The Forrester Wave™: Video Advertising Demand-Side

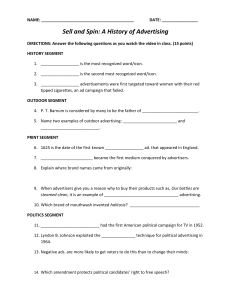

advertisement

FOR B2C MARKETING PROFESSIONALS The Forrester Wave™: Video Advertising Demand-Side Platforms, Q4 2015 The 10 Providers That Matter Most And How They Stack Up by James Nail November 30, 2015 Why Read This Report Key Takeaways In our 21-criteria evaluation of video advertising demand-side platform (DSP) providers, we identified the 10 most significant vendors and researched, analyzed, and scored them. This report shows how each provider measures up and helps B2C marketing professionals make the right choice. TubeMogul, Videology, And The Trade Desk Lead The Pack Forrester’s research uncovered a market in which TubeMogul, Videology, and The Trade Desk are leaders. AOL, BrightRoll, DataXu, Google, Tremor Video, Turn, and Viant offer competitive options. Cross-Screen Capabilities And Assurance Of Inventory Quality Drive Video Ad DSP Growth The video advertising DSP market is growing because more B2C marketing professionals see these platforms as a way to take advantage of the explosive growth of digital video consumption. Marketers need a technology platform that helps them manage an increasingly complex video environment, where viewing behaviors fragmented across devices, ad fraud, and viewability are key issues. Television Capabilities Differentiate The Video Advertising DSP Market As consumer viewing of television and video content continues to diversify across devices, vendors that can help advertisers stitch together their desired audience will lead the pack. Vendors that can provide inventory from all types of video viewing and can integrate TV planning with digital video to fill audience gaps will earn a share of advertisers’ television and digital video budgets. FORRESTER.COM FOR B2C MARKETING PROFESSIONALS The Forrester Wave™: Video Advertising Demand-Side Platforms, Q4 2015 The 10 Providers That Matter Most And How They Stack Up by James Nail with Luca S. Paderni, Brigitte Majewski, Richard Joyce, Rebecca McAdams, and Laura Glazer November 30, 2015 Table Of Contents 2 Marketers Must Follow Consumers As They Embrace Digital Video A Fragmenting Video Landscape Requires New Media Strategies Advertisers Embrace Digital Video For Reach, Flexibility, And Measurement Advertisers Seek A Solution To Manage Complex Video Campaign Execution Needs 8 Video Advertising DSP Evaluation Overview Advertisers Focus On Inventory Quality And Cross-Screen Capabilities Evaluated Vendors Give The Buy-Side Comprehensive Video Ad Features Notes & Resources Forrester conducted product evaluations in September 2015 of nine vendor companies and surveyed a total of 82 client references among their customers. The evaluated companies are AOL, DataXu, The Trade Desk, Tremor Video, TubeMogul, Turn, Viant, Videology, and Yahoo BrightRoll. In addition, we evaluated Google’s DoubleClick Bid Manager, although the firm opted not to be a participating vendor. Related Research Documents Digital Disruption Rattles The TV Ad Market How Software Is Eating Video Ads And, Soon, TV Making Sense Of The Video Ad Ecosystem 9 Leaders Support Planning And Execution Of Both TV And Digital Video 11 Vendor Profiles Leaders Strong Performers 15 Supplemental Material Forrester Research, Inc., 60 Acorn Park Drive, Cambridge, MA 02140 USA +1 617-613-6000 | Fax: +1 617-613-5000 | forrester.com © 2015 Forrester Research, Inc. Opinions reflect judgment at the time and are subject to change. Forrester®, Technographics®, Forrester Wave, RoleView, TechRadar, and Total Economic Impact are trademarks of Forrester Research, Inc. All other trademarks are the property of their respective companies. Unauthorized copying or distributing is a violation of copyright law. Citations@forrester.com or +1 866-367-7378 FOR B2C MARKETING PROFESSIONALS November 30, 2015 The Forrester Wave™: Video Advertising Demand-Side Platforms, Q4 2015 The 10 Providers That Matter Most And How They Stack Up Marketers Must Follow Consumers As They Embrace Digital Video Video’s sight-sound-motion delivery of emotionally engaging brand stories has long been the gold standard in advertising. But, as consumers embrace new ways of watching video content, advertisers can’t rely on old planning approaches to deliver the reach that they were used to with TV. This is even truer now that video is freed from limitations of the broadcast and cable distribution. In the 21st century, all advertisers need to learn how to use digital video to achieve their marketing and branding objectives. Combined with the advent of programmatic buying, advertisers need new technology tools to help them plan, buy, execute, and measure video campaigns across the entire spectrum of video content and devices. A Fragmenting Video Landscape Requires New Media Strategies Video is booming. With devices, bandwidth, and new video content formats at their fingertips, consumers’ video entertainment is breaking free from the television set. This challenges both traditional television and online display advertisers as: ›› Television upfront spending declines for a third year. Upfront sales of television ads have historically been a story of ever-increasing year-over-year sales until recently. For the 2015 to 2016 season, upfront ad sales declined 3%, according to Media Dynamics.1 The media consultant firm notes this is the third straight year of declines for broadcast networks and the second for cable networks. ›› Viewing on digital devices explodes. Observations that younger viewers increasingly watch video on their smartphones and laptops are one driver fueling the declines in upfront spending. Forrester’s Consumer Technographics® data shows that 90% of