WORKING PAPER NO. 14-28 IDENTITY THEFT AS A TEACHABLE

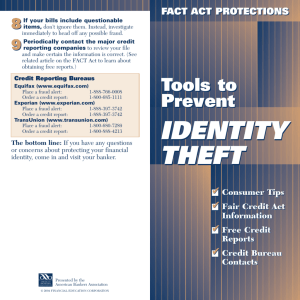

advertisement