university of ljubljana faculty of economics international center for

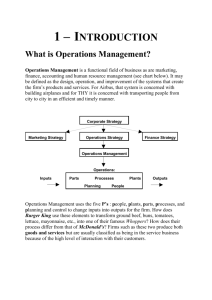

advertisement