Your Guide to Benefits Enrollment

advertisement

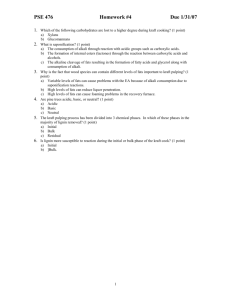

THE BENEFITS OF KRAFT Your Guide to Benefits Enrollment Newly Eligible Employees Salaried and Non-Union Hourly 2015 Important Notices and Disclosures Kraft is required to provide you with information to help you understand what benefits and coverage options are available to you and your family so you can make informed benefit choices. In addition to the information in this guide, you should also review the following annual notices. These notices can be found online on MyBenefits Online (go to MyHR Online at https://myhronline.kraftfoods.com and click on Benefits) or go directly to MyBenefitsOnline.Kraft.com. A hard copy can be obtained by calling the Kraft Foods Benefits Center at 1-800-321-7960. • Summary of Benefits and Coverage (SBC) & Uniform Glossary • HIPAA Notice of Privacy Practices • HIPAA Notice of Special Enrollment Rights • Medicaid and the Children’s Health Insurance Program (CHIP) Notice • Newborns’ and Mothers’ Health Protection Act • Notice of Coverage Options (Exchange Notice) • Notice of Creditable Coverage • Women’s Health and Cancer Rights Act In June 2013, the U.S. Supreme Court overturned a key provision of the Federal Defense of Marriage Act (DOMA) of 1996, which defined a spouse as a member of the opposite sex. In turn, the IRS ruled that for all federal tax purposes, a marriage (whether same-sex or oppositesex) is recognized if it is determined legal within the state it occurred, regardless of where the couple resides. This ruling may affect your marital status and beneficiary designations on file at Kraft. It is important for Kraft to know if you are married for payroll, employment and benefit plan purposes. To update your information, go to MyHR Online and click on Personal Information under Life & Career. In addition, effective June 26, 2013, same sex spouses were recognized as spouses for all purposes under Kraft’s retirement and health and welfare plans. If you participate in a Kraft pension plan, your spouse will have certain rights and benefits on your death under the pension plan, including the right to a survivor annuity. Also, at the time you elect to begin distribution of your benefits, any designation of a non-spouse beneficiary under the plan will be void unless you obtain the consent of your spouse for such designation. Important Note: Your Guide to Benefits Enrollment is intended to provide basic plan information — not all the details. For more detailed benefits information, please refer to the appropriate Summary Plan Descriptions. Every attempt was made to make this communication as accurate as possible. However, if a discrepancy exists between this communication and the official plan documents, the plan documents will govern. Benefits to support a healthy workforce Welcome to Kraft! Contents Your health ... both physical and financial ... is important to Kraft, and the benefits we provide are designed to help you achieve and maintain a healthy lifestyle. Learn About Kraft’s Benefits Steps to Enroll What Happens if You Don’t Enroll Benefit Programs 2 3 3 4 In turn, we need you to keep benefits on your radar throughout the year … make informed choices to support good health — both physical and financial. The company is here to help you, and offers you and your family tools and resources to make good decisions … and financial incentives when you do. Supporting You Physically • Health Care Benefits • Resources for Managing Health • Aetna One • Healthy Living Rewards 4 8 9 10 As a newly eligible employee, this is an ideal time to learn about all the benefits available to you — so you can use them to your full advantage. Supporting You Financially • Life & Disability Benefits 11 • 401(k) Savings Plan and Financial Planning 13 Supporting You Personally • Optional Protection Programs • Additional Benefits 14 15 Visit BenefitsOfKraft.com for more info, tools and resources 1 Benefit programs provided by Kraft Learn about Kraft’s benefit programs 1 2 Read this booklet for highlights of Kraft’s benefit plans and programs, what to consider when making enrollment decisions, and how to get the most out of your benefits. Go to BenefitsOfKraft.com for more info, tools and resources. The site is frequently updated and you’ll find useful links, videos and much more! And it’s mobile. Scan the QR code below to add BenefitsOfKraft.com to the home screen of your mobile device or to bookmark the site. Who’s eligible for Kraft benefits? • Salaried and non-union hourly employees eligible to participate in most benefits on eligibility date. Eligibility for specific plans or for part-time and hourly employees may vary. • Your eligible dependents, who generally include: — Your spouse or domestic partner — Your children under age 26 You may also cover one eligible unmarried, dependent adult child, age 26 or older, but not if you cover a domestic partner. 