (800) 245-3321 / +1 (512) 478-9000 | 13

23rd Annual ACFE Fraud

Conference and Exhibition

June 17-22, 2012 • Orlando, FL

Join nearly 2,500 of your fellow anti-fraud professionals at the 23rd Annual ACFE Fraud Conference and Exhibition at the Gaylord Palms Resort and Convention Center in Orlando, FL, June

17-22, 2012. Address the challenges and critical issues faced by anti-fraud professionals during

top-level educational sessions and participate in unparalleled networking opportunities with the

premier practitioners and thought leaders in the fight against fraud.

Register by Dec. 31 and

SAVE up to $370!†

FraudConference.com

CoNFERENCE Details

Premier Anti-Fraud Education

Customize your learning by choosing from an entire

week (Full Conference) of education, including

parallel educational tracks with more than 60 unique

courses and optional Pre- and Post-Conference

educational sessions, advanced-level options and

interactive panel discussions, all led by industry experts from the world’s top organizations. Both new

practitioners and experienced professionals will find

opportunities to enhance their knowledge, expand

capabilities and learn new skills. Regardless of your

experience level we offer the right training for you.

CPE Credit: 4-40

Unparalleled Networking Opportunities

The ACFE believes in the power of networking

as one of the most effective ways to advance

your career. With every annual conference, we

integrate a variety of networking opportunities

to ensure you maximum exposure to invaluable

knowledge sharing and resource exchanges

among fraud specialists from around the globe.

Professional Development and

Career Growth

Whether you are seeking a new job, a new career

or simply striving to be aware of the latest trends

and opportunities for professional development,

you won’t want to miss the benefits that the ACFE

Career Connection has to offer. Build relationships

and informally interview with recruiters from top

firms, companies and government organizations.

Attend informative presentations loaded with relevant suggestions and receive valuable strategies

and motivation from one-on-one time with career

coaches.

Discover the Leaders in Fraud

Prevention Solutions

Tour the Exhibit Hall during the conference, where

more than 60 leading anti-fraud vendors come

together. The Exhibit Hall features a Cyber Café,

the ACFE Bookstore, professional development

presentations, book signings and author meetand-greets, the ACFE Fraud Museum and Career

Connection.

Everything about the conference was first-rate, from the speakers to the location to

my fellow attendees. This is my fourth conference and I get more out of attending

every year. It is a great value as well since I can get all my CPE credits for the year at

one time along with the networking opportunities.

— Lisa Handy, CFE

Transition Team Finance Manager

Jones Lang LaSalle

Visit FraudConference.com for continually updated information.

14

|

VISIT FraudConference.com

CALL (800) 245-3321 / +1 (512) 478-9000

Hotel Information

Gaylord Palms Resort and

Convention Center

6000 W. Osceola Parkway

Kissimmee, Florida 34746

Phone: +1 (407) 586-2000

†

Payment must be received by Early

Registration Deadline to obtain savings.

2011 ACFE Asia-Pacific

Fraud Conference

October 23-25, 2011 • Singapore

The 2011 Asia-Pacific Fraud Conference provides you with cutting-edge anti-fraud training and education that is global in scope, but with a uniquely Asian perspective. Learn from leading practitioners

and representatives from some of the region’s top companies about the challenges they face and the

strategies they have used to overcome them in this economically dynamic part of the world. You will

also have numerous formal and informal networking opportunities with fellow anti-fraud professionals, providing you new perspectives and new resources upon whom to call for ideas and inspiration.

Join us for our first conference in Singapore and give yourself an edge in the fight against fraud.

Register by Sept. 23

and

SAVE!†

ACFE.com/AsiaPac

CoNFERENCE Details

CPE Credit

4-20

Course Levels

Basic – Advanced

Prerequisites

None

Hotel Information

Marina Bay Sands

10 Bayfront Avenue, Singapore, 018956

Phone: +65 6688 88898

Hotel Cut-Off: September 23, 2011

Early Registration Deadline†: Sept. 23

†

Payment must be received by Early Registration Deadline to obtain savings.

