Buffalo Wild Wings (BWLD) - University of Oregon Investment Group

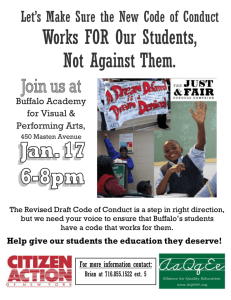

advertisement

UNIVERSITY OF OREGON INVESTMENT GROUP March 12th, 2010 Consumer Goods Buffalo Wild Wings (BWLD) RECOMMENDATION: Stock Data Price (52 weeks) Symbol/Exchange Beta Shares Outstanding Average daily volume (3 month average) Current market cap Current Price Dividend Dividend Yield Valuation (per share) DCF Analysis Comparables Analysis Target Price Current Price SELL 29.18 - 48.73 BWLD / NASDAQ 0.85 18.17M 439,672 = 839M $46.49 - $55.01 (70%) $30.29 (30%) $47.60 $47.00 Summary Financials Revenue: Net Income: Operating Cash Flow LTM (Thousands) $538,900 $30,671 $79,286 BUSINESS OVERVIEW Buffalo Wild Wings was founded in 1982 by Scott Lowery and Jim Disbrow. Based primarily in the Midwest, they own, operate, and franchise restaurants throughout the United States. Featuring their New York style chicken wings, the company has continually expanded their menu offerings to include salads, ribs, burgers, and a variety of other dishes. Covering Analyst: Lee Lenker Email: LLenker@uoregon.edu The University of Oregon Investment Group (UOIG) is a student run organization whose purpose is strictly educational. Member students are not certified or licensed to give investment advice or analyze securities, nor do they purport to be. Members of UOIG may have clerked, interned or held various employment positions with firms held in UOIG’s portfolio. In addition, members of UOIG may attempt to obtain employment positions with firms held in UOIG’s portfolio. Buffalo Wild Wings university of oregon investment group http://uoig.uoregon.edu The company began operations in Ohio, and 15% of company-owned and franchised stores are located within the state. 90% of total revenue is derived from the company-owned stores while the remaining 10% is allocated from a 5% royalty of sales from franchised restaurants. Food and nonalcoholic beverages account for 74% of restaurant sales. The remaining 26% of restaurant sales is from alcoholic beverages. The BWLD chain and restaurant model has evolved to serve an encompassing group of patrons. With geographic locations ranging from 5500-9500 sq/ft, BWLD offers furnishings, up to 10 projection screens, a full bar, BuzzTime trivia games, and 50 televisions. It provides an upbeat atmosphere that utilizes their flexible-service model for customers. FINANCIAL OVERVIEW In November of 2003, Buffalo Wild Wings raised roughly $50 million through an initial public offering. This served as a catalyst for their growth and expansion. Currently, the company holds 652 retail locations with 232 company-owned and 420 franchised throughout the U.S. Management seeks to increase their expansion to entail operating 1000 restaurants domestically with hopes of a company-owned/franchisee ratio of 36/64. Their debt-free capital structure is a primary strength of the company, whereas many of their competitors contain significant debt. (See the Beta table in the DCF to see the comps. L-T Debt) As seen in the table, during 2007, 2008 and 2009 the company‘s margins are expanding as the company has become more efficient. Some of their margin increases in 2009 can be attributed to the casual transition from traditional chicken wings to boneless wings (a better margin item), lower conference costs, better leverage of rent expense from sales, and cheaper cable costs. Liquidity remained steady from 2003-2007. This was due to the significant portions of cash and marketable securities. In 2008, marketable securities decline significantly from $66 million, to $36 million moving the % of cash and securities of total assets from 34% to 18%. The securities were sold and allocated to pay for an increase property and equipment. The Return on Assets has shown on average to be 9.01% for the last three fiscal years. This is reference to the company‘s increasing net income in relation to assets. 