990

Form

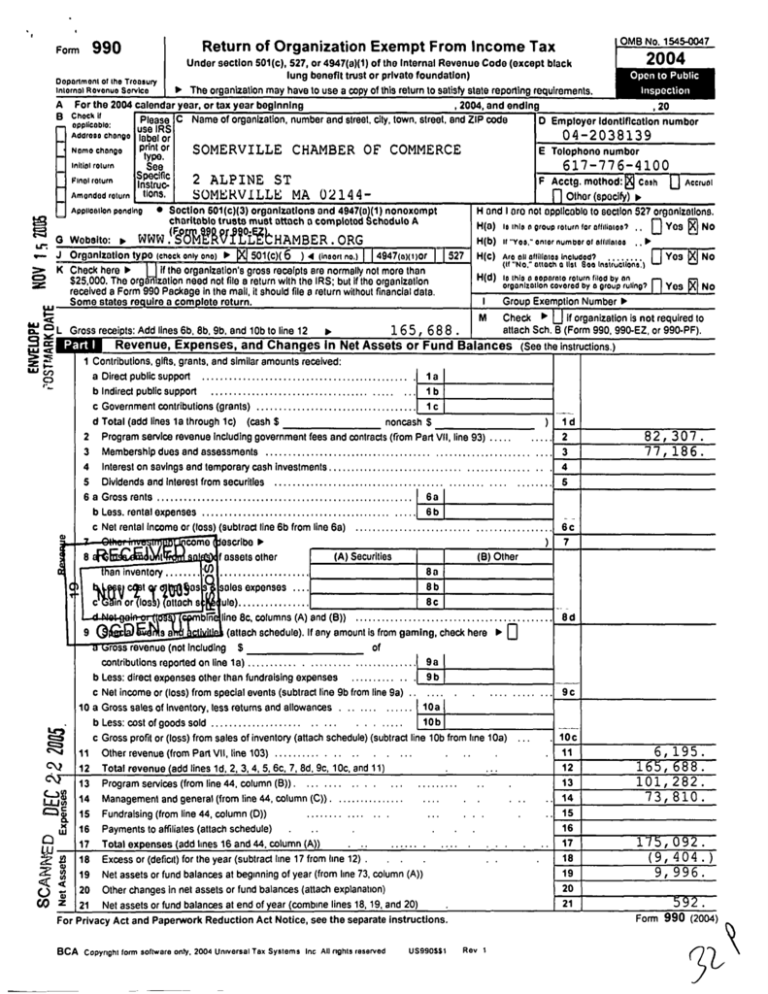

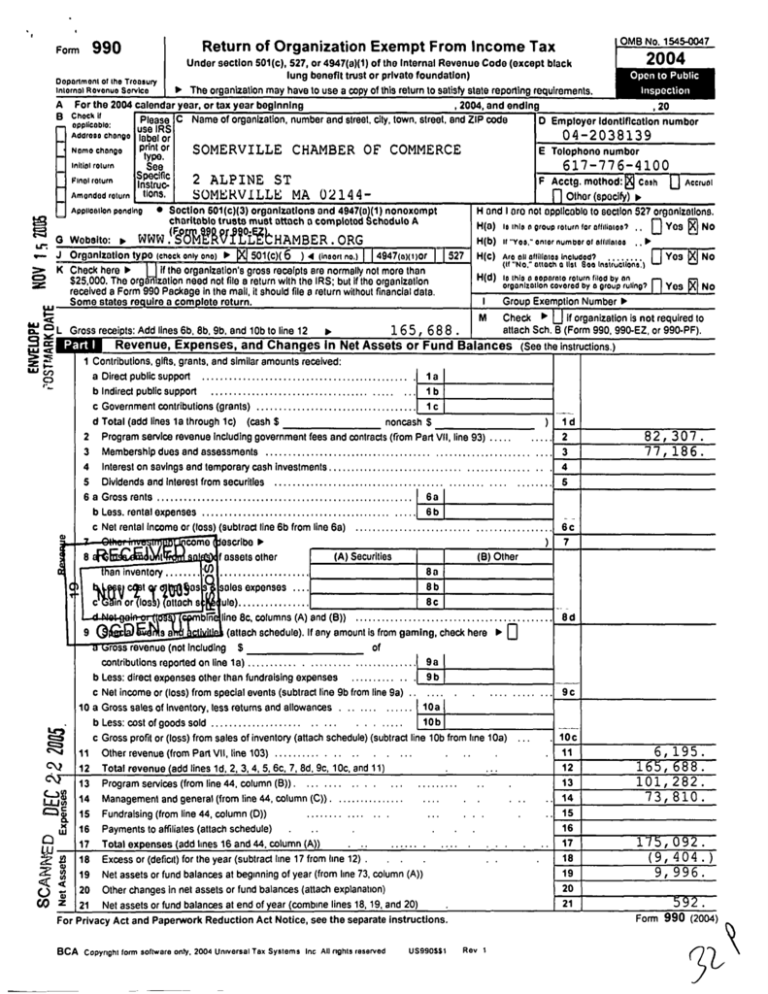

Return of Organization Exempt From Income Tax

2004

Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except black

lung benefit trust or private foundation)

Department of the Troasury

internal ROvonuo-Sorvko

0- The organization may have to use a copy of this return to satisfy state reporting requirern

A For the 2004 calendar )ar, or tax year beginning

, 2004, and ending

,10

g Chock 11

Name

of

organization,

number

and

street,

city,

town,

street,

end

ZIP code

Please

0 Employer identification number

opplieoDio:

nddrooo ononpo

Nome ononpo

Initial rolum

use IRS

label or

print or

type.

