excerpts - Al Manakh

advertisement

Al

Manakh

ARCHIS

Al Manakh 2 is a special edition of Volume, a project by Archis + AMO + C-Lab + Pink Tank + NAi + ...

Volume 23 this issue € 29.50

EXCERPTS

A

Al Manakh 2

Under the exclusive sponsorship of

the Abu Dhabi Urban Planning Council,

Abu Dhabi

Abu Dhabi is moving towards realising its overarching ambition to be globally

recognised as the sustainable Arab Capital and the gateway city to the Gulf.

The exclusive sponsorship of Al Manakh 2 offers the Abu Dhabi Urban Planning

Council (UPC) the opportunity to initiate and participate in international and

regional discussions on the growing importance and influence of the cities

within the Gulf.

The UPC is committed to strategic and sustainable urban planning and creating

dialogue with communities. Its partnership with Al Manakh 2 allows the UPC

to reinforce and further demonstrate this commitment and join in the wider

global debate on the implementation of best practice sustainability within urban

planning techniques.

This second edition of Al Manakh captures the events of 2009 and tells the

urban stories on how events, people and trends affected the Gulf. The collection

of analysis, contributions and interviews within Al Manakh 2 converges into one

main conclusion: the success of the Gulf region will be decided in its cities.

Introduction

Al Manakh 2

10

When we first conceived a second Al Manakh, the global crisis was not

yet reality. ‘An eventual correction’ loomed over every new development

plan in the Gulf, but it would be difficult to find anyone today who

predicted the crisis’ onset and in what form it would come – a liquidity

shortfall that started far away, then spread globally, and relentlessly

exposed real estate bubbles in the Gulf.

In January 2009, we started Al Manakh 2 in the midst of a terrible cloud

of no-information and misinformation. Crisis had bungled our initial

plans and given us a new assignment: to follow its course and look for

the ideas that might suggest the Gulf region’s way out of it. Several

times elucidation seemed near, but almost every lead proved a ruse.

In the end, crisis was just part of the story.

Al Manakh 2 had to take the next step. It had to begin uncovering the

structures and networks that lay underneath the images easily found. To

do that, we asked people living and working in the region to contribute.

And as is the nature of the region, we couldn’t rely just on voices in the

Gulf cities; we reached out also to people who felt the Gulf in other

corners of the world: Malaysia, China, Egypt, India, the US and the UK.

More than 120 people contributed to this book. Al Manakh 2 assembles

voices that sometimes unknowingly collude together and other times

contradict one another. Distinguishing the voices ‘on the ground’ from

those offering an outsider’s commentary is not difficult,

and therefore it is clear that more work is to be done in stimulating the

exchange of ideas and opinions over supposedly porous boundaries.

The first Al Manakh was a photographic documentary, in text and

images: Gulf cities were what you saw, and what you saw was unde­ni­

able. The book relied on a process of collecting facts and figures that

up to that point had not been gathered in one place. If Al Manakh was

the first book to assemble an urban history of this region, Al Manakh 2

could be the first that explores the cultural linkages among these cities

in regard to their ambitions, predicaments and needs. Our attempt

here charts an experiment to show congruence and contradiction – both

mutually inclusive to any collaborative effort. And both are recon­cep­

tualizing the Gulf.

The editorial voice of the Al Manakh team attempts not to summarize

these views, but to link them through cross-references, and to find within

them what events of 2009/early 2010 did with the past and what they’ve

meted out for the future. Assembling information in lists and timelines,

the team searched for the larger pictures in the fractured news media,

finding hints of the Gulf’s next agenda (see Pink Tank’s monthly sum­

maries at the end of the book).

After this book goes to print, some ideas will be surely proven wrong or

obsolete. That’s how it goes in this region. To publish a book on the Gulf

is a risky endeavor because the region moves at a rate more suit­able for

other media outlets. But the Gulf does need books about it. And in the

midst of a financial crisis – when much time has passed and more time

must still be endured – the Gulf is at a point where the information

available at this moment should be considered and examined.

United?

11

Volume 23

A book that covers six cities in five autonomous countries – no matter how

much it tries to underline their differences – assumes they share some­

thing in common. Each of the countries has elected to collaborate to some

degree through the Gulf Cooperation Council (GCC).1 There is relative ease

in moving over GCC borders (especially if you are a GCC citizen), and with

that ease, there has been a seeping of ideas and expertise from one place

to another. One idea of 2009 loaded with considerable social implications

for the GCC countries was the return of the GCC railway proposal.

Huge infrastructure projects – Guinness World records for engin­eering

feats, thousands of kilometers of highway (and some rail), vast seaports

and airports – have characterized the region’s modernization over the

last 60 years. Physical infrastructure is worth more than its weight in

concrete and steel; it lends the space for other kinds of infra­structural

development: educational, healthcare, economic and cultural. Highways,

telegraph technology and a postal system all have their

roots in a twentieth-century idea of a unified Gulf. And if the 1970s were

characterized by legions laying roads and pipes, the 80s, 90s and 00s

were about harnessing those systems in order to build societies.

Al Manakh 2

12

As with many other good ideas, the rail project is not a result of the

crisis, but current economic conditions have certainly given the project

resuscitation. In addition to the proposed GCC rail network, other

countries are developing their own national rail plans. Saudi Arabia

is fueling its economy by expanding upon the region’s sole rail line

between Riyadh and Dammam. Abu Dhabi is also pursuing rail to con­

nect its oil industries to its cities and port. The bridge connecting Bahrain

to Qatar (auspiciously called the ‘Friendship Causeway’) will not only

serve automobiles but will also include a rail corridor. In addition to rail

connection, the GCC-wide electrical grid went online in 2009, aiding the

region in sharing energy resources and paving the way to overcoming

the paradoxical electrical blackouts some areas suffer in this oil-rich

region. The energy link also suggests further unity as oil runs out and

some governments move toward developing alternative forms of energy

with export potential.

Not to be undervalued, infrastructure also aids in the imaginative

process of understanding a common cause. Cities that seem far apart

might suddenly be drawn together, physically and psychologically. Right

now going from Abu Dhabi to Doha requires one to go through the same

routine as from Abu Dhabi to London. Simplifying a travel routine would

draw the two cities together, more than ever before.

The GCC does not spark the popular imagination. It elicits a trail

of political setbacks, especially this past year – disputes over the

location of a central bank; the decreasing likelihood of a monetary union;

deflated claims for an ‘Arab agenda’; images of droves of UAE trucks

trapped at the Saudi border. It might be infrastructure’s role, once again,

to demonstrate how the physical can generate ideas and ignite a

regional enthusiasm.

Vision, which earns a chapter in this volume, bears many meanings,

from a leader’s direction for his city or country to a popular cause for

the future. This region’s resilience is based on a steadfast dedication

to vision. Its modern history is one of futures – futures described in

speeches and written words. Prosperity first started with words, organ­

izing wishes and emotions into rational, though not always reasonable,

milestones. And vision continues to define these cities’ futures. The

terms and conditions of vision can change. Take Bahrain, for instance, it

has ’master-planned’ its entire island, but it reserves the word ‘vision’ for

Vision Bahrain 2030, which has more to do with strategically positioning

the island within a global context. Vision is ensuring and developing

opportunities for people. Abu Dhabi has also made strides in reexam­

ining vision’s meaning. Its Plan Abu Dhabi 2030 downplays the physical

to give process a chance at ensuring prosperity.

It’s a cruel joke to ask a newcomer: ‘What do you think of Abu Dhabi?’

To be asked the question is paralyzing, especially if compared to being

asked the same question in Paris or New York. There, ‘Great.’ would

suffice. How do you answer – acknowledging the socioeconomic

conditions, yet not dwelling on them entirely? How do you talk about

the ‘speed’ without oversimplifying or missing the point? If it’s cruel

to ask the newcomer, it is laborious to ask the resident or citizen about

his or her city. Globalized media have made these cities grow under

inter­national scrutiny. The oversight aids in some regards, others not,

and in every regard creates complex issues of self-awareness. Each

writer here, putting pen to paper, finger to keyboard, is thinking how that

word just written relates to a whole network of global opinions. It can

be dizzying, discouraging and stimulating all at the same time.

Words and visions are not reserved for the power base. In the Gulf, the

written and spoken word is a serious endeavor. This is a region where

poetry recitations are televised, where blogs provide evidence

of complex and non-complacent societies, and where debates happen

in living rooms and cafes. Western critics might miss the voting booths,

but the level and magnitude of discussions are by no means lacking.

