OPPENHEIMER

INTERNATIONAL GROWTH FUND

Q4 2015 COMMENTARY | AS OF 12/31/15

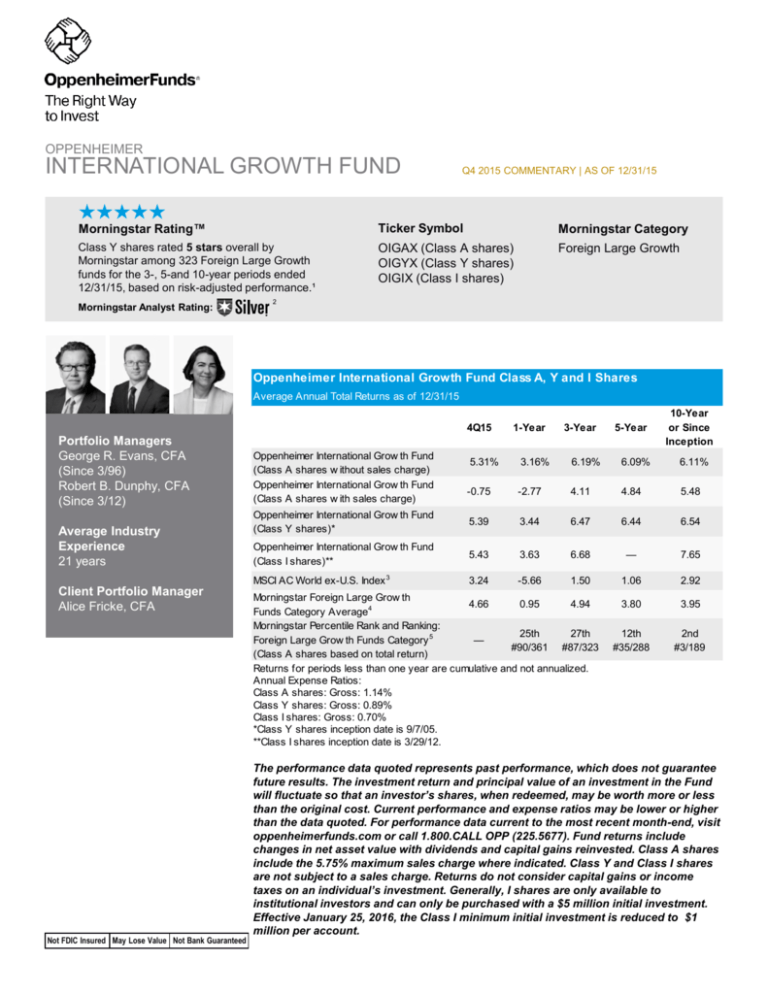

Morningstar Rating™

Ticker Symbol

Morningstar Category

Class Y shares rated 5 stars overall by

Morningstar among 323 Foreign Large Growth

funds for the 3-, 5-and 10-year periods ended

12/31/15, based on risk-adjusted performance.¹

OIGAX (Class A shares)

OIGYX (Class Y shares)

OIGIX (Class I shares)

Foreign Large Growth

Morningstar Analyst Rating:

2

Oppenheimer International Growth Fund Class A, Y and I Shares

Average Annual Total Returns as of 12/31/15

4Q15

Portfolio Managers

George R. Evans, CFA

(Since 3/96)

Robert B. Dunphy, CFA

(Since 3/12)

Average Industry

Experience

21 years

Client Portfolio Manager

Alice Fricke, CFA

Not FDIC Insured May Lose Value Not Bank Guaranteed

Oppenheimer International Grow th Fund

(Class A shares w ithout sales charge)

Oppenheimer International Grow th Fund

(Class A shares w ith sales charge)

1-Year

3-Year

5-Year

10-Year

or Since

Inception

5.31%

3.16%

6.19%

6.09%

6.11%

-0.75

-2.77

4.11

4.84

5.48

Oppenheimer International Grow th Fund

(Class Y shares)*

5.39

3.44

6.47

6.44

6.54

Oppenheimer International Grow th Fund

(Class I shares)**

5.43

3.63

6.68

—

7.65

MSCI AC World ex-U.S. Index 3

3.24

-5.66

1.50

1.06

2.92

3.80

3.95

12th

#35/288

2nd

#3/189

Morningstar Foreign Large Grow th

4.66

0.95

4.94

Funds Category Average4

Morningstar Percentile Rank and Ranking:

25th

27th

Foreign Large Grow th Funds Category 5

—

#90/361 #87/323

(Class A shares based on total return)

Returns for periods less than one year are cumulative and not annualized.

