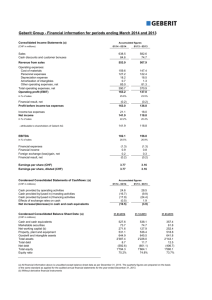

Example 10.1 - International Federation of Red Cross and Red

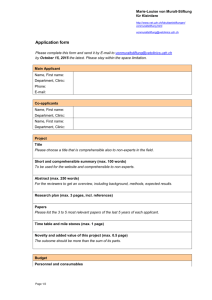

advertisement