See

Final roiurn

Amended rolurn

Specific

Instruct

Application pondina

dons,

E Telephone number

2 ALPINE ST

F ACCtg .1110thOd :

Cash

Other (spocly) 1,

r J Organization

typo (chock only ono) 0,

501(C)( 6 ) t IIneort no .)

4947(o)(t)0r

aw. Y L Gross receipts : Add lines 6b, 8b, 9b, and 10b to line 12

b.

U Accrual

H and I ore not opplicoblo to section 527 organizaIlons.

its Section 601(c)(3) organizations and 4947(a)(1) nonexempt

charitable

t

trusts must attach a completed 3chodulo A

K Check here Iii,

If the organization's gross receipts ere normally not more than

$25,000 . The org ani zation need not file e return with the IRS ; but if the organization

received a Form 990 Package in the mail it should file a return without financial data

Some states re q uire a com p lete return.

s

617-776-9100

5UMEKV ILLE MA 02144-

o wobelto: ~ WWW~FS~~SC'IV~t~I~~,0L~'T'bHAMBER . ORG

o

09-2038139

SOMERVILLE CHAMBER OF COMMERCE

H(0)

327

,,

If "Y00," Onion numbOr Of AIIIIIH100

. . 1110

11

Y08

FM

nro ell ellllloioa Inoludod9

, ,

(If "NO," attach o list Sao InakucUOne .)

H(d)

to this n eopOrnto rolurn IIIOO by an

organization tovared by p group ruling? n yes R NO

M

Group Exec

Check 10

attach Sch .

Y09

NO

H(H(C)

I

165, 688 .

10 this p group r6turn for 0lfillgl0o7

NO

Number

if organization is not required to

(Fo rm 990, 990-EZ, or 990-P F) .

Revenue, Expenses, and Changes in Net Assets or Fund Balances See the Instructions.

r`

N

C\?

64

1 Contributions, gifts, grants, and similar amounts received :

a Direct public support

1a

b Indirect public support

.. . .. ... .. .. ... .. . .. ... .. . . . .. ..... . ... . .

1b

c Government contributions (grants) . . . . . . . . . . . . . . . . ., . . . . ., . . . . . . . . . . . . 1 c

d Total (add lines 1a through 1c) (cash $

noncash $

2 Program service revenue including government fees and contracts (from Part VII, line 93) . . . . .

3 Membership dues and assessments . . . . . . . . . . . . . . . . . ., . . . . . . . . . . . . . . . . . . , . . . ., . . . . . . ., . . . . . .

4 Interest on savings end temporary cash Investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . , . . . . . . . . . . .,

5 Dividends and Interest from securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8 a Gross rents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6a

b Less .rental expenses . . . ., . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8b

c Net rental Income or (loss) (subtract line 6b from line 6a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

_

come ascribe ~

(A) Securities

8 aKWs.dMdJAl~

f assets other

(B) Other

an Inventory . . . . . . . . .N . . . . . . . . . . . . . . . . . . . .

80

t~~.~~1 cqet pr ~~~os

elect expenses . . . .

8b

c~~ n or7losl) O110Chea

,

ule)

8C

bin line 8c, columns (A) and (B)) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9 ~~C~

sa

..

(attach schedule) . If any amount is from gaming, check here t 0

)

. ... .

. . .. .

. .. .

.. ... .

4

6

.. ... .

)

8c

7

.. ...

8d

ross revenue (not including $

of

contributions reported on line 1a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9a

b less : direct expenses other than fundraising expenses

. .. .. . . .. . . . . 9b

c Net income or (loss) from special events (subtract line 9b from line 9a) . . . . . . .

.. . . . .. . . ..

10 a Gross sales of Inventory, less returns and allowances . . . . . . . . . . . . . 10a

b less : cost of goods sold . . . . . . . . . . . . . . . . . . . . . . . . .

10b

. . . .. .. .

c Gross profit or (loss) from sales of inventory (attach schedule) (subtract line 10b from line 10a) . . .

11 Other revenue (from Part VII, line 103) . . . . . . . . . . .

,.

,

12 Total revenue add lines 1d, 2, 3, 4, 5, 6c, 7, 8d, 9c, 10c, and 11) . . . .

13

14

15

16

17

18

19

Program services (from line 44, column (B)) . . . . . . . . . . . .

.. .

. . .. .. . ..

Management and general (from line 44, column (C)) .

~r

Fundraising (from line 44, column (D))

.. .. . .. . . .. .

.. .

.. .

Payments to affiliates (attach schedule)

..

Total expenses (add lines 16 and 44, column (A))

. ..

. .. ... .

.. ..

Excess or (deficit) for the year (subtract fine 17 from line 12) .

. .

Net assets or fund balances at beginning of year (from line 73, column (A))

20 Other changes in net assets or fund balances (attach explanation)

21 Net assets or fund balances at end of year (combine lines 18, 19, and 20)

For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions .

BCA Copyright term software any, 2004 Universal Tax Systems Inc All rights reserved

US990E51

..

.

.

.

.

. . .

. .

1d

2

..

9c'

10c

»

12

13

14

6~ 195

165, G88

101, 282

73,810

tip18

1s

175,092 .(9, 404 . )

9, 996 .

15

16

20

.

.

.

.

Forth 99U (2004)

Rev 1

3z

Form99o(2ooa) SOMERVILLE CHAMBER OF COMMERCE

liam

Statement of

Functional Ex p enses

Do not Inetudo amounts roportod on lino Bb, 8b, 8b. 10b, or 18 of Port 1.

(A) Total

22

Grants and allocations (attach schedule)

23

24

28

Specific assistance to Individuals (attach schedule) . . . .