Ritchie-Jennings Memorial Scholarship Recipient Finds Path Toward CFE

Kerri O’Donnell, CFE, is an associate lecturer in the School

of Accounting and Corporate Governance at the University of

Tasmania, Australia, and received the ACFE’s Ritchie-Jennings

Memorial Scholarship in 2006. She grew up in Hobart, the

capital of Tasmania, and worked in the entertainment industry in

Sydney. At 35, she returned to Tasmania with two young daughters and enrolled at the University of Tasmania to train for what

she calls a “responsible” job: an accountant. “I was stunned to

learn of devious things people do in business. I went in search

of more information, quickly found the ACFE website and

straight away became a devoted student member. “

O’Donnell was the family bread-winner, and the scholarship

paid for her textbooks and an Internet connection so she could

work at home. She says the scholarship helped not just monetarily but in confirming her career path.

“At the time of my scholarship, no peers shared my interest,” she says. “People I knew never used words such as ‘fraud’

and ‘criminology,’ and everyone seemed to assume that balance

sheets were correct if they balanced and that anomalies were all

‘errors.’ So the scholarship validated my interests and signaled I

was on the right path.”

It also strengthened her ties to the ACFE,

and she became a CFE thereafter. “The CFE

designation set me apart from other accounting graduates with workplace experience,” says

O’Donnell. “I am sure it played a part in my

successful application for academic work and

in subsequently being asked to teach auditing again. Students

seem to pay more attention when I talk about auditing, ethics,

policy implications and even theory; and colleagues forward

articles and networking opportunities to me when they arise.”

Her doctoral thesis focuses on professional skepticism and

financial statement fraud because, “I wondered why external auditors were not detecting huge frauds in external financial statement

audits, especially as so many flags are considered obvious in

hindsight. Academic literature and regulation revealed skepticism

as a knowledge black hole.” She aims to fill that black hole.

As for her advice to college students or anyone else considering getting their CFE? “Start the CFE Prep Course,” she says.

“Every new awareness makes a difference to the fight.”

VISIT ACFE.com/AsiaPac

n

CALL (800) 245-3321 / +1 (512) 478-9000 | 15

17th Annual ACFE

Canadian Fraud Conference

and Exhibition

November 27-30, 2011 • Toronto

The 17th Annual ACFE Canadian Fraud Conference provides you with practical skills and solutions that are relevant, immediately implementable and proven to be successful. Discover answers to the challenges and critical issues faced by anti-fraud professionals during a variety of

educational sessions, and participate in exclusive networking opportunities with others vested

in the fight against fraud.

The Pre-Conference workshop is a great way to kick-start your ACFE Canadian Fraud Conference experience and will give you the tools to gain the professional edge you need. Enhance

your professional development by attending the half-day Pre-Conference program, featuring an

intensive workshop that allows you to expand your understanding of particular anti-fraud issues.

Register by Oct. 27 and

SAVE CAD 100!†

ACFE.com/Canadian

CONFERENCE Details

CPE Credit

Hotel Information

4-23

Hilton Toronto

145 Richmond Street W.

Toronto, ON M5H 2L2

Room Rate*: 215 CAD single/double

Hotel Phone: 800-HILTONS

Hotel Cut-Off: November 4, 2011

Early Registration Deadline†: Oct. 27

Course Levels

Basic – Advanced

Prerequisities

None

*Reservations subject to availability.

†

Payment must be received by Early Registration Deadline to obtain savings.

Early Registration

Standard Registration

Full Conference

Members�����������������������������������CAD 995

Non-Members������������������������CAD 1,095

Members�������������������������������€CAD 1,095

Non-Members�����������������������€CAD 1,195

Main Conference only

November 28-30, 2011

Members����������������������������������€CAD 945

Non-Members��������������������������€CAD 995

Members�������������������������������€CAD 1,045

Non-Members�����������������������€CAD 1,095

Pre-Conference only

N/A

Members����������������������������������€CAD 295

Non-Members��������������������������€CAD 395

Pricing**

November 27-30, 2011

November 27, 2011

(by Oct. 27, 2011)*

**USD registration fees include 13% HST.

16

|

VISIT ACFE.com/Canadian

CALL (800) 245-3321 / +1 (512) 478-9000

(after Oct. 27, 2011)*

Principles of Fraud

Examination

Build a solid foundation in fraud prevention, detection and deterrence with Principles of Fraud

Examination, the most comprehensive course on the subject. Explore the four key areas of fraud

examination: Fraud Prevention and Deterrence, Legal Elements of Fraud, Fraudulent Financial

Transactions and Fraud Investigation. By learning from leading practitioners, you gain best practices with a proven success record, as well as expert insight from professionals who are dealing

with the same challenges you encounter daily.