Trade data reveal that each of these cities is more connected to places

beyond the Gulf than to each other. Al Manakh 2 argues that there is a

united Gulf, united in resilience but distinguished greatly in details and

far from unison. A united GCC is not just around the corner, but the

ideas, however latent, are there to support its becoming. While cities

in the West remain stagnated in the face of the global crisis – looking for

ways to bring things back to the way they were, these cities move for­

ward. There is a propelling energy that aggravates any tendency toward

enervation. Grave errors have been made, and leaders will address

them, but critics will also be asked to see these mistakes in perspective.

One can disagree with leaders’ arguments, and chastise their lack

of transparency, but the pace and the perseverance of these cities

require that the world take note. We hope that Al Manakh 2 helps you

in the process.

We wish to thank the Abu Dhabi Urban Planning Council for making

this book a possibility.

13

Volume 23

1The Gulf Cooperation Council is a union of Saudi Arabia, Kuwait, Bahrain, Qatar, United Arab Emirates

and Oman pursuing cooperation on economic, social, political and other matters.

Excerpts from Introductions

stresstest – Rem Koolhaas

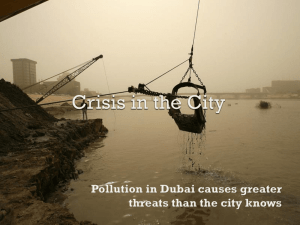

…In fact the genius of Dubai was to suspend reality for one euphoric

decade. The result, in the form of the Palm, the Burj Khalifa, Business Bay,

Dubai Marina, are significant prototypes that even if they read today as

Al Manakh

symptoms of excess will soon become recognizable as defining achieve2 ments

– the crisis

a potentially

check

of the

of thecreating

early twentieth

century,embarrassing

both good andreality

bad.....

It is also

obvious

that Dubai’s

energy

and talent

are book.

not spent:

it has

reached

a point and

where

arguments

that

informed

the first

But the

crisis

happened,

it it

can onlyDubai

have aand

great

future.

reached

the

Gulf. Among other agendas, the first Al Manakh

Crisis Dubai’s

and Crises

- Daniel Camara

Mitra Khoubrou

(Pink

Tank)

freude,

discomfiture.

Whereand

pre-crisis

Dubai was

ridi

culed for its

… There are also tales of resilience. Abu Dhabi, Doha and Riyadh are richer

unchecked surrender to Anglo-Saxon modes of development, post-crisis

cities. They reinforced their projections by digging into the deepest public

Dubai has been blamed by its American and European critics for not

budgets the region has ever seen. Launches are still happening and opening

being

immune

Wallsent

Street’s

‘Model

Dubai’

hasofbitten

invitations

are to

being

as thetoxic

Gulf corruption.

is ahead of the

game

in terms

the

dust,

maybe

forever.

But

in

fact,

such

a

reading

only

reinforces

our

on-going projects, especially in infrastructure. How can it be a crisis when

initial

accusation

of laziness:

Dubai

is an

entirelyunveiled

different

construct,

the

Dubai,

the poster-child

for 2009’s

annus

horribilis,

the

tallest tower

brainchild

of and

a local

that

generously

invited manpower and

in the world

the minority

first metro

system

of the Gulf?

expertise from everywhere to assemble an artificial community, to test,

explore and put into practice the relationship between Islam and modernity.

Consultants

- Todd

Reisz

Where

a Western

perspective

could only register unguided frivolity,

…The

constant

cycles

of adding consultants

to problems

addressed

Dubai from an Iranian perspective

would represent

freedom;

from by

anthe

ones

before

them

eventually

add

up,

leaving

lumpy

layers

of

history

that

not

Indian, opportunity; to an Arab, the hope that Arab modernity can work.

only obfuscate the lack of a solution but also make the problems disappear

The nature of this experiment and its success or failure should have been

in a confusion of PowerPoint slides and terminology. At some point, will the

land

stacking stop? Do the Gulf cities have the time to find their own way

ofbans

4

It is true that at one point a grotesque developer’s euphoria created in

the

Gulf-aOle

number

of unsustainable

‘visions’, some barely built, others

Vision

Bouman

(NAI)

…This attempt

is nothing

lessthe

than

an historical

mission

epic proportions.

mercifully

evaporated.

With

yearly

Cityscape

as a of

nightmarish

Never

before

so

much

wealth

was

spent

so

fast

on

so

much

city, forin

so little

apotheosis, Dubai became an experiment in what would happen

direct

reason.

Can

this

city

survive

without

the

fuel

that

made

it

run?

Can

a world where the developer would no longer encounter resistance. it

findthe

a new

fuelon

timely

enough,remains

to let it run?

But

reality

the ground

much more complex.

Seen this way, the speed of development can no longer be seen as insane or

What has been surprising is how Dubai in particular, and the Gulf in general,

arrogant. Suddenly the speed becomes a bare necessity. Where there is a

have been discussed and criticized strictly as ‘new’, as a freeze-frame –

time limit to the availability of the fuel, you need to work fast for finding new

aone.

single

moment

in time,

typically

the duration

of an

too brief

visit.

And

this is what

happens.

Keeping

momentum

toall

create

enough

critical

The

history

of

Dubai’s

modernization

–

the

70s

beginning,

the

oil

running

urban gravity within a few decades that justify continuity for centuries

to

out

in the 90s, development as the new raison d’être, the consultantcome.

Al Manakh 2

defining a city?

Cohabitation - Arjen Oosterman (Archis)

…The gradual coming into existence of a middle class – or its recent acceptance as reality and opportunity – is an important one. It changes the game

on many levels. This middle class has needs and expectations that are not

part of the blueprint. This middle class might prove to be the incubator for

innovation and renewal, provided that open access to information and

certain personal and professional amenities are guaranteed. This middle

class needs rental houses and mortgages, efficient public transport, affordable education, leisure activities, and a public realm to socialize and relax. It

will in the process become more independent. Yet, as a non-ruling class, the

middle class might demand more openness and more influence; cautious

experiments with participation in planning signal an emerging awareness of

Al Manakh

these new realities. But will it do?

2 – the crisis creating a potentially embarrassing reality check of the

arguments that informed the first book. But the crisis happened, and it

reached Dubai and the Gulf. Among other agendas, the first Al Manakh

Export Gulf – Todd Reisz

…The cities of the Gulf convey strong images to the imaginations of people

from countries

Egypt, India,

Pakistan.

The Gulf

is still

seen

a place

freude,

Dubai’s like

discomfiture.

Where

pre-crisis

Dubai

was

ridias

culed

for of

its

opportunity – chances of financial gain laced with stories of terrific risk. With

unchecked surrender to Anglo-Saxon modes of development, post-crisis

the help of Gulf investments, the Cairo film industry has been able to deliver

Dubai has been blamed by its American and European critics for not

the Gulf Dream to replace the American Dream of the last century. Cairo and

being

Wallstudies

Street’s

‘Model

Dubai’

bitten

Keralaimmune

serve astocase

in toxic

this Alcorruption.

Manakh. They

are only

twohas

places

in

the

dust,

maybe

forever.

But

in

fact,

such

a

reading

only

reinforces

our of

the world where ‘Gulfanization’ is an everyday term. The stories from each

initial

of laziness:

Dubaisocial,

is an entirely

construct,

theseaccusation

places accentuate

economic,

religiousdifferent

and cultural

ties thatthe

brainchild

a local

minority

that generously

invited

manpower

and on

expose theofGulf’s

variated

influences

in countries

whose

people depend

Gulf salaries.

expertise

from everywhere to assemble an artificial community, to test,

explore and put into practice the relationship between Islam and modernity.

Where a Western perspective could only register unguided frivolity,

Dubai from an Iranian perspective would represent freedom; from an

Indian, opportunity; to an Arab, the hope that Arab modernity can work.

The nature of this experiment and its success or failure should have been

land bans

Al Manakh 2

5

It is true that at one point a grotesque developer’s euphoria created in

the Gulf a number of unsustainable ‘visions’, some barely built, others

mercifully evaporated. With the yearly Cityscape as a nightmarish

apotheosis, Dubai became an experiment in what would happen in

a world where the developer would no longer encounter resistance.

But the reality on the ground remains much more complex.

What has been surprising is how Dubai in particular, and the Gulf in general,

have been discussed and criticized strictly as ‘new’, as a freeze-frame –

a single moment in time, typically the duration of an all too brief visit.

The history of Dubai’s modernization – the 70s beginning, the oil running

out in the 90s, development as the new raison d’être, the consultant-

Content

4

stresstest

Rem Koolhaas

Introduction

10

14

16

38

40

The Process: United?

