HDFS 183X Credits - Iowa State University

advertisement

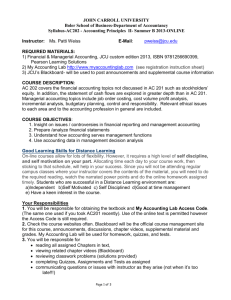

Instructor: Office: Kelly Carnine 1335 Palmer Email: Blackboard preferred Phone: (515) 294-8671 Course: Method: Textbook: HDFS 183X Online Not required– materials provided via Blackboard Credits: 1 Credit Prerequisites: None Grading: S: F: 80% or higher on all 16 competency quizzes and 2 required assignments Below 80% or non-completion of any of the 16 competency quizzes or 2 required assignments Course Purpose: To provide students with a foundation in personal finance and an understanding of personal financial issues, including (but not limited to): budgeting, credit history/credit scores, student loans/financial aid, and the time value of money. Learning Objectives: Give students the knowledge to create and maintain their personal financial health, now and in the future. Provide students with hands-on activities to deepen their understanding of personal finance. Provide students with available resources that may assist with managing personal and financial issues. Specifically, the successful student in this course will develop applicable skills in: 1. Developing financial goals and creating a realistic budget. 2. Monitoring credit history and credit usage. 3. Understanding appropriate credit and lending usage. 4. Planning and paying for collegiate expenses. 5. Understanding consumer behaviors. 6. Comparing housing options, rights and responsibilities. 7. Protecting assets through appropriate insurance tools. Modules: Before any module can be started, each student must take and pass a Policy and Procedures quiz. This quiz will focus on the logistics of the course and common questions, and will center on the information provided in your syllabus. The purpose of this quiz is to ensure students understand how the course is structured, which will then minimize repetitive questions when working through course content. In addition to the Policy and Procedures quiz, there will be 15 modules to complete. Modules can be completed at the student’s pace throughout the semester; *however* - there are deadlines for completion of the modules, which are set throughout the course to ensure students do not fall behind (*please see the Policies and Procedures below for specific deadlines). Modules are sequential, in a progressive pattern with a competency quiz at the end of each module. Module 1 quiz will need to be passed with an 80% accuracy before Module 2 will be available; Module 2 quiz will need to be passed with 80% accuracy before Module 3 will be available, and so on. Module competency quizzes will be available until the deadlines stated in the Policies and Procedures below. They will allow an unlimited number of attempts, and will allow 40 minutes for completion. All competencies will be tested through Blackboard. Modules will also include a streaming presentation with voice-over, interactive activities, resources, and competency quizzes. The only component of your grade are the quizzes and two required activities, which are noted as ‘required’ in their respective Modules. All other activities are for student use and do not need to be submitted to the instructor. Note that module activities will assist you in successful achievement of course activities and provide a deeper understanding of content – it is strongly recommended that you complete the module activities prior to taking each quiz. Communication: Correspondence for this course will be provided through Blackboard Learn. The instructor will check Blackboard messages no later than Noon, Monday – Friday, during the normal academic calendar. You should not expect the instructor to respond earlier than this. For example, if you email at 2 pm on Friday, the earliest you should expect the instructor to receive the message would be Noon the following Monday. Messages are not checked over the weekend. This course is meant to give basic personal financial knowledge. If you are looking for more in-depth information, it is recommended you enroll in HDFS 283 or make an appointment at the ISU Financial Counseling Clinic for more personalized information. If you have questions about content or are having difficulties, please contact the instructor via Blackboard mail. All lectures are provided via voice-over PowerPoint/Adobe Presenter and posted in Blackboard. These PowerPoint presentations require the latest version of Adobe Reader. Please make sure that your computer supports these capabilities. For a free download of Adobe Reader, please visit http://get.adobe.com/reader/. Academic Integrity: As stated by the Dean of Students Office, “the value of an education at Iowa State University depends greatly upon the quality of academic work and research completed by students at our institution. Each member of the Iowa State community has an opportunity to play an important role in promoting and preserving integrity on campus. The academic work of all students must comply with all university policies on academic honesty” (http://www.dso.iastate.edu/). Examples of academic misconduct are: Attempting to use unauthorized information in the taking of a quiz or exam Submitting as one’s own work, themes, reports, drawings, laboratory notes, computer programs, or other products prepared by another person. Knowingly assisting another student in obtaining or using unauthorized materials Plagiarism o A useful link in understanding plagiarism, the consequences of plagiarism, and best practices for avoiding plagiarism is available at: http://instr.iastate.libguides.com/content.php?pid=10314. Academic honesty policies are included in the Policy on Academic Dishonesty and the Acceptable Use of Information Technology Resources. These policies are also contained in the Student Disciplinary Regulations. In addition, students are responsible for following ethical standards adopted by the various colleges and departments. Students with Disabilities: Please address any special needs or special accommodations with me at the beginning of the semester or as soon as you become aware of your needs. Those seeking accommodations based on disabilities should obtain a Student Academic Accommodation Request (SAAR) form from the Student Disability Resource (SDR) office (Phone 515-294-7220). SDR is located on the main floor of the Student Services Building, Room 1076. Policies and Procedures: Some Reminders... Modules MUST be done in sequential order. If a module will not open for you, you have not successfully completed the previous module by the due date. If you feel you have successfully completed the module and are still having difficulties opening the next module, please contact the instructor via Blackboard mail. This course is one-credit, and is based on a typical 16 week semester. It is recommended that students try to complete at least one module per week. It may be beneficial to complete 2-3 modules at a time to help retention of information. There are a few deadlines in place to ensure that students don’t fall behind and risk failing the class. If you have missed a deadline, please contact the instructor via Blackboard email as soon as possible. Deadlines for each module: o Modules 1-5 – Must be completed by FRIDAY, OCTOBER 18th at 5:00 PM. Module 1-5 quizzes will close October 18th at 5 pm and will not allow regular completion after that date. o Modules 6-10 – Must be completed by FRIDAY, NOVEMBER 15th at 5:00 PM. Module 6-10 quizzes will close November 15th at 5 pm and will not allow regular completion after that date. o Modules 11-15 – Must be completed before FRIDAY, DECEMBER 20th at 5:00 PM. Module 11-15 quizzes as well as the two required assignments, will close December 20th at 5 pm and will not allow regular completion after that date and time. A Comprehensive Final will be tested through the Module 15 competency. This will only become available after the other 14 modules have been successfully completed. Module 15 serves as a refresher of what the course has covered throughout the entire semester. The Module 15 competency will contain questions based on content from all of the modules. The Policies and Procedures quiz, all 15 modules, and two required assignments (from modules 1 and 6) must be completed with no less than 80% accuracy in order to pass the course. Failure to complete any of these components with 80% accuracy will result in failure of the course. All quizzes and the comprehensive final are open note; however, collaboration with other individuals on competencies is prohibited. Unlimited attempts are allowed on all of the competencies. There will be several questions selected from a test bank for each competency. Do not expect to see the same questions on a quiz if additional attempts are necessary on a module quiz. It is highly advised to participate in the module activities as it helps you retain the content. Remember, there are also TWO REQUIRED ASSIGNMENTS to complete throughout the semester in order to successfully complete the course. After completion of the course, you may want to print or save your notes and activities from each module for reference. Since this is an online-only course, there is limited interaction with your instructor. In exchange for the convenience of a self-paced, online-only course, you forego the more personalized, face-to-face discussions offered in typical classroom lectures. That being said, you are welcome to message your instructor through Blackboard if you have any questions or concerns about the course. You may also use the course discussion board to interact with your classmates, share ideas, or ask questions of each other. Module Topics: Topics for each module are listed below. Please note that all modules have a required quiz. In addition, two modules have required assignments, which are noted with an asterisk (*) Module 1 – Course Overview / Budgeting* Module 2 – Credit Module 3 – Credit Cards Module 4 – Debt Management Part 1: Debt & Your Limits Module 5 – Debt Management Part 2: How to Repair Poor Debt Management Module 6 – Financial Aid Part 1: Steps to Obtaining Aid* Module 7 – Financial Aid Part 2: Types of Aid Module 8 – Other Consumer Debt Module 9 – Saving, Part 1: How to Handle Your Bank Account Module 10 – Saving, Part 2: The Time Value of Money Module 11 – Insurance Module 12 – Housing Module 13 – Taxes Module 14 – Your Career Path: What it All Means Module 15 – Resources on Campus Required Activities: Complete instructions and due dates for the two required activities are available in Blackboard. Each activity is worth 25 points, and you MUST receive at least 80% on each activity in order to achieve the course requirements for passing. You are allowed one attempt for submitting each of these required assignments. Module 1 contains your first required activity. Although Module 1 is due by October 18th, this assignment will be due Friday, November 15th at 5:00 pm. This will allow you plenty of time to explore the modules and complete this assignment, which requires you to write out, create a timeline for, and assign a dollar amount on financial goals (short-, intermediate-, and long-term). You will then create a budget that incorporates these goals into your finances. Module 6 contains the second required activity, which will be due on Friday of Dead Week (Dec 13th at 5 PM). This activity entails creating a 4-year plan for college expenses, in which you will be asked to infer living expenses (on- or off-campus housing), as well as list financial aid options that may aid in financing your college education and determine if you have any shortfalls in your educational funding. Both required assignments may be submitted through the assignment link in their respective module folders, or you may use the shortcut links provided on the left-hand side of the course menu in Blackboard.