For 3½ days, immerse yourself in anti-fraud training while interacting with your colleagues and

peers. Participate in discussions and watch helpful video screenings. In addition to anti-fraud

training, this event provides ample opportunities to network with peers as well as ACFE staff and

faculty members through group lunches and social functions.

While in Austin, your visit to ACFE headquarters will provide a unique opportunity to experience the Fraud Museum exhibit, located in the offices of the Geis Building. Established by ACFE

founder and Chairman Dr. Joseph T. Wells, CFE, CPA, the Fraud Museum tells the story of fraud’s

intriguing past with an extensive and eclectic collection of historical fraud pieces. The ACFE

Open House reception also welcomes you to the Gregor Building, a historic, 1920s-era home

that houses the ACFE’s executive and administrative staff. Tour the building and meet ACFE staff

members as you visit the home of the world’s premier anti-fraud association.

Register early and

SAVE $200!†

ACFE.com/POFE

Course Details

What You Will Learn

• Fraud Prevention and Deterrence

— Causes of fraud

— Prevention of fraud

• Legal Elements of Fraud

— Rules of evidence

— Key legal rights and privacy issues

— Testifying

• Fraudulent Financial Transactions

— Internal fraud schemes

— External fraud schemes

— Evaluating financial information

— Using software in fraud examinations

• Fraud Investigation

— Sources of information

— Internet fraud resources

— Interviewing prospective witnesses

— Evaluating deception

— Report writing

Who Should Attend

• All professionals and educators interested in

the field of fraud examination

• Individuals who are considering starting an

anti-fraud practice

• Those seeking to complement existing

practical experience with the knowledge of

leading anti-fraud professionals

Schedule

Austin, TX • July 18-21, 2011

Omni Austin Hotel Downtown

Room Rate*: $169 single/double

(limited gov’t rate rooms available)

Hotel Phone: (800) THE-OMNI

Early Registration Deadline†: June 17

Austin, TX • December 12-15, 2011

Omni Austin Hotel Downtown

Room Rate*: $169 single/double

(limited gov’t rate rooms available)

Hotel Phone: (800) THE-OMNI

Early Registration Deadline†: Nov. 11

Fees

ACFE Members: $1,195

Non-Members: $1,395

CPE Credit

28

Course Level

Basic

[

Overall a tremendous learning experience that

will benefit both me and my organization.

— Robert M. Kazmirchuk

Security Manager, Chrysler Canada LLC

[

Prerequisites

None

*Reservations subject to availability.

†

Payment must be received by Early Registration Deadline to obtain savings.

VISIT ACFE.com/POFE

CALL (800) 245-3321 / +1 (512) 478-9000 | 17

Auditing for Internal Fraud

As an auditor, finding fraud is part of your professional responsibility. Auditing for Internal

Fraud will help you develop and sharpen your existing skills and teach you the techniques

necessary for effective fraud detection. Over the two-day course, you will explore the challenges that auditors traditionally face in identifying fraud and learn the fundamentals of auditing for fraud, with an emphasis on understanding the common schemes, detection techniques and methods of preventing occupational fraud.

Register by Sept. 16

and

SAVE $95!†

ACFE.com/AIF

Course Details

What You Will Learn

• The types, costs and red flags of fraud

• Avoiding malpractice: the auditor’s fraud

responsibilities

• What obstacles auditors often face in finding

fraud and how to avoid them

• How to conduct an effective fraud risk assessment

• The fundamentals of occupational fraud and

abuse

• How to incorporate fraud brainstorming into

the audit planning

Schedule

Seattle, WA • October 17-18, 2011

DoubleTree Hotel Seattle Airport

Room Rate*: $139 single/double

Hotel Phone: (800) 222-TREE or +1

(206) 246-8600

Early Registration Deadline†: Sept. 16

Fees

ACFE Members: $695

Non-Members: $845

CPE Credit

16

Course Level

• Common internal fraud schemes including:

— Fraudulent financial statements

— Bribery and corruption

— Asset misappropriation

Basic

• How data analysis can be used to find fraud

*Reservations subject to availability.

• How to handle tips from whistleblowers

Prerequisites

None

†

Payment must be received by Early Registration Deadline to obtain savings.

