H. W. Singer

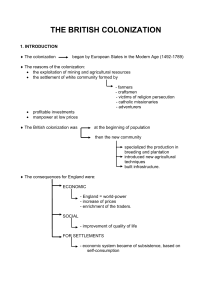

advertisement