3 2 Enroll. You can do this online or by phone; see page 3. When you see this symbol : enrollment decision required Steps to enroll $ : earn Healthy Living Rewards : where to get more info What Happens if You Don’t Enroll 1 Learn about your benefits. You will make enrollment selections for these benefits: 2 Enroll online or by phone. You must enroll within 45 days of your eligibility date. • Medical, including prescription drug coverage • Health Savings Account (HSA) •Dental •Vision • Health Care Flexible Spending Account (FSA)* • Dependent Day Care FSA • Long-Term Disability (LTD) •Optional Protection Programs •Supplemental Life Insurance •Accidental Death and Dismemberment (AD&D) Enroll online 24/7 •Go to MyHR Online at https://myhronline.kraftfoods.com. MyHR Online is available anywhere you have Internet access. • You will be prompted for your user name (LAN ID) and password. •Once you enter MyHR Online, go to Quick Links on the left and click on Benefits. You will be asked again for your user name (LAN ID) and password to access the benefits site. Enroll by phone or get help enrolling •Call the Kraft Foods Benefits Center at 1-800-321-7960. Representatives are available Monday through Friday, 7 a.m. through 7 p.m. (Central time), excluding holidays. You will need your employee identification (ID) number. Enter your 8-digit employee ID, including the leading zeros. For example, if your employee ID is 12345, please enter 00012345. • 3 4 Sign up your dependents and name beneficiaries for your benefits. You must include a Social Security number and birthdate. Check your confirmation statement. After you review and submit your benefit elections, you can print a copy for your reference. If you need assistance, call the Kraft Foods Benefits Center. * Only available if you are enrolled in the Kraft Foods Medical Plan and are not eligible for an HSA, or if you waive medical coverage for 2015. If you do not to enroll within 45 days of your eligibility date, you will not have coverage in 2015 for: Medical Dental Vision Health Savings Account (HSA) NOTE: If you enroll in the Medical Plan you can enroll or change your HSA contributions at any time throughout the year. (If you enroll for medical coverage but don’t choose an HSA contribution, you won’t receive Kraft’s Matching Contribution to your HSA unless you begin contributing later in the year.) Flexible Spending Accounts for Health Care and Dependent Day Care Supplemental Life Insurance Accidental Death & Dismemberment (AD&D) Long-Term Disability (LTD) Group Legal Plan • • • • • • • • • The only other time to make changes to your benefits is if you have an IRS-defined qualified life event during the year. For Optional Protection Programs, you can enroll in or drop coverage for the following programs any time throughout the year: Auto and Homeowners Insurance Group Long-Term Care (LTC) Insurance (Evidence of insurability is required after the initial eligibility period.) • • Go to BenefitsOfKraft.com for details about qualified life events. 3 Benefit programs provided by Kraft Supporting you physically … HEALTH CARE BENEFITS Kraft Foods Medical Plan (with a Health Savings Account) The Kraft Foods Medical Plan is a comprehensive, high deductible health plan that includes a Health Savings Account (HSA), prescription drug coverage, and access to a national network of Aetna providers. • To see if your doctor is in Aetna’s network, go to Aetnanavigator.com and select Find a Doctor, Dentist or Facility; For more info: www.AetnaNavigator.com 1-888-598-1577 BenefitsOfKraft.com select the Provider Type; or call Aetna at 1-888-598-1577. • Preventive care 100% covered (subject to limitations). • You must meet an annual deductible (combined for medical and prescription drugs) before the plan begins to pay: I n-Network Annual Deductible —$1,500 Employee Only coverage —$3,000 all other coverage levels ut-of-Network Annual Deductible O —$3,000 Employee Only coverage —$6,000 all other coverage levels • After you meet the deductible, you pay co-insurance of 20% for in-network care and 40% for out-of-network care. • In-network out-of-pocket maximum is $3,400 for Employee Only coverage and $6,800 for all other coverage levels. After you meet the out-of-pocket maximum, the plan pays 100% of covered charges and services for the rest of the plan year. • Local plans are available in Hawaii. 