AMB Country Risk Report

August 18, 2015

Our Insight, Your Advantage.

Italy

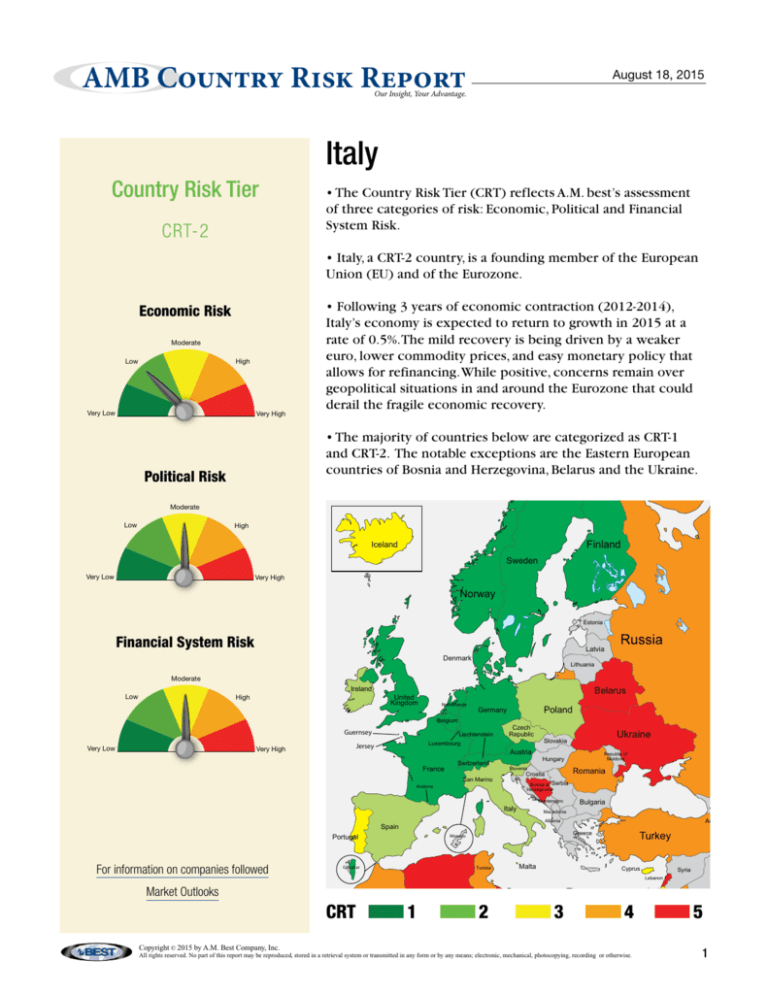

Country Risk Tier

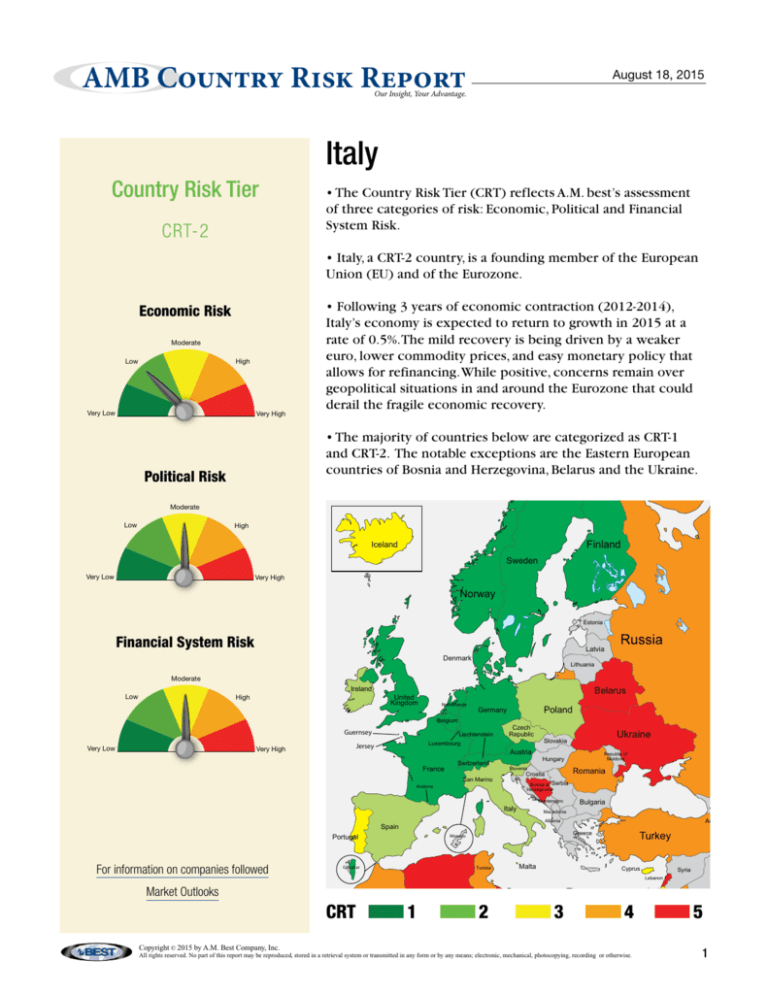

• The Country Risk Tier (CRT) reflects A.M. best’s assessment

of three categories of risk: Economic, Political and Financial

System Risk.

CRT-2

• Italy, a CRT-2 country, is a founding member of the European

Union (EU) and of the Eurozone.

• Following 3 years of economic contraction (2012-2014),

Italy’s economy is expected to return to growth in 2015 at a

rate of 0.5%. The mild recovery is being driven by a weaker

euro, lower commodity prices, and easy monetary policy that

allows for refinancing. While positive, concerns remain over

geopolitical situations in and around the Eurozone that could

derail the fragile economic recovery.

Economic Risk

Moderate

Low

High

Very Low

Very High

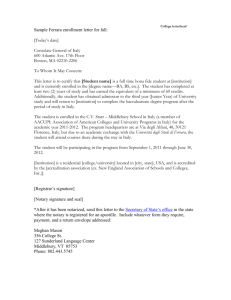

• The majority of countries below are categorized as CRT-1

and CRT-2. The notable exceptions are the Eastern European

countries of Bosnia and Herzegovina, Belarus and the Ukraine.

Political Risk

Moderate

Low

High

Iceland

Greenland

Finland

Iceland

Greenland

Sweden

Very Low

Finland

Sweden

Very High

Norway

Norway

Estonia

Financial System Risk

Isle of Man

Isle of Man

Russia

Latvia

Denmark

Denmark

Latvia

Lithuania

Low

High

Belarus

Ireland

United

Kingdom

Netherlands

United

Germany

Kingdom

Belgium

Guernsey

Very Low

Liechtenstein

Guernsey

Luxembourg

Jersey

Very High

Switzerland

France

San Marino

Croatia

France

Andorra

Andorra

Portugal

Azores

Market Outlooks

Copyright © 2015 by A.M. Best Company, Inc.

as

