Test 3a

advertisement

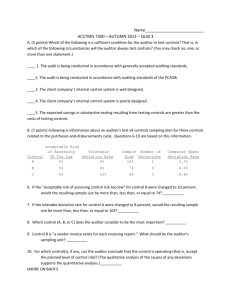

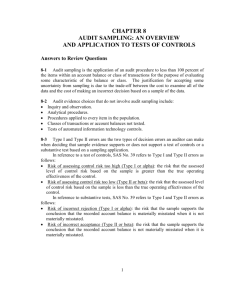

Accounting 408 Test 3a Name _______________________ Section _______ Row _______ I. Multiple Choice. (2.5 points each) Read the following questions carefully and indicate your one best answer to the questions by placing an X over the appropriate letter on the answer sheet. 1. The process of assessing control risk for account balance assertions is straightforward for accounts that are affected by a single transaction class. Which of the following accounts is affected by two transaction cycles? a. cash b. accounts receivable c. inventory d. accounts payable 2. The primary means by which the auditor meets the requirements of the third field work standard (obtain sufficient appropriate evidence) is through a. designing substantive tests. b. performing substantive tests. c. gathering evidence to support the assessed level of control risk. d. preparation of a detailed audit program. 3. Which of the following is not considered a substantive test? a. analytical procedures. b. tests of controls. c. tests of detail of transactions. d. tests of detail of balances. 4. The least costly form of testing is usually a. analytical procedures. b. tests of controls. c. tests of details of transactions. d. tests of details of balances. 5. A dual purpose test is an audit procedure that a. tests two assertions simultaneously. b. is used to obtain an understanding of the control structure and also tests for effectiveness of a control. c. both tests for control effectiveness and for monetary error. d. can be used in both the planning phase and the testing phase of the audit. 6. 7. An auditor is examining the detailed debit and credit activity posted in an account during the year. The auditor is most likely performing a. analytical procedures. b. tests of controls. c. tests of details of transactions. d. tests of details of balances. Tests of details of balances focus on obtaining evidence a. by inspecting the individual debit and credit entries to the account. b. directly about an account balance. c. in the least costly manner. d. to refute instead of support an assertion. 8. In practice, early substantive testing of account balances is done only when a. the client has a calendar year end. b. the client has reporting requirements under the Securities Acts. c. evidence indicates effective control policies and procedures. d. the audit is a first time audit. 9. Audit sampling is least likely to be used when the auditor is a. vouching. b. tracing. c. confirming. d. conducting analytical procedures. 10. If the sample supports the conclusion that the recorded account balance is materially misstated when it is not materially misstated, then this statement illustrates the a. risk of assessing control risk too low. b. risk of assessing control risk too high. c. risk of incorrect acceptance. d. risk of incorrect rejection. 11. The greatest impact on audit effectiveness comes from the risks of a. assessing control risk too low and assessing control risk too high. b. incorrect acceptance and incorrect rejection. c. assessing control risk too low and incorrect acceptance. d. assessing control risk too high and incorrect rejection. 12. The critical difference between statistical and nonstatistical sampling is the a. required use of judgment in nonstatistical. b. use of the laws of probability in statistical. c. elimination of nonsampling risk with statistical. d. greater competence of the evidence gathered with statistical. 13. Random selection is used in audit sampling so that a. the auditor can minimize time required for the selection process. b. larger items are more likely to be selected. c. each item has a known and equal chance of being selected. d. a representative sample is guaranteed. 14. The efficiency gained from stratification of a population is based on the fact that a. the subpopulations can be examined by different audit personnel. b. it is inherently easier to test several sets of fewer items. c. sample size and standard deviation are directly related. d. more errors are normally found in the largest and the smallest items of a population. 15. The population consists of many individual items for which no book values are known. The objective is to estimate the financial statement balance for the item in question. The only appropriate sampling plan here is a. attribute sampling. b. PPS sampling. c. ratio estimation. d. mean-per-unit estimation. e. difference estimation. 16. In moving from the traditional file method to a database method, which of the following can be eliminated? a. redundant information across applications. b. operating systems. c. application programs. d. All of the items listed here can be eliminated by adopting the database method. 17. Which of the following is not a widely used data processing method? a. batch entry/batch processing. b. batch entry/on-line processing. c. on-line entry/batch processing. d. on-line entry/on-line processing. 