Benefits paid to or for members (attach schedule) . . . . . .

Compensation of officers, directors, etc . . . . . . . . . . . . . . . .

(cosh $

28

2 5 0 0 . noncesh S

)

22

35

Pension plan contributions . .

Other employee benefits . . . .

Payroll taxes . . . . . . . . . . . . . .

Professional fundrolslng fees

Accounting tees . . . . . . . . . . . .

Legal fees . . . . . . . . . . . . . . . . . .

Supplies . . . . . . . . . . . . . . . . . .

Telephone . . . . . . . . . . . . . . . . . .

Postage and shipping . . . . . .

...

...

...

...

...

...

...

...

...

..

..

..

..

..

..

..

..

..

...

...

...

...

...

...

. ..

. ..

. ..

.. ...

.. ...

.. ...

.. ...

.. ...

.. ...

.. ...

.. ...

... ..

..

..

..

..

..

..

..

..

..

. ..

. ..

. ..

., .

. ..

. ..

. ..

. ..

. ..

.. ...

.. .. .

.. ...

.. ...

.....

.....

.....

.....

.....

..

..

..

.

.

..

..

..

..

.

.

.

37

38

Equipment rental and maintenance . . . . . . . . . . . . . . . . . . .

Printing and publications . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(B)

2500 .

23

24

s6

Other salaries and wages . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

27

28

29

30

31

32

33

34

09-2038139

_

27

28

29

30

31

32

33

39 Travel . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39

70 .

. 35

37

38

43

44

Othar oxpanooa not COVOrOd

b M15l.

0

mlzo):

a

. .. .... .

I N S URANC E

42

a3a

1573 .

1573 .

9 40

240 .

9 41

240 .

35 .

3287 .

896 .

5532 .

35 .

27917 .

957 .

454 .

227 .

227 .

1292 .

43c

43d

43e

17 5

28874 .

692 .

41

43b

Tota l functional expenses (odd nnoe ss through aa),

35673 .

12 150 .

17 5

3287 .

895 .

5532 .

1881

480 .

40 Conferences, conventions, and meetings . . . . . . . . . . . . . . 40

Depreciation, depletion, etc (attach schedule)

2500 .

350

3s Occupancy . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3s

42

(D) FundroitiIng

-f-2-5-f97

34

interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(C)

1-1-5-4-67 -3-5-6-7 3 .

2 476 .

1 1

3146 .

6574 .

1791 .

11064 .

411

Page 2

AI organiza tions mus t compl e te co l umn

, Co l umns

, en

are requi red for se ct ion

c

and (4) organizations and section 4947(x)(1) nonexempt charitable trusts but optional for others. (See

the instructions . )

692 .

1292 .

Organizations completing columns (B)-(Dg,

carry these tows to lines 13-16

44

175092 .

101282 .

73810 .

Joint Costs . Check 0,

if you ore following SOP 98-2 .

Are any joint costs from o combined educational campaign and fundraising solicitation reported in (B) Program services? . . . . . . 10.

Ii "Yes," enter (I) the aggregate amount of these Joint costs $

; (II) the amount allocated to Program services $

(III) the amount allocated to Mana g ement and g eneral $

; and Iv the amount allocated to Fundralsing

Yes

0 No

jj] Statement o Program Service Accompl i shments (See the Instructions.)

What Is the organization's primary exempt purposed

P.

CHAMBER OF COMMERCE

Kpensos (Roqulrod

r 60t(e)(J) 8 (4) orpo,.

4947(o)(i) trusts : but

All organizations must describe their exempt purpose achievemen t s n o c lear an conci se manner, St a te e num ber o c lien t s

served publications issued, etc. Discuss achievements that are not measurable . (Section 501(c)S3) and (4) organizations and

4947(a)(1) nonexempt charitable trusts must also enter the amount of grants and allocations to o hers .)

o MEETINGS WITH LOCAL BUSINESS AND LOCAL GOVERNMENT OFFICIALS

IN OPEN FORUM

95368 .

(Grants and allocations $

2500 . )

n BUSINESS DIRECTORY TO ALLOW RESIDENTS TO MAINTAIN A BETTER

UNDERSTANDING OF BUSINESSES WITHIN THEIR COMMUNITY

and allocations

$

and allocations

$

(Grants and allocations

and allocations

$

$

c

d

e Other program services (ettac

f Total of Program Service Ex

should equ al line 44, column I

BCA Copyright form software any, 2004 Universal Tea Systems, Inc All rights reserved

>

I

5919 .

Form 990 (2004)

US9905S2

Rev 1

Form990(zo04) SOMERVILLE CHAMBER OF COMMERCE

09-2038139 Fege3

Balance Sheets (Seethe instructions.)

Note :

Where required, attached schedules and amounts within the description

column should be for end-of-year amounts only.

(A)

Beginning of year

Cash - non-Interest-bearing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Savings end temporary cash Investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

45

48

22 , 3 4 6 .

47 a Accounts receivable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47a

b Loao : ollowonco for doubtful accounts . . . . . . . . . . . . 47b

47c

Plodgoa rocetvoblo . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 480 - --- ---- -----Loss : allowanco for doubtful accounts . . . . . . . . . . . . 48b

Grants receivable . ., . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Recelvobles from officers, directors, trustees, and key employees

(attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

51 a Other notes and loans receivable (attach

schedule) . . . . . ., . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 51a

b less : allowance for doubtful accounts . . . . . . . . . . . . Sib

52 Inventories for sale or use . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

53 Prepaid expenses and deterred charges . . . . . . . . . . . . . . . . . . . . . . . . . . . , . . . . . . .

54 Investments - securities (attach schedule) . . . . . . . . . . . . 111, a Cost 0 FMV

55 a Investments - land, buildings, and

equipment : basis . . . . . . . . . . . . . . . . . ., . . . . . . . . . . . . SSa

48 o

b

48

50

°'

b Less: accumulated depreciation (attach

schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

56 Investments- other (attach schedule)

57 a Land, buildings, and equipment : basis

b Less: accumulated depreciation (attach

schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

58

othor

45

48

-(B)

End of year

9,133 .