online Millennials watch at least some TV online on a weekly basis versus only 58% of older adults.2 Meanwhile, video platform provider Ooyala reports that viewing on mobile devices accounted for 44% of over-the-top video viewing among its customers in the second quarter of 2015.3 ›› But viewability and fraud issues plague digital video ad opportunities. While online display advertising has battled viewability and fraud for years, the higher costs per thousand (CPMs) for video make it an even more appealing target for fraudsters. The Association of National Advertisers in collaboration with fraud detection firm White Ops found that one-quarter of video ads were the result of bot fraud, twice the rate for display ads.4 Advertisers Embrace Digital Video For Reach, Flexibility, And Measurement Advertisers have long favored television because its ability to deliver sight-sound-motion ads tells a more engaging brand story. More recently, they have been quick to add online video to their advertising plans, making video advertising the fastest growing ad format through 2019.5 In addition to better message communication compared to banners and other online ad formats, advertisers see digital video’s potential for: © 2015 Forrester Research, Inc. Unauthorized copying or distributing is a violation of copyright law. Citations@forrester.com or +1 866-367-7378 2 FOR B2C MARKETING PROFESSIONALS November 30, 2015 The Forrester Wave™: Video Advertising Demand-Side Platforms, Q4 2015 The 10 Providers That Matter Most And How They Stack Up ›› Recapturing elusive audiences. The TV ratings declines are a symptom of a measurement system lagging changes in consumer viewing behavior, not consumers abandoning the network content they have long loved. In announcing the availability of its total audience measurement tool in December 2015, Nielsen noted that for one unnamed broadcaster’s drama program, only 15% of viewers aged 25 to 34 watched the episode live at the scheduled air time while 18% timeshifted their viewing to watch on a PC, tablet, or smartphone.6 Nielsen executive vice president Megan Clarken summed up these changes saying, “Live and DVR is very dominant in the older demographics, very less predominant in the younger demographics.” ›› More automated and precise buying. Advertisers have embraced programmatic buying for online display advertising because it automates otherwise laborious negotiations and enables the use of data to deliver ads only to viewers who precisely match their target. Having gotten a taste of this capability in display advertising, brands are pressing media companies to offer these benefits in their video content as well.7 ›› Better accountability. Broadcast television’s power is somewhat blunted by its mass nature: the advertising planner only has broad demographic data about who is watching the programming. As more video is streamed at the request of individual viewers, planners have better data not only about each viewer, but about the impact of the actions that viewer takes as a result. Multitouch attribution studies combining the individual viewer data from comScore, Nielsen, and Rentrak with relevant purchase data from firms like Datalogix, IHS Automotive, and brands’ CRM databases are becoming more commonplace. Advertisers Seek A Solution To Manage Complex Video Campaign Execution Needs As part of this Forrester Wave evaluation, Forrester fielded an online survey to 82 customers of the platforms included in this evaluation to understand how they manage cross-screen video buys, what capabilities they value most today, and what they expect from video platforms in the future. These users of video advertising DSPs told us: ›› Television and online video are increasingly planned together. About one-third of respondents told us that a single group handles planning and buying of both television and online ads (see Figure 1). But another 39% said that while different groups manage television and digital video, they jointly plan and execute campaigns. Only about one-quarter said digital video was totally independent of television advertising or that they only run digital video campaigns. Planning and buying online video that best complements a TV ad schedule requires specialized data and tools. ›› Today’s advertisers want tools that give quality, flexibility, and control. Like programmatic display advertising, video advertising engages a complex ecosystem of technologies. It also requires different buying processes depending on the “premium” nature of the ad inventory.8 When asked about the video marketing capabilities they currently use, at least 50 survey respondents selected 15 from a list of 21 (see Figure 2). Since digital video is vulnerable to the same unscrupulous practices that plague display advertising, and because video prices are higher than © 2015 Forrester Research, Inc. Unauthorized copying or distributing is a violation of copyright law. Citations@forrester.com or +1 866-367-7378 3 FOR B2C MARKETING PROFESSIONALS November 30, 2015 The Forrester Wave™: Video Advertising Demand-Side Platforms, Q4 2015 The 10 Providers That Matter Most And How They Stack Up display, advertisers currently use capabilities to measure viewability, avoid fraudulent inventory, and screen out potentially offensive content. Advertisers also look for flexibility in the KPIs they measure their campaign by, the ad formats they use, and the type of programmatic buying process they use. Ad delivery controls to limit frequency or sequence ad creatives round out today’s capabilities. ›› Video planners will look for cross-device capabilities; mobile video ads next. We also asked which capabilities will be important for video DSPs to offer in