4 Remember: You can use your HSA to help pay for these out-of-pocket costs. See page 6 for more info. HEALTH CARE BENEFITS Prescription Drug Coverage The Prescription Drug Plan provides automatic coverage through Aetna if you are enrolled in the Kraft Foods Medical Plan. • Coverage includes retail pharmacies (up to 30-day supply) and a mail-order prescription service (90-day supply). • Your co-payment/co-insurance amount depends on if you use generic, preferred brand name or non-preferred brand name drugs. • Your deductible needs to be met before prescription drug co-payments/co-insurance goes into effect. (Costs for drug types For more info: www.AetnaNavigator.com 1-888-598-1577 BenefitsOfKraft.com can be found on BenefitsOfKraft.com. Select Health and Wellbeing, select Prescription Drug Coverage, select Prescription Drug Plan At a Glance.) Note: If you enroll in Health Plan Hawaii, your prescription drug coverage will be provided through that plan. What You’ll Pay for Medical Coverage You and Kraft share the cost, and Kraft pays most of it. Our goal is to keep medical coverage affordable and accessible for all employees. How much you pay depends on: • How many family members you cover • Your base pay as of your eligibility date You will pay more if you have a Medical Plan Spousal Surcharge (see below). Medical Plan Spousal Surcharge: If you cover your spouse or domestic partner and he/she has waived coverage through an employer-sponsored plan, $125/month will be added to your Medical Plan premium. 5 Benefit programs provided by Kraft HEALTH CARE BENEFITS Health Savings Account (HSA) Administered by Payflex, part of Aetna • If enrolled in the Kraft Medical Plan, you are eligible* to contribute tax-free dollars to a Health Savings Account to pay current and future health care expenses. You can use this account to pay your out-of-pocket expenses, such as your annual deductible, co-insurance, prescription drug, dental, orthodontia and vision expenses. • Contribute as much as you can to your Health Savings Account. Kraft will match your contribution $1-for-$1 up to $250 for Employee Only coverage and up to $500 for all other coverage levels. You can change your contribution amount anytime. • The maximum IRS contribution in 2015 is $3,350 for Employee Only coverage and $6,650 for all other coverage levels, including any contribution made by Kraft. • You don’t lose money you put into your HSA. It rolls over to the next year, helping you build savings for future health care expenses. You take it with you in retirement or if you leave Kraft. • Once you have a balance of $1,000 in your HSA, you can open an investment account. You can invest any amount over the For more info: www.AetnaNavigator.com 1-888-598-1577 BenefitsOfKraft.com PayFlex: 1-888-678-8242 TIP: Participate in Kraft Healthy Living Rewards and earn up to an additional $1,000 in your Health Savings Account, see page 10. $1,000 balance and the earnings are also tax free, as long as they are used for health care expenses. • You don’t pay taxes on withdrawals from your account, as long as you use the money for eligible health care expenses. And the money you contribute is tax-free, which lowers your taxable income. Who Is Eligible to Contribute to an HSA? 1. You must be enrolled in a high deductible health plan like the Kraft Foods Medical Plan. 2. You can’t have other health coverage — including under another employer’s plan, or a government plan such as Medicare or TriCare — unless the other coverage also qualifies as “high deductible health plan” coverage as defined by the IRS. Disability, long-term care, dental care and vision care are not considered to be other health plan coverage for this purpose. 3. You or your spouse cannot be covered under a Health Care Flexible Spending Account — even if your spouse elects it under his or her employer’s plan and even if you don’t claim any reimbursements for services or supplies you obtain. 4. You cannot be claimed as a dependent on someone else’s tax return. (Filing a joint return with your spouse does not constitute being claimed as a dependent.) IMPORTANT: You are solely responsible for determining whether you are eligible to maintain an HSA in accordance with the applicable Internal Revenue Service rules. See your Medical Plan Summary Plan Description for more information; go to MyHR Online, click Benefits to access MyBenefits Online. *Certain exclusions apply; see BenefitsOfKraft.com for details. 