Dominican

Monaco

Gibraltar

Canary

Islands

Montenegro

Malta

Tunisia

Turkey

Greece

Cyprus

Malta

Syria

Cyprus

Lebanon

Iraq

Israel

Morocco

Algeria

Azerbaija

Turkey

CRT 1 2 3 4 5

Canary

Islands

Georgia

Armenia

Albania

Monaco

Tunisia

Russia

Bulgaria

Macedonia

Greece

Gibraltar

Morocco

Bosnia & Serbia

Herzegovina

Italy

Albania

Spain

Portugal

Azores

For information on companies followed

Macedonia

Romania

Croatia

Bulgaria

Republic of

Moldova

Hungary

Slovenia

Bosnia & Serbia

Herzegovina San Marino

Italy

Ukraine

Republic of

Switzerland

Romania

Montenegro

Spain

Czech

Ukraine

Republic

Slovakia

Moldova

Austria

Hungary

Slovenia

Poland

Germany

CzechBelgium

Republic

Slovakia

Liechtenstein

Luxembourg

Austria

Jersey

Belarus

Poland

Netherlands

Russia

Lithuania

Moderate

Ireland

Estonia

Lebanon

Israel

Jordan

Libya

Algeria

Libya

Egypt

All rights reserved. No part of this report may be reproduced, stored inWestern

a retrieval system

or transmitted in any form or by any means; electronic, mechanical, photocopying, recording or otherwise.

Sahara

(Occupied by Morocco)

Western Sahara

(Occupied by Morocco)

Jordan

Kuwa

Bahrain

Egypt

Saudi

1 Arabia

Qat

AMB Country Risk Report

Italy

Regional Summary: Western Europe

Vital Statistics 2014

• Western Europe is a highly developed

and affluent region. The 28 countries of

the European Union (EU) accounted for

25% of world GDP in 2014. The EU is

facilitating a single European market with

standardized regulatory systems and free

movement of people, goods, services and

capital. The 17 EU members of the eurozone use the euro as their currency.