the next three years. While quality capabilities remained among the top needs, cross-device capabilities to identify individuals and optimize ads jumped into the top 10 along with the ability to use the advertiser’s first-party data. Mobile ad inventory beat out over-the-top TV ad inventory as the most critical future type of video inventory (see Figure 3). FIGURE 1 TV And Digital Video Planning Converges “How is your firm organized to manage television and digital video advertising?” Only digital, Other 5% no TV 7% A single group handles both 32% Different TV and digital groups operate independently 17% 71% of respondents coordinate TV and digital video Different TV and digital groups, but plan jointly 39% Base: 86 survey respondents Source: The Forrester Wave™: Video Ad Platforms, Q4 2015 Customer Reference Survey © 2015 Forrester Research, Inc. Unauthorized copying or distributing is a violation of copyright law. Citations@forrester.com or +1 866-367-7378 4 FOR B2C MARKETING PROFESSIONALS November 30, 2015 The Forrester Wave™: Video Advertising Demand-Side Platforms, Q4 2015 The 10 Providers That Matter Most And How They Stack Up FIGURE 2 Advertisers Want Quality, Flexibility, And Control “Does your company use the following capabilities in its video marketing?” (Please select one response per row.) Currently using Plan to use in the next 12 months No plans to use 1 Support for a variety of KPIs (e.g., CPM, clicks, reach, etc.) 72 3 Ability to define and avoid content deemed inappropriate for my brand 71 3 2 Support for ad formats such as VPAID, VAST, MRAID 69 3 4 Ad delivery controls (e.g., frequency capping, creative sequencing, etc.) Third-party ad viewability verification 67 3 Data from third-party sources for planning and targeting ads 66 4 A bidding engine that provides flexibility in setting bid parameters and prices 6 65 Both auction and direct publisher buys 8 6 11 5 62 Attribution for actions such as site visits, search volume, etc., to ads 60 55 53 5 10 3 63 Both audience guaranteed and non-guarantee types of buys 5 7 65 4 Both private marketplaces and open exchanges Attribution for leads, sales, revenue, or other business impacts to ads 7 3 66 Selecting ad placements based on type of content (e.g., sports, travel, cooking, etc.) 6 5 3 67 Ability to eliminate fraudulent inventory Brand lift measurement 5 3 68 13 8 15 8 Base: 72 survey respondents Source: The Forrester Wave™: Video Ad Platforms, Q4 2015 Customer Reference Survey © 2015 Forrester Research, Inc. Unauthorized copying or distributing is a violation of copyright law. Citations@forrester.com or +1 866-367-7378 5 FOR B2C MARKETING PROFESSIONALS November 30, 2015 The Forrester Wave™: Video Advertising Demand-Side Platforms, Q4 2015 The 10 Providers That Matter Most And How They Stack Up FIGURE 3 Cross-Screen Capabilities And Mobile Inventory Top Future Needs 3-1 Support for first-party data and cross-screen capabilities will grow in importance “Please rate the importance or unimportance of a video DSP platform offering the following capabilities in the next three years.” Not important Somewhat important Important Critically important Ability to define and avoid content deemed inappropriate for my brand 2 12 62 Ability to eliminate fraudulent inventory 1 13 62 Third-party ad viewability verification 2 58 16 Support for a variety of KPIs (e.g., CPM, clicks, reach, etc.) 2 57 17 Ad delivery controls (e.g., frequency capping, creative sequencing, etc.) 3 18 55 A bidding engine that provides flexibility in setting bid parameters and prices 3 18 55 Importing my first-party data to use in planning and targeting ads 1 5 Support for ad formats such as VPAID, VAST, MRAID 5 Cross-screen, cross-device optimization 4 Identification of individuals across 2 screens/devices 16 54 18 53 20 52 21 53 Base: 72 survey respondents Source: The Forrester Wave™: Video Ad Platforms, Q4 2015 Customer Reference Survey © 2015 Forrester Research, Inc. Unauthorized copying or distributing is a violation of copyright law. Citations@forrester.com or +1 866-367-7378 6 FOR B2C MARKETING PROFESSIONALS November 30, 2015 The Forrester Wave™: Video Advertising Demand-Side Platforms, Q4 2015 The 10 Providers That Matter Most And How They Stack Up FIGURE 3 Cross-Screen Capabilities And Mobile Inventory Top Future Needs (Cont.) 3-2 Advertisers demand mobile video inventory “Please rate the importance or unimportance of a video DSP platform offering extensive advertising inventory in each of the following types of placements in the next three years.” Not important Somewhat important Mobile apps 3 6 10 Television content streamed to over-the-top devices 3 (e.g., Roku, game consoles, SmartTV, etc.) 11 Web-based user generated video (YouTube, Vine, etc.) 12 7 Video-on-demand Professionally-produced web-based video content (e.g., Stylehaul, Machinima, etc.) 15 9 Linear television 6 37 34 16 Addressable television ads 4 42 25 9 Television content streamed over the Internet 3 to a computer or laptop Critically important 25 Mobile web 4 Television content streamed via apps 3 to mobile devices Important 28 37 27 30 27 35 25 29 25 14 33 20 17 33 20 10 23 31 12 Base: 72 survey respondents Source: The Forrester Wave™: Video Ad Platforms, Q4 2015 Customer Reference Survey © 2015 Forrester Research, Inc. Unauthorized copying or distributing is a violation of copyright law. Citations@forrester.com or +1 866-367-7378 7 FOR B2C MARKETING PROFESSIONALS November 30, 2015 The Forrester Wave™: Video Advertising Demand-Side Platforms, Q4 2015 The 10 Providers That Matter Most And How They Stack Up Video Advertising DSP Evaluation Overview To assess the state of the video advertising DSP market and see how the vendors stack