48C

49

60

51c

55b

. .. .. .. .. .

. . . . . . ., . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . 57a

55t

58

. .. .. .... .

57C

67b

Decals (doscribo

59

80

81

82

83

Total assote odd tines 45 throu gh 58 must e q ual line 74 ) . . . . . . .

Accounts payable and accrued expenses . . . . . . . . . . . . . . . . . . . . . . . .

Grants payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Deferred revenue . . . . . . . . . . . . . . . . . . . . ., . . . . . . . . . . . . . . . . . . . . . . . . .

Loans from officers, directors, trustees, and key employees (attach

schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

64 a Tax-exempt bond liabilities (attach schedule) . . . . . . . . . . . . . . . . . . . . .

b Mortgages end other notes payable (attach schedule) . . . . . . . . . . . . .

85 oinor

P- TAX WITHHOLDINGS

..

..

..

..

. . .. .. .

.. .. .

.. . .. .. .

.. . .. .. .

..

..

..

..

..

..

.. .

.. .

22, 396 . I ss

.. .. . .. .. . .. . ..

.. ... .. .. . .. ...

2 , 350 .

ss

5 , 629 .

2 912 .

1-2 , 250 .

ss

8

9 996 .

67

Ilnblliiioo (aoaaribo

66 Total Ilabilitlos add lines 60 throu gh 65 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Organizations that follow SFAS 117, check here . . . . ~ ~ and complete lines 67

through 69 and lines 73 and 74 .

67 Unrestricted . . . . . . . . . . . . . .

. . .. . .. .

. . . .. ..

68 Temporarily restricted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. .. . . . . .. .. ... .

69 Permanently restricted . . . . . . . . . . . . . . . . .

. .

. . ...

. . .. .. ... .

Organizations that do not follow SFAS 117, check here . . ~ a , and complete

o`

70

71

72

c,

z

73

lines 70 through 74 .

.. .. . . .

.. .

..

Capital stock, trust principal, or current funds

Paid-in or capital surplus, or land, building, and equipment fund

.. . . .

Retained earnings, endowment, accumulated income, or other funds .

Total net assets or fund balances (add lines 67 through 69 or lines

..

9 , 133 .

..

.

..

.. . . .

.. ..

68

69

591 .

592 .

70

70 through 72 ;

9 , 996 .

73

592

column (A) must equal line 19, column (B) must equal line 21)

2

2

,

3

4

6

.

74

1

9,

net

assetsHund

balances

add

lines

66

and

73

74 Total liabilities and

Form 990 is available for public inspection and, for some people, serves as the prima ry or sole source of information about a particular

3anization . How the public perceives an organization in such cases may be determined by the information presented on its return . Therefore,

ease make sure the return is complete and accurate and fully describes, in Part III, the organization's programs and accomplishments

A

Copynght form software only . 2004 Unrveroel Tax Systems, Inc All rights reserved

US990SS3

Rev 1

.

Form sso (zooa) 50MERVILLE CHAMBER OF COMMERCE

LVEM

Reconciliation of Revenue per Audited

Financial Statements with Revenue per

Return (see the Instructions .)

71

a

b

(1)

(2)

(3)

(4)

Total revenue, gains, and other support

per audited financial statements . . . . . . . 0Amounts included on line a but not on

.

line 12, Form 990:

Net unrealized gains

on Invoatmonta . . . . $

Donated services

8. use of facilities . . $

Rocoverloa of prior

year grunts . . . . . . . . 5

Other (specify) :

S

Add amounts on lines (1) through (4) . . . . 0,

c

d

Line a minus line b . . . . . . . . . . . . . . . . . . . .,

Amounts Included on line 12,

Form 990 but not on line a :

(1) Investment expenses

not included on

line 6b, Form 990

$

(2) Other (specify) :

e

5

Add amounts on lines (1) and (2) . . . . . . . . to,

Total revenue per line 12, Form 990

( line c p lus line d

. 10,

a N/A

04-203 8139 Page 4

Reconciliation of Expenses per Audited

Financial Statements with Expenses per

Return

o

Total expenses end losses per audited

financial statements . . . . . . . . . . . . . . . . . . . . 1111b Amounts included on line a but not

on line 17, Form 990;

(1) Donated services

& U80 01 facilities

$

(2) Prior year odJuntmonto roportod on

$

Ono 20, Form 890

(3) Lossoo reported on

line 20, Form 990

(4) Other (specify) :

$

b

c

d

e

Add amounts on lines (1) through (4) . . . 00

Line a minus line b . . . . . . . . . . . . . . . . .

Amounts included on line 17,

Form 990 but not on line a :

(1) Investment expenses

not included on

line 6b, Form 990

$

(2) Other (specify) .

c

d

e

5

Add amounts on lines (11) and (2) . . . . . . . . 10,

Total expenses per line 17, Form 990

( line c p lus line d

,t

d

e

List of Officers, Directors, Trustees, and Key Employees (use each one even If not compensated: seethe

instructions .)

75 Did any officer, director, trustee, or key employee receive aggregate compensation of more than $100,000 from your

organization and all related organizations, of which more than $10,000 was provided by the related organizations?