• What to do when fraud is found during an

audit

• Methods for preventing management and

occupational fraud

Who Should Attend

• Certified Fraud Examiners and other antifraud specialists

• Internal and independent auditors seeking to

increase their anti-fraud effectiveness

• Professionals who want to help deter fraud

within their entities

• Employees and educators seeking the

knowledge necessary to detect fraudulent

activities

18

|

VISIT ACFE.com/AIF

CALL (800) 245-3321 / +1 (512) 478-9000

Conducting Internal

Investigations

From receiving the initial allegation to testifying as a witness, Conducting Internal Investigations

will prepare you for every step of an internal investigation of fraud. Lead an investigation with

accuracy and confidence by gaining knowledge about legal considerations, document collection, interviewing skills and evidence documentation.

This instructor-led course includes a relevant practical problem, which you and your fellow attendees will work from beginning to end. Get hands-on experience you will take back to apply

in your own work.

Conducting Internal Investigations is where technical skills, practical tips

and inspirational examples all blend.

— Dan Kimbler, CFE, CPA

Auditor, U.S. Army Corps of Engineers

Register early and

SAVE $95!†

ACFE.com/CII-Seminar

Course Details

What You Will Learn

• The steps involved in conducting an internal

investigation

• Legal issues you may encounter

Schedule

Visit ACFE.com/CII for updated seminar dates and

information.

Fees

• Investigating by computer

ACFE Members: $695

Non-Members: $845

• Internal and external document collection and

analysis

CPE Credit

16

• Develop interviewing skills

• Interviewing witnesses

• Conducting admission-seeking interviews

• Documenting evidence

• How to testify as a fact witness

Course Level

Basic

Prerequisites

None

†

Payment must be received by Early Registration Deadline to obtain savings.

Who Should Attend

• Certified Fraud Examiners and other anti-fraud

specialists

• Loss prevention and security professionals

• Forensic accountants

• Internal and independent auditors

• Business managers and professionals

assuming fraud deterrence or investigation

responsibilities

VISIT ACFE.com/CII-Seminar

CALL (800) 245-3321 / +1 (512) 478-9000 | 19

Professional

Interviewing Skills

Are people lying to you? Do you know for sure? When can actions speak louder than words?

Fraudsters, clients and even your own employees may each be hiding something from you.

This two-day, interactive course will teach you how to be more effective in asking direct and

follow-up questions, while evaluating both verbal and non-verbal responses, so you can be a

better listener and observer during subject interviews.

Auditors, law enforcement, human resources professionals and many others have benefited

from this course. Learn how to get more information, more insight and less deception from

everyone you interview as you begin to understand the fundamental interviewing techniques

presented by our expert instructors.

Register by June 10

and

SAVE $95!†

ACFE.com/PIS

Course Details

What You Will Learn

• Personality styles and interviewing

• Interviewing witnesses

• Introduction to statement analysis

• Analysis of the subject’s narrative and

terminology

• Semantic indicators of deception

• Steps in an admission-seeking interview

• How to take confessions and signed

statements

Who Should Attend

• Certified Fraud Examiners and other

anti-fraud specialists

• Loss prevention and security professionals

Schedule

Detroit, MI • July 11-12, 2011

Sheraton Detroit Novi

Room Rate*: $115 single/double

Hotel Phone: (866) 837-4180

Early Registration Deadline†: June 10

Fees

ACFE Members: $695

Non-Members: $845

CPE Credit

16

Course Level

Basic

Prerequisites

None

*Reservations subject to availability.

†

Payment must be received by Early Registration Deadline to obtain savings.

• Internal and independent auditors

• Forensic accountants

• Lawyers and law enforcement personnel

• Detectives and private investigators

• Business professionals who conduct

interviews

• Internal and External Auditors

20

|

VISIT ACFE.com/PIS

CALL (800) 245-3321 / +1 (512) 478-9000

Legal Elements of a

Fraud Examination

As an anti-fraud professional, you must be aware of the legal issues that affect all fraud examinations. Not only is it important for you to understand the essential aspects of the law, but, as new

legislation, regulations and court decisions emerge, it is also important that you learn about any

developments in the law and the potential impact these changes will have on your practice.

This course provides an introduction to the fundamental legal elements of fraud examination that

you and your client may face during a financial investigation. It will cover the legal background

and definitions of fraud, the legal rights and duties of employers and employees during a fraud

examination, the methods of discovery and their limitations, and the evidentiary requirements

necessary to help ensure that evidence is admissible in court. This course will also give you insight on the pitfalls of expert testimony and ways to combat attacks by opposing counsel.

Course Details

What You Will Learn

Schedule

Visit ACFE.com/LEFE for updated seminar dates

and information.