up against each other, Forrester evaluated the strengths and weaknesses of top video advertising DSP vendors (see Figure 4). FIGURE 4 Evaluated Vendors: Vendor Information And Selection Criteria Vendor Product evaluated AOL One by AOL: Video DataXu The DataXu Platform Google DoubleClick Bid Manager The Trade Desk The Trade Desk Demand-Side Platform Tremor Video Tremor Video Demand Side Platform TubeMogul TubeMogul Platform Turn Turn Campaign Suite Viant Viant Advertising Cloud Videology Videology Platform Yahoo BrightRoll DSP Vendor selection criteria The vendor must support buy-side advertising clients. The vendor must support ad inventory in both desktop/laptop Web, mobile Web, and mobile app video. The vendor must support ad inventory in at least three forms of television content: live linear, streamed via network or MVPD app, streamed via connected TV device, MVPD VOD, or MVPD addressable ads. Advertisers Focus On Inventory Quality And Cross-Screen Capabilities After examining past research, user need assessments, and vendor and expert interviews, we developed a comprehensive set of evaluation criteria. We evaluated vendors against 22 criteria, which we grouped into three high-level buckets: ›› Current offering. Our 11 evaluation criteria are grouped into 7 capabilities. Five of these reflect the capabilities needed to support the core tasks in managing a campaign: planning capabilities, TV campaign extension, transaction capabilities, campaign execution, and measurement. Of the © 2015 Forrester Research, Inc. Unauthorized copying or distributing is a violation of copyright law. Citations@forrester.com or +1 866-367-7378 8 FOR B2C MARKETING PROFESSIONALS November 30, 2015 The Forrester Wave™: Video Advertising Demand-Side Platforms, Q4 2015 The 10 Providers That Matter Most And How They Stack Up final two criteria, one looks at the breadth of ad inventory across the entire spectrum of video types available, while the other reflects the satisfaction ratings on 15 capabilities that the reference clients of each participating vendor indicated in an online survey that Forrester administered.9 ›› Strategy. To determine whether the company has a strategy that will meet the expected changes in this fast-evolving area, Forrester evaluated the breadth of expertise of the management team and the product strategy for its robustness in addressing the need for cross-device individual identification, incorporating all forms of digital and video advertising, and the ability to provide quantitative, scientific measurement of campaign results. ›› Market presence. These eight criteria examine four areas of each firm’s position in the market: customer base, revenue, revenue growth, and global capabilities. Evaluated Vendors Give The Buy-Side Comprehensive Video Ad Features Forrester included 10 vendors in the assessment: AOL, DataXu, Google DoubleClick Bid Manager, The Trade Desk, Tremor Video, TubeMogul, Turn, Viant, Videology, and Yahoo BrightRoll. Each of these vendors has: ›› Capabilities to enable the buy side. In order to qualify, vendors had to have a set of features designed to enable advertisers or their agencies to plan, buy, and execute video advertising campaigns. While some of the included vendors offer platforms intended to be used by both buy and sell side, pure sell-side platforms were excluded from consideration. ›› Broad video content including inventory in television programs. With consumer viewing behavior shifting to diverse online, over-the-top, and TV everywhere options, advertisers need a tool that can reach these viewers to fill the increasing gaps in traditional television ad plans as linear TV ratings sag. We focused on vendors who tap into the entire spectrum of video opportunities, including linear television, while excluding vendors who handled web-native video alone. Leaders Support Planning And Execution Of Both TV And Digital Video The evaluation uncovered a market in which: ›› TubeMogul, Videology, and The Trade Desk lead the pack. These three vendors built their technologies from day one in anticipation of television programming and advertising becoming more digital in nature. Their understanding of the way traditional TV planners and buyers operate, along with their vision of the new capabilities this digitization will enable to make TV more flexible and measurable, put them ahead of other vendors in this space (see Figure 5). ›› Strong performers provide a strong technology platform but lack linear TV inventory. Other vendors come to video with technologies originally developed for other types of advertising. BrightRoll and Tremor Video have evolved from being video ad networks, and their need to bolster © 2015 Forrester Research, Inc. Unauthorized copying or distributing is a violation of copyright law. Citations@forrester.com or +1 866-367-7378 9 FOR B2C MARKETING PROFESSIONALS November 30, 2015 The Forrester Wave™: Video Advertising Demand-Side Platforms, Q4 2015 The 10 Providers That Matter Most And How They Stack Up DSP functionality means some more television-focused functions are not yet present. Vendors from the display advertising side, including DataXu and Turn, have added video inventory to their offerings but lack capabilities that support the branding objectives that video primarily serves. Viant envisioned a new platform and built its Advertising Cloud through a series of acquisitions that show strong promise. DoubleClick Bid Manager is relatively new to the video space and opted not to participate in the evaluation, but given the importance of this vendor in online advertising, Forrester included it as a nonparticipating vendor.10 This evaluation of the video advertising DSP market is intended to