If "Yes," attach schedule - see the instructions

0- 0 Yes

0 No

Form 990 (2004)

BC/r

Copyright form software only . 2004 Universal Tax Systems, Inc All rights reserved

US990E54

Rev 1

Form99o(200a) SOMERVILLE CHAMBER OF COMMERCE

Other Information (Seethe instructions.)

78

77

04-2038139 Pages

Yes No

Did the organization engage in any activity not previously reported to the IRS? II `Yon .' attach o detailed description of each activity

. .. ... .. ... ...

Were any changes made in the organizing or governing documents but not reported to the IRS? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

I( "Yes ;" attach a conformed copy of the changes.

78 a Did the organization have unrelated business gross income of $1,000 or more during the year covered by this return? . . . . . . . . . .

b if "Yes," has it filed e tax return on Form 990 "T for this year? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ,

79

Was there a liquidation, dissolution, termination, or substantial contraction during the year? It "Yes," attach o statement . . . . . . . .

80 0 la the organization related (other than by association with o statewide or nationwide organization) through common

membership, governing bodies, trustees, officers, etc,, to any other exempt or nonexempt organization? . . . . . . . . . . . . . . . . . . . . . .

b If "Yes," onlor " ho name of tho organization 1110,

and chock whether It Is . . . . oxompt or

nonozompt .

81 o Enter direct or Indlroct political oxpenditures, Sao line 81 Instructions . . . . . . . . . . . . . . . . . . . . . . 1 810 1

b Old the organization file Form 1120" POL for this year? . . . . . . . . . . . . . . . , . . , . . . . . , . . . . . . . . . . . . . . . . . . . . . . , . . . . , . . , , , , , , , , , , ,

82 a Did the organization receive donated services or the use of materials, equipment, or facilities at no chargo or at

substantially less than fair rental value? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . , . . . . . . . . . . . . . , . . . . . . . . . . . . . . . . . . . . .

b If "Yes," you may Indicate the value of these Items here . Do not Include this amount

as revenue In Part I or as an expense in Part II . (See Instructions in Pen III .) . . . . . . . . . . . . . . . . 82b

83 a Did the organization comply with the public Inspection requirements for returns and exemption applications? . . . . . . . . . . . . . . . . .

b Did the organization comply with the disclosure requirements relating to quid pro quo contributions? . . .

. . .. .. . . . . .. . . .

84 a Did the organization solicit any contributions or gifts that were not lax deductible?

. .. . .. . . .. .. . .. . .. .. . . . .. .. . .. .. . .. .

b If "Yes," did the organization Include with every solicitation an express statement that such contributions or gifts were not

tax deductible? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

85

501(c)(4), (5), or (6) organizations .a Were substantially all dues nondeductible by members? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b Did the organization make only in-house lobbying expenditures of $2,000 or less? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

If "Yes" was answered to either 85a or 85b, do not complete 85c through 85h below unless the organization received a

waiver (or proxy tax owed for the prior year .

c Dues, assessments, end similar amounts from members . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 85c

d Section 162(e) lobbying and political expenditures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 85d

e Aggregate nondeductible amount of section 6033(e)(1)(A) dues notices . . . . . . . . . . . . . . . . . . . . . . . . 850

t Taxable amount o1 lobbying and political expenditures (line 85d less 85e) . . . . . . . . . . . . . . . . . . . 85f

g Does the organization elect to pay the section 6033(e) tax on the amount on line 85f? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

h If section 6033(e)(1)(A) dues notices were sent, does the organization agree to add the amount on line 85f to Its

reasonable estimate of dues allocable to nondeductible lobbying and political expenditures for the following tax year? . . . . . . . .

88

501(c)(7) orgs . Enter: o Initiation fees and capital contributions Included on line 12

. . . . . . . . . 88a

b Gross receipts, Included on line 12, for public use of club facilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . 86b

501(c)(12) orgs . Enter : o Gross Income from members or shareholders . . . . . . . . . . . . . . . . . . . . . . . . 87a

b Gross Income from other sources . (Do not net amounts due or paid to other sources

against amounts due or received from them .) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 87b

88

At any time during the year, did the organization own a 50% or greater interest in a taxable corporation or

partnership, or en entity disregarded as separate from the organization under Regulations sections

301 .7701-2 and 301 .7701-3? If "Yes," complete Part IX . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

89 a 501(c)(3) organizations. Enter: Amount of tax imposed on the organization during the year under :

, section 4955 0,

section 4911 "

; section 4912 lo,

b 501(c)(3) and 501(c)(4) orgs. Did the organization engage In any section 4958 excess benefit transaction

during the year or did It become aware of an excess benefit transaction from a prior year? If "Yes," attach

X

76

X

77

780

78b

79

X

X

X

-80a ,

-

X ,

81 b

X

82a

X

83e

83b

84a

84b

85a

85b

X

X

X

X

X

X

85g

X

85h

X

88

X

87

a statement explaining each transaction . . . . . . . . . . . . . . . . . . . . .

. . . .. . .. .

c Enter : Amount of tax Imposed on the organization managers or disqualified persons during the year

sections 4912, 4955, and 4958 . . . .

..

. . .

. .. . . . .

.. .

. . . . .

. .. . .

d Enter Amount of tax on line 89c, above, reimbursed by the organization

filed

a

the

with

which

of

this

return

is

01,

90

List

states

a copy

. .. . . .

under

.

. . .. .

. . . . . . ..

L

. . . . . 89b

b Number of employees employed in the pay period that includes March 12, 2004 (See instructions .) . .

. ..

