Some Homework 2 Solutions #2.1 Without loss of generality, we

advertisement

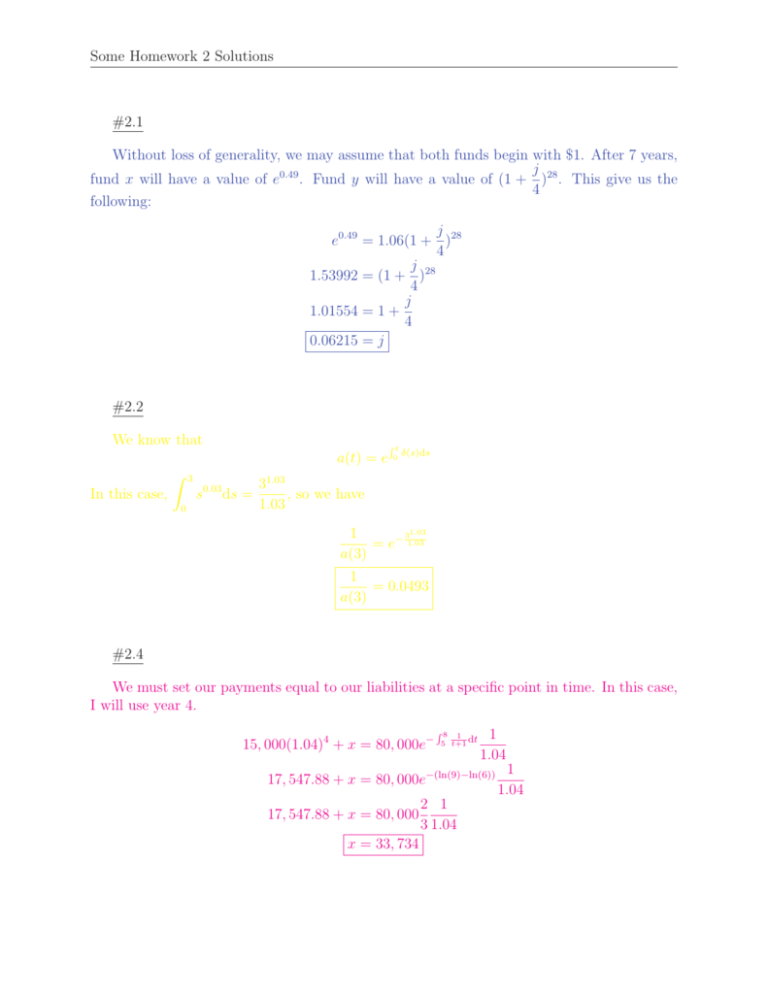

Some Homework 2 Solutions #2.1 Without loss of generality, we may assume that both funds begin with $1. After 7 years, j fund x will have a value of e0.49 . Fund y will have a value of (1 + )28 . This give us the 4 following: j e0.49 = 1.06(1 + )28 4 j 28 1.53992 = (1 + ) 4 j 1.01554 = 1 + 4 0.06215 = j #2.2 We know that a(t) = e In this case, Z 3 s0.03 ds = 0 Rt 0 δ(s)ds 31.03 , so we have 1.03 31.03 1 = e− 1.03 a(3) 1 = 0.0493 a(3) #2.4 We must set our payments equal to our liabilities at a specific point in time. In this case, I will use year 4. 15, 000(1.04)4 + x = 80, 000e− R8 1 5 t+1 dt 1 1.04 17, 547.88 + x = 80, 000e−(ln(9)−ln(6)) 17, 547.88 + x = 80, 000 x = 33, 734 2 1 3 1.04 1 1.04 Some Homework 2 Solutions #2.5 2 0.1 Over the first year the $400 accrues to 400 1 + = 441. Adding the deposit at 2 time 1 gives us the accumulated value of $483 at time 1. Then we must use the force of interest. 483e This gives us that R2 1 1 k+t dt k+2 = 483eln k+1 k+2 = 483 k+1 = 552 by the fourth assumption 552 k+2 = . Solving for k, we arrive at the solution k = 6 k+1 483 #2.7 The investment is made at time 1, so the integral’s lower bound is 1. The upper bound is 9. 14e R9 1 √ 0.3 tdt t1.5 9 = 14e0.3 1.5 |1 = 14e0.2(27−1) = 14e5.2 = 2537.81 #2.8 The accumulated value of the fund is 1000e R4 0 δ(t)dt = 1000e R3 0 0.02tdt+ R4 2 t=3 3 0.045dt = 1000e0.01t |t=0 +0.045 = 1000e0.135 = 1144.54 This gives a nominal rate compounded quarterly of 16 i(4) 1+ = 1.14454 4 i(4) = 1.00847 1+ 4 i(4) = 0.00847 4 i(4) = 0.03389 Some Homework 2 Solutions #2.9 By our assumptions, we have the following equation: 5000 + 3000v 12∗1 + 2000v 12∗5 = 10000v 12∗t where v = gives us 1 1 . Evaluating the three terms on the left hand side of our equation .12 = 1.01 1 + 12 8763.26 = v 12t 10000 8763.26 ln = 12t ln v 10000 8763.26 1 =t ln 12 ln v 10000 Evaluating this term gives us that t = 1.056