be a starting point only. We encourage clients to view detailed product evaluations and adapt criteria weightings to fit their individual needs through the Forrester Wave Excel-based vendor comparison tool. FIGURE 5 Forrester Wave™: Video Advertising Demand Side Platforms, Q4 ‘15 Challengers Contenders Strong Strong Performers Leaders TubeMogul Videology The Trade Desk Viant Turn Tremor Video BrightRoll Current offering DataXu Google Go to Forrester.com to download the Forrester Wave tool for more detailed product evaluations, feature comparisons, and customizable rankings. AOL Market presence Full vendor participation Incomplete vendor participation Weak Weak Strategy Strong © 2015 Forrester Research, Inc. Unauthorized copying or distributing is a violation of copyright law. Citations@forrester.com or +1 866-367-7378 10 FOR B2C MARKETING PROFESSIONALS November 30, 2015 The Forrester Wave™: Video Advertising Demand-Side Platforms, Q4 2015 The 10 Providers That Matter Most And How They Stack Up FIGURE 5 Forrester Wave™: Video Advertising Demand Side Platforms, Q4 ‘15 (Cont.) Challengers Contenders Strong Strong Performers Leaders TubeMogul Videology The Trade Desk Viant Turn Tremor Video BrightRoll Current offering DataXu Google Go to Forrester.com to download the Forrester Wave tool for more detailed product evaluations, feature comparisons, and customizable rankings. AOL Market presence Full vendor participation Incomplete vendor participation Weak Weak Strategy Strong Vendor Profiles Leaders ›› TubeMogul’s video-first heritage empowers the buy side. TubeMogul was founded as an online video platform and designed to serve brand-focused advertisers, a departure from most online advertising’s direct response bias. Its emphasis on serving branding objectives is confirmed by the strong offer of TV network private marketplaces and the platform’s capabilities in planning online video that complements a linear TV schedule. TubeMogul customers gave it strong ratings for its data sourcing and management abilities, fraud prevention, and ad delivery controls. Ad agencies and marketers who want to directly manage their programmatic video buying will find the self-serve platform compelling. To maintain its leadership position, TubeMogul needs to strengthen its cross-device individual identity graph, the weakest capability area as highlighted by its customer references, but key to the ability to give brand-focused advertisers optimal control over the reach and frequency of their campaigns. © 2015 Forrester Research, Inc. Unauthorized copying or distributing is a violation of copyright law. Citations@forrester.com or +1 866-367-7378 11 FOR B2C MARKETING PROFESSIONALS November 30, 2015 The Forrester Wave™: Video Advertising Demand-Side Platforms, Q4 2015 The 10 Providers That Matter Most And How They Stack Up ›› Videology excels at mastering the convergence of television and online video. Videology designed its solution with the view that the TV buying process would eventually be automated and the thinking behind TV planning would drive online video buying. As a result, Videology has the most sophisticated media optimizer to analyze the right allocation of TV and online video to optimize reach and campaign cost, a compelling feature for media planners grounded in a traditional TV discipline. The firm serves both advertisers and publishers — notably Comcast’s Spotlight ad sales — but maintains its neutrality by not owning any advertising inventory. Videology’s bidding engine and in-flight optimization client reference scores lag, and the firm will need to improve these functions as video advertising evolves from content placements to impression-by-impression buying. ›› The Trade Desk combines strong programmatic technology for digital video inventory. This firm, a Leader in our demand-side platforms Q2 2015 Forrester Wave, has built a strong technology platform for digital media buying based on its roots in online display advertising.11 These digital roots show in its strength in digital video inventory, bidding engine, and in-flight optimization capabilities. The Trade Desk received the highest customer satisfaction ratings of all participants, and most capabilities scored significantly above the median for each. The firm aspires to move beyond its display heritage to be the platform for everything digital, and these broad capabilities are best for ad agencies and marketers with large budgets distributed across all forms of display and video ad opportunities. The Trade Desk’s digital roots expose weaknesses for more brand-oriented advertisers: planning screens that focus on impressions without the ability to calculate a campaign’s unduplicated reach and frequency and only average brand lift measurement capabilities. Strong Performers ›› Turn offers a solid video DSP but can improve on ad inventory quality controls. Given Turn’s history as an early provider of programmatic advertising, it’s no surprise that the firm scores highly for core DSP capabilities, such as its bidding engine and in-flight optimization. It has augmented these strengths by tapping into all the major video and television inventory sources, such as clypd and One by AOL: Video Marketplace. Turn’s “media path to conversion” and “optimal reach and frequency to drive actions” analyses will appeal especially to brands in high consideration categories where the consumer decision path is long and likely moves across many touchpoints. Turn’s customer reference scores for its fraud prevention capabilities were well below average, and we found its viewability and brand safety features middle of the pack. Like other programmatic platforms that started in the display space, its platform