2 Buffalo Wild Wings university of oregon investment group http://uoig.uoregon.edu INDUSTRY ANALYSIS The industry is composed primarily of full service restaurants engaged in providing food services to patrons along with alcoholic beverages, take out services, and entertainment. There are also a limited number of restaurants that require patrons to pay before obtaining their food. The top five market share holders are Darden, Brinker, CBRL Group, DineEquity, and Buffets Holdings, whom compile 8% of the total industry market share. This references the competitive nature of the industry, and the significance of not only differentiating oneself from competitors, but increasing the company‘s brand loyalty and recognition. As Buffalo Wild Wings continues to expand into new thriving markets, it will be imperative they portray and maintain a strong brand image to consumers. Upholding a strong brand image during times of economic uncertainty is vital to Buffalo‘s aggressive growth model. People look for stable brands that will be strong and dependable, especially during a poor economy (BpPost). Judy Shoulak, senior vice-president, credited BWW‘s success during the current recession by fostering guest loyalty. The company cultivates allegiance through supporting local communities with causes like the Great American Dine-Out (NRN). Buffalo Wild Wings‘ restaurants that have been open for at least a year in 2008 had increased sales of 4.5%, while the casual dining sector as a whole saw a decline of 6.3%. The restaurant industry is also showing an increase in food and labor costs. Labor cost increases can be attributed to the Fair Labor Standards Act raising minimum wage standards annually. What is more significant, especially for Buffalo Wild Wings, is the rise in price of fresh chicken wings as can be seen below: Average Quarterly Wing Prices 2004-2008 3 Buffalo Wild Wings university of oregon investment group http://uoig.uoregon.edu While it is not included in this chart, wing prices grew to $1.63/lb in 2009Q1. Restaurants compensate for the increases costs by raising their menu prices which increased by 5% for the industry as a whole in 2008. Increasing food and labor costs are not the only concern for the restaurant industry. The current economic recession has put a stranglehold on disposable income in the United States. Disposable income can be defined as money available after tax and non-tax payments have been paid. It is a major concern and risk for an industry that is subject to the whim of the consumer‘s dollar. The following graph taken from Ibisworld illustrates the projected % change in disposable income through 2015. Per-Capita Disposable Income Through 2015 While disposable income is expected to show growth in 2010, an important note is that higher unemployment rates are predicted to likely offset any positive advance. With unemployment expected to continue increasing through 2010, and consumer confidence remaining low (Ben Bernanke), the economy will continue to recover at a sluggish rate. Unemployment Rate Through 2014 4 Buffalo Wild Wings university of oregon investment group http://uoig.uoregon.edu BUSINESS AND GROWTH STRATEGIES Buffalo Wild Wings implements a flexible service model that enables the company to appease a wide sample of patrons. This gives customers the opportunity to call in take out, sit at the bar or at a table, or get quick counter service. This model allows Buffalo Wild Wings to cater to customers with differing time demands and preferences. The takeout option has accounted for 16-18% of sales the last three years. The menu has evolved from a traditional greasy bar menu, to include a wide-array of wraps and salads as an attempt to appeal to women. The flexible service model in accordance with their geographic layout in restaurants, allows Buffalo Wild Wings to appeal to families, drinkers, and sports viewers alike. The bar and family segments are effectively separated, and having forty plus televisions allows families to request shows to keep their kids entertained and happy. A focal point of Buffalo Wild Wings operational strategy is focus on increasing same-table sales, rather than turning tables as fast as possible. Most restaurants in the industry aim to have high table turnover rates for greater sales volume. Buffalo takes a creative stance by trying to increase same-table orders. This is most effective during sporting events, especially with their wide array of cheap appetizers, 20 domestic and imported beers on tap, along with other cheap menu offerings that are made quickly. The Company‘s aggressive growth strategy is to add company-owned restaurants in existing markets while seeking franchise partners in new areas. This allocates the risk of entering a new market onto the franchisee. If the restaurant is successful, the company could potentially add a company-owned restaurant to the area