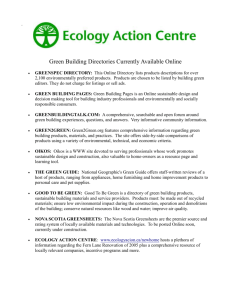

Valuing our Fisheries - Ecology Action Centre

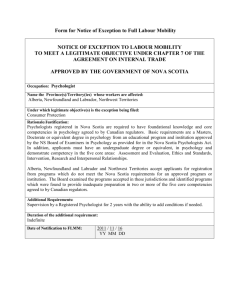

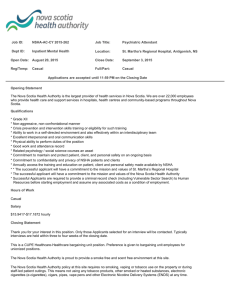

advertisement