lags in offering tools to plan digital video buys that fill gaps in TV buys. ›› Viant’s integrated stack aims to slash the “technology tax.” Viant has assembled its Advertising Cloud from a series of acquisitions with the goal of squeezing costs out of today’s ecosystem of disparate specialist services, such as viewability, DMP, attribution, etc., that constitute the so© 2015 Forrester Research, Inc. Unauthorized copying or distributing is a violation of copyright law. Citations@forrester.com or +1 866-367-7378 12 FOR B2C MARKETING PROFESSIONALS November 30, 2015 The Forrester Wave™: Video Advertising Demand-Side Platforms, Q4 2015 The 10 Providers That Matter Most And How They Stack Up called technology tax that siphons off up to 60% of the online advertising budget.12 The firm further differentiates itself with its offering of 1 billion proprietary deterministic cross-device, people-based profiles derived from Myspace, which it acquired in 2011. Its focus to date has been on digital media, including video (through its 2010 acquisition of Vindico), but the firm plans to launch its Xumo platform in connected TVs in the next six months to build its TV inventory and viewer data. Advertisers who don’t want day-to-day management of their campaigns will appreciate Viant’s managed services focus. Viant needs to enhance its bidding engine, ad delivery controls, and planning capabilities and expand beyond connected TV inventory to have a full video solution to move into the Leader category. ›› Tremor Video makes the transition from ad network to video marketplace. Started as a video ad network in 2007, the firm saw the market move away from the network model and has spent two years evolving its capabilities to serve both buy and sell side with its VideoHub. Tremor Video shows strong progress in its DSP, offering credible capabilities in all areas and particular strengths in its audience forecasting and in-flight optimization, while its customers further rated its brand lift and attribution measurement abilities highly. This combination of features is well suited for brand advertisers who allocate a significant portion of their budget to digital channels. While the firm needs to continue to strengthen its fraud and brand safety capabilities, it also needs to build out its television inventory and tools for converging TV and digital video planning, which the firm told us is on its road map for 2016. ›› BrightRoll offers strong digital video inventory for digital advertisers. BrightRoll was a pioneer video ad network, launching in 2006, and pivoted to the programmatic space with the launch of BrightRoll Exchange in 2010. Yahoo’s acquisition of BrightRoll in 2014 should have bolstered the DSP’s cross-device individual identity graph with first-party deterministic data, though client reference scores indicate this hasn’t been fully realized yet. BrightRoll users give it strong marks for inventory availability, and Yahoo’s integration of mobile analytics tool Flurry strengthens BrightRoll’s mobile advertising offering. Advertisers whose budget is predominantly digital will benefit from this breadth of ad inventory. But BrightRoll’s platform is built around online display advertising processes and metrics that don’t fully support the objectives of a converged TV/online video plan. To become a leader, BrightRoll needs to improve its tools to help media planners understand how digital video will extend and complement their TV schedules. ›› DataXu’s strong platform hasn’t fully translated to video’s branding power. As a Leader in the DSP Forrester Wave, its buy-side platform starts with strong in-flight optimization capabilities and a powerful bidding engine. The vendor backs its claims of strong fraud prevention with a moneyback guarantee that differentiates it in the market. Large advertisers who don’t use TV and whose business has a direct response focus will find the platform capable for their needs. © 2015 Forrester Research, Inc. Unauthorized copying or distributing is a violation of copyright law. Citations@forrester.com or +1 866-367-7378 13 FOR B2C MARKETING PROFESSIONALS November 30, 2015 The Forrester Wave™: Video Advertising Demand-Side Platforms, Q4 2015 The 10 Providers That Matter Most And How They Stack Up But the firm’s omnichannel approach only applies to digital channels, including video, and it lags others in linear TV inventory and planning capabilities. In addition, its display heritage comes through in its focus on impressions and clicks, and with other actions and gaps in its ability to serve brand objectives. ›› DoubleClick Bid Manager shows potential to be a strong competitor. DoubleClick launched its video capability at the end of 2013 and opted to be a nonparticipating vendor in this evaluation. Despite the limited information Forrester was able to gather, the firm earned Strong Performer status, particularly for the strength of its in-flight optimization and cross-device individual identification, which benefits from Google’s broad first-party relationship with over a billion Internet users globally. Television is a high priority for DoubleClick, and it demonstrated a clear vision and strong strategy for how it will expand its capabilities. It is also committed to further integrating the measurement capabilities acquired through Adometry, enabling users to optimize to business results. The firm reported strong growth since the launch of its video capability, and DoubleClick will be an easy addition for advertisers already using the platform for their display advertising. ›› One by AOL: Video is a new platform that needs improvement to fulfill its promise. The One by AOL: Video platform launched in April 2015 as the result