18. The most timely information about a certain data item is available with a. batch entry/batch processing. b. batch entry/on-line processing. c. on-line entry/batch processing. d. on-line entry/on-line processing. 19. In general, errors should be corrected by a. data conversion clerks. b. the control group. c. the internal audit department. d. the party responsible for the mistake. 20. The use of the tagging transactions audit approach is most likely in a system with a. batch entry/batch processing. b. batch entry/on-line processing. c. on-line entry/batch processing. d. on-line entry/on-line processing. 21. Which of the following methods is not a method used by an auditor to audit through a computer system? a. Test data approach. b. Integrated test facility. c. Audit hooks. d. Comparing computer generated results with data manually processed by the auditor. 22. Parallel simulation involves a. actual company data being reprocessed using an auditor-controlled software program. b. the creation of a small subsystem (a minicompany) within the regular EDP system. c. dummy transactions prepared by the auditor and processed under the auditor's control by the client's computer program. d. placing an indicator on a selected transaction so the transaction can be traced through the system as it is being processed. 23. An advantage a disk storage unit has over a magnetic tape drive system is a. a disk storage unit does not need an operating system. b. a disk storage unit offers random access to data files. c. a magnetic tape drive system can only serve as an output device. d. a magnetic tape drive system cannot operate on-line. 24. A computer program that updates the inventory master file with the inventory transaction file is an example of a(n) a. systems program. b. application program. c. utility program. d. operating system. II. Problems Answer each problem in the space provided and SHOW ALL WORK as appropriate! all monetary answers to the nearest dollar. Round 1. (6 points) Determine the sample size, upper deviation limit, and identify the controls that support the auditor's planned control risk for each of the following attributes. When determining sample size, report the actual sample size you find in the table, but when determining the upper deviation limit, round each sample size down to the nearest sample size in the table. Attribute Risk of Overreliance Expected Deviation Rate a 10% 1% b 10% c d Tolerable Deviation Rate Support Upper Planned Deviation CR? Limit (Y/N) Sample Size Number of Sample Deviations 6% ______ 2 ______ _____ 3% 9% ______ 3 ______ _____ 5% 1% 8% ______ 1 ______ _____ 5% 1.5% 6% ______ 1 ______ _____ 2. (6 points) Given the following information about the accounts receivable of Wind River Company, calculate the sample size for a probability-proportional-to-size sampling plan. Risk of Incorrect Acceptance. Clients Recorded Book Value . Number of Accounts. . . . . . Tolerable Misstatement. . . . Anticipated Misstatement. . . Population Standard Deviation . . . . . . . . . . . . 15% $2,920,000 15,700 $146,000 $7,000 $ 360 3. (14 points) As auditor for the Glacier Company, you decide to use PPS sampling in determining the fairness of accounts receivable. In executing the plan, you discover the following errors: Book Value $ 525 6,270 Audit Value $ 0 5,016 The total book value of the accounts receivable is $450,000, the risk of incorrect acceptance is 10%, the sample size is 80, and tolerable misstatement is $27,500. Required: (a) Calculate basic precision. (b) Calculate total projected misstatement. (c) Calculate incremental allowance resulting from the misstatements. (d) Do you ACCEPT or REJECT (circle one) the client's account balance. Why? 4. (9 points) for MedCo, Inc. The following information is available for the audit of inventory Client's book value . . . . . Population size . . . . . . . Risk of incorrect acceptance. Risk of incorrect rejection . Tolerable misstatement. . . . Estimated standard deviation. . . . . . . . . . . . . $95,000 1,000 20% 10% $9,000 $50 Determine the sample size for a MPU sampling plan (assume sampling without replacement). Answers I. Multiple Choice Question Number 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 Correct Answer a b b a c c b c d d c b c c d a b d d d d a b b II. Problems 1. Attribute Sample Size Upper Deviation Support Limit Planned CR? a 64 8.6 N b 58 11.7 N c 58 8.3 N d 103 4.7 Y 2. 2,920,000 x 1.9 n = -------------------------146,000 – (7,000 x 1.4) = 41 3. a. BP = RF x SI SI = N/n = 450000/80 = 5625 = 2.31 x 5625 = 12,994 b. Errors 1 2 BV $525 $6,270 AV $0 $5,016 Difference $525 $1254 Tainting 100% * SI 5625 * PE $5625 $1254 $6,879 c. Ranked PE $5625 Chg in RF - 1 0. 58 IA $3,263 d. UEL = = PE + BP + IA 12994 + 6879 + 3263 = 23,136 ACCEPT 23,136 < 27,500 4. Not covered currently in Accounting 4080