REAL ESTATE TRANSACTIONS AND FINANCE Fall Semester

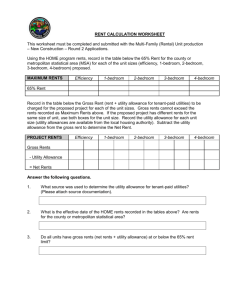

advertisement