of a series of acquisitions, including video platform Adapt.TV in 2013 and attribution technology Convertro in 2014. AOL’s 30 owned media properties, such as the Huffington Post and TechCrunch, give the platform a strong foundation of first-party deterministic identities. The platform also offers unique television capabilities, with audience data for all television programming and its proprietary “tRatio” metric. Advertisers will appreciate the ability to use digital ads to fill gaps in TV schedules as audiences rapidly migrate to non-linear viewing options. Despite these strong capabilities, One by AOL: Video earned the lowest satisfaction scores among all participants, suggesting the firm must better integrate these capabilities. The firm has two additional integrations in process: Millennial Media and Verizon customer data. If successful, it has the potential to be a future Leader. © 2015 Forrester Research, Inc. Unauthorized copying or distributing is a violation of copyright law. Citations@forrester.com or +1 866-367-7378 14 FOR B2C MARKETING PROFESSIONALS November 30, 2015 The Forrester Wave™: Video Advertising Demand-Side Platforms, Q4 2015 The 10 Providers That Matter Most And How They Stack Up Engage With An Analyst Gain greater confidence in your decisions by working with Forrester thought leaders to apply our research to your specific business and technology initiatives. Analyst Inquiry Analyst Advisory Ask a question related to our research; a Forrester analyst will help you put it into practice and take the next step. Schedule a 30-minute phone session with the analyst or opt for a response via email. Put research into practice with in-depth analysis of your specific business and technology challenges. Engagements include custom advisory calls, strategy days, workshops, speeches, and webinars. Learn more about inquiry, including tips for getting the most out of your discussion. Learn about interactive advisory sessions and how we can support your initiatives. Supplemental Material Online Resource The online version of Figure 5 is an Excel-based vendor comparison tool that provides detailed product evaluations and customizable rankings. Data Sources Used In This Forrester Wave Forrester used a combination of three data sources to assess the strengths and weaknesses of each solution: ›› Vendor surveys. Forrester surveyed vendors on their capabilities as they relate to the evaluation criteria. Vendors provided detailed descriptions and supporting evidence pertaining to their current offering, strategy, and market presence. Where necessary, we conducted vendor calls or written requests to gather additional details of vendor capabilities as they relate to the evaluation criteria. ›› In-depth briefings and product demos. We met with each vendor for a two-hour briefing and demonstration of their products’ functionality, including two scenarios we designed to provide a standard process for understanding key features. We used findings from these product demos to validate details of each vendor’s product capabilities. © 2015 Forrester Research, Inc. Unauthorized copying or distributing is a violation of copyright law. Citations@forrester.com or +1 866-367-7378 15 FOR B2C MARKETING PROFESSIONALS November 30, 2015 The Forrester Wave™: Video Advertising Demand-Side Platforms, Q4 2015 The 10 Providers That Matter Most And How They Stack Up ›› Customer reference survey. To validate product and vendor qualifications, Forrester also conducted an online survey with up to 10 of each vendor’s current customers. The Forrester Wave Methodology We conduct primary research to develop a list of vendors that meet our criteria to be evaluated in this market. From that initial pool of vendors, we then narrow our final list. We choose these vendors based on: 1) product fit; 2) customer success; and 3) Forrester client demand. We eliminate vendors that have limited customer references and products that don’t fit the scope of our evaluation. After examining past research, user need assessments, and vendor and expert interviews, we develop the initial evaluation criteria. To evaluate the vendors and their products against our set of criteria, we gather details of product qualifications through a combination of lab evaluations, questionnaires, demos, and/or discussions with client references. We send evaluations to the vendors for their review, and we adjust the evaluations to provide the most accurate view of vendor offerings and strategies. We set default weightings to reflect our analysis of the needs of large user companies — and/or other scenarios as outlined in the Forrester Wave document — and then score the vendors based on a clearly defined scale. These default weightings are intended only as a starting point, and we encourage readers to adapt the weightings to fit their individual needs through the Excel-based tool. The final scores generate the graphical depiction of the market based on current offering, strategy, and market presence. Forrester intends to update vendor evaluations regularly as product capabilities and vendor strategies evolve. For more information on the methodology that every Forrester Wave follows, go to http://www.forrester.com/marketing/policies/forrester-wave-methodology.html. Integrity Policy All of Forrester’s research, including Forrester Wave evaluations, is conducted according to our Integrity Policy. For more information, go to http://www.forrester.com/marketing/policies/integrity-policy.html. Endnotes Ed Papazian, the president of Media Dynamics, notes that this decline “hasn’t been seen before” and in total, spending is down 11% since the 2012 to 2014 season. Source: Wayne Friedman, “Broadcast, Cable Upfront Spending Drops Again,” MediaPost, September 9, 2015 (http://www.mediapost.com/publications/article/257973/broadcastcable-upfront-spending-drops-again.html). 