• Elements of civil and criminal fraud

• Evidence and discovery issues

Fees

ACFE Members: $295

Non-Members: $395

• Workplace constitutional issues

• Testifying about your fraud case

CPE Credit

Who Should Attend

8

• Certified Fraud Examiners and other anti-fraud

specialists

Basic

• Forensic accountants

• Loss prevention and security professionals

• Special Investigations Unit personnel

Course Level

Prerequisites

None

• Law enforcement personnel

• Internal and independent auditors

Excellent course. I strongly encourage all law enforcement

and security professionals to attend this course.

— John H. Nutt

Sr. Investigator, Lockheed Federal Credit Union

VISIT ACFE.com/LEFE

CALL (800) 245-3321 / +1 (512) 478-9000 | 21

Introduction to Digital

Forensics

It takes a variety of skills and disciplines to conduct a successful financial investigation. This

newly updated, instructor-led course will introduce you to basic concepts of computer forensic investigation and analysis.

During this two-day seminar, you and a team of fellow anti-fraud professionals will immerse

yourselves in a training exercise structured as a fraud examination. This scenario will begin

with a client contacting you to look into an internal matter involving a suspicious “possible

virus” that was detected on the computer of the firm’s senior accounting manager.

You and your team will look at webmail history, deleted files, encrypted volumes and more to

uncover the fraud. You will also learn basic techniques involved in gathering and analyzing digital evidence in fraud examinations, as well as the proper procedures for seizing and securing

digital evidence. A software demonstration will also allow you to examine forensic artifacts.

Whether you simply want to understand how to more effectively work with computer forensics specialists, or you want to steer your career toward a specialized skill set in this area, this

class can help you achieve your goals.

Register by Sept. 20

and

SAVE $95!†

ACFE.com/IDF

Course Details

What You Will Learn

• How computer forensics has evolved

• The process of a computer

forensic examination

• Industry guidelines and relevant case law

• How computers store documents, emails

and other communications

• The elements of, and what to look for in,

evidence searches and seizures

Schedule

New Orleans, LA

October 20-21, 2011

New Orleans Marriott

Room Rate*: $199 single/double

Hotel Phone: (888) 364-1200 or

+1 (504) 581-1000

Early Registration Deadline†: Sept. 20

Fees

ACFE Members: $795

Non-Members: $945

• How to work and communicate with a digital

forensic examiner

CPE Credit

• How to organize and prepare your case for

trial

Course Level

Who Should Attend

16

Basic

Prerequisites

• Certified Fraud Examiners

None

• Insurance fraud investigators

*Reservations subject to availability.

†

• Bank examiners

Payment must be received by Early Registration Deadline to obtain savings.

• Forensic accountants

• Attorneys

• Law enforcement personnel

• Private investigators

• Internal auditors

22

|

VISIT ACFE.com/IDF

CALL (800) 245-3321 / +1 (512) 478-9000

Fraud Prevention

Virtually every organization suffers from fraud, though they may not know it. Fraud is a growing problem, despite attempts to control it, costing entities an average of five percent of their

revenues. This one-day, instructor-led course will show you why traditional internal controls can

be ineffective in preventing many frauds.

Discover what you can do to better protect your company. Learn more about compliance with

Section 404 of Sarbanes-Oxley as a first step for public companies. This course will take you

further into leading techniques to manage the risk of fraud and cut its ongoing cost for all types

of organizations.

Course Details

What You Will Learn

Schedule

• How leading entities are saving millions by

fighting fraud effectively

• Deterrence vs. detection — the lessons from

other industries

• Why traditional internal controls often fail to

deter fraud

Tampa, FL • November 2, 2011

Renaissance Tampa International Plaza

Room Rate*: $169 single/double

Hotel Phone: (800) 228-9290 or

+1 (813) 877-9200

COMBO: Healthcare Fraud, pg. 34

Fees

• The seven fraud deterrence processes all

companies should have

ACFE Members: $295

Non-Members: $395

• How to find the gaps in your fraud deterrence

processes

CPE Credit

8

• Avoiding common mistakes in fraud risk

assessment

Course Level

• Using process re-engineering to cut your fraud

risks dramatically

Prerequisites

Who Should Attend

• Certified Fraud Examiners and other anti-fraud

specialists charged with fraud detection and

deterrence

• Business owners and managers of

government entities

• Internal and independent auditors

• Audit committee members and CFOs

Register for both events and

Basic

SAVE $100!

None