Nominal GDP

Population

GDP Per Capita

Real GDP Growth

Inflation Rate

Premiums Written (Life)

Premiums Written (Non-Life)

Premiums Growth (2013 - 2014)

USD bn

mil

USD

%

%

USD mil

USD mil

%

2147.95

60.0

35,823

-0.4

0.2

145,292

49,443

15.3

Regional Comparison

• Western Europe has been experiencing

a prolonged period of slow economic

growth, with the EU growing 1.4% in

2014. Growth is largely expected to

remain muted at 1.8% and 1.9% in 2015

and 2016 respectively. On-going concerns

over Greece’s economic and political

future have increased the potential

downside risks to growth and stability

throughout the European Union.

Country Risk Tier

CRT-2

CRT-1

CRT-1

CRT-2

CRT-1

CRT-1

Italy

France

Germany

Spain

Switzerland

United Kingdom

Source: IMF, Axco, Swiss Re and A.M. Best

• In March 2015 the European Central

Bank (ECB) launched a program of

Quantitative Easing, expected to last

through September 2016.The program

entails the purchase of 60 billion EUR of

assets monthly in an effort to boost growth,

encourage lending and increase inflation.

Economic Growth

Economic Risk: Low

• Italy is a large, modern economy that

supports one of the largest manufacturing

sectors in the world. However, industrial

investment, restructuring and labor

reforms are necessary to remain

competitive in Europe.

4

Real GDP

2

1

0

• Political instability, high debt, low

productivity and a large shadow economy

have been headwinds to economic

growth. In addition, unemployment

remains stubbornly high (12%) and the

country is prone to labor strikes.

• Easing credit conditions and an

improved outlook in the Eurozone should

help to support Italy’s growth.

CPI Inflation

3

%

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

-1

-2

-3

-4

-5

-6

Source: IMF World Economic Outlook and A.M. Best

2

AMB Country Risk Report

Italy

Political Risk: Moderate

Political Risk Summary

• Italy has a large and cumbersome

bureaucracy and an inefficient public

sector supporting a modern and advanced

business infrastructure.

Score 1 (best) to 5 (worst)

Italy

World Average

International Transactions

Policy

5

4

Legal System

• The government’s current agenda

focuses on the structural issues preventing

it from reaching full economic potential

including reforms in the labor market,

judicial system, public sector, and electoral

law. A proposed “Jobs Act” would promote

hiring and reduce employers tax burdens.

Monetary Policy

3

2

1

Regional Stability

Fiscal Policy

0

Social Stability

Business Environment

Government Stability

• Measures to reduce the deficit

face political challenges and doubts

surrounding sustainability. Political

infighting has halted much needed

reforms. Electoral reforms effective in

July 2016 may ease instability with the

transition to a two-party system.

Labor Flexibility

Source: A.M. Best

Financial System Risk: Moderate

GDP Per Capita and Population

for Selected Countries

• The Institute for the Supervision of

Insurance Companies took over regulation

of the insurance market in January 2013.

90

100,000

GDP Per Capita

• Italy is under pressure from the ECB and

EU to rein in its high government debt,

which surpassed 132% of GDP in 2014.

Population

90,000

80

80,000

• Italy’s stock exchange, Borsa Italia, is

large by global standards, but small relative

to its European neighbors. Italian banking

standards are adequate.

70

70,000

60

60,000

40

40,000

30

30,000

20

20,000

• The ECB’s Outright Monetary

Transaction program and quantitative

easing has stabilized the Italian sovereign

debt market over the past 3 years,

boosting investor confidence and greatly

reducing yields.

10

10,000

0

Millions

USD

50

50,000

Italy

France

Source: IMF and A.M. Best

Germany

Spain

Switzerland

United Kingdom

0

• Banks have made progress in

governance reforms and private capital

raising, but the Non-Performing Loans

ratio reached a record 16%.

3

AMB Country Risk Report

Italy

GUIDE TO BEST’S COUnTry rISk TIErS

A.M. Best defines country risk as the risk that country-specific factors could adversely affect the claims-paying ability of an insurer. Country risk is

evaluated and factored into all Best’s Credit Ratings. Countries are placed into one of five tiers, ranging from “CRT-1” (Country Risk Tier 1), denoting

a stable environment with the least amount of risk, to “CRT-5” (Country Risk Tier 5) for countries that pose the most risk and, therefore, the greatest

challenge to an insurer’s financial stability, strength and performance.

