Statistical definitions for the fixed income market (FI)

advertisement

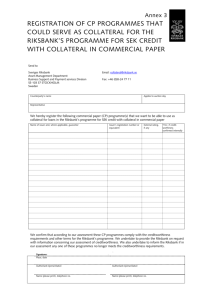

DNR 2011-568-AFS Statistical definitions for the fixed income market (FI) Source: Sveriges Riksbank, Bank for International Settlements (BIS), European Commission and NASDAQ OMX. SELMA FI (Fixed Income) reporting covers the daily turnover for different types of debt securities and derivatives denominated in Swedish kronor (SEK). The transactions must be reported under the various transaction types, contract types and counterparty types as specified below. In that way, Sveriges Riksbank can gain an understanding of the activity on the Swedish fixed income market in Swedish kronor and a picture of how the market shares are distributed between the reporting institutions. Institution-specific information is only communicated to the institution itself. Aggregate turnover figures for all institutions are published on Sveriges Riksbank's website and in the SELMA system. It is important that the institutions appoint a person responsible for quality that can make a reasonability assessment and give rapid responses to questions concerning the statistics reported to Sveriges Riksbank. Note that all amounts must be expressed in millions of Swedish kronor without decimals. CONTENTS 1. Instrument (Asset Types) ......................................................................................................... 2 1.1. Bonds ............................................................................................................................... 2 1.2. Short-term debt securities ............................................................................................. 2 1.3. Derivatives ...................................................................................................................... 4 2. Transaction type ...................................................................................................................... 5 2.1. For bonds and short-term securities ............................................................................. 5 2.2. For derivatives ................................................................................................................ 5 3. Contract types ......................................................................................................................... 7 3.1. For bonds and short-term securities ............................................................................. 7 3.2. Derivatives ...................................................................................................................... 8 4. Counterparty Types ................................................................................................................. 9 1 1. Instrument (Asset Types1) The instruments are divided into various main categories: bonds, short-term debt securities and derivatives. 1.1. Bonds Government Bonds: Bonds issued by the Swedish Government (National Debt Office) with a remaining maturity of 1 year or more (≥365 calendar days), denominated in Swedish kronor. Short Government Bonds: Bonds issued by the Swedish Government (National Debt Office) with a remaining maturity shorter than 1 year (<365 calendar days), denominated in Swedish kronor. Inflation Linked Bonds: Inflation-linked bonds issued by the Swedish Government (National Debt Office), denominated in Swedish kronor. Mortgage Bonds: Bonds issued by mortgage institutions with a remaining maturity of 1 year or more (≥365 calendar days), denominated in Swedish kronor. Examples of Swedish mortgage institutions are Nordea Hypotek, SBAB, SEB, Stadshypotek and Swedbank Hypotek. Short Mortgage Bonds: Mortgage bonds issued by mortgage institutions with a remaining maturity shorter than 1 year (<365 calendar days), denominated in Swedish kronor. Examples of Swedish mortgage institutions are Nordea Hypotek, SBAB, SEB, Stadshypotek and Swedbank Hypotek. Corporate Bonds: Corporate bonds issued by government-owned and private companies, denominated in Swedish kronor. Kommuninvest Bonds: Bonds issued by Kommuninvest i Sverige AB with a remaining maturity of 1 year or more (≥365 calendar days), denominated in Swedish kronor. Short Kommuninvest Bonds: Bonds issued by Kommuninvest i Sverige AB with a remaining maturity shorter than 1 year (<365 calendar days), denominated in Swedish kronor. Other Bonds: Other bonds denominated in Swedish kronor. They may be issued by banks, credit market companies, municipalities or county councils. 1.2. Short-term debt securities T-Bills (Treasury Bills): Treasury bills issued by the Swedish Government (National Debt Office). 1 The instruments are called “Asset Types” only for technical reasons. 2 Mortgage Certificates: Mortgage certificates issued by mortgage institutions, denominated in Swedish kronor. Examples of Swedish mortgage institutions are Nordea Hypotek, SBAB, SEB, Stadshypotek and Swedbank Hypotek. Riksbank Certificates: Certificates issued by Sveriges Riksbank, denominated in Swedish kronor. The certificates are usually issued weekly by Sveriges Riksbank. Corporate Certificates: Corporate certificates issued by government-owned and private companies, denominated in Swedish kronor. Kommuninvest Certificates: Certificate issued by Kommuninvest i Sverige AB, denominated in Swedish kronor. Other Short-Term Securities: Other short-term debt securities, denominated in Swedish kronor. These may be issued by banks, credit market companies, municipalities or county councils. Screenshot of FI report 3 1.3. Derivatives The general rule for reporting swaps is that only ordinary swaps are to be reported (”plain vanilla swaps”) IRS SEK/SEK: Swaps2 denominated in Swedish kronor with a maturity of more than 1 year must be reported with the principle amount. Note that only the fixed income leg of a swap is to be reported. So-called buy-outs, terminations and novations are not to be included in reporting. Only new swaps are to be reported. Example If a reporter pays the 5-year swap interest rate and receives the 3-month STIBOR rate at the nominal amount of SEK 5 billion; this is to be reported as follows. In the example, the counterparty is a foreign customer. Asset type: IRS SEK/SEK Transaction type: Pay Contract Type: NA (-) Counterparty type: Non-Swedish Customer Amount: 5 000 (note that the amount is to be expressed in SEK millions). Screenshot of this example of reporting IRS SEK/SEK 2 An interest rate swap (IRS SEK/SEK) is an agreement between two parties to exchange interest rate flows for a specified period. 