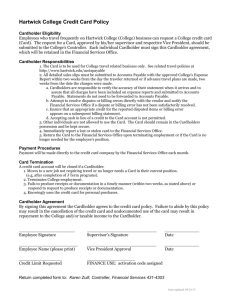

Credit Card Program Agreement

advertisement