A.M. Best’s Country Risk Tiers are not credit ratings and are not directly comparable to a sovereign debt rating, which evaluates the ability and

willingness of a government to service its debt obligations.

Country risk Tiers

Country risk Tier

Definition

CRT-1

Predictable and transparent legal environment, legal system and business infrastructure; sophisticated financial

system regulation with deep capital markets; mature insurance industry framework.

CRT-2

Predictable and transparent legal environment, legal system and business infrastructure; sufficient financial system

regulation; mature insurance industry framework.

CRT-3

Developing legal environment, legal system and business environment with developing capital markets; developing

insurance regulatory structure.

CRT-4

Relatively unpredictable and nontransparent political, legal and business environment with underdeveloped capital

markets; partially to fully inadequate regulatory structure.

CRT-5

Unpredictable and opaque political, legal and business environment with limited or nonexistent capital markets; low

human development and social instability; nascent insurance industry.

Country risk reports

A.M. Best Country Risk Reports are designed to provide a brief, high-level explanation of some of the key factors that determine a country’s Country

Risk Tier assignment. It is not intended to summarize A.M. Best’s opinion on any particular insurance market or the prospects for that market.

Categories of risk

Country Risk Reports provide scores for three categories of risk for each country. These scores are (1) Very Low; (2) Low; (3) Moderate; (4) High

and (5) Very High.

Category of risk

Definition

Economic Risk

The likelihood that fundamental weaknesses in a country’s economy will cause adverse developments for an insurer.

A.M. Best’s assessment of economic risk evaluates the state of the domestic economy, government finances and

international transactions, as well as prospects for growth and stability.

Political Risk

The likelihood that government or bureaucratic inefficiencies, societal tensions, inadequate legal system or

international tensions will cause adverse developments for an insurer. Political risk comprises the stability of the

government and society, the effectiveness of international diplomatic relationships, the reliability and integrity

of the legal system and of the business infrastructure, the efficiency of the government bureaucracy, and the

appropriateness and effectiveness of the government’s economic policies.

Financial System Risk

Financial system risk (which includes both insurance and non-insurance financial system risk) is the risk that financial

volatility may erupt due to inadequate reporting standards, weak banking system or asset markets, and/or poor

regulatory structure. In addition, it includes an evaluation of whether the insurance industry’s level of development and

public awareness, transparent and effective regulation and reporting standards, and sophisticated regulatory body will

contribute to a volatile financial system and compromise the ability of an insurer to pay claims.

Political risk Summary

To provide additional detail on the political risk in a given domicile the Country Risk Reports include the Political Risk Summary. The Political Risk

Summary is a radar chart that displays scores for nine different aspects of political risk scored on a scale of one to five with one being the least

amount of risk and five being the highest amount of risk.

Category

Definition

International Transactions

Policy

Measures the effectiveness of the exchange rate regime and currency management.

Monetary Policy

Measures the ability of a country to effectively implement monetary policy.

Fiscal Policy

Measures the ability of a country to effectively implement fiscal policy.

Business Environment

Measures the overall quality of the business environment and ease of doing business.

Labor Flexibility

Measures the flexibility of the labor market, including the company’s ability to hire and fire employees.

Government Stability

Measures the degree of stability in a government.

Social Stability

Measures the degree of social stability, including human development and political rights.

Regional Stability

Measures the degree of stability in the region.

Legal System

Measures the transparency and level of corruption in the legal system.

Country risk Tier Disclosure

A Country Risk Tier (CRT) is not a credit rating, rather it represents a component of A.M. Best’s Credit Rating Methodology that is applied to all

insurers. A CRT is not a recommendation to purchase, hold or terminate any security, insurance policy, contract or any other financial obligation

issued by a government, an insurer or other rated issuer, nor does it address the suitability of any particular policy, contract or other financial

obligation for a specific purpose or purchaser.

Copyright © 2015 by A.M. Best Company, Inc.

Version 091714

Copyright © 2015 by A.M. Best Company, Inc.

All rights reserved. No part of this report may be reproduced, stored in a retrieval system or transmitted in any form or by any means; electronic, mechanical, photocopying, recording or otherwise.

4