City Ranks

City Reports

Global Visibility

Yearly Investment Breakdowns

Crisis and Crises

44

51

52

55

58

64

66

68

69

70

72

74

79

83

84

90

94

97

101

106

110

111

112

114

117

118

120

122

126

128

134

137

138

146

147

151

6

153

Introduction Daniel Camara and Mitra Khoubrou

The Global Crisis and the Gulf’s Money Souks Matein Khalid

Diversification, Clustering, and Risk in Dubai Stephen Ramos

Dubai World, Its Roots, and Its Creations Sandra Bsat

Jumeirah Gardens and the Urban Checklist Todd Reisz

Dubai World & Nakheel Compiled by Sandra Bsat, Daniel Camara and Mitra Khoubrou

Dubai: Crisis & Reinvention Compiled by Sandra Bsat, Daniel Camara and Mitra Khoubrou

The Final Plan

Dubai Bashing: A List of Headlines and Quotations Chronicling

a Year of Dubai Bashing

Dubai Bashing Article Generator Rory Hyde

Business Bay, Dubai, 2009 Todd Reisz

A Tall Emblem Structure for Dubai Aleksandr Bierig

Cityscape 2009 Reviews Todd Reisz

The Strength of Dubai – Khalid Al Malik Interviewed by Rem Koolhaas and Todd Reisz

Planning for Growth H.E. Falah Al Ahbabi

Abu Dhabi Crisis & Reinvention Compiled by Sandra Bsat, Daniel Camara and Mitra Khoubrou

What’s Next in the City of Dream Buildings? Bradley Hope

Abu Dubai: A Forward Tale of Two Cities That Could Only Be One Mishaal al Gergawi

Power Networks: Dubai

Power Networks: Abu Dhabi

Modern Gulf Cities Shafeeq Ghabra

Institutional Real Estate: Investing in the GCC Faisal Khan and Anuscha Ahmed

Time to Reflect Hamda al Kindi

Ajman in 2009 Daniel Camara and Mitra Khoubrou

From Increasing Supply to Managing Demand: Resourceful Efforts

in the United Arab Emirates Kevin Mitchell

Abu Dhabi: Paving the Way to Sustainability? Volker Soppelsa and Neil Mallen

The Paradox of Sustainability and Abu Dhabi Jim Heid

Tackling the Paradox: Homegrown Solutions to Sustainability Salem K. Al Qassimi

Kuwait’s Future Prospects Yasser Mahgoub

Welcome to Saudi Arabia

Riyadh Timeline Natalie al Shami

Riyadh Ready?: The Megacity of 2020 Joumana al Jabri

Makkah’s Crest

The Hajj is a Myriad of Details – Bodo Rasch Interviewed by Reda Sijiny

Master Plan for Pilgrims Accommodation, Mina (Muna) Kayoko Ota

Jeddah between Crisis and Hope Ziad Aazam

Qatar 2009: Weathering the Crisis Daniel Camara and Mitra Khoubrou

Qatar Headlines 2009

Al Manakh 2

42

Consultants

156

158

160

164

167

168

170

172

176

Introduction Todd Reisz

At Your Service: Ten Steps to Becoming a Successful

Urban Consultant Reinier de Graaf

Measuring the Presence of Consultants Rory Hyde

Selling Adelaide Rory Hyde

Abu Dhabi’s French Enlightenment: French Professionals and Institutions

Coming to Abu Dhabi Compiled by Natalie Al Shami and Jonathan Hanahan

From Extreme Skateboarding to Stalled Globalization: The Changing Rhetoric

of McKinsey in the Gulf, Before and After the Crisis Rory Hyde

KSA – Open for Business?: A Report from the Construcion Week

Saudi Arabia Conference Reda Sijiny

Two or False: Vancouver Replicants Timothy Moore

Will the Last Consultant Please Turn On the Light?

A Meeting with Andrés Duany in Al Ain, UAE Todd Reisz

Vision

180

182

182

191

194

195

196

204

212

216

Introduction Ole Bouman

Regulate Sachin Kerur and Philip Corfield-Smith

Closing the Gap Rami el Samahy and Kelly Hutzell

Bahrain: Another Vision Digby Lidstone

Petals and Atolls: Atkins Makes Islands – Rob Ruse Interviewed by Nicholas Kothari

Sheikh Zayed: The Urbanized Arab Emirates Sultan Sooud Al Qassemi

National Housing: An Opportunity for Change X-Architects

The People’s Icon? Urban Rail and Socio-spatial Cohesion in Dubai Tabitha Decker

Abu Dhabi’s Renewed Urbanism – Larry Beasley Interviewed by Rem Koolhaas

The Abu Dhabi Urban Planning Council: Update – Michael White

Interviewed by Rem Koolhaas and Todd Reisz

224

226

229

232

236

239

242

243

244

246

248

254

264

266

269

272

273

274

276

278

280

282

286

Volume 23

290

The Modern Majlis: Public Participatory Planning in Shaham and Bahia Lia Gudaitis

Capital District Plan 2030 – Jody Andrews Interviewed by Mitra Khoubrou

The Abu Dhabi Investment Forum Lucy Bullivant

A Cultural Island: Abu Dhabi Imports Cultural Institutions

to Build Upon Tradition Negar Azimi

Yas Island Katrin Greiling

Shrink to Fit C-Lab

Doing by Learning: Abu Dhabi Opens the Masdar Institute

of Science & Technology – Georgeta Vidican Interviewed by Natalie Al Shami

KEO: International Consultants Advise – Uwe Nienstedt Interviewed by Holley Chant

Masdar 2009 Headlines Sandra Bsat

Masdar Takes a Pulse Yasmine Abbas

The National Spatial Strategy for Saudi Arabia Mohamed Abdel Rahman and Saleh AlHathloul

The Doxiadis Effect: A Master Plan for Riyadh Joyce Hsiang

A Vision for Riyadh: Arriyadh Development Authority’s Ongoing Work

for Riyadh Joumana al Jabri and Todd Reisz

Cities Solve Problems

City of Knowledge – Redwan Zaouk Interviewed by Joumana al Jabri, Todd Reisz, Reda Sijiny

City of Industry – Mohammed Ahmed Al-Attas, Zahir Bin Hassan,

Fadi Farouk Jabri Interviewed by Reda Sijiny

The Social Responsibility in City Making: Linking Jazan to Malaysia Suetlin Lo

Thoughts on Growth AbulAziz Aldukheil

Planned Development Projects in Makkah

Sporting Cities Marisa Mazria Katz

Express Integration: The Return of the GCC Rail Project Tabitha Decker

Promises on a Friendship Causeway: From Qatar to Bahrain Nicholas Kothari

Going Nuclear in the Gulf Jonathan Hanahan

A Demand for Water Jonathan Hanahan

Educational Entrepreneurship Bimal Mendis

7

220

About

297

The Abu Dhabi Urban Planning Council (UPC)

Cohabitation

322

326

332

334

336

338

340

342

346

352

354

355

356

358

364

366

370

372

374

376

377

Introduction Arjen Oosterman

Line 1 Madeha Al Ajroush

Pregnant Women Walk – Madeha Al-Ajroush Interviewed by Joumana al Jabri and Todd Reisz

The Abu Dhabi Waterfront Alamira Reem Al Ayedrous

The Boundaries of Sharjah Sean S. Anderson

Wrestling for the Masses

Skateboarding in Riyadh Laith Sadeldin, Mohammad Balobaid, Shady Fanous and Hisham Ziard