6 HEALTH CARE BENEFITS Dental Plan The in-network Dental Plan has two options. Both cover preventive care at 100% and are administered by Aetna: • Dental Plan $50 Deductible — does not cover orthodontia or Temporomandibular Joint (TMJ) syndrome. The annual maximum benefit is $1,000. For more info: www.AetnaNavigator.com 1-888-598-1577 BenefitsOfKraft.com • Dental Plan No Deductible — includes $2,000 lifetime orthodontia coverage and $1,200 TMJ coverage. The annual maximum benefit is $3,000. Vision Plan • Routine annual eye exam • One pair of eyeglass lenses or contact lenses each calendar year • Eyeglass or sunglass frames every two years • Prescription sunglasses Health Care Flexible Spending Account (FSA) Administered by PayFlex, part of Aetna With the Health Care Flexible Spending Account, you can take advantage of before-tax savings for certain health care expenses for you and your eligible dependents if: • You are not eligible for the HSA, or • You waive medical coverage. For more info: www.AetnaNavigator.com 1-888-598-1577 BenefitsOfKraft.com For more info: www.AetnaNavigator.com 1-888-598-1577 BenefitsOfKraft.com PayFlex: 1-888-678-8242 You can make before-tax contributions up to $2,500 per year to pay for eligible, out-of-pocket health care expenses. • • If you are enrolled in the Kraft Foods Medical Plan and participate in the Health Care FSA, Kraft will match your before-tax contribution to the Health Care FSA $1-for-$1 up to $250 for Employee Only coverage and up to $500 for all other coverage levels. (You will not receive the Kraft Matching Contribution unless you contribute your own before-tax dollars.) Your $2,500 contribution limit does not include the Kraft Matching Contribution. ligible expenses include medical, prescription drug, dental, orthodontia and vision expenses, as well as deductibles, E co-insurance and co-pays. TIP: Make sure you plan your contribution carefully so you don’t forfeit any unused money. • If you do not spend the dollars you have set aside during the calendar year on eligible health care expenses, you will forfeit the money, due to the IRS “use it or lose it” rule. Note: If you are enrolled in the Kraft Foods Medical Plan and you are eligible to maintain a Health Savings Account, you cannot participate in the Health Care FSA election for the same period in the same year. 7 Benefit programs provided by Kraft RESOURCES FOR MANAGING HEALTH Castlight Health Castlight Health is a cost comparison tool to help you find the best quality and value in doctors, hospitals, procedures and drugs. • Provides quality reviews for doctors and hospitals. • Shop smart and earn money in your paycheck by selecting high quality, low cost “blue tag” providers. (see right) • Earn 2015 Healthy Living Rewards for your Health Savings Account when you register. CASTLIGHT SHARED SAVINGS Smart Shopping If you or your spouse/domestic partner choose to see a provider with a blue tag, you are selecting a lower-cost provider. As a result, Kraft will put money in your HSA. (This does not apply to the $1,000 Healthy Living Rewards limit.) Labs: $25 X-rays: $25 Mammograms: $50 CT scans: $100 Colonoscopies: $100 MRI: $100 • • • Teladoc is quality medical care that is just a phone call away. • 24/7 access to U.S. board-certified doctors for non-emergency, common health conditions such as allergies, urinary tract infection, sinus problems, ear infections, pink eye and more. • Confidential phone or video consultations and prescriptions, if needed. • $40 or less per consultation; applies to Medical Plan deductible, coinsurance and out-of-pocket maximum. • Prior to using Teladoc, you need to set up an account and complete a medical history for you and your covered dependents. • Earn 2015 Healthy Living Rewards for your Health Savings Account when you register for the first time. Sonic Boom Wellness Have fun, get fit, earn Health Living Rewards. • Earn up to $400 in Kraft Healthy Living Rewards for participating in the Sonic Boom Wellness fitness challenges. • Keep track of your Healthy Living Rewards activities. • Quarterly fitness challenges. • Online fitness and nutrition tracker and more. Healthy Lifestyle Coaching • FREE confidential wellness coaching — work with a trained coach who understands your needs and can work through your challenges in making healthy changes. • Get help and support to lose weight, manage stress or meet another health goal. • Do it when and where it works for you. • Earn 2015 Healthy Living Rewards for your Health Savings Account for setting and reaching a personalized health goal. 8 $ • Teladoc No cost for your own personal wellness coach; includes tobacco cessation. For more info: mycastlight.com/kraftfoods 1-888-272-9692 BenefitsOfKraft.com For more info: teladoc.com/aetna 1-855-TELADOC 1-855-835-2362 For more info: kraft.app.sbwell.com 1-877-766-4208 For more info: www.AetnaNavigator.com 1-888-598-1577 $ $ $ Refer to the chart on page 10 for a complete list of Healthy Living Rewards. AETNA ONE* Aetna One is an additional resource that simplifies and enhances how you manage your health and health care. Health Concierge • Call the Health Concierge to get direct, confidential assistance in managing your care. They’ll help you coordinate support and educational services, navigate claims and benefit questions