Annual Expense Ratios:

Class A shares: Gross: 1.14%

Class Y shares: Gross: 0.89%

Class I shares: Gross: 0.70%

*Class Y shares inception date is 9/7/05.

**Class I shares inception date is 3/29/12.

The performance data quoted represents past performance, which does not guarantee

future results. The investment return and principal value of an investment in the Fund

will fluctuate so that an investor’s shares, when redeemed, may be worth more or less

than the original cost. Current performance and expense ratios may be lower or higher

than the data quoted. For performance data current to the most recent month-end, visit

oppenheimerfunds.com or call 1.800.CALL OPP (225.5677). Fund returns include

changes in net asset value with dividends and capital gains reinvested. Class A shares

include the 5.75% maximum sales charge where indicated. Class Y and Class I shares

are not subject to a sales charge. Returns do not consider capital gains or income

taxes on an individual’s investment. Generally, I shares are only available to

institutional investors and can only be purchased with a $5 million initial investment.

Effective January 25, 2016, the Class I minimum initial investment is reduced to $1

million per account.

OPPENHEIMER

INTERNATIONAL GROWTH FUND

Q4 2015 COMMENTARY | AS OF 12/31/15

Information Technology sector on the back of our overweight

position within it, and in the Materials sector due to stock

selection. There were only two sectors in which the Fund

underperformed the benchmark. We underperformed in the

Consumer Discretionary sector because of our luxury stocks,

which declined on renewed concerns over China. We remain

very positive on our luxury holdings; we believe the concerns

over Chinese consumption are overblown in the longer term and

we believe that the Chinese are not the only consumers of

luxury goods. We also underperformed slightly in the Industrials

sector due to stock selection.

MARKET REVIEW

The world’s equity markets opened the fourth quarter with a

rebound from the significant correction they experienced over

the summer. But it was short lived. Investors continued to worry

about China, specifically the effect it might have on the rest of

the world as it grows more slowly and rebalances that growth

away from infrastructure and toward consumption. The Mideast

refugee crisis produced headlines, both good and bad, and

caused some investors concern about the outlook for Europe.

Finally, in December, the U.S. Federal Reserve enacted their

long-awaited rate rise, to mixed reviews. While equity markets

ended the quarter higher than they opened it, they produced

negative returns for the full year. Within this negative sentiment

environment, our Fund continued to outperform, supported by

our emphasis on secular growth trends and the overall quality of

our companies. Our car automation and data deluge themes

were particularly supportive and many of our medical product

companies performed well. Our structural underweight to

commodities helped as well. Our luxury theme was a detractor

this quarter.

With regard to countries, we remind investors that we are

bottom-up investors in companies and our geographic exposure

is purely the result of our stock selection. The Fund

outperformed the benchmark most in Switzerland, Germany and

France as our stocks outperformed others there. We

underperformed in Japan, where we are underweight, in

Thailand, due to the retailer that we own there, and very slightly

in Australia, where we are underweight.

INDIVIDUAL HOLDINGS DRIVING RESULTS

As we look ahead, we expect that the adjustments necessitated

by China’s rebalancing will continue to cause market volatility.

However we are fairly sanguine on the outlook for overall world

growth, albeit slow. In our opinion, this economic cycle is likely

to be very long, with slightly higher—but still relatively low—

interest rates and subdued inflation. In this environment,

properly managed growth companies can perform well and

support higher than average valuations. The U.S. has largely

recovered. The outlook for European companies is relatively

positive—despite the muted macroeconomy—due to their

earnings momentum, improved operating leverage, and the

liquidity the European Central Bank continues to inject into the

system. That said, we simply do not try to right-size the Fund for

any particular macroeconomic environment. Our discipline is

long-term investment in companies that can monetize secular

growth trends to create wealth for their shareholders.

The top three positive performance contributors were Infineon

Technologies AG, Temenos Group AG and Syngenta AG.

Infineon Technologies AG is a German semiconductor

manufacturer whose chips are widely used in three main

areas: power management and control, automobiles, and

chip cards and security. In our opinion, these areas will drive

secular demand for chips for some time, and Infineon is one

of the best placed companies to benefit from this growth in

demand and pricing power. During the quarter, the stock

price rose when the company announced earnings that were

ahead of analyst expectations.