If It’s Not Green It Will Become Invisible: A Sociological Account

of a Color in Bahrain Gareth Doherty

Global Village Katrin Greiling

Burj Khalifa is Downtown

Many Questions, No Answers: Riots in Khobar, Saudi Arabia Ahmed al Omran

Legal Protests in Bahrain Nicholas Kothari

Human Rights Watch in Bahrain – Faisal Fulad Interviewed by Mitra Khoubrou

Makkah Preparing for the Hajj Bernhard Zand

Ithmaar for the People: Affordable Housing in Bahrain –

Mohammed Khalil Al Sayed Interviewed by Sheyma Buali

Color Correction: Bahrain’s Rainbow Houses Nicholas Kothari

Bachelor Ban: A Form of Gentrification of Muharraq, Bahrain Sheyma Buali

A Case for Urban Change: Revitalization in Manama, Bahrain Ahmed Al-Dailami

KSA on Message – Muna Abu-Sulayman Interviewed by Joyce Hsiang

Infinite Possibilities: Riyadh’s Vast Cultural Projects Carol Fleming Al-Ajroush

Creation of a Mortgage Culture – Philip Thigpen and Mike Scott

Interviewed by Joumana al Jabri and Todd Reisz

382

384

388

391

396

399

400

404

407

408

412

418

419

420

424

426

427

430

432

438

Saudization Update Fiona Hill

The Bidoon and the City: A Historical Account of the Politics

of Exclusion in Kuwait Farah Al-Nakib

New Generation Expats: Fear and Belonging Alia al Sabi

Exodus to the Gulf From God’s Own Country: Travails of a People

Doomed to Vaga-bondage Shajahan Madampat

26 (or so) Museums Brian Salter

Abu Dhabi Art Reem Al Ghaith

Kamp Ka Champ Katrin Greiling

Towards a Lasting Richness: Finding Space for Culture in Kuwait Tim Koehn

Makeshift Mosques

After the Party: Culture in Dubai Antonia Carver

Controlled Experiment: The Opening of KAUST John Gravois

The American Invasion of Science: Jeddah, Saudi Arabia Mai al Jadawi

While KAUST Takes the Spotlight, Princess Nora University

is for the Masses: Riyadh, Saudi Arabia Joumana al Jabri

Saudi Arabia’s Modernity Mashary al Naim

Preserving the Past Rashad Faraj

To Be Buried in Bahrain Mohamed Duaij Al Khalifa

Making Souk Waqif: Doha, Qatar – Mohamad Ali Abdullah Interviewed by Todd Reisz

The Flattening of Riyadh Joumana Al Jabri

Abu Dhabi’s Empty Quarter Katrin Greiling

Khawater (Thoughts): The Shugairi Show Sandra Bsat

Export Gulf

446

448

8

451

Introduction Todd Reisz

Gulf Model Export Jonathan Hanahan

Qatari Diar: From Expansion to Entanglement Rory Hyde

Too Littoral: Gulf Export to Lebanon and the Case of Cedar Island

Rami Abou-Khalil

Al Manakh 2

444

454

456

464

468

470

470

472

474

476

480

484

488

490

493

494

496

498

501

502

504

Dubai, Copied and Pasted: A Photoshop Campaign in Turkey Emre Altürk

Gulfworld: Corporate Profiles and Networks of Gulf Cities Ronald Wall

Food Security Jonathan Hanahan

The Gulfanization of Egypt Khaled Adham and Mostafa Hossam

Immigration and Experts

Gulf Real Estate Portfolio in Egypt

Cairo's Boulevard of Dreams: A Visit to Emaar

From the American Dream to the Gulf Dream

Report from Kerala Todd Reisz

Gulf Houses of Kerala Todd Reisz

Three Kerala Interviews Interviewed by Todd Reisz and Sahil Latheef

Pay it Back: Measuring Remittances Sandra Bsat

The UK and the UAE: Best Frienemies 2009 Rory Hyde

On a Flight

New Silk Road: The Fate of the Old Continent Jiang Jun

GCC and China Sandra Bsat

Faithfully Qatari With A Global Resonance Hady Amr and Noha Aboueldahab

Building Bridges of Culture: Qatar Museums Authority Roger Mandle

The UAE Pavilion – Lamees Hamdan Interviewed by Mitra Khoubrou

The Gulf in the Media Hugh Miles

Appendix

532

534

536

Volume 23

•

Monthlies Update January–December 2009

Al Manakh Network Map

Biographies

Colophon

Compiled by Daniel Camara and Mitra Khoubrou

Note to our readers: Throughout the book the green dot and green text are used to

provide references to other related texts in the book and also provide additional information

from the editorial team. Contributors’ footnotes are found at the end of articles.

9

508

City Statistic // United Arab Emirates ABU DHABI

independence

DECEMBER 2 1971

form of government

!"#'%&

FEDERATION

ruler

H. H. SHEIKH KHALIFA BIN

ZAYED AL NAHYAN

currency

UAE DIRHAM

$$$

population

4.48 MILLION (NATIONAL)

1.46 MILLION (EMIRATE)

most populous cities

Abu Dhabi

Al Ain

| 896,751

| 651,904

AbuDhabi

United Arab Emirates (UAE)

Area

!"#$%&

km2

Coastal length

"&&

km

Ecological footprint

'('

gha/

pers

Reliance on desalinated

water

%

Al Manakh 2

16

')

The Global Crisis and

the Gulf’s Money Souk

Matein Khalid

Conventional wisdom goes: in 2009 liquidity dried up, real estate

projects suffered a great blow and this impact on economic output was

felt across the Gulf. But there are other ways to look at 2009. Matein

Khalid tells the story with a financial angle to reveal a fresh reading

on the impact of the crisis and the future of Gulf cities.

Dubai’s DIFC Gate, Bahrain’s Financial Harbor, Doha’s West Bay and Riyadh’s King

Abdullah Financial District are visible, futuristic symbols of the world’s newest financial

hubs. As a symbol of international power and influence, a financial center is deemed

by most Gulf states to be as critical as a national airline, an aluminum smelter or a central

bank. Despite the fallout from the recent crisis, these centers will wield influence in the

decades ahead as the Arabian Gulf is still home to a $2 trillion pool of private wealth.

However, the global financial crisis will define the future prospects of the Gulf’s financial

centers and even the social DNA of their emerging, cosmopolitan urban clusters.

The UAE: A Tale of Two Cities

•

For a chronicle of the past year’s purchases, p. 88.

•

Abu Dhabi Update: Aabar Investments will acquire 32% of Richard Branson’s Virgin Galactic,

the space tourism flight division of Virgin Group, for about $280 million. The agreement gives

Aabar exclusive regional rights to host VG tourism and scientific research space flights according

to a statement released by both companies. Aabar has announced its intention to build a facility

in Abu Dhabi from which space flights can be launched (Gulf News, July 28, 2009).

Al Manakh 2

44

Despite spectacular losses in the white knight investments made by its sovereign fund

in Citigroup and Advanced Micro Devices, Abu Dhabi’s oil revenues and accumulated

investment reserves made it somewhat immune to the worst impact of the credit crunch

in the Gulf. In fact, Abu Dhabi’s sovereign funds and quasi-sovereign companies used the

crisis to snap up highly visible investments• in the West. These include the Abu Dhabi

Investment Company’s purchase of New York’s Chrysler Building, Aabar’s shares in

Daimler and Virgin Galactic• and Taqa’s stake in several North Sea and Canadian oil

and gas producers.

Abu Dhabi has made no secret of its ambition to emerge as a technology hub, an

Arabian Silicon Valley, with its high profile forays into semiconductor chip manufacturing

and, above all, clean energy. Abu Dhabi’s Masdar City, a carbon neutral ‘green technology’

hub and the region’s most ambitious renewable energy project, recognizes most astutely

that the post-oil era will create perhaps the greatest issue for the GCC’s next generation.

Masdar City is a natural response to the West’s obsession with reducing its dependence

on imported oil after the oil shocks of 2008, when prices soared to $148 per barrel. Currently exporting 2.5 million barrels of oil a day, Abu Dhabi’s natural alternative is solar energy.

Abu Dhabi has not trumpeted its ambitions to create a financial center but its sovereign wealth funds are among the largest, most ambitious deal makers in international

finance. The Abu Dhabi Investment Authority (ADIA) has been the flagship fund for the

emirate and is now one of the world’s largest sovereign wealth funds. It has emerged as

one of the world’s most well-managed and respected, if secretive, money managers with

none of the rogue insider scandals or reckless losses that have plagued the sovereign

wealth funds of Kuwait, Brunei and Gabon. Abu Dhabi’s other investment arm Mubadala

has even reassured investors with a new model of transparency, notably having disclosed

its losses on Pearl Energy. Mubadala’s reward for this measure has been its success

in securing funds from international lenders.

One way the crisis has benefited Abu Dhabi is that there is a boost in international

investor demand for its debt. Despite its colossal reserves, the government of Abu Dhabi

issued a bellwether sukuk• to establish a benchmark yield curve and enable its stateowned funds and companies to borrow $15 billion. Every debt deal from a quasi-sovereign

Dubai: Crisis & Reinvention

Compiled by Sandra Bsat, Daniel Camara and Mitra Khoubrou

Late 2008 brought to a close what had defined Dubai’s ‘diversified’ economy: the value

of daily land transactions plummeted. The real estate bubble was exposed and popped.

As the news continued to give a steady 30…40…% loss of local property values, Dubai’s

authorities promised, and in some cases delivered, clarity through new regulation.

