advertisement

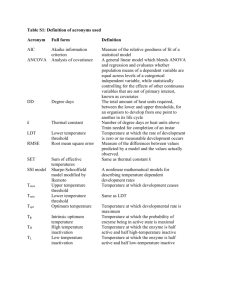

+N November 6th, 2015 Volume 159, Issue 697 Week 45 “You just can’t beat the person who never gives up.” - Babe Ruth Highlights: MARKET COMMENTARY EASE THE PRESSURE! • Sales rack up. The anticipated glut of fourth quarter sales began in earnest this week with several decent sized panamax containers sold amidst the now customary dry panamax and capesize bulker sales. • Bangladesh absorbs. • Container woes. • Sharing burden. • 100 capes for year? It was little surprise that all of those vessels were committed into the best-placed market i.e. Bangladesh, as levels and demand pushed on there for another consecutive week. Struggling container freight rates and the continued disappointments of the dry-bulk sector should see many more vessels hit the recycling market before the end of the year, but questions remain as to how much longer this Bangladesh revival can (will?) hold for. A number of the hot buyers have already been booked with larger LDT tonnage in recent weeks and those buyers that remain are simply not as aggressive or do not have their LCs in place, in order to conclude a safe deal with. As such, the job of a dependable cash buyer is to ensure on LC facilities in order to confirm that the vessel can be imported upon arrival, without any banking delays / non-performance issues by the end user. The responsibility therefore has to fall on competing sub-continent markets – Pakistan in particular – in absorbing some of this tonnage, in the final few months of the year. India appears to be absolutely nowhere (in terms of its current ability to negotiate / conclude available units) and is as much as USD 30/LDT behind on select tonnage. With 89 capesize bulkers sold so far this year for recycling and several more in the pipeline for the weeks ahead, it would be no surprise to see 100 capes sold for scrap this year, to ease the pressure on a currently bloated sector. For week 45 of 2015, GMS demo rankings for the week are as below: Cash Buyer to be ISO 9001:2008 Certified Demo Ranking 1 2 3 4 5 Country Bangladesh Pakistan India Turkey China Market Sentiment Weak Weak Weak Weak Weak GEN CARGO Prices USD 300/lt ldt USD 295/lt ldt USD 280/lt ldt USD 175/lt ldt USD 125/lt ldt TANKER Prices USD 330/lt ldt USD 325/lt ldt USD 310/lt ldt USD 180/lt ldt USD 145/lt ldt GMS Weekly Page 2 of 8 BANGLADESH TO THE FORE! BANGLADESH BANGLADESH A number of high LDT vessels were concluded at decent rates into Chittagong this week as the Bangladeshi market maintained its top-placed status once again. Top status. At current levels, demand and sentiments remain good but there are concerns that some of the more capable buyers are starting to dwindle and the market may inevitably cool off in the weeks ahead. BANGLADESH Of the tonnage concluded, Swissmarine sold their capesize bulker CHOULEX (18,563 LDT) for a rather firm USD 330/LT LDT (although the vessel had 500 Ts of bunkers included in the sale). BANGLADESH Vessels sold. BANGLADESH Two panamax containers were concluded ‘as is’ Singapore with the EVER RACER (22,144 LDT) sold for an impressive USD 322/LT LDT with extra payment for bunkers and lubes, whilst the Laeisz controlled PUSAN (18,851 LDT) was fixed for a more modest USD 315/LT LDT, in what seems to be the initial signs of a softening market. BANGLADESH Finally, the panamax bulker SEA VENUS (9,937 LDT) was fixed from Korean owners for a good USD 315/LT LDT ‘as is’ Singapore with 400 Ts bunkers included in the sale. BANGLADESH MARKET SALES REPORTED VESSEL NAME TYPE LDT CHOULEX Bulker 18,563 EVER RACER Container 22,144 PUSAN Container 18,851 SEA VENUS Bulker 9,937 REPORTED PRICE USD 330/LT LDT (with 500 Ts bunkers upon arrival) USD 322/LT LDT (‘as is’ Singapore with extra payment for bunkers and lubes) USD 315/LT LDT (‘as is’ Singapore with extra payment for bunkers) USD 315/LT LDT (‘as is’ Singapore with 400 Ts bunkers included in sale) GMS Weekly Page 3 of 8 INDIA ALL ENVELOPING GLOOM! INDIA INDIA The depression presently enveloping the Indian market showed few signs of abating this week, with further falls reported on local steel plate prices, resulting in an overall reluctance to offer on any available units, in the fears of further losses in the future. No sales. INDIA As a result, there have been no sales reported to Indian end buyers and whilst Pakistan and Bangladesh continue to perform better, it is likely to be a much quieter period on the shores of Alang. INDIA Indeed, fresh arrivals at the waterfront have been limited over the last few weeks as only 20 - 25 yards remain operational locally, out of the 150 or so that have been acquiring vessels over the peak of the last few years. No arrivals. INDIA Banks remain incredibly reluctant to sanction new LCs due to the severity of the falls this year (almost 50% of market value has been lost) and a number of yards have been forced into closure as a result. INDIA The Indian Rupee spent much of the week trading at levels around Rs. 65 against the U.S. Dollar as the currency gives little respite to under pressure and beleaguered endbuyers. INDIA As such, it remains worth steering clear of the Indian market in the current form. NO MARKET SALES REPORTED Steer clear. GMS Weekly Page 4 of 8 PAKISTAN PRICE GAP TOO GREAT! INDIA INDIA Losing out. Pakistan lost out to a rampant Bangladeshi market this week and was unable to secure any sales despite an improving demand. INDIA Presently, the price gap remains