1 Millennials are defined here as 18 to 35 year olds, while older adults are 36 and older. Source: Forrester’s North American Consumer Technographics® Online Benchmark Survey (Part 1), 2015. 2 Younger consumers continue to drive the adoption of mobile video, seeing it as the core of their entertainment universe. Source: “Ooyala Q2 Global Video Index,” Ooyala (http://go.ooyala.com/wf-video-index-q2-2015). 3 © 2015 Forrester Research, Inc. Unauthorized copying or distributing is a violation of copyright law. Citations@forrester.com or +1 866-367-7378 16 FOR B2C MARKETING PROFESSIONALS November 30, 2015 The Forrester Wave™: Video Advertising Demand-Side Platforms, Q4 2015 The 10 Providers That Matter Most And How They Stack Up The ANA/White Ops study notes: “Almost a quarter of video ad impressions in the study were identified as bot fraud, as were 11 percent of display ad impressions, while 17 percent of programmatic display bot traffic was fraudulent, and bot fraud for retargeted ads averaged 19 percent.” Source: Michael J. McDermott, “Fraudsters, Liars, and Cheats,” Association of National Advertisers, March 1, 2015 (http://www.ana.net/miccontent/show/id/ana-2015-mar-fraudstersliars-cheats). 4 Forrester forecasts a 21% compound annual growth rate for video advertising on PCs through 2019, and an almost 40% growth rate on mobile devices. Source: Forrester Research Online Display Advertising Forecast, 2014 To 2019 (US). 5 Source: Jason Lynch, “A First Look at Nielsen’s Total Audience Measurement and How It Will Change the Industry,” Adweek, October 20, 2015 (http://www.adweek.com/news/television/first-look-nielsen-s-total-audiencemeasurement-and-how-it-will-change-industry-167661). 6 As advertisers grow more comfortable with the new way of buying video ad inventory, television programming delivered online, in apps and across devices will be progressively pulled into programmatic buying’s orbit and will eventually arrive at television’s doorstep. See the “How Software Is Eating Video Ads And, Soon, TV” Forrester report. 7 Different types of video content have higher or lower value to advertisers, largely depending on the perceived level of production quality; advertisers often consider video content produced for TV broadcasting at the top of the pile. As the advertising industry gains experience with programmatic buying, the practice is morphing beyond its original open real-time bidding format, creating four types of programmatic buying models. See the “How Software Is Eating Video Ads And, Soon, TV” Forrester report. 8 Forrester invited vendors participating in this Wave to provide up to 10 client references each. Forrester fielded an online survey to the 88 references provided, asking them to prioritize the importance of DSP platform capabilities and rate their satisfaction with their vendor on 15 of these capabilities. These results formed the basis of the customer satisfaction criterion in the Forrester Wave model. 9 Occasionally, vendors we choose to include in a Wave decline to actively participate in the process. If the analyst feels the vendor is important in this market, he or she may choose to include it in the report as a nonparticipating vendor. Nonparticipating vendors do not go through the formal evaluation process; instead, Forrester uses public information and data gathered via briefings and/or independently sourced client references. 10 To learn more about our assessment of the demand side platforms market, see the “The Forrester Wave™: DemandSide Platforms, Q2 2015” Forrester report. 11 The term “technology tax” refers to the significant percent of the advertising budget that is spent on intermediary technologies and data sources such as ad servers, DSPs, et al., instead of purchasing media. For one estimate of the size of this “tax,” visit the following link. Source: “The Technology Tax,” Aol Platforms (http://www.aolplatforms.com/ research/technology-tax). 12 © 2015 Forrester Research, Inc. Unauthorized copying or distributing is a violation of copyright law. Citations@forrester.com or +1 866-367-7378 17 We work with business and technology leaders to develop customer-obsessed strategies that drive growth. PRODUCTS AND SERVICES ›› ›› ›› ›› ›› ›› Core research and tools Data and analytics Peer collaboration Analyst engagement Consulting Events Forrester’s research and insights are tailored to your role and critical business initiatives. ROLES WE SERVE Marketing & Strategy Professionals CMO B2B Marketing ›› B2C Marketing Customer Experience Customer Insights eBusiness & Channel Strategy Technology Management Professionals CIO Application Development & Delivery Enterprise Architecture Infrastructure & Operations Security & Risk Sourcing & Vendor Management Technology Industry Professionals Analyst Relations CLIENT SUPPORT For information on hard-copy or electronic reprints, please contact Client Support at +1 866-367-7378, +1 617-613-5730, or clientsupport@forrester.com. We offer quantity discounts and special pricing for academic and nonprofit institutions. Forrester Research (Nasdaq: FORR) is one of the most influential research and advisory firms in the world. We work with business and technology leaders to develop customer-obsessed strategies that drive growth. Through proprietary research, data, custom consulting, exclusive executive peer groups, and events, the Forrester experience is about a singular and powerful purpose: to challenge the thinking of our clients to help them lead change in their organizations. 113501 For more information, visit forrester.com.