through the health care delivery system and understand your benefit coverage. Aetna Health Assessment • Questionnaire that can help identify your health needs and provides a report to share with your doctor. It’s confidential, secure and free. In Touch Care • When you’re facing a chronic or acute health challenge, In Touch Care decisions. Call day or night with whatever health care question you have. These confidential nurses can help you decide if it’s an emergency, what preventive care you should get and self-care skills and advice for chronic conditions and complex medical situations. Personal Health Record • With an easy-to-use online tool, you can: - View information about your own health history, such as claims information, laboratory results or medication you’re taking. - Add and access information about a specific disease or condition. - Share your personal medical information with your family or provider. $ provides powerful resources and support to adapt to your needs, your pace and your life. In less severe situations, In Touch Care provides support with dynamic virtual care. Virtual care provides convenient, personalized online tools designed to help you adopt new lifestyle behaviors. Beginning Right Maternity Program • Provides services, information and resources to help improve pregnancy $ outcomes. The program includes educational materials, early risk identification for women at high risk for pre-term labor and delivery, and care coordination by trained obstetrical nurses. Informed Health® Line • Registered nurses are available 24/7 to help you make informed health care For more info: www.AetnaNavigator.com 1-888-598-1577 Aetna Resources For Living Provides 24/7 confidential counseling services for a variety of professional and personal issues — up to five free Employee Assistance Program (EAP) counseling visits per year. • • Provides resources and referrals for such things as elder and child care, legal assistance, financial services and convenience services. • P rovides free concierge services, including hands-on help with scheduling appointments, locating appropriate services and making reservations for a range of everyday activities and specialty requests. There is no service fee and no limit on the number of times you can use this service. * Does not apply to employees in Hawaii. Programs including Personal Health Record, Healthy Lifestyle Coaching, In Touch Care and Beginning Right Maternity are only available to employees enrolled in the Kraft Foods Medical Plan. 9 Benefit programs provided by Kraft $ HEALTHY LIVING REWARDS Participate in these programs — Earn up to $1,000 in your HSA1 Program Employee Rewards Biometric Screening Measures2 Glucose Triglycerides HDL cholesterol Blood pressure Waist circumference • $300 for 3 or 4 of the 5 • • • • • Cotinine (tobacco)2 Indicates presence of nicotine in your blood Healthy Lifestyle Coaching or In Touch Care Reviewing Biometric Screening results (for those who don’t receive any Healthy Living Rewards for their biometrics) Setting and reaching a goal results in the healthy range • An additional $200 if all 5 results are in the healthy range • $100 • $200 Sonic Boom Wellness Quarterly activity challenge Up to $400 Beginning Right Maternity3 $100 Register for Teladoc New registration $50 Castlight Health Awareness New registration and exploration $50 If you are not eligible to maintain an HSA or if the reward would cause you to exceed the annual HSA maximum, the reward will be paid in your paycheck, subject to applicable withholding. If you are hired January 1, 2015 or later, you will automatically pay the Participating Premium through December 31, 2015. You are not required to get the Biometric Screening or complete the Aetna Health Assessment. However, if you are hired before February 28, 2015, you may register to take a Biometric Screening at an onsite event or at a Quest Diagnostics Patient Service Center. If you do, you are eligible to receive Healthy Living Rewards for the Biometric Screening. You and your spouse/domestic partner may complete the Aetna Health Assessment by February 28, 2015. 