just too great to divert vessels from the shores of Chittagong – especially for those units coming from the Far East (and therefore closer to Bangladesh). INDIA Improving? There were signs towards the end of the week that prices were starting to improve to compete with Bangladesh and with many containers set to come into the market (not the unit of choice for Gadani buyers due to draft issues), they will need to make a notable improvement in prices, in order to get their hands on desired vessels once again. INDIA INDIA INDIA NO MARKET SALES REPORTED GMS Weekly Page 5 of 8 CHINA GREEN GAP CLOSING! With levels at around USD 150/LDT (over half of what sub-continent markets are presently offering), there was no chance of any international market tonnage being concluded into China. Half of sub-continent. Moreover, with class NK certifying several yards in India recently, the gap in standards on green tonnage between both locations is also significantly (and certifiably) narrowed. Notwithstanding, the number of deliveries of Chinese flagged vessels from state owners to local yards continues to keep them busy, so the supply has not totally dried up for them and it remains business as usual (to a certain extent). NO MARKET SALES REPORTED State supply continues. GMS Weekly Page 6 of 8 TURKEY MIXED POSITIVITY. TRY tumbles. The uptick in the national currency did not last long, with the Turkish Lira bouncing back to TRY 2.9 levels (where it has been trading during the recent past) wiping out any positive sentiment created last week, due to the unexpected appreciation to TRY 2.7 levels against the U.S. Dollar. Nonetheless, local steel plate prices keep appreciating, thereby further encouraging the rumors that prices starting with USD 2XX/MT are inevitable. This also resulted in offers improving by another USD 5/MT during the course of the week. Meanwhile, supply remains notably dithered with only 1 (less than 4K LDT) vessel having reportedly arrived Aliaga during the last week as demand remains high (in light of the inability of yards to secure tonnage and the increasing value of local steel prices). NO MARKET SALES REPORTED Miscellaneous Page 7 of 8 i THE HUMAN BODY… 1 in 10,000 people have their internal organs reversed or "mirrored" from their normal positions. 10% of human dry weight comes from bacteria. 10% of men and 8% of women are left-handed. 80 head hairs are likely to fall every day. Diabetes causes 6 deaths every minute and 1 in 20 deaths in the world. Every year 3.2 million people in the world die from diabetes or related causes. Body fat is not particularly hazardous to health until the level of total body fat reaches 35% for men and 40% for women. Eating Breakfast helps to burn 5 to 20% of calories throughout the day. A red blood cell can circumnavigate your body in under 20 seconds. A child’s ability to learn can increase or decrease by 25% or more depending on if the child grows up in a stimulating environment. IMPORTANT DATES INDIA BANK HOLIDAYS BEACHING TIDES November 11 – Diwali November 25 – Guru Nanak Jayanti November 10 – November 17 November 23 – December 01 BANGLADESH BANK HOLIDAYS BEACHING TIDES November 09 – Birthday of Muhamma Iqbal November 11 – November 13 November 25 – November 27 IMPORTANT BANK HOLIDAYS TURKEY PAKISTAN CHINA No more holidays until 2016 November 09 – B’day of Muhammad Iqbal No more holidays until 2016 Prices indicated above are as reported in the market and are not necessarily accurate. This information is provided without prejudice and is given in good faith and without any guarantees whatsoever. While every care has been taken in the preparation of this report, no liability can be accepted for any loss incurred in any way whatsoever by any person relying on the information contained herein. Opinions expressed herein may be deemed subjective and arbitrary. This WEEKLY is intended only for the person or entity to which it is addressed and may contain confidential and/or privileged material. Any review, retransmission, dissemination or other use of this information by persons or entities other than the intended recipient is prohibited. GMS Port Report Page 8 of 8 ALANG - Port Position as November 06, 2015 No. 1 2 3 4 5 6 7 8 VESSEL NAME Ahura Infinity MSC Anna SCF Suek Tsunomine Ville D'aquarius Wind Forrader Winner LDT 6,977 7,878 3,938 15,335 19,701 15,887 2,461 9,203 Total Tonnage TYPE STATUS Passenger Bulk Carrier Gen Cargo Bulk Carrier Bulk Carrier Container Reefer Bulk Carrier Beached November 03 Arrived October 04 Arrived November 03 Arrived October 27 Arrived October 09 Arrived November 02 Arrived November 04 Arrived November 04 81,378 CHITTAGONG - Port Position as of November 06, 2015 No. 1 2 3 4 5 6 7 8 VESSEL NAME Banglar Moni Duke Feng Forever Multi Delta (Dead Vessel) Tania Tiger Bridge Zim Pacific Total Tonnage LDT 6,090 10,644 13,973 9,724 9,184 4,647 8,596 16,900 TYPE STATUS General Cargo Bulk Carrier Bulk Carrier Bulk Carrier Tanker Container Container Container Arrived July 17 Arrived October 30 Arrived November 02 Arrived November 04 Arrived November 04 Beached November 02 Arrived October 30 Arrived October 31 79,757 GADANI - Port Position as of November 06, 2015 No. VESSEL NAME LDT TYPE STATUS No new vessels reported. Total Tonnage 0 WHILE EXTREME CARE HAS BEEN TAKEN IN THE PREPARATION OF THIS REPORT, NO LIABILITY CAN BE ACCEPTED FOR ANY LOSS INCURRED IN ANY WAY WHATSOEVER BY ANY PERSON RELYING ON THE INFORMATION CONTAINED HEREIN.