Temenos Group AG is a Swiss company that is the only

provider of software dedicated to banking. The banking

industry is one of the largest spenders on technology. This is

not surprising given the complex regulatory environment in

which they operate and the constant demand from their

clients for new, technologically advanced products. (Think of

depositing bank checks through your mobile phone as just

one example.) In the past, most banks have developed

proprietary technology in house. However, this is becoming

prohibitively expensive. This year Nordea, one of the largest

Scandinavian banks, selected Temenos to replace its core

banking system software. In our opinion, if Temenos

executes this contract successfully, it will significantly

increase its addressable market.

As we have often said before, volatility is our friend. We

understand that it is uncomfortable for investors so we dampen

it in the Fund by investing in a large number of companies in

relatively equal amounts. But down markets give us the

opportunity to buy stocks at prices that we could not get when

sentiment is optimistic. As the market has pulled back, we have

bought more shares in companies we already own and taken

the opportunity to acquire some new ones that we have coveted

for some time.

PERFORMANCE REVIEW

Syngenta AG is a Swiss producer of crop protection

chemicals and seeds. The share price has been relatively

volatile this year because the company is seen as a potential

target in a sector that is beginning to consolidate. In our

opinion, Syngenta’s crop protection business is very

attractive due to the demographic trends that we expect to

support demand over the long term and in terms of its

pipeline and the geographical areas in which it is dominant.

Furthermore, there is room for better management and

restructuring within the company that could raise its value.

Oppenheimer International Growth Fund (Class A shares

without sales charge) outperformed its benchmark MSCI AC

World ex-U.S. Index significantly in the fourth quarter, rising

5.31% versus the 3.24% rise in the benchmark. For the full year,

the Fund (Class A shares without sales charge) returned 3.16%,

outperforming the benchmark, which declined 5.66%, by over

800 basis points.

SECTOR AND COUNTRY ANALYSIS

During the quarter, the Fund outperformed the benchmark most

in the Health Care sector due to stock selection, in the

2

OPPENHEIMER

INTERNATIONAL GROWTH FUND

Q4 2015 COMMENTARY | AS OF 12/31/15

INDIVIDUAL HOLDINGS DRIVING RESULTS (CONT.)

The bottom three performance contributors were Dollarama,

Inc., Hudson’s Bay Co. and CP All Public Co. Ltd.

Dollarama, Inc. is a Canadian discount retailer that is much

like Dollar Tree and Dollar General in the U.S. The economy

in Canada is suffering with the fall in oil prices and Dollarama

is benefitting as shoppers migrate down the affordability

scale. (We saw the same effect in the U.S. during the

financial crisis, when companies like Walmart and

McDonald’s gained share.) After reaching record highs, the

stock suffered a pullback in the quarter when the company

announced expansion plans that were below analysts’

heightened expectations. We remain positive on the outlook

for the company’s growth.

Hudson’s Bay Co. is a Canadian retailer whose portfolio

includes its namesake chain in Canada, Saks Fifth Avenue

and Lord & Taylor in the U.S., and Galeria Kaufhof, a highend German retailer that it recently acquired. In most cases,

Hudson’s Bay also owns the buildings in which its stores

operate, and the land upon which they stand. The company

is monetizing these real estate assets to cover the cost of

upgrading and expanding its operations. Its goal is to widen

margins by increasing sales per square foot, and by taking

better advantage of scale. To accomplish this, the company

is renovating its 10 largest stores by sales volume for each

retail chain and investing in digital infrastructure across its

entire fleet of stores. After reaching record highs, the stock

pulled back significantly when the company announced

disappointing earnings for the third quarter when it, and many

other retailers, such as Nordstrom’s suffered from weak

demand.

CP All Public Co. Ltd. is the exclusive operator of more than

8,500 7-Eleven stores in Thailand. It has more than a 50%

share of the convenience store format there and is expanding

into what is still a relatively fragmented informal retail market

by adding roughly 700 more outlets annually. The company

also owns the Costco-style Siam Makro chain, which has 92

outlets, averaging 30,000 square feet each, and produces an

exceptionally high 30% return on capital employed. After

reaching record highs, the stock pulled back during the

quarter. In our opinion, over the longer term CP All’s modern

retail formats will continue to draw customers away from

more informal competitors.

SPECIAL RISKS

Foreign investments may be volatile and involve additional

expenses and special risks, including currency fluctuations,

foreign taxes, regulatory and geopolitical risks. Emerging and

developing market investments may be especially volatile.

Eurozone investments may be subject to volatility and liquidity

issues. Investments in securities of growth companies may be

volatile. Mid-sized company stock is typically more volatile than

that of larger company stock. It may take a substantial period of

time to realize a gain on an investment in a mid-sized company,

if any gain is realized at all. Diversification does not guarantee

profit or protect against loss.