3 10 Your spouse/domestic partner is eligible for Beginning Right Maternity. Making an effort to be healthy pays off — literally! If you participate in Kraft’s Healthy Living Rewards activities or programs, you can earn up to $1,000 deposited directly into your Health Savings Account. $100 if negative 1 2 Get Rewarded for Healthy Living Your Information Is Confidential Our health care benefits and wellbeing programs are administered by independent, outside companies. You can be assured that all information is confidential and will not be disclosed to anyone without your written authorization unless permitted by law. These companies follow the federal guidelines as defined by HIPAA. Kraft is never notified of an individual’s biometric, health assessment or diagnostic data. Your personal health information does not affect your employment, plan benefits or eligibility. Supporting you financially … LIFE & DISABILITY BENEFITS Basic Life Insurance: MetLife Basic Life Insurance through MetLife provided automatically by Kraft at no cost to you. • Coverage equal to two times your annual base pay, up to a maximum of $1 million. • Eligibility differs for part-time hourly employees. Business Travel Insurance Business Travel Insurance is provided automatically at no cost to you. •Pays a benefit to your beneficiary in case you die — or to you in case of certain injuries — as a result of traveling on business for Kraft. •Coverage up to four times your annual base pay, up to a maximum of $5 million. Short-Term Disability The Short-Term Disability Plan provides up to 26 weeks of income protection in the event you are unable to work, and is provided automatically by Kraft at no cost to you. • G enerally, requires a one week elimination period . You may be able to use PTO or paid sick days, if eligible during the Part A waiting period. For details, go to MyHR Online, click Benefits to access MyBenefits Online to see your summary plan description. • Coverage provides two weeks of income replacement at 100% for every year of service, then 66.67% For more info: Kraft Foods Benefits Center 1-800-321-7960 (Monday through Friday 7:00 a.m. to 7:00 p.m. CT) For more info: Kraft Foods Benefits Center 1-800-321-7960 (Monday through Friday 7:00 a.m. to 7:00 p.m. CT) For more info: www.wkabsystem.com/ Select “register now” 1-877-201-9187 of annual salary for the remainder of short-term disability, up to 26 weeks. Long-Term Disability The Long-Term Disability Plan provides tax-free income after 26 weeks of disability. • You pay the full cost through after-tax payroll deductions. • Your benefit is reduced by other income such as Social Security or Workers’ Compensation. • Two coverage options to choose from: 50% or 60% of annual salary. • You will need to provide evidence of insurability if you do not enroll within your initial eligibility period. For more info: www.wkabsystem.com/ Select “register now” 1-877-201-9187 11 Benefit programs provided by Kraft LIFE & DISABILITY BENEFITS Supplemental Life Insurance: MetLife Supplemental Life Insurance through MetLife provides supplemental death protection for you, your spouse/domestic partner and/or child(ren). • You pay the full cost at group rates. • Coverage for you ranges from 1 to 6 times your annual salary and is rounded to the next higher $10,000, up to a maximum of $2 million. • Coverage for your spouse/domestic partner can be purchased in $10,000 increments, up to $250,000. • Coverage of $5,000 or $10,000 per child can be purchased. • Evidence of insurability is required for amounts greater than 3 times your annual salary or $500,000 for you, For more info: Kraft Foods Benefits Center 1-800-321-7960 (Monday through Friday 7:00 a.m. to 7:00 p.m. CT) for coverage greater than $50,000 for your spouse/domestic partner, or if you enroll after the initial eligibility period. Accidental Death & Dismemberment (AD&D) Insurance: MetLife AD&D Insurance through MetLife provides benefits to you or your dependents if death or dismemberment occurs as a result of an accident. •You pay the full cost at group rates. •Options are a flat $10,000 or 1 to 10 times your annual salary, up to a maximum of $1 million. •Other coverage levels available for your covered dependents: - Spouse or domestic partner coverage available: 50% of employee coverage. - Child(ren) coverage: $5,000. 12 For more info: Kraft Foods Benefits Center 1-800-321-7960 (Monday through Friday 7:00 a.m. to 7:00 p.m. CT) OTHER BENEFITS Thrift 401(k) Savings Plan Kraft offers a comprehensive retirement savings plan with a wide array of investment options, as well as automatic and matching contributions to help you achieve your retirement savings goals. •Kraft automatically makes a basic contribution equal to 4.5% of your eligible pay, each payroll period. • You can elect to contribute up to 15% of your pay on a before — or after — tax basis, or a combination of both. • Kraft matches $1-for-$1 on the first 1% of pay contributed and 70¢ for every $1 on the next 5% of pay contributed. That’s equal to an additional 4.5% of savings if you contribute at least 6%. • If eligible, you’re automatically enrolled after 30 days of service with a 6% before-tax contribution. Look for a separate enrollment packet from Fidelity. TIP: Don’t leave Kraft’s contributions on the table! Contribute at least 6% of your eligible pay to receive an additional 4.5% from Kraft Financial Planning Fidelity