this article - Legal Practitioners' Liability Committee

advertisement

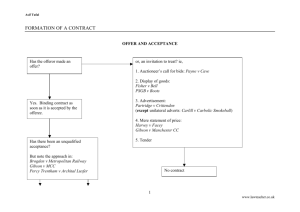

LPLC lplccolumn@liv.asn.au POst it NOt Good office procedures can help you avoid some costly mistakes this festive season. D elays in sending letters by post are common during the festive season. You can find details of delays to the delivery of post on the Australia Post website (www.auspost.com.au). Sometimes delays are due to specific events such as a contractor truck accident. Other delays are due to inclement weather and sheer volume of mail. Practitioners need to take into account possible delays in the delivery of the post and be mindful of the prospect of an item going missing in the post. Knowing about these delays can help you avoid missing deadlines. Service by post There are many reasons a letter or document is sent by post. This method of service may be prescribed. Numerous statutes deal with service by post including: • Corporations Act 2001 (Cth), s109X; • Interpretation of Legislation Act 1984 (Vic), s49; and • Criminal Procedure Act 2009 (Vic), s17. A contract may specify service by post and the date by which a notice must be received by the recipient and/or specify when a notice sent by post is deemed to be received, usually between one and two business days after posting. General condition 17.1 of the Contract of Sale of Real Estate, as prescribed by the Estate Agents (Contracts) Regulations 2008 (Vic), provides that a document sent by post is deemed to be served the next day after posting unless proved otherwise. By comparison, the LIV Lease of Real Estate (copyright form November 2012 revision) specifies in clause 14.2 that: “Posted notices will be taken to have been received 72 hours after posting unless proved otherwise”. The postal rule and acceptance of an offer Sometimes a contract is silent as to the method of service when communicating acceptance of an offer. In such circumstances, the postal rule, as set down in the case of Henthorn v Fraser 1892 2 Ch. 27 may apply. To quote Lord Herschell in Henthorn’s case: “Where the circumstances are such that it must have been within the contemplation of the parties that, according to ordinary usage of mankind, the post must be used as a means of communicating the acceptance of an offer, the acceptance is complete as soon as it is posted”. This rule was considered more recently in the case of Ronay Investments Pty Ltd v Pinnacle VRB Ltd (2000) 35 ACSR 247. In this case, acceptance of an issue of shares had to be received by 5pm, 6 December 1999. Ronay posted its acceptance by express post on 3 December. Ronay successfully argued that it was entitled to the shares based on the postal rule even though Pinnacle did not receive the notice of acceptance until 7 December. Lessons One lesson for practitioners is to choose the appropriate method of service given the time available. Where a contract specifies the method of service and this method cannot be complied with, the practitioner should seek consent to serve by other means. In some situations it may be necessary to seek an order of the court allowing service by another means. It also pays to check the relevant court rules about service and the time fixed for service. For example, the Supreme Court Rules provide that in calculating the time fixed by the Rules, the period from 24 December to 9 January shall be excluded. See Rule 3.04. In some instances it may be appropriate for practitioners to place the letter in the envelope and personally post it or place it in the DX where an affidavit of service is required. This festive season keep in mind that there may be delays in delivery of the post. Making sure a deadline is met may mean sending a document by courier rather than by post. l This column is provided by the legal PraCtitiONers’ liability COmmittee. For further information ph 9672 3800 or visit www.lplc.com.au. AustrAliAn unity Enjoy peace of mind and a generous discount with quality health cover from Australian Unity. Join or switch to Australian Unity and you’ll receive a 7.5% discount* off your health cover when you pay by direct debit. Visit www.australianunity.com.au/liv/ or call 13 29 39 8.30am to 8.30pm Est Monday to saturday *Conditions apply. Terms and Conditions The LIV receives revenue on member generated activity through this member benefits program. The revenue is applied to maintain the quality and diversity of LIV services, further benefiting you professionally, personally and in your career and business. All costs incurred in marketing specific LIV programs are borne by the member benefit partner. l i j d e c e m b e r 2 0 1 3 79