$1.6 billion

Value of Land Transactions

Moody’s cut the outlook for 4 banks last month: Dubai Islamic Bank, Dubai Bank,

Abu Dhabi Commercial Bank and First Gulf Bank. The National, February 2, 2009

Moody’s places Dubai Inc corporate ratings on review for downgrade. Zawya.com, February 2, 2009

Standard & Poor’s cuts ratings of seven Dubai companies. The National, M

$1.4 billion

$1.2 billion

Dubai Government prevents cancelations of property contracts and encourages

developers to extend payment plans. Quote: ‘We are trying to stop the panic’.

Emad Eldin Farouq, Dubai Land Department. The National, January 28, 2009

$1.0 billion

Bulk bookings on Indian carriers to fly 20,000 workers in March. Emirates Business 24|7, February 8, 2009

DUBAI LAUNCHES $20 BILLION BONDS. The National, February 22, 2009

‘The number of Dubai property developers dropped by 47% to 427.’ RERA CEO Marwan Bin Ghalita. Zawya.com, February 25

DUBAI 2015 STRATEGY UNDER REVIEW. The economic component of the Dubai

Strategic Plan 2015 is being revised with an emphasis on stabilizing the emirate’s

financial system and safeguarding jobs. The National, March 16, 2009

$0.8 billion

HOUSE PRICES COULD PLUNGE BY 70%: UBS. Zawya.com, April 23

DUBAI COMMITTEE WILL SCRAP ‘UNVIABLE’ PROJECTS.

Construction Weekly Online, May 7, 2009

CONSTRUCTION FIRMS OWED BILLIONS.

The National, May 10, 2009

$0.6 billion

Rothschild’s roadmap for

Dubai’s economic recovery.

The National, May 17, 2009

$0.4 billion

Dubai World hires reform consultants. The National, June 22, 2009

Nakheel cuts 400 more jobs in overhaul. Zawya.com, July 9, 2009

$0.2 billion

Dubai World piles up debts of $59 billion.

Khaleej Times, August 21, 2009

UAE: Mall delay by Nakheel. Zawya.com, March 25, 2009

Nakheel Tower hits further delay. AMEinfo.com, March 14, 2009

Dubai World, MGM Mirage talks on CityCenter loan said to collapse.

Business Intelligence Middle East, March 5, 2009

$0.0 billion

2008

Jan

Feb

Mar

Apr

May

Jun

Al Manakh 2

64

Aug

Still, developers were slowly exposed. And there was more bad news in store as the

value of land transaction struggled not to go further south over the course of the year. Like

a post-traumatic reaction, the line on value couldn’t sustain a continuous decline, until

the late-2009 ‘standstill’ announcement from Dubai World. The reality check delivered the

news that land values hadn’t finished bottoming out. The only way now was not yet up.

March 18, 2009

Moody’s takes multiple rating actions on Dubai government-owned corporates:

Outlook negative. Zawya.com, April 1, 2009

Moody’s downgrades Dubai companies, says $10 billion federal funds provide assurance. Business Intelligence Middle East, April 2, 2009

Moody’s places ratings of 4 Dubai banks on review.

Arabian Business, August 11, 2009

Moody’s downgrades five Dubai companies. The National, November 4, 2009

DUBAI DEBT STANDSTILL BRINGS SWIFT RATINGS DOWNGRADE.

Standard & Poor’s and Moody’s downgrade several Dubai-government

related companies. The National, November 26, 2009

5, 2009

‘THE WORST IS OVER FOR DUBAI’, SAYS SHEIKH MOHAMMED. ‘And I want to tell

those people who nag about Dubai and Abu Dhabi to shut up.’ Sheikh Mohammed bin

Rashid Al-Maktoum, Ruler of Dubai. Arab News, November 10, 2009

3, 2009

DUBAI REAL ESTATE AMONG ‘RISKIEST POST-WAR MARKETS’.

CROWN PRINCE TELLS WORLD ECONOMIC FORUM UAE ECONOMY IS

‘HUMMING’. Mohammed Alabbar says the emirate’s economy would expand

by 5% this year. He also says Dubai’s population has grown by 400,000 this

year. A recovery in Dubai’s property market may take 12 to 18 months.

Arabian Business, June 23, 2009

The National, November 21, 2009

Dubai poised to introduce standard property contract.

Arabian Business, 25 May 2009

MOHAMMED UNVEILS DUBAI 2020. His Highness Sheikh Mohammed bin Rashid Al

Maktoum, Vice-President and Prime Minister of the UAE and Ruler of Dubai unveils

Dubai 2020, a new initiative that presents Dubai’s potential to host the World Expo

and the Olympic and Paralympic Games in 2020. Emirates Business 24|7, June 29, 2009

RERA cracks down on unregistered property brokers.

Emirates Business 24|7, July 11, 2009

DUBAI FACES PROSPECT OF OVER 30,000 EMPTY

HOMES BY END 2009, SAYS JP MORGAN.

DUBAI RESHUFFLES BOARD OF STATE INVESTMENT UNIT. The ruler

of Dubai has reshuffled the board of the Investment Corporation of

Dubai, the state conglomerate that owns Emirates airlines, naming two

of his sons as directors. Khaleej Times, November 21, 2009

DUBAI STUNS DEBT MARKETS. ‘This will destroy confidence

in Dubai, the whole process has been so opaque and unfair

to investors.’ Eckart Woertz, Dubai’s Gulf Research Centre.

Financial Times, November 26, 2009

WHERE NEXT FOR THE RULING FAMILY IN DUBAI?

The ‘Dubai vision’, which has suffered a crushing blow

from the freewheeling Gulf emirate’s sudden debt crisis,

is the creation of one man who failed to apply the rules of

open governance. Quote: ‘It’s too early to write Dubai’s

obituary.’ Martin Hvidt, Middle East Studies Professor.

Business intelligence Middle East, August 16, 2009

Reuters, November 27, 2009

Dubai rejects guarantee for Dubai World. Financial Times, November 30, 2009

DUBAI WORLD SEEKS DEBT PAUSE. Dubai’s Government asks creditors of Nakheel’s $3.5

billion Islamic bond maturing on December 14 for a standstill. The National, November 25, 2009

NAKHEEL, DUBAI WORLD DISCUSS REPAYMENT OF $0.96 BILLION SUKUK.

Nakheel bond prices plunge.

Gulf Daily News, October 16, 2009

Dubai World restructures top level management.

Gulf News, September 19, 2009

Aug

Sep

Oct

Nov

Volume 23

News / Events

Dec

Credit Ratings

2010

Regulations

Dubai World

Nakheel

65

The National, September 17, 2009

Jul

Khaleej Times, November 12, 2009

NAKHEEL SETTLES $1.2 BILLION BANK DEBT. The National, October 20, 2009

DUBAI WORLD HAS CUT 12,000 JOBS. Rothschild and AlixPartners have been

advising the company on the realignment. The National, October 17, 2009

Nakheel assets moved to Istithmar.

Riyadh 1932–1950

The First Years of a Unified Kingdom of Saudi Arabia

1 Early Riyadh Justice Square,

Old Riyadh, Riyadh rooftops,

Justice Palace.

2 1932 Karl Twitchell’s 1932

report has no good news

about water prospects in

Saudi Arabia, but reveals

evidence of oil in the Eastern

Province. With King Abdul

Aziz’s blessing, Twitchell

returns to the US to rally

American oil companies to

invest in Arabian oil

exploration.

3 1939 King Abdul Aziz’s car.

By 1939 there are 300 cars

in a city of 30,000.

4 1945 President Franklin

Roosevelt invites King Abdul

Aziz to meet him aboard

the USS Quincy, docked in

the Suez Canal. The king

guarantees to give the US

secure access to Saudi oil.

In exchange, the US will

provide military assistance

to Saudi Arabia.

5 1946 King Abdul Aziz visits

government sectors in Egypt.

6 1946 The first plan of Riyadh.

Expansion outside the old

city walls starts in 1937 when

King Abdul Aziz moved his

residence north of the walled

city to Al Murabba’a Palace.

7 1949 Alharaj souq.

8 The towers and wall

of Riyadh.

1

3

4

6

5

7

8

11

9

128

13

10

12

Eastern Province

Hundreds of kilometers from

the Saudi capital, the Eastern

Province supplies the wealth

integrally linked to Riyadh’s

modernization. The Eastern

Province’s oil required foreign

expertise to be extracted. A

series of existing cities are

transformed, and new cities

built, to manage the wealth of

natural resources. The Eastern

Province delivers Riyadh not

only the funds it needed to

finance its development, but

also the spirit of modern

organization.