and Financial Engines offer a variety of tools and resources to help you manage your savings and investments. or more info: F Fidelity NetBenefits http://netbenefits.com/kraft Kraft Foods Retirement & Savings Plan Center 1-877-208-0782 (Monday through Friday 7:30 a.m. to 7:30 p.m. CT) If calling from outside the U.S. use your country’s AT&T Access Code, followed by 1-877-208-0782. If calling from an area unsupported by AT&T Direct call collect: 1-508-787-9902. Automated phone system available 24/7. • • BenefitsOfKraft.com For more info: Fidelity NetBenefits http://netbenefits.com/kraft • Provided at no cost to you. • For financial education tools and resources, you can access Fidelity NetBenefits. • For independent financial advice, you can access web-based Financial Engines at Fidelity NetBenefits. 13 Benefit programs provided by Kraft Supporting you personally … OPTIONAL PROTECTION PROGRAMS Long-Term Care (LTC) Insurance: CNA Long-Term Care Insurance through CNA provides custodial care for you, your spouse/domestic partner, parents, grandparents or dependent adult child at home, an adult day care center or nursing home. • Evidence of insurability is required if you enroll after the initial eligibility period. • You can enroll in or drop coverage at any time throughout the year. Group Legal Services Plan: ARAG The Group Legal Services Plan through ARAG provides legal hotline and coverage for legal assistance, such as: •Wills • Estate Planning • Real estate matters •Divorce • Document preparation • And more To enroll, visit CNA at www.cna.com/groupltc Password: kraftltc or call 1-800-264-1614 For more info: www.araglegalcenter.com Access Code: 10312kfi 1-800-247-4184 You pay the full cost at group rates. Auto and Homeowners Insurance: Mercer Voluntary Benefits The Auto and Homeowners Insurance through Mercer Voluntary Benefits provides optional auto and homeowners insurance, including renters and liability insurance. • 14 You can enroll in or drop coverage at any time throughout the year. To enroll, visit www.KraftHomeandAuto.com or call 1-866-810-9382 ADDITIONAL BENEFITS Dependent Day Care Flexible Spending Account The Dependent Day Care Flexible Spending Account is for tax-free reimbursements for eligible child day care or elder care expenses (and not for dependent health care expenses). • Your contribution cannot be more than $5,000 for all Dependent Day Care FSAs combined, including your spouse’s/domestic partner’s if he/she has one through his/her employer. • Eligible dependents include dependent children under age 13 who qualify as your dependents for income tax purposes, For more info: www.AetnaNavigator.com 1-888-598-1577 BenefitsOfKraft.com PayFlex: 1-888-678-8242 and your spouse or other dependent of any age who is incapacitated and whom you claim as an exemption on your federal income tax return. If you do not spend the dollars you have set aside during the calendar year on eligible expenses, you will forfeit the money, due to the IRS “use it or lose it” rule. • TIP: Plan your contributions carefully because IRS rules require that you forfeit unspent money. Adoption Assistance The Adoption Assistance program through Kraft provides employees and their spouses with adoption expense reimbursement of up to $5,000 per child. • Expenses may be incurred over two calendar years, but are still limited by the $5,000 maximum per child. If your spouse is also an employee of Kraft Foods, the maximum reimbursement is still $5,000 per child. • The program offers an Adoption Consultation and Referral Service provided by Aetna One who will put you in touch For more info: Go to MyHR Online https://myhronline.kraftfoods.com and search for Adoption Assistance with a trained adoption specialist. 15 ADDITIONAL BENEFITS Paid Time Off (PTO) For more info: Visit MyHR Online http://myhronline.kraftfoods.com PTO provides salaried employees with flexible, paid time off for absences such as vacation, illness, family member’s illness, health care appointments, school activities, holidays not observed by Kraft Foods and other personal business. For new employees hired after January 1st, the following pro-rated vacation schedule applies to the first calendar year of employment. Following the first calendar year of employment, the employee will have 20 PTO days available, to use as indicated above. Month of Initial Employment Maximum Vacation Days During the Calendar Year January 19 Days February 17 Days March 15 Days April 14 Days May 11 Days June 9 Days July 7 Days August 6 Days September 3 Days October 2 Days November 1 Day December 1 Day Note: Non-union hourly employees’ vacation differs for each location. 16 2015 For details on Kraft benefit plans and programs, visit BenefitsOfKraft.com THE BENEFITS OF KRAFT NH - 2015