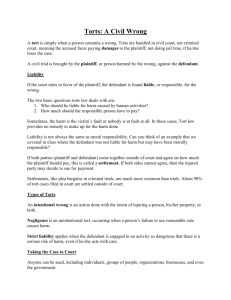

BUSINESS TORTS - Fellers Snider

advertisement