9 Aramco 1936 Texaco buys

50% of the California

Arabian Standard Oil

Company, which would

eventually become Aramco

(Arabian American Oil

Company). With oil still a

prospect, the first American

wives and children start to

move into their homes in the

kingdom’s Eastern Province.

10 Lucky 7 King Abdul Aziz

inspects ‘Lucky 7’ well on his

visit to Dhahran, May 1939,

to celebrate the striking of

commercial quantities of oil.

Newfound wealth is directed

toward Riyadh.

11 1946 Aramco’s first publication, Arabian Sun and Flare.

12 The Flying Camel The first

airline in Saudi Arabia is

Aramco airlines.

13 Newly built villas in Dhahran

for Aramco employees.

14 Aramco company car.

14

Al Manakh 2

2

Qatar 2009

Weathering the Crisis

Daniel Camara and Mitra Khoubrou

The economic slowdown of 2008-9 reinforced the exceptionality of Qatar.

Over the last few years, Doha has emerged out of the shadows of its

more high-profile Gulf neighbors to become one of the most dynamic

economies of the region. The country has been growing at record levels

and has heavily invested in infrastructure and diversification strategies

as set in the Qatar National Vision 2030. Dotted with unique natural

resources, Qatar has reinvested its wealth into nation-building and longterm projects. The economic slowdown did not entirely spare Qatar:

property prices fell and banks did not lend as easily. Yet it is obvious

that amid the downturn, Qatar has revenues. 2009 proved to be a year

of visionary decisions.

•

Read article on Qatar’s diplomatic ambitions, p. 498.

151

Volume 23

Over the last decade and in anticipation to a tipping point in oil and gas, Qatar has been

pushing for a more diversified economy. The country has invested in transformation: from

developing a mature property sector to positioning itself as a strong diplomatic hub•.

In April 2009, Qatar announced an expansionary budget, the largest in the country’s

history. It was a further acceleration of the public investment policy by committing to

infrastructure projects: a new bridge between Bahrain and Qatar, a new airport as well

as plans for a metro in Doha.

As part of its diversification strategy into non-oil industries, Qatar attracted banks

from around the world to open offices in the Qatar Financial Tower. Also in 2008, Shell

announced that it will have over 250,000 employees in Qatar in the next five years. Qatar

also engaged in cultural and knowledge development. The Qatar Science and Technology Park opened in April 2009, backed by a $1 billion endowment from the Qatar

Foundation. Following the opening of the Museum of Islamic Art in 2008, the first Doha

Tribeca Film Festival took place in November of 2009 building a reputation for Doha

to become Arab Capital of Culture for 2010.

Qatar has also made its marks internationally. 2009 headlines were marked by the

country’s foreign investments, most notably in London’s property markets with investments in the Shard, Chelsea Barracks and One Hyde Park. Qatar’s $75 billion sovereign

wealth fund, Qatar investment Authority (QIA), made the news by recapitalizing Barclays

and Credit Suisse and taking stakes in Porsche and Volkswagen Group. On the real

estate front, Qatari Diar – the real estate arm of QIA – invested in more than 35 countries

with investments of up to $60 billion, along with more than 60 projects in cooperation

with more that 125 world companies. The company also opened 11 branches abroad.

Inside the country, the Qatar National Master Plan 2010-2032, unveiled last January,

outlined the country’s development for the next twenty years. Qatar placed infrastructure

and the development of regulations as main priorities for its urban sector. While construction firms shed jobs and projects were stalled in other cities of the Gulf, Qatar – along

with its neighbor Saudi Arabia – used this as an opportunity to source staff for its own

Key Historical Events

1991 – Gulf War

1989 – Iraq War ends

1980 – Iraq War begins

1979 – OPEC Oil Crisis

Oil price

British Protectorate

1910

1920

1930

1940

1950

1960

1970

1980

1990

2000

Gross Domestic Product ($US Billion)

1973 – OPEC Oil Embargo

1971 – Formation of United Arab Emirates

1966 – Sheikh Zayed becomes Ruler of UAE

1932 – Formation of Kingdom of Saudi Arabia

1918 – Fall of Ottoman Empire

1908 – Young Turks enact process of modernization

1908 – Discovery of Oil in Persia (Iran)

ColliersKSA 350

Sunland Group

Jones Lang Lasalle

Fosters

Carlyle Group

Urbis

300

Hopkins

Gensler

Burt Hill

Benoy

Tilke

250

Woods Bagot

Contrack

NORR

RTKL

Iran

Gulf Consult

200

D & AR

Khatib & Alami

Oil

Price Waterhouse Coopers

Van Oord

SOM

UAE

Mott Macdonald

150

HOK

EDAW (AECOM)

Cansult Maunsell (AECOM)

ARUP

Hyder

100

Dewan

Kuwait

RMJM

Adnan Saffarini

Atkins

KEO

50

Overseas AST

Qatar

Halcrow

Bechtel

Halliburton

Grey Mackenzie

Costain

2010

Year

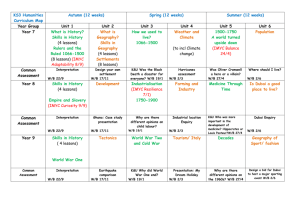

Graph of consultancy arrivals mapped over the GDPs of various Gulf countries.

Revenue Compared Between Knowledge Consulting and Architecture

The combined revenues of the eight largest architectural/planning consultancies operating in the Gulf is roughly equal to the revenue derived solely by PriceWaterhouseCoopers.

Although both disciplines offer expert knowledge, the product of architecture

remains constrained by working for a percentage of the construction value of a physical

building. By comparison, there seems to be no limit to the value of intangible advice

and report documents produced by management and financial consultancies.

Should architects bemoan the relative wealth and success of the knowledge

consultant? Or can we overthrow the burden of our fee scale in order to operate

competitively in the knowledge economy? Either way, right now the safe money is with

reports, not resorts.

KNOWLEDGE

PriceWaterhouseCoopers $715mn1

600

500

400

300

200

100

0

ARCHITECTURE

700

Atkins – $280mn2

Halcrow – $135mn3

KEO – $68.1mn

Gensler – $50.0mn

RMJM – $50.0mn

Perkins & Will – $48.6mn

Dewan – $45.0mn

Burt Hill – $37.3mn

161

Volume 23

$US (Millions)

Abu Dhabi’s French Enlightenment

French Professionals and Institutions Coming to Abu Dhabi

Compiled by Natalie Al Shami and Jonathan Hanahan

all of the French national collections, allowing

specific projects to be under­taken thanks to French

loans, while also assisting in the devel­op­ment of

Louvre Abu Dhabi collec­tion’, says Henri Loyrette,

Director of the Louvre Museum www.uaeinteract.com

27/5/2009 * There are five outlets of the French super­

market Carrefour in Abu Dhabi www.carrefouruae.com *

President Nicolas Sarkozy formally opens France’s

first permanent military base in the Gulf in the

UAE www.BBCnews.com 26/5/2009 * France’s Bombardier

Trans­portation: ‘We are looking at upcoming

oppor­tu­ni­ties for light-rail projects in Abu Dhabi

and Doha.’ The Gazette 09/11/2009 * Fabrice Bousteau

of Beaux Arts Magazine curates for Abu Dhabi Art

2009 www.abudhabiartfair.ae * Francois Pinault, owner

of the retail company PPR, is on the Abu Dhabi Art

Inter­national Patrons Committee www.abudhabiartfair.ae

167

Volume 23

The Institute for Enterprise Development (IED) at

Abu Dhabi University and the HEC School of Man­

age­ment in Paris signs a memorandum of under­

standing www.ameinfo.com 13/5/2006 * The Paris Sorbonne

University-Abu Dhabi is estab­lished by Emiri Decree

www.uaeinteract.com 30/5/2006 * The Abu Dhabi 2030 Urban

Planning Project has generated widespread

interest among French businesses. French Minister

of Foreign Affairs: ‘French com­panies are world

leaders in areas such as water distribution and

treatment, transport infrastructure – especially

railway transport networks – and urban street

furniture’ www.ameinfo.com 27/4/2007 * ‘President H.H.

