Update on Current Conditions in the Credit Markets

advertisement

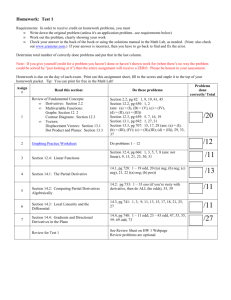

Update on Current Conditions in the Credit Markets (May 6, 2013) General Market News According to a report released by the Labor Department Friday (5/3) U.S. employment rose more than expected in April, pushing the unemployment rate to a four-year low of 7.5% – Following the strong U.S. jobs report, the Dow Jones Industrial Average and Standard & Poor’s 500 index both rose to record highs as U.S. Treasury and Municipal bond prices fell (yields decreased) On Friday (5/3), the Commerce Department reported new orders for manufactured goods dropped 4% in march – New orders slipped $19.5 billion to $467.3 billion; the largest drop since August 2012 The Institute for Supply Management reported Friday (5/3) that the U.S. services sector expanded at a slightly slower pace in the month of April as the non-manufacturing business activity composite index was 53.1% for the month, compared to 54.4% in March On Thursday (5/2), the European Central Bank cut its main interest rate by 25 basis points to 0.5%, which marks a new record low for the 17 European Union Countries that use the euro The Federal Open Market Committee released a statement on Wednesday (5/1) saying the Federal Reserve will continue open-ended programs to purchase longer-term Treasuries at a rate of $45 billion per month and mortgage-backed securities at a $40 billion per month – The Federal Open Market Committee also decided to keep the target range for the federal funds rate at zero to 0.25% Reported on Wednesday (5/01), the U.S. Manufacturing Purchasing Managers Index slipped to 52.1% from 54.6% in March, which is the lowest final reading since October (2012), as U.S. manufacturing growth pulled back to its slowest pace in six months U.S construction spending dropped to a seven-month low in March as public outlays recorded their largest drop since 2006; the Commerce Department said on Wednesday (5/1), that construction spending fell 1.7% to an annual rate of $856.72 billion, the lowest level since August (2012) The Commerce Department said on Monday (4/29), that consumer spending advanced 0.2% last month after an unrevised 0.7% increase in February The National Association of realtors announced on Monday (4/29) that its Pending Sales Index, based on last month’s contracts signed to purchase previously owned homes, rose 1.5% to 105.7%, as the housing market continues to accelerate this year Municipal Fixed Rate Market 10-year Treasury closed at a 1.78% on Friday, up from last week’s close of 1.70% and the 30-year Treasury closed at a 2.96%, up from last week’s close of 2.87% 10-year MMD closed at a 1.68% on Friday, slightly down from last week’s close of 1.69% and the 30-year MMD closed at a 2.82%, down from last week’s close of 2.87% Maturity 1-year 5-year 10-year 15-year 20-year 30-year Historical Low Since 6/1/1981 0.18 0.62 1.47 1.80 2.10 2.47 MMD Close Prior (5/3) Week (4/26) 0.20 0.20 0.73 0.74 1.68 1.69 2.23 2.28 2.53 2.58 2.82 2.87 Since 7/1/2004 Weekly Change (bps) -1 -1 -5 -5 -5 Min Max 51.75 58.80 75.07 80.99 81.96 82.74 333.33 229.46 190.45 215.36 221.82 212.27 MMD – US Treasury Ratio Rolling 1-year Current Prior Week Avg Avg (5/3) (4/26) 104.92 127.47 185.19 183.49 88.31 102.81 100.00 105.71 91.80 101.86 96.55 100.59 101.03 110.61 108.36 115.27 104.21 110.10 107.16 113.33 101.22 101.10 95.59 100.35 *New low As reported by the Bond Buyer, municipal issuers came to market last week with a total of about $5.52 billion According to Lipper FMI, municipal bond mutual funds reported $391 million of net outflows in the week ended 5/1 – This marks the ninth consecutive week, the longest stretch since mid-2011, equally a total of $2.5 billion Municipals improved 2-8 basis points early in the week but gave back some gains after Friday’s employment report Municipals substantially outperformed Treasuries on Friday as the 30-year Treasury bond was weaker by 14 basis points and MMD was cut by 3 basis points The primary market had another strong week, led by the $1.1 billion Iowa Fertilizer deal; the bonds traded up by more than 30 basis points in secondary trading 5/6/2013 4:43 PM Municipal