~ 90b

Telephone

617

-77 6-4 10 0

The

fn

0CHAMBER

no

0,

91

books are care of

92

BCA

Locatedat 0, 2 ALPINE ST SOMERVILLE MA

ZAP+a0-

Section 4947(a)(1) nonexempt charitable trusts filing Forth 990 in lieu of Form 1041 - Check here

and enter the amount of tax-exempt interest received or accrued during the tax year

Copyright loan software only . 2004 Universal Tax Systems, Inc Alt rtphle reserved

US990E55

Rev 1

02194. .. .

0,

. .

I .92 I .

..

Form 990 (2004)

Form99o(2ooa) SOMERVILLE CHAMBER OF COMMERCE

Anal ysis of Income-Producin g, Activities (Seethe tnstruatons .

ExGuded b section 512, 513, or 514

Unrelated business income

Note : Enter gross amounts unless

otherwise indicated.

97 Program service revenue :

oMEETINGS & OUTINGS

bNEW GROUP

(A)

Business

code

09-2038139 Page 6

(C)

Exclusion code

(B)

Amount

(E)

Related or exempt

function income

(D)

Amount

59,307 .

28,000 .

c

d

e

f Medlcore/Medicold payments

. ... ... .

94

g Foos a controcta from govt . ogencloa . .

77,

Momborshlp duos & nsaosamonts . . . . . .

moroet on savings end temporary croon

96

Invoelmonte

98

97

$

. . . . . . . . . . """ . "" . . . " . """"

98

Dividends 8. Interest from securities . . . .

Not rental income or (loss) from real estate :

a debt-financed property . . . . . . . . . . . . . .

b not debt-financed property

.. .. . .. . . .

Not rental income or (lose) from personal

proporty . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

99

100

Other investment Income . . . . . . . . . . . . . .

Gain or (loss) prom 50103 Of 050018 other

than Inventory . .

... .. .. . .. ..

. .. .. . .. . . .

.. . .

101

Not Income or (lose) from special events

102

Gross profit or (loco) from solos of Inventory , ,

103 Ott,errevenue: aMEMB DIR

b

591800

6,195 .

c

d

e

104 Subtotal (odd columns (e), (D), and (E)) . . ,

r 19 5

104,

(D),

and

(E))

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

. .. .. . . . .. . .. .. .. .. .. . .. . .. .. . . .. .

105 Total (add fine

columns (8),

Note: Line 105 p lus line 1d Part I should eq ual the amount on line 12 Part I .

Line No .

..

159,4

~

,8

Relationshi p of Activities to the Accom p lishment of Exem pt Pur p oses ( Seethe Instructions .)

Explain how each activity for which Income la reported In column (E) of Pan VII contributed Importantly to the accomplishment of the

organization's exempt purposes (other than by providing funds for such purposes) .

FORUM FOR OPEN DISCUSSION AMONG BUSINESS LEADERS REGARDING CURRENT

ISSUES AFFECTING BUSINESS AND ECONOMIC ACTIVITY

EETINGS AND PRESS RELEASES REVOLVING AROUND ECONOMIC DEVELOPMENT

F THE CITY AND ITS BUSINESS RESIDENTS

Information Regarding Taxable Subsidiaries and Disregarded Entities (Seethe Instructions . )

93A

93B

S( ,

. Name, address, andAEIN of corporation,

paAnership or diare arded emit

NONE

C

Nature of activities

Percentage of

ownershi p Inl .

~D

Total (Income

E

End-of-year

assets

o

o

o

Information Regarding Transfers Associated with Personal Benefit contracts see Specific Instructions)

(a) Did the organization, during the yr ., receive any funds, directly or indirectly, to pay premiums on a personal benefit contract? . . .

. .

(b) Did the organization, during the year, pay premiums, direly or indirectly, on a personal benefit contract?

Note : If "Yes" to ( b ) , file Form 8870 and F

472

e instructions

Please

Sign

Here

P a ld

'~

'

Signat

T

y

V

o

xor~

lion o

opor

is et

I ,

41 ~~rf'~1~~'

or print name and title

Firm's name (or yours

it calf-employed) .

address andZIP-4

pen~m~ efr heuea pnd sloto enpts

090 ~o o (n ormot on of which re

~A o

o its

f officer

signature

Preparer's

Use Only

BC{\

n Cr P4n0

s o ~or u

beliol, 1

uo, eo oe ,

the b

Res en

1 0l mY

now19E

-ledge and

Date

/°X~fta~71>T~L~E"n

Check if

self-

_7D t

`7

employed 0

PAUL B BA.0 JR - CPA

17 COLLEGE AVE

~SOMERVIL-aMA 02144-0001

Copyright form software any, 2004 universal Tax Syete.jp. .\F All rights reserved

nd t

are,

Yes {X~ No

Yes ~ No

US990E56

Preparer's SSN or PTIN (See Gen Inst W)

-

010

EIN

Phonano ~

Rev 1

-34-3630

04-2630604

617-666-9759

Form 990 (2004)

04-2038139

us 990

Class of Activi

RANT

Grants and Allocations

990 : Paae 2 . Line 22 : 990-EZ : Paae

Donee's Name end Address

HOME FIRST CORP

SOMERVILLE MA

Copyright form software only, 2004 Universal Tax Systems . Inc

All rights reserved

Line 10

2004

NE

2, 500 .

USSTX221

04-2038139

us 990

Lenders Name and Title

and Relationship to Any

Officer, Director, or Other

Dis qualified Person

Mortgages and Other Notes Payable as of Year End

990: Pa g e 3 Line 64b; 990-PF : Page 2 Line 21

Repayment Terms, Interest

Rate, Security Provided, Loan

Purpose, Description and

FMV of the consideration

WINTER HILL BANINTEREST MONTHLY

Copyright form software only, 2004 universal Tax Systems . Inc

All rights reserved

Original Amount

of Note

10,000 .