and continue expansion into the new market. The company therefore takes little risk in expanding into new areas and this growth model has enabled them to see an extremely low restaurant closure and relocation percentage. MANAGEMENT AND EMPLOYEE RELATIONS A unique aspect of Buffalo Wild Wings is the fact that women hold five of the seven executive positions. CEO Sally Smith, and CFO Mary Twinem have helped lead a successful turnaround since their initiation to the company in 1994. A standard point-of-sale management information system has been successfully implemented, and the company feels it is scalable for the continuing growth. This was an important factor, especially after having serious IT issues in the mid-nineties. When Smith was Chief Executive Officer in 1996 the company had less than 75 restaurants and through her leadership has grown it to nearly 652 locations across 40 states. PORTFOLIO STATUS Tall Firs: Currently hold 425 shares with a cost basis $8,975. Current market value is $18,428 for a purchase return of 105.33% Svigals: Currently hold 50 shares with a cost basis of $1,008.18. Current market value of $2,168.00 for a purchase return of 115.04% Dadco: Currently hold 175 shares with a cost basis of $3,624. Current market value of $8,225 for a 127% purchase return. 5 Buffalo Wild Wings university of oregon investment group http://uoig.uoregon.edu RECENT NEWS ―Woman Asked to leave dining area for Breast Feeding,‖ ConnectMidMichigan.com—March 7th ―UPDATE 1-Buffalo Wild Wings keeps 2010 outlook on 2010 20% EPS growth,‖ -- Reuters ―Buffalo Wild Wings Inc. (BWLD) Executive VP, CFO & Treasurer Mary J Twinem sells 2,000 Shares,‖ – GuruFocus.com S.W.O.T. ANALYSIS Strengths The Business Growth Model that enables them to transfer much of the risk to others when expanding into new markets is invaluable. Flexible Service model Experienced and stable management team that has overseen the rapid growth of the company in the last 14 years. Weaknesses Highly concentrated in the Midwest and specifically Ohio. Susceptible to more risk if a regional recession were to take place, especially in Ohio (84 locations). Chicken wings account for 20% of restaurant non-alcoholic sales. A disruption in the supply of chicken wings would be disastrous for the company. Opportunities Yet to move company-owned stores into the ―Western Frontier,‖ including the company‘s primary target of California. Potential for an international market, two specialists have been hired on to begin the planning stages for taking BWLD global. Threats Economic recession continuing into 2010 Volatility of chicken wing prices. Subject to intense competition in the restaurant industry. 6 Buffalo Wild Wings university of oregon investment group http://uoig.uoregon.edu CATALYSTS Upside: Stronger same-store sales than competitors. Downside: Decrease in consumer spending, lower disposable income, and higher unemployment. COMPARABLES ANALYSIS I selected my comparable companies based on the following criteria: 1. Similarity in size (as measured by market capitalization w/ exception of DRI and EAT). 2. Similar profitability and operating margins. 3. Similar growth strategy (In the case of Brinker w/Chilis). In the initial report, Red Robin, Texas Roadhouse, BJ‘s, and Darden were used for conducting an analysis. However, I felt that including Brinker (Chilis), Cheesecake factory, and California Pizza Kitchen were conducive to the analysis. RRGB, TXRH, BJ‘s, and Chilis all franchise their restaurants (with the exception of Darden who operates all of its restaurants through its‘ subsidiaries). Here‘s a brief description of the companies pulled directly from their respective 10-k‘s: Red Robin Gourmet Burgers, Inc., together with its subsidiaries, is a casual dining restaurant chain focused on serving an imaginative selection of high quality gourmet burgers in a family-friendly atmosphere. As of the end of our fiscal year on December 28, 2008, the system included 423 restaurants, of which 294 were company-owned, and 129 were operated under franchise agreements including one restaurant that was managed by the Company under a management agreement with the franchisee. As of December 28, 2008, there were Red Robin® restaurants in 40 states and two Canadian provinces. Texas Roadhouse is a growing, moderately priced, full-service, casual dining restaurant chain. Our founder and chairman, W. Kent Taylor, started