Sheikh Khalifa bin Zayed Al Nahyan issued a

decree establishing an Abu Dhabi chapter for the

Paris Sorbonne University.’ Abu Dhabi will restore

France’s Chateau de Fontainebleau www.ameinfo.com

30/4/2007 * INSEAD, a world-re­nowned international

business school with cam­puses in Singapore and

France, officially opened its Centre for Executive

Education and Research in Abu Dhabi last week

gulfnews.com 15/9/2007 * Etisalat and France Telecom will

make joint in­vest­ments in a number of diversified

areas includ­ing home services, contents, and inter­

national net­works www.khaleejtimes.com 03/7/2008 * Nathalie

Criniere, of French design house Agence NC, is

chosen to create the design for Louvre Abu Dhabi

gulfnews.com 07/1/2009 * Anne Baldassari, Di­rec­tor of

Musée National Picasso in Paris, curates the first

major survey of artists working in the United Arab

Emirates called Emirati Expressions Khaleej Times 03/4/2009

* President Nicolas Sarkozy of France makes a

two day state visit to the UAE to review relations

of friendship and cooperation between the UAE

and France in various fields www.business24-7.ae 24/5/2009

* French President Nicolas Sarkozy launches the

‘Desert Louvre’ project in Abu Dhabi www.france24.com

26/5/2009 * ‘All of the major French museums have

been involved in creating Agence France-Mu­seums:

Centre Pompidou, Château de Ver­sail­les, Musée

d’Orsay, Musée Rodin and Bibliothèque Nationale

de France. This is a won­der­ful oppor­tu­ni­ty to link

Regulate

Each Gulf country has developed its own set of urban development regulations. These tend to be a mixture

of historic building codes and modern urban development planning laws, which take into account the issues

faced by the recent increase of population and construction activity. Urban development is not limited to

issues relating to development projects but is much wider, integrating land-use, transport and environmental

planning. General property laws have also been developed to provide a legal framework to govern property

ownership, and in certain countries, to assist in attracting foreign investment. New regulation across the

Gulf has started to deal with improving energy efficiency when planning developments. The importance of

developing a considered urban development framework can not be underestimated. The value and success

of modern-day projects is not only reliant on the design and build-quality of the buildings and structures

but also the surrounding development and infrastructure plans. The costs of addressing issues during the

course of constructing a development retrospectively, far out-weigh the costs that should have been spent

at the front-end ensuring that such issues do not arise.

Sachin Kerur and Philip Corfield-Smith

Location Bahrain

Plan/Vision Bahrain 2030 National Planning Development

Strategy / Bahrain Vision 2030

Planning Agency Ministry of Housing (The Ministry of Housing

divests its authority to a number of ministries responsible

for the various elements of development) / Economic Development Board (EDB) / Housing and Urban Development

Committee (HUDC) / Consultants for Bahrain Vision 2030:

PricewaterhouseCoopers

New Regulation Law dealing with the reconstruction of different

areas within the kingdom issued at the end of 2009

Sustainability No green regulations but historic environmental

laws exist

Location Doha

Plan/Vision Qatar National Vision 2030 / Greater Doha Master Plan

Planning Agency Ministry of Municipality and Urban Planning /

General Secretariat For Development Planning / Urban Planning

and Development Authority (UPDA)

Sustainability QSAS (Qatari Sustainability Assessment System) /

Qatar Green Building Council (QGBC) (Qatar is the newest

member of the World Green Building Council (WGBC), under a

new initiative that sees the formation of the Qatar Green Building

Council (QGBC). This new model will become the standard for all

developers in Qatar and will take into account local culture and

traditions) / Qatar is the first GCC country to join the World Bank’s

Global Gas Flaring Reduction Partnership to control gas flaring /

The Texas A&M University launches the Qatar Sustainable Water

and Energy Utilization Laboratory to promote sustainable water

use. / ‘SustainableQatar’ (a group created to support Qatar’s

sustainablity aspirations)

Location Riyadh

Plan/Vision MEDSTAR (A Vision for 2050)

Planning Agency Arriyadh Development Authority (ADA) /

Riyadh Municipality

New Regulation An anticipated mortgage law, expected

for the last several years, is necessary to help solve the

city’s housing shortage (applicable to all Saudi cities)

182

Location Makkah

Plan/Vision Master Plan for the Development of

Central Makkah

Planning Agency Makkah Development Authority

Al Manakh 2

Location Jeddah

Plan/Vision Jeddah Strategic Plan (a 20-year plan)

Planning Agency Jeddah Municipality / Jeddah Development

and Urban Regeneration Company (JDURC) / Consultants:

Space Syntax

New Regulation An anticipated mortgage law, expected

for the last several years, is necessary to help solve the

city’s housing shortage (applicable to all Saudi cities)

Sustainability Jeddah Urban Observatory (JUO) with the

UNDP plan to develop an Environmental Master Plan for

Jeddah. The plan will take two years to develop

Location Kuwait City

Plan/Vision Third Kuwait Master Plan (3KMP), 1996

Planning Agency Municipality of Kuwait / Higher

Council of Planning and Development / Consultants:

SSH / WS Atkins Overseas Ltd.

New Regulation Mortgage Law (March 2008)

(‘Mortgage law, economic crisis hit Kuwait real estate

market’, Kuwait Times, February 24, 2009)

Map Sandra Bsat

Location Abu Dhabi

Plan/Vision Plan Abu Dhabi 2030

Planning Agency Abu Dhabi Urban Planning Council (UPC)

New Regulation Abu Dhabi Framework Development Regulations (FDR) / Abu Dhabi Municipality Building Code /

Five laws, similar to those of Dubai, have been drafted and are waiting for official approval. They include a

strata law, defining the roles of property owners in multiple-occupancy developments; a trust-account law similar

to Dubai’s escrow requirements; a law establishing a regulator; a mortgage law to protect financiers; and a law

to ensure that developers have acquired titles and permits before selling properties to the public

Sustainability Estidama Sustainability Guidelines 2008 (The Pearl rating system / Interim Estidama Community

Guidelines IECG / Estidama Integrative Design Process (EIDP) / Interim Coastal Development Guidelines) /

Energy Vision 2030 / Abu Dhabi Strategic Water Plan / International Energy Conservation Code (IECC) / MASDAR

(Masdar City has used the ten principles of One Planet Living as minimum standards to build a sustainable development. The ten principles comprise of reducing to zero carbon emission and waste, implementing sustainable transport,

promoting local and sustainable material, food, and water, respecting the natural habitats, the wildlife, the culture and

the heritage of the region and supporting equity and fair trade. Masdar City is committed to meet, and even exceed,

the targets set by One Planet Living)

Location Dubai

Plan/Vision Dubai Strategic Plan 2015

Planning Agency Dubai Urban Planning Committee / Real Estate Regulatory

Agency (RERA)

New Regulation I-Code (International Building Code relating to performance, fire,

mechanical, energy conservation, etc., – adopted June 2009, effective 2010) /

Four new regulations to clarify role of homeowners associations within a

housing community / RERA Price Index / Amendment of the law regulating the

Interim Real Estate Register regarding off-plan contracts (New developers in

Dubai will now have to pay 100% of the land price to start selling properties

‘off plan’ and will have to inject a minimum 20% of project value to commence

construction) / Law to address the perceived imbalance that was created

by the Interim-Registration Law (The new law will look to address some of the

issues faced by property purchasers that have invested in projects that are now

heavily delayed, suspended or cancelled) / Draft law for credit checks on loans

Sustainability Emirates Green Building Council 2006 / Green Building Code /

LEED system (It has been two years since buildings in Dubai were ordered

to conform to sustainability standards to reduce their environmental impact

on the city, but only six such buildings currently exist. ‘Only six green

buildings in Dubai yet’, Gulf News, November 2, 2009)

Location Ajman

Plan/Vision Ajman Master Plan

Planning Agency Ajman Real Estate Regulatory Agency (ARERA) /

Consultants: HOK

New Regulation Emiri decree No 11, 2008

(Ajman Real Estate Regulatory Agency (ARERA) has begun to put

land and property regulations in place to streamline the emirate’s

growing real estate sector. Developers who want to build projects

in Ajman now must register with ARERA, according to the newly

issued Emiri decree No 11, 2008, which is aimed at regulating

the emirate’s properties and construction sector. ‘Ajman tightens

land regulations’, Gulf News, Feb 8, 2009)

Location Al Gharbia

Plan/Vision Plan Al Gharbia 2030

Planning Agency Abu Dhabi Urban Planning Council (UPC)

/ Western Region Development Council (WRDC) / Western

region Municipality (WRM)