3

OPPENHEIMER

INTERNATIONAL GROWTH FUND

Q4 2015 COMMENTARY | AS OF 12/31/15

Top Ten Holdings by Issuer6

Top & Bottom Contributors to Return 6

4th Quarter 2015 (as of 12/31/15)

4th Quarter 2015 (as of 12/31/15)

Top Five

Continental AG

1.78%

Infineon Technologies AG

1.73

Infineon Technologies AG

0.41%

Dollarama, Inc.

1.59

Temenos Group AG

0.25

Novo Nordisk AS

1.59

Syngenta AG

0.25

Nippon Telegraph & Telephone

1.59

Continental AG

0.24

Carnival Corp.

1.51

HOYA CORPORATION

0.23

Valeo SA

1.49

Aalberts Industries NV

1.38

Dollarama, Inc.

-0.26%

Vodafone Group plc

1.37

Hudson's Bay Co.

-0.23

Heineken NV

1.35

CP All Public Co. Ltd.

-0.17

Total

15.38

Burberry Group plc

-0.16

Rolls-Royce Holdings plc

-0.15

Bottom Five

Sector Attribution Analysis6

4th Quarter 2015 (as of 12/31/15)

International Grow th Fund

Health Care

Information Technology

Materials

Telecommunication Services

Energy

Financials

Utilities

Consumer Staples

Industrials

Consumer Discretionary

Other

Cash

Total

Average

Weight

11.81%

15.68

5.06

6.03

1.25

4.07

0.00

10.88

20.41

23.21

0.00

1.60

100.00

Return

11.67%

9.65

11.59

10.94

6.79

3.49

0.00

3.64

2.80

1.53

0.00

0.03

5.67

MSCI AC World ex-U.S. Index

Contribution Average

to Return

Weight

1.27%

9.29%

1.42

7.78

0.56

6.64

0.63

5.19

0.09

6.37

0.16

27.18

0.00

3.49

0.45

10.77

0.60

11.21

0.49

12.07

0.00

0.01

0.00

0.00

5.67

100.00

Return

3.14%

8.19

0.34

2.30

-0.50

2.46

1.37

3.66

4.50

4.45

-0.08

0.00

3.17

Contribution

to Return

0.30%

0.55

0.05

0.12

0.03

0.69

0.05

0.38

0.49

0.51

0.00

0.00

3.17

Attribution Analysis

Sector

Allocation

0.06%

0.38

0.05

0.00

0.16

0.16

0.07

0.01

0.12

0.15

0.01

-0.02

1.15

Stock

Selection

0.91%

0.22

0.54

0.50

0.08

0.04

0.00

0.03

-0.33

-0.65

0.00

0.00

1.35

Total

Effect

0.98%

0.60

0.59

0.50

0.25

0.21

0.07

0.04

-0.21

-0.51

0.01

-0.02

2.50

The mention of specific sectors is subject to change and does not constitute a recommendation on behalf of the Fund or OppenheimerFunds, Inc.

Attribution m ethodology notes: The attribution provides analysis of the effects of several portfolio management decisions, including allocation

and security selection. Securities classified as "Other" may include non-equity securities, derivatives and securities for w hich a sector classification

may not be appropriate. The Fund is actively managed and portfolio holdings are subject to change in accordance w ith the prospectus. The

percentage w eights represented for the Fund are dollar w eighted based on market value. Performance numbers include all share classes and may

not tie to actual Fund returns. Contribution to Return measures the performance impact from portfolio holdings over a defined time period. It takes into

account both w eight and performance of the portfolio holdings. Contribution to Return is calculated at security level and reported at sector/strategy

level. Past perform ance does not guarantee future results.

4

OPPENHEIMER

INTERNATIONAL GROWTH FUND

Q4 2015 COMMENTARY | AS OF 12/31/15

DISCLOSURES

Past performance does not guarantee future results.

1. For each fund with at least a three-year history, Morningstar calculates ratings based on a proprietary risk-adjusted return score that

accounts for variation in a fund’s monthly performance (including the effects of sales charges, loads and redemption fees), placing more

emphasis on downward variations and rewarding consistency. The top 10% of funds in each category receive 5 stars, the next 22.5% 4

stars, the next 35% 3 stars, the next 22.5% 2 stars and the bottom 10% 1 star with some adjustments for multiple share class portfolios.