10,000 .

USSTX64B

Bolonce Due

2004

Data of Note

Mat rit Date

5,629 .11/15/200902/1672006

5,629 .

Form

8868

S~d

9/~ ,

Application for Extension of Time to File an

(December 2004)

Exem P t Or 9 anization Return

DaDOrlmpnl of the Treasury

File a separate application for each return .

iniainal Revenue Service

1s45-17o9~

OMB N0 .

[(you are filing for an Automatic 3-Month Extension complete only Port I end check this box . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ~

.

If you ore filing for an Additional (not automatic) 3-Month Extension, complete only Port II (on page 2 of this form) .

Do not complete Part II unless you have alread y been granted on automatic 3-month extension of o previousl y filed Form 8888 .

Automatic 3-Month Extension of Time - Only submit original (no copies needed)

Form 89u-7 corporations requesting on automatic 6-month extension - chock this box and complete Pun 1 only

. .. . .. .. .. . . . .. . .. .. .. .. . . . .. .. .

Au other corporations (including Form 990-C filoro) must use Form 7004 to roquoot an extension of time to I'llo Income tax returns . Partnerships,

REnniCo rind trusts must use Form 8738 to request an extension of limo to file Form 1085, 1086, or 1041 .

Electronic Filing (o "fllo) . Form 8888 Con be filed electronically II you want o 3-month automatic extension of time to Illo ono of the returns naiad

below (8 months for corporate Form 890 " T fliers) . However, you cannot 1110 It electronically II you wont the additional (not automatic) 3-month

extension, instead you must submit the fully Completed signed pogo 2 (Pan II) of Form 8888 . For morn details on the electronic filling of this

Typo or

print

File oy the

cue do[o log

filing your

return . $oe

instructions

Name of Exempt Organization

Employer Identification number

04-2038139

SOMERVILLE CHAMBER OF COMMERCE

Number, street, and room or suite n0. If a P 0. box, see instructions .

2 ALPINE ST

City, town or post office, state, and ZIP code . For a foreign address, see instructions .

SOMERVILLE MA 02144

Check type of return to be filed (file a separate application for each return):

Form 990

Form 990-T (corporation)

Form 990-8L

Form 990-T (sec . 401(a) or 408(a) trust)

Form 990-EZ

Form 990-T (trust other than above)

Form 990-PF

Form 1041-A

10

The books ere

will cover.

2

4720

5227

6069

8870

to the care of * CHAMBER

Telephone No . 0, 617-77 6 - 4 100

FAX N0 .

II the organization dons not have an office or place of business in the United Slates, check this box

II this is for Group Return, enter the organization's four digit Group Exemption Number (GEN)

Check this box 0, a. II II IS for port of the group. check this box

1

Form

Form

Form

Form

Ili-

0

... .

. .. . .. .. . .. .. . .. . . .. . .. . .. .. .

If this is fog the whole group,

and attach e list with the names and EINa of all members the extension

I request on automatic 3-month (6-month, for o Form 990-T corporation) extension of time until

AUG

to file the exempt organization return for the organization named above . The extension is for the organization's return for :

calendar year 20 0 9

or

P. 8 pox year beginning

. 20

and ending

II this tax year is for less than 12 months, check reason :

0 Initial return

a Final return

1

,

20

,

20

Q Change in accounting period

7 a II this application is for Form 990-BL . 990" PF, 990" T, 4720, or 6089, enter the tentative tax, less any nonrefundable

credits See instructions

. .. .. .. .. . .. ... . . . . . . .

.

. . . . .. .. .. . . . . . . . ..

b I( this application is for Form 990"PF or 990-T, enter any refundable credits and estimated lax payments made . Include any

prior year overpayment allowed as a credit

. . . .. . .. . . . .. . .. .

. . .. .

. .

, . , .

. ..

c Balance Due. Subtract line 3b from line 3a . Include your payment with this form, or, d required, deposit with FTD Coupon or,

$

$

C

if required. by using EFTPS (Electronic Federal Tax Payment System) See instructions

..

.. .. .

. . ..

. $

O

Caution if you are going to make an electronic fund withdrawal with this Form 8868, see Form 8453-EO and Form 8879-EO for payment instructions

For Privacy Act and Paperwork Reduction Act Notice, see instructions .

BCA Cooy',Qni Corm software only 2004 Universal Tax Systems . inc

All rights reserved

Form 8868 (12-2004)

USB8881t

Rev

t

.S00+

c ItY 1L_t.E

Somerville Chamber of Commerce Board of

Directors 11/O1/OS

Officers

Chairman Adam Dash, Adam Dash & Associates

Treasurer Richard rlahcrty

Clerk Arnold J. Knox

John Cole, Arrowstrect

Kevin Douglas, Langton & Douglas

Cheryl Faulkner Ciardi, Walnut Hill Mgt

George Uonnclly, Boston Business Journal

Mary Frascr, Citizens Bank

Charles McKenzie, Hamlen & Company

"timothy 0'Malley, Winter Hill Bank

(to be announced), Ikea

William Zamparelli, Nstar

Class of 2006

David Blumsack, Rockmont Management

Susan Callahan, Attorney

Pauline D'Aurora, Winter Hill Bank

Rui Domingos, Cambridge Portuguese CU

Brett Henry, Mt. Vernon Restaurant

William Herman, J .J . Vaccaro

Barbara Rubel, Tufts University

Domenic Siraco Jr, Siraco Sharpening

Ray 7_onghetti, Consultant

Michelle Mulvena, Dardeno

CO #* /A 4,c 4-C

C Ff An' 66i;,Lff

7w 0011

2.09139

Class of 2007

Joseph Benoit, Benoit Consulting

Joe Bianco, Central Bank

Nancy Busnach, Busnach Associates

James Conforti, Gargoyles on the Square

Pat Crombie, Somerville Hospital

Kirk Ftamsaucr, Mmes Safety Envelope Co.