New Regulation Abu Dhabi regulations apply

Sustainability Estidama Sustainability Guidelines 2008 (The Pearl

rating system / Interim Estidama Community Guidelines IECG /

Estidama Integrative Design Process (EIDP)/ Interim Coastal

Development Guidelines). / The Western Region Municipality

plans to make Al Gharbia the ‘greenest’ region in the emirate

by giving all six cities at least three parks each. ‘Green goals

for arid Al Gharbia region’, The National, January 25, 2009

183

Volume 23

Location Al Ain

Plan/Vision Plan Al Ain 2030

Planning Agency Abu Dhabi Urban Planning Council (UPC) / Al Ain

Municipality / Consulant for second phase Plan Al Ain 2030: Duany

Plater-Zyberk & Company

New Regulation Abu Dhabi regulations apply

Sustainability Estidama Sustainability Guidelines 2008 (The Pearl rating

system / Interim Estidama Community Guidelines IECG / Estidama

Integrative Design Process (EIDP)/ Interim Coastal Development

Guidelines). / ‘Plan Al Ain 2030 strikes a delicate and much-needed

balance between conservation and development’, said Falah al

Ahbabi, General Manager of UPC. (The plan, which describes Al Ain

as the ‘soul’ of the emirate, emphasises that growth will be ‘measured

rather than uncontrolled’, maintaining the city’s low-built scale,

spaciousness, greenery and traditions. Zawya.com, April 10, 2009)

Key Cultural Concerns For Locals

How is the relation to the commercial and community facilities?

good

30%

good

25%

no good

35%

good

65%

Mosques

no good

75%

good

50%

no good

70%

Schools

Gym

Commercial

Don’t know

10%

Common

10%

Semi-Private

30%

Not important

10%

No

40%

Private

60%

What is your preference

for your personal garden?

good

29%

no good

50%

Normal

24%

Yes

60%

Is there a need for separate

male & female Majlis, entry, etc.?

no good

71%

Children Playground

Very important

19%

No

45%

Yes

55%

Important

37%

How important is the need

for future expansion?

Would you use local transport

like monorail / tram if sufficient

connection is provided?

Key Cultural Concerns For Locals

1. Program

1.1 No. of bedrooms

1.2 Majlis

1.3 Car space

2. Expandability

2.1 Service area

2.2 Bedrooms

2.3 Majlis

2.4 Additional family unit

5 bedrooms

2 Majlis

2 Car spaces

How important is the need

for future expansion?

80%

80% of the UAE citizens

interviewd responded

important or very important.

3. Privacy/Security

3.1 Visual privacy for villa

from neighbors

3.2 From street

What is your preference for

your personal garden?

60%

private

30%

10%

semi-private

common

60% private

30% semi-private

10% common

yes

mosque

25%

30%

yes

schools

yes

gym

60%

60% said yes

yes

4. Community Facilities Access

4.1 Mosque, kindergarten,

play area, etc.

65%

Is there a need for

separate male & female

Majlis, entry, etc. in a villa?

50%

20%

yes

yes

commercial children

playground

Is the relation to the

commercial and community

faciliets good?

65% good for mosques

25% good for schools

30% good for gym

50% good for commercial

20% good for children playg.

Would you use local

transport like monorail/

tram if sufficient connection

is provided?

55%

55% said yes

yes

Al Manakh 2

202

The analysis of the Emirati housing questionnaire was critical in evaluating the core principle of users existing and future needs. The results from

the survey gave our team a clearer perspective on the essential elements that define life in the average Emirati house­hold. Items such as car

usage, number of bedrooms, majlis (including sizes and locations) and levels of security and privacy all contributed to our refinement of the design

parameters. Families stated that villa expansion was an essential item that should be considered. We also obtained information on essential

community facilities that the families would expect for their housing community.

Yas Island

Photos Katrin Greiling

Al Manakh 2

232

Yas Island’s master developer says that the island ‘will be as smooth and simple

as driving around the F1 Track itself, but at less speed of course’. For now, it is a

landscape-in-formation experienced over a vast highway connecting to Abu Dhabi

Island. Last fall, the Formula One Grand Prix was held on Yas Island. Yet work

still continues on the $36 billion project with: hotels, shopping malls, and a Ferrari

theme park (featuring the world’s fastest roller coaster). As it prepares for an esti­

mated popu­lation of 110,000, Yas Gateway Park completes its ‘green spread’ of

500,000 square meters providing 10,500 parking spaces, sporting fields, pedestrian

pathways and cycling paths.

233

Volume 23

Photo Katerin Greiling

City of Knowledge

Redwan Zaouk interviewed by Joumana al Jabri,

Todd Reisz, Reda Sijiny

October 17, 2009

SAGIA• wants to build for Saudi Arabia six new cities, six economic cities. Such a huge

ambition, however, has been difficult to follow and analyze. It seems that only three

of the cities are anywhere near underway (King Abdullah Economic City is nearing

delivery of its first residences), and each of these, while under the aegis of SAGIA,

is pursuing its own trajectory of planning and financing. Though this also holds true

with media relations, they have all maintained a careful distance when addressing

public inquiries. Redwan Zaouk, who oversees marketing efforts for Medina Knowledge Economy City (KEC),1 indicates that this distanced approach has to do with

being careful not to promise too much.

•

See previous page for more on SAGIA’s mandate.

AM2 One of the reasons why we are interested

in talking with you is that it has been difficult

to get an understanding of the story behind

some of these new economic cities. The international press can make it seem that they

are pursued with little planning behind them.

But given how we understand Saudi Arabia’s

changing demographics, we suspect there

is a strong narrative. We also got the sense

that KEC has been moving along further than

most of the others – an IPO3 is set for later this

year or early next year.

Redwan Zaouk Since 2006, we haven’t engaged

the press all that much or made any big marketing

campaigns. One reason is that we don’t want

to promise and then not be able to deliver later.

The crisis came before we got started so that

actually benefits us. To give you an example, our

infrastructure estimate was at SR2.7 billion.4 Now

it’s at SR1.5 or 1.6 billion. So we’ve saved over

1 billion. So the crisis has been to our favor.

[Referring to a PowerPoint presentation] The vision of KEC

is to become a global icon for excellence in Saudi

civilization. Our mission is to leverage Madinah

as the beacon of knowledge, to develop KEC

as a planned community, a smart environment and

a distinctive lifestyle. One of our aims is to establish a central business district for Madinah. In

Al Manakh 2

266

Several sources indicated KEC is one of the more

advanced economic cities in terms of planning. It

has a master plan and an on-site office readying

for a 2010 ground-breaking after the initial public

offering (IPO) launch, which will give it the boost

of capital needed to begin. As with the other

economic cities, KEC intends to be a fully private

sector endeavor. Operating on $1.5 billion in

capital, the company plans to offer shares in 30%

of the company. Questions have been raised in the

press whether any of these new cities can move

forward without governmental support, but there

has been no indication that such help is coming.

Whereas most of these new economic cities

are being built as new independent cities (though

in proximity to existing cities), KEC is located within

Madinah, but just outside the second ring road –

as close as non-Muslims can get to Madinah’s

center and haram.2

A quick fact list: the project is estimated to

generate $8 billion in investments, 20,000 new jobs,

150,000 residents, 30,000 residential units and

30,000 annual visitors. It is the smallest economic

city at 4.8 square kilometers with an estimated

8 million square meters of built area.

Promises on a Friendship Causeway

From Qatar to Bahrain

Nicholas Kothari

•

See map on previous page.

•

Read p. 151, p. 184.

•

Read Atkins interview on p. 194.

in 1878. Besides this potential destination, many

Bahrainis have relatives in Qatar, making the forthcoming physical connection a family reunion of

sorts and another cause for traffic. On the Bahrain

side, the bridge will come over the horizon and

touch down near Askar, a fishing village, and

a lonely desert highway will take one either to the

urban centers of the north or to the Durrat Al

Bahrain• development in the south.

The QBC is also expected to jump-start

Bahrain’s other transit projects, including its

delayed 180 kilometer transportation system to

align with Qatar’s metro system. From a regional

perspective, the Bahrain-Qatar Causeway is

an important link in the proposed GCC Railway

master plan. Any passenger and freight train that

connects to the GCC railway at the Iraq-Kuwait

border (from the Middle East and Europe) will

have to traverse Qatar and Bahrain to reach the

UAE and Oman. From the opposite direction, every

passenger wishing to enter into Saudi Arabia to

visit the holy cities of Makkah and Madinah must

pass through the two countries as well. The potential of becoming an international rail hub is incentive for both country’s to complete major infrastructure projects on time.

The bridge will offer access to jobs for

Bahrainis, as the King Fahd Causeway did in the

80s and 90s. Another expectation is that Qataris

will use the causeway similar to the Saudi travelers

who take day trips to Bahrain as a lifestyle and

entertainment destination. Even if Qatar has enough

resorts, cinemas, malls and schools in place by

2015 to keep nationals at home, Bahrain still has

the chance to offer such amenities not yet available in Qatar, as it has done for Saudi Arabia over