The Overall Morningstar Rating is derived from a weighted average of the 3- , 5- and 10-year ratings (where applicable). For the

3-, 5- and 10-year periods, respectively, the Fund was rated 4, 5 and 5 stars among 323, 288 and 189 funds in the Foreign Large Growth

category for the time period ended 12/31/15. Morningstar rating is for Class Y shares and rating may include more than one share class

of funds in the category, including other share classes of this Fund. Different share classes may have different expenses, eligibility

requirements, performance characteristics and Morningstar ratings.

2. The Morningstar Analyst Rating is not a credit or risk rating but a subjective evaluation performed by the analysts of Morningstar, Inc.

(Mstar). Mstar evaluates funds based on five key pillars (process, performance, people, parent and price). Mstar's analysts use this

evaluation to identify funds they believe are more likely to outperform over the long term on a risk-adjusted basis. Analysts consider

quantitative and qualitative factors and the weightings of each pillar may vary. The Analyst Rating reflects overall assessment and is

overseen by Morningstar's Analyst Rating Committee. The analyst rating scale is five-tiered, with three positive ratings (Gold, Silver,

Bronze), a Neutral rating and a Negative rating, with Gold being the highest rating and Negative being the lowest rating. The Mstar

Analyst Ratings should not be used as the sole basis in evaluating a mutual fund and are based on Mstar’s current

expectations about future events. Mstar does not represent ratings as a guarantee. Analyst Ratings involve unknown risks

and uncertainties which may cause Mstar’s expectations not to occur or to differ significantly.

3. The MSCI AC World ex-U.S. Index is designed to measure the equity market performance of developed and emerging markets and

excludes the U.S. The index is unmanaged and cannot be purchased directly by investors. Index performance is shown for illustrative

purposes only and does not predict or depict the performance of the Fund.

4. Source: Morningstar, Inc., 12/31/15. The Morningstar Foreign Large Growth Funds Category Average is the average return of all funds

within the investment category as defined by Morningstar. Returns are adjusted for the reinvestment of capital gains distributions and

income dividends, without considering sales charges. Performance is shown for illustrative purposes only and does not predict or depict

the performance of the fund.

5. Source: ©2015 Morningstar, Inc., 12/31/15. Morningstar ranking is for Class A shares and ranking may include more than one share

class of funds in the category, including other share classes of this Fund. Ranking is based on total return as of 12/31/15, without

considering sales charges. Different share classes may have different expenses and performance characteristics. Fund rankings are

subject to change monthly. The fund’s total-return percentile rank is relative to all funds that are in the Foreign Large Growth Funds

Category. The highest (or most favorable) percentile rank is 1 and the lowest (or least favorable) percentile rank is 100. The top

performing fund in a category will always receive a rank of 1.

6. Holdings, sector and country allocations are subject to change, do not constitute recommendations by OppenheimerFunds, and are

dollar-weighted based on assets. Top holdings excludes cash and cash equivalents. Attribution analysis is a process used to analyze the

absolute return (often called contribution) and the excess return (often called relative return) between a portfolio and its benchmark. The

total effect measures both the allocation effect to a sector as well as stock selection within a sector. Holdings are subject to change, and

are dollar weighted based on total net assets. Negative weightings may result from the use of leverage. Leverage involves the use of

various financial instruments or borrowed capital in an attempt to increase investment return. Leverage risks include potential for higher

volatility, greater decline of the fund’s net asset value and fluctuations of dividends and distributions paid by the fund.

Shares of Oppenheimer funds are not deposits or obligations of any bank, are not guaranteed by any bank, are not insured by the

FDIC or any other agency, and involve investment risks, including the possible loss of the principal amount invested.

These views represent the opinions of OppenheimerFunds, Inc. and are not intended as investment advice or to predict or depict the

performance of any investment. These views are as of the close of business on December 31, 2015, and are subject to change based on

subsequent developments. The Fund’s portfolio and strategies are subject to change.

Total returns do not show the effects of income taxes on an individual’s investment. Taxes may reduce an investor’s actual investment

returns on income or gains paid by the Fund or any gains realized if the investor sells his/her shares.

Before investing in any of the Oppenheimer funds, investors should carefully consider a fund’s investment objectives, risks,

charges, and expenses. Fund prospectuses and summary prospectuses contain this and other information about the funds,

and may be obtained by asking your financial advisor, visiting oppenheimerfunds.com, or calling 1.800.CALL OPP (225.5677).

Read prospectuses and summary prospectuses carefully before investing.

Oppenheimer funds are distributed by OppenheimerFunds Distributor, Inc.

225 Liberty Street, New York, NY 10281-1008

© 2016 OppenheimerFunds Distributor, Inc. All rights reserved.

CO0825.001.1215 January 15, 2016

5