Rod Laurenx, Edward Jones

Gail Simms, Holiday Inn

Joseph Taglicntc, '1'Aglicntc

Class of 2008

Ronald I3onney, Arlcx Yellow Cab

Paul Connolly, Federal Realty

Anthony Cota, Sr, Cota-Struzziero Funeral Home

Cyndie K. Femino, KK Realty

Nora Gomez-Diaz, Atellier Pilates

Patricia Harty, Verizon

Ken Kelly, The Independent

Peter Kwass, Mt . Auburn Associates

Frank Privitera Jr., Attorney

Delio Susi, Amelia's Kitchen

Past Chairs

Sandra McGoldrick, Winter Hill Bank

Thomas p . Bent, Dent Electrical Contractors

Arnold J . Knox (Clerk)

Frank Scimone

Nicholas Salerno, U .S . Travel World

Robert Arnold, Ames Safety Envelope Company

Form 8868 (Rev . 12-2004)

Pa e 2

If you are filing for an Additional (not automatic) 3-Month Extension, complete only Part II and check this box

.. . .. .. . .. .. .. .. . ... .. .. ..

Note : Only complete Part II if you have already been granted en automatic 3-month extension on a previously filed Form 8888.

If you are fiiin for an Automatic 3-Month Extension com loto only Part I on pa ge 1 ) .

FO, Mit

Additional not automatic ) 3-Month Extension of Time " Must File Orig inal and Ono Co

Typo or

Name of Exempt Organization

Employur Identification number

print

Pilo oy ma

extended

filing Ana

.ow..+ . Goo

instructions .

SOMERVILLE CHAMBER 0F COMMERCE

Number, street . and room or suite no. If o P.O . box, see Instructions.

~2 ALPINE ST

I

I

09-2038139

For IRS use only

- _

City, town or post office . state . and YIP code . For o foreign address, see Instructions .

SOMFRVILLE MA 02194

Chock typo of return to be filed (File a separate application for ouch return):

Form 990

Form 990" T (sec . 401(0) or 408(0) trust)

Form 990.91.

Form 990-T (trust other then above)

Form 990-E2

Form 1041 " A

~~ Form 990-PF

n Form 4720

Form 5227

Form 8088

Form 0870

STOP : Do not complete Port II If you were not already granted an automatic 3-month extension on o previously filed Form 8868 .

The books ore in the care of P- CHAMBER

TelephoneNo.0, 617-776-4100

FAX NO .0,

If the organization does not have an office or place of business in the United States, check this box

. .. .

. ... .. . . .. . . . .. ... .. . . . .

I( this is (or a Group Return enter the organization's (our digit Grou Ezemptlon Number (GEN)

It this is for the whole group,

check this box ~ n . If It Is for part of the group, check this box ~ ~ and attach a list with the names and EINS of ell members the extension is for .

4 I request on additional 3-month extension of time until

NOV 1

, 20

5 For calendar year

2 0 0 4 or other lax year beginning

, 20

, 20

and ending

6 If this tax year is for loss than 12 months, chock reason :

Final

Initial return

return

Change in accounting period

0

7 State indetail whyyouneed thoextension

TAXPAYER REQUIRES ADDITIONAL TIME TO

COMPLETE RECORDS

8a If this application is for Form 990-BL, 990-PF, 990-T, 4720, or 6069, enter the tentative fox, less any nonrefundable credits .

See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

b If this application is for Form 990-PF, 990-T, 4720, or 8089, enter any refundable credits and estimated tax payments mode .

Include any prior year overpayment allowed as a credit and any amount paid previously with Form 8888

... .. .. . .. . .. .. .. .

c Balance Duo . Subtract line 8b from line 8a . Include your payment with this form, or, if required, deposit with FTD coupon or,

if required, by using EFTPS (Electronic Federal Tax Payment System) . See Instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

Signature and Verification

Q~

(7

Under penalties of perjury. I declare that 1 have examined this form, Including accompanying schedules and statements, and to the bast of my knowledge

and belief, it Is true, co ct, and mpl to, and at I am authorized to prepare this form .

Si noture ~

~

TIUe ~

- /~!/~'

Date ~ 7/2_x /ms s

of ce to Applicant - To Be Completed by the IRS

We have approved this application . Please attach this form to she oiganicetion's rulurn .

We hove not approved this application. However, we have granted a 10-day grace period from the later of the date shown below or the due date

of the organization's return (including any prior extensions). This grace period is considered to be a valid extension of time for elections otherwise

required to be made on a timely return . Please attach this form to the organization's return .

We have not approved this application . After considering the reasons stated in item 7, we cannot grant your request for an extension of lime to file

We are not granting a 10-day grace period .

We cannot consider this application because it was filed after the extended due data of the return for which an extension was requested

Other

.,

By:

r

Date

Director

the

copy

of

this

application

for

an

additional

3-month

extension

returne

to`ars?adCress

Alternate Mailing Address - Enter we address if you want

" 1 L

different than the one entered above .

Name

PAUL B BAIN, JR - CPA

Type or

Number, street (include suite, room, or apt . no ) or a P.0 box number

print

`- pOBOX 440040

City or town, province or state, and country (including postal or ZIP code)

SOMERVILLE MA 02149 -0 001

BCA

Copyright form software only, 2004 Universal Tax Systems Inc

All rights reserved

US886852

Rev

1

_ ti Form 8868(12-2004)