4 2. Transaction type 2.1. For bonds and short-term securities Turnover on bonds and short-term securities must be allocated among bought and sold as follows: Purchased (SEK million): Refers to purchases from counterparties. Sold (SEK million): Refers to sales to counterparties. Screenshot showing transaction types for bonds and short-term securities 5 2.2. For derivatives Turnover in IRS SEK/SEK and NOIS swap futures must be divided into paid and received as follows: Pay: Refers to the payment by the reporter of a fixed interest rate to the counterparty. Receive: Refers to the receipt by the reporter of a fixed interest rate from the counterparty. This screenshot shows allocation among the different transaction types for derivatives. 6 3. Contract types 3.1. For bonds and short-term securities Bonds and short-term securities must be allocated among the following contract types: Spot: Refers to transactions settled up to and including 10 business days from trade date, also designated T+10. Forward: Refers to transactions settled later than 10 business days from trade date, also designated T+11. Note that OMX-cleared forwards must always be reported as Forwards (even if they were settled sooner than T+11). Repo: A repo transaction is a repurchase agreement between two parties – that is, a purchase or sale of securities to a counterparty in exchange for cash, under the agreement that the same securities will be sold back or bought back for a given price at a specific future date. Both cleared and uncleared repo transactions must be included in reporting. Note that only the first leg of the repo transaction is to be reported. For example: A repo transaction in which a reporter purchases 5-year government bonds for SEK 500 million from a foreign customer in the first stage of the repo transaction must be reported as follows: Asset type: Government bond, Transaction type: Purchase, Contract Type: Repo, Counterparty type: Non-Swedish customer, Amount: 500 This screenshot shows the repo transaction in the example above 7 3.2. Derivatives Turnover in IRS SEK/SEK and NOIS swap futures must not be allocated by contract type. -: Not applicable. This screenshot shows that derivatives do not have contract types 8 4. Counterparty Types Counterparty Types refer to the counterparty the reporter is trading with. Primary Market: Primary market refers to transactions conducted with one issuer. The counterparty in this case could be the Swedish National Debt Office, Sveriges Riksbank, a mortgage institution, a Swedish or foreign reporter, another bank or a company. Participation in an issue must be reported as purchased on the Primary Market. When the issuer purchases/advance redeems existing securities, this is considered to be sold to the Primary Market. Substitutions must be reported as bought and sold to the Primary Market (a received instrument is to be registered as bought, a handed-over instrument is to be registered as sold). Swedish Reporter: The Riksbank’s primary monetary policy counterparties and counterparties to the Swedish National Debt Office are defined as “Swedish Reporters”. See www.riksbank.se for an updated list of reporters. This information is available at SELMA’s start page under the function “Active Institutions”. Non-Swedish Reporter: The Riksbank’s foreign primary monetary policy counterparties and foreign counterparties to the Swedish National Debt Office are defined as “Non-Swedish Reporters”. See www.riksbank.se for an updated list of reporters. This information is available at SELMA’s start page under the function “Active Institutions”. Other Market Maker The term Other Market Maker refers to an institution that acts as a market maker but is not a Swedish or Non-Swedish Reporter. Transactions concluded with the Inter Bank Desk at institutes in the list should be reported under category “Other Market Maker”. Transactions concluded with Asset Management or Propriety Desk in the same organizations should be reported under customer categories. See www.riksbank.se for an updated list of Other Market Makers. Find the list under “Monetary Policy/Reporting SELMA/Documentation SELMA”. No Name Give Up Brokers: Transactions made with Fixed Income Brokers, such as ICAP, Tullett Prebon and R P Martin. Swedish Customer: Customers active in Sweden.3 This also functions a general item for counterparties in Sweden. That means all counterparties not categorised as Swedish Reporter, Non-Swedish Reporter, No Name Give Up Brokers or Sveriges Riksbank. 3 The customer’s domicile is the country in which the customer has its legal domicile. For branches, the domicile is the country in which the customer has its head office. 9 Non-Swedish Customer: Customers active outside Sweden.4 This also functions as a general item for counterparties outside Sweden. That means all counterparties not categorised as Swedish Reporter, Non-Swedish Reporter, No Name Give Up Brokers or Sveriges Riksbank. Sveriges Riksbank: The counterparty is the central bank of Sweden, Sveriges Riksbank. Note that when Sveriges Riksbank acts as issuer, for example in the issuance of Riksbank certificates, this transaction must be reported in Primary Market. 4 See footnote 4 10