the business in 1993. Our mission statement is "Legendary Food, Legendary Service®." Our operating strategy is designed to position each of our restaurants as the local hometown destination for a broad segment of consumers seeking high quality, affordable meals served with friendly, attentive service. As of December 30, 2008, there were 314 Texas Roadhouse restaurants operating in 46 states. We owned and operated 245 restaurants in 43 states and franchised and licensed an additional 69 restaurants in 23 states. BJ‘s Restaurants, Inc. owned and operated 82 restaurants at the end of fiscal 2008, located in California, Texas, Arizona, Colorado, Oregon, Nevada, Florida, Ohio, Oklahoma, Kentucky, Indiana, Louisiana and Washington. A licensee also operates one 7 Buffalo Wild Wings university of oregon investment group http://uoig.uoregon.edu restaurant in Lahaina, Maui. Each of our restaurants is operated either as a BJ‘s Restaurant & Brewery ® which includes a brewery within the restaurant, a BJ‘s Restaurant & Brewhouse ® which receives the beer it sells from one of our breweries or an approved third-party craft brewer of our proprietary recipe beers (―contract brewer‖), or a BJ‘s Pizza & Grill ® which is a smaller format, full service restaurant with a more limited menu than our other restaurants. Several of our BJ‘s Restaurant & Brewery restaurants feature inhouse brewing facilities where BJ‘s proprietary handcrafted beers are produced for many of our restaurants. Darden Restaurants, Inc. (Darden) operates in the full-service dining segment of the restaurant industry, primarily in the United States. As of May 25, 2008, the Company operated, through its subsidiaries, 1,702 restaurants in the United States and Canada. In the United States, it operated 1,667 restaurants in 49 states (the exception being Alaska), including 651 Red Lobster, 647 Olive Garden, 305 LongHorn Steakhouse, 32 The Capital Grille, 23 Bahama Breeze and seven Seasons 52 restaurants, and two specialty restaurants: Hemenway‘s Seafood Grille & Oyster Bar and The Old Grist Mill Tavern. In Canada, Darden operated 35 restaurants, including 29 Red Lobster and six Olive Garden restaurants. Through subsidiaries, the Company owns and operates all of its restaurants in the United States and Canada, except three restaurants, which are located in Central Florida and are owned by joint ventures managed by Darden. I weighted each of the comparables at 25% for risk. The metrics I used in the comparable valuation were EV/EBITDA, EV/OCF, and EV/Revenue. Here are each of the comparables respective operating and profit margins taken from Google Finance for the fiscal year 2008. 8 Buffalo Wild Wings university of oregon investment group http://uoig.uoregon.edu DISCOUNTED CASH FLOW ANALYSIS Revenues: The percent of sales method was used for this analysis. I chose to use an terminal rate of 3% moving into perpetuity. Revenue was projected as a function of the number of new company-owned restaurants added each year. Average unit sales and same store sales were both known, therefore projecting my restaurant sales this way made sense. To arrive at the level of revenue for each year, I projected the total amount of new restaurants assuming the company moving towards a 40/60 ratio of company-owned stores to franchised stores and that each new store would have a lower level of sales than existing restaurants. The following chart takes the total revenue from new stores from the last three years and averages them to arrive at average revenue per new store. Thus, the average revenue per new store was $854,577. Taking this figure and dividing it by the average sales of existing stores of $1,927,340 arrives at .4433. This means new stores produce 44.33% of the sales of an existing restaurant. The company projects to open 98 stores in 2010 (15% unit growth), and in accordance with their historical benchmarks, this is very feasible. Taking 98 * .365 arrives at 35.77. This is the number of new company-owned stores. Then taking (35.77) * (.443) we arrive at 15.52. This was done to account for the revenues those new restaurants will produce which is approximately the same as 15 existing company-owned restaurants. Adding 15 onto the number of existing company owned restaurants of 232 equates to a projection of having 247 company owned stores in 2010. 9 Buffalo Wild Wings university of oregon investment group http://uoig.uoregon.edu However, we must take into account the assumption that previous years new stores that were producing ―new store revenue‖ are now producing existing store revenue. For 2010, there will be 47 stores from previous years that will now produce ―existing store revenues.‖ Adding (47+253) and then multiplying by $1,927,340 arrives at the restaurant sales projection for 2010 of $691,204,143. This calculation was done for each projected year, and the outline can be seen in the appendix. I increased average unit sales per restaurant by 9% for 2010 and 2011, and slowly trending down to growth rate of 5% in the terminal year. Having backdated the last 2-3 years, these increases are normal given a constant trend of increased samestore sales. Also, the number of projected store openings followed managerial guidance of a 15% unit growth rate through 2012, and then declines steadily moving towards the terminal year (See Appendix IV for more details on revenue projections). Buffalo Wild Wings collects a 5% royalty from franchised restaurant sales. Data was found to show that on average franchised stores generate $2,340,917. Therefore, coming up with a total restaurant sales figure from the difference between total projected and company-owned, and multiplying it by $2.3 million gives us franchised sales. Multiplying this by 5% arrives at franchised royalties. Note: average revenue per franchisee was grown at a conservative rate of 3% due to historical performance, and to account for inflation. Capital Expenditures: The company has given guidance that each new restaurant costs $1.75M and maintenance costs are roughly $98, 253 for each restaurant. Thus, I took the number of projected company owned restaurants for the year and multiplied it by $1.5 million. Then, the following year, the new projected restaurants are added in and the total is multiplied against the maintenance cost. Summing these figures arrives at capital expenditures. The following model illustrates my calculation. Costs of sales: Cost of sales is influenced primarily by the volatile swings in fresh chicken wing prices. Fresh chicken wing prices in 2008 averaged 4.7% lower than 2007 as the average price per pound dropped to $1.22 in 2008 from $1.28 in 2007. Currently, the wings account for approximately 21%, 24%, and 24% of the cost of sales in 2008, 2007, and 2006. Management noted that a 10% increase in 2008 in wing prices would have increased restaurant sales costs by $2.3 million. After reviewing the 2009Q4, wing prices soared to $1.70/lb increasing cost of sales to 30.2% of revenue from 29.8%. Management expects the steady shift from traditional wings to boneless wings to lower the cost of goods percentage. I have cost of sales remaining constant as the company is becoming larger, more efficient and with the volatility of chicken wing prices being offset with the transition of wing styles. 10 Buffalo Wild Wings university of oregon investment group http://uoig.uoregon.edu Labor expense: Increased by $9.7 million, or 37.5%, to $35.5 million in 2009 from $25.9 million in 2008 due to more restaurants being operated in 2009. Labor expenses as a percentage of restaurant sales decreased in 2009 to 30.0% due to lower hourly labor costs but were partially offset by increased incentives and medical costs. The Fair Labor Standards Act (FLSA) has will increase labor costs in the future with rising minimum wage standards. Hence I have adjusted the figures to be slightly higher in the projection at 30.1% of restaurant sales. Operating expense: This includes repair and maintenance costs, general liability insurance costs, credit card fees, utilities, and some others. This figure has gradually declined as a % of restaurant sales in the last four years. This is attributable to the company‘s extensive operational efficiency measures that have been taken include the WCT Program, a new ERP system, as well as the implementation of point-of-sale systems. This expense as a percentage of revenue was projected to decline steadily through 2013, and then held constant. Occupancy expense: Occupancy expenses as a percentage of restaurant sales was flat at 6.6% for both 2009 and 2008. Historically it has ranged from 6.5%-7.1%and was projected on this basis along with the increase in number of restaurants to be operated. Depreciation: Has increased annually because of the increase in restaurant openings. I projected depreciation to correlate directly w/ the increased openings, with store opening unit growth beginning to decline 2013 and continuing to decline into the terminal year. General and administrative expense: As a percentage of total revenue, G&A decreased to 9.2% in 2009 from 9.5% in 2008. Exclusive of stock-based compensation, the G&A expenses decreased to 8.0% of total revenue in 2009 from 8.3% in 2008. This decrease was primarily due better leverage of wage-related expenses. Restaurant Impairment Expense: Related directly to underperforming restaurants that are either closed or relocated. Held constant moving forward. Income Tax Expense: As can be seen on the DCF, the effective tax rate has fluctuated over the past five years. I have projected the company being subject to a 35% tax rate moving forward both due to guidance, Working Capital: Current assets declined significantly from 2007 to 2008 due to a sell of around $30 million in marketable securities most likely allocated to plant property and equipment. Current assets were held constant at 20.2% moving forward with current liabilities at 13.6%. Beta: Calculating the beta for BWLD has been troublesome historically due to its debt-free position relative to all of its‘ comparable companies. A 5yr monthly regression against the S&P500 yielded a beta of 1.11, with a Hamada (using industry means) yielding a beta of 1.29. If the Hamada is conducted excluding CAKE and EAT which are both over 2, and skewing the data, the respective beta is 1.04. Yahoo Finance exhibited a beta of .85 with Google finance at .94 and a Factset 52-weekly at .68. Below is the Hamada: 11 Buffalo Wild Wings university of oregon investment group http://uoig.uoregon.edu After weighing the different options, I felt the Hamada and 5 yr monthly regressions were not representative of BWLD‘s current risk to the market. With a Factset 52-weekly at .68 as of December, along with Google and Yahoo at .94 and .85, I could not justify using a beta greater than 1. I decided to use a Beta of .85 for the valuation, as I feel it fits in the middle of the two outliers, and yields a target DCF price comparable to analyst projections. RECOMMENDATION Buffalo Wild Wings has generated purchase returns of over 100% in all three UOIG portfolios. My comparables analysis yielded a target price of $30.29 with my discounted cash flows analysis yielding a target price of $55.01 which is right in line with the target prices of all ‗Buy Analyst recommendations.‘ I feel that my comparables analysis does not accurately reflect truly comparable companies, as BWLD has experienced extreme growth during the last two years that no other competitors have exhibited. I feel that my quantitative analysis in the DCF is extremely accurate after having backdated the revenue model; however my projections are not entirely conservative. With that said, I chose to weight the DCF 70% and the Comps 30%, generating a weighted average implied price of $47.60 and resulting in a 1% undervaluation. While I feel that the DCF price of $55.01 is a more accurate indicator, it assumes nearly perfect performance for BWLD in their continued aggressive expansion. Given the transaction costs of Dadco, the inability to adequately turnover the portfolio holdings quickly, and the returns already generated, I do not feel that holding out for an additional 10-17% is a smart hold. Therefore, I am recommending to sell Buffalo Wild Wings for ALL portfolios. 12 Buffalo Wild Wings university of oregon investment group http://uoig.uoregon.edu APPENDIX I– COMPARABLES ANALYSIS 13 Buffalo Wild Wings university of oregon investment group http://uoig.uoregon.edu APPENDIX II – DISCOUNTED CASH FLOWS ANALYSIS 14 Buffalo Wild Wings university of oregon investment group http://uoig.uoregon.edu APPENDIX III – DISCOUNTED CASH FLOWS ANALYSIS ASSUMPTIONS APPENDIX IV – REVENUE PROJECTIONS 15 Buffalo Wild Wings university of oregon investment group http://uoig.uoregon.edu APPENDIX V – STORE OPENINGS/RELEVANT COMPARABLE STATISTICS Comparable Company Store Openings: BWLD SAME STORE SALES: 16 Buffalo Wild Wings university of oregon investment group http://uoig.uoregon.edu ADVERTISING ALLOCATIONS (BWLD, CPKI, RRGB): APPENDIX VI – SOURCES IBISWORLD 10K DRI, RRGB, TXRH, BWLD 10Q DRI, RRGB, TXRH, BWLD National Restaurant Association Google Finance Yahoo Finance Factset Franchise.business-opportunities.com www.buffalowildwings.com 17