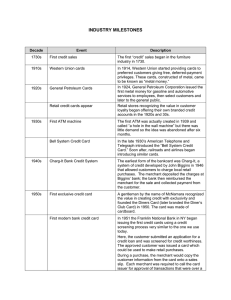

INDUSTRY MILESTONES

advertisement

INDUSTRY MILESTONES Decade Event Description 1730s First credit sales The first “credit” sales began in the furniture industry in 1730. 1910s Western Union cards In 1914, Western Union started providing cards to preferred customers giving free, deferred-payment privileges. These cards, constructed of metal, came to be known as “metal money.” 1920s General Petroleum Cards In 1924, General Petroleum Corporation issued the first metal money for gasoline and automotive services to employees, then select customers and later to the general public. Retail credit cards appear Retail stores recognizing the value in customer loyalty began offering their own branded credit accounts in the 1920s and 30s. First ATM machine The first ATM was actually created in 1939 and called “a hole in the wall machine” but there was little demand so the idea was abandoned after six months. Bell System Credit Card In the late 1930’s American Telephone and Telegraph introduced the “Bell System Credit Card.” Soon after, railroads and airlines began introducing similar cards. 1940s Charg-It Bank Credit System The earliest form of the bankcard was Charg-It, a system of credit developed by John Biggins in 1946 that allowed customers to charge local retail purchases. The merchant deposited the charges at Biggins’ bank; the bank then reimbursed the merchant for the sale and collected payment from the customer. 1950s First exclusive credit card A gentleman by the name of McNamara recognized the value in creating credit with exclusivity and founded the Diners Card (later branded the Diner’s Club Card) in 1950. The card was made of cardboard. First modern bank credit card In 1951 the Franklin National Bank in NY began issuing the first credit cards using a credit screening process very similar to the one we use today. Here, the customer submitted an application for a credit loan and was screened for credit worthiness. The approved customer was issued a card which could be used to make retail purchases. During a purchase, the merchant would copy the customer information from the card onto a sales slip. Each merchant was required to call the card issuer for approval of transactions that were over a 1930s certain amount, determined by the financial institution. The issuer would then credit the merchant’s account for the sale, minus a discount to cover the costs of providing the loan. 1950s MasterCharge The late 1950s was the beginning of the real credit card industry with MasterCharge appearing on the scene. However, cards had regional boundaries and could not be used nationally or internationally. Then in 1967, four California banks changed their name from the California Bankcard Association to the Western States BankCard Association (WSBA). WSBA opened its membership to other financial institutions in the Western U.S. Its bankcard product was known as MasterCharge. 1960s Revolving Credit By now, many card issuers were offering an added service: revolving credit. With this new service, the cardholder could maintain a balance on the account. The customer’s monthly payment included a finance charge on the unpaid balance. BankAmericard: First national credit card Bank of America was the first bank to actually issue national credit cards. In 1960, Bank of America introduced its own bankcard, the BankAmericard. Beginning with a small group of cardholders and merchants, the bank began licensing regional financial institutions to act as the BankAmericard bank for their region. The BankAmericard plan grew and in the next few years more and more communities all across the U.S. became serviced by a regional member representing BankAmericard. 1970s 1980s ATMS make a comeback ATMs and Debit Cards became popular between 1967 and 1971. The trend spread to Europe and now over 85% of the people use debit cards as opposed to 66% of the people using credit cards. BankAmericard became Visa In 1977, BankAmericard changed it’s name to Visa USA / Visa International Today Visa, located in San Francisco, CA has approximately 4.6 million global sales MasterCharge becomes MasterCard MasterCharge eventually became MasterCard. Today, MC is located in Purchase, NY has 1.7 million global sales. Discover Card It was inevitable that other cards would join the mix and Sears brought forward their own card in 1981 – the Discover Card. Today American Express The American Express Company we know today actually began in 1850 as an express delivery service; adding money orders in 1812 and travelers checks in 1958. Eventually credit cards were also added. Third party processors As the system became more complicated, outside service companies (third party processors) began to sell processing services to MasterCard and Visa members and member associations, reducing the cost of the card program for issuers and acquirers and expanding the ranks of participants in the bankcard industry system. MasterCard and Visa dominant Eventually, financial institutions interested in issuing cards in the U.S. became members of either BankAmericard or MasterCharge - bank associations with members sharing card program costs, making the bankcard program available to even very small financial institutions. Interbank (MasterCharge) and Bank of America (BankAmericard) emerged as the leaders in the bankcard systems . They developed rules and standardized procedures for their bankcard systems. The two associations also created international processing systems to handle the exchange of money and information and established an arbitration procedure to settle disputes between members. MasterCard and Visa, taken together, are second only to cash and checks as a payment system, generating hundreds of billions of dollars in charge volume annually. This is substantial growth for an industry that has only existed for about 50 years.