Fixed Rate Market Visible Supply As reported by TM3, the 30-day tax-exempt visible supply is approximately $6.73 billion – The maximum visible supply over the last 60 days was $13.84 billion, while the minimum was $5.34 billion and the average was $9.19 billion Municipal bonds to be sold this week are estimated to total $4.97 billion – $3.03 billion negotiated – $1.93 billion competitive Top Municipal Bond Transactions for the Week of 5/06 (in excess of $50 million) Preliminary Size ($000) 300,000 202,280 190,000 187,940 169,290 156,715 152,365 147,000 142,120 137,000 130,710 127,605 117,000 92,895 92,550 90,480 82,995 69,715 68,530 67,830 59,250 58,650 55,150 51,700 50,000 50,000 Issuer Build Illinois Bonds, IL Regional Transportation District Sales Tax Ref (Fastracks Project) City Of Houston, TX Combined Utility System First Lien Rev & Ref Bonds Massachusetts Water Poll State Revolving Fund Bonds, MA Louisiana Taxable General Obligation Bonds Beacon Health System, IN; Indiana Finance Authority Hospital Rev & St. Joseph County Hospital Rev Illinois Finance Authority Rev Bonds, The University Of Chicago Maryland Health & Higher Educational Facilities Authority Rev Medstar Health Issue, MD Cypress-Fairbanks, TX Independent School District Ref Bonds Sonoma County, CA Junior College District General Obligation Ref Bonds 2013 Louisiana General Obligation Bonds Illinois Housing Development Authority Housing Bonds, IL Massachusetts Housing Finance Agency Housing Bonds (Non AMT), MA Virginia Resource Authority, Infrastructure Rev Bonds, VA Pima County, AZ Certificates of Participation Northside Independent School District, TX Variable Rate School Building Bonds Metropolitan School District of Warren Township Vision School Building Corporation, IN Ref Bonds Charleston County, SC General Obligation Transportation Sales Tax Ref Bonds Desert Sands Unified School District Riverside County, CA Ref Series Mcallen Independent School District Texas Unlimited Tax Ref Bonds Series 2013A Lafayette, IN Sewage Works Ref & Rev Bloomfield Hills Schools County Of Oakland, MI School Building And Site Bonds Seattle, WA Limited Tax General Obligation Improvement & Ref Bonds Rhode Island Health & Educational Building Corporation, RI University Of Rhode Island Seattle, WA Unlimited Tax General Obligation Improvement Bonds Metropolitan Transportation Authority, NY Transportation Rev Bonds Structure TAX TE TE TE TAX TE TE TE TE TE TE TAX TE TE TE TE TAX TE TE|TAX TE TE TE TAX TE TE TE Neg vs. Comp Comp Neg Neg Comp Comp Neg Neg Neg Neg Neg Comp Neg Neg Neg Neg Neg Neg Comp Neg Neg Neg Neg Comp Neg Comp Comp Build America Bonds (“BABs”) The following are the BAB secondary market spreads as of close Friday (5/3): Transaction Sale Date Ratings Selected Maturity Call Provisions Initial Taxable Yield (%) Initial Spread to Treasury (bps) Current Spread to Treasury (bps) Initial Tax-Exempt Equivalent Yield(%)1 Initial Spread to MMD (bps)1 Current Spread to MMD (bps)1 1Tax-Exempt State of California 11/19/2010 A1/A-/A2040 Non-Callable 7.600 +325 +145 4.94 31 7 University of Texas 6/10/2009 Aaa/AAA/AAA 2039 Make-Whole + 20bps 5.262 +100 +70 3.42 (62) (40) City of Chicago 1/11/2010 Aa3/A+/AA2036 Make-Whole +25bps 6.207 +150 +230 4.03 37 74 Equivalent Yield takes into account the 35% interest-cost rebate from the U.S. Treasury Municipal Variable Rate Market SIFMA reset at a 0.19%, 95.86% on a day count adjusted basis of 1-month LIBOR (0.198%) and 69.57% on a day count adjusted basis of 3-month LIBOR (0.273%) Disclaimer All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness. All information and opinions as well as any prices indicated are currently only as of the date of this report, and are subject to change without notice. Any estimations or projections as to events that may occur in the future (including projections of market performance) are based upon the best judgment of Siebert Brandford Shank & Co., L.L.C. ("SBS") from publicly available information as of the date of this report. There is no guarantee that any of these estimates or projections will be achieved. SBS expressly disclaims any and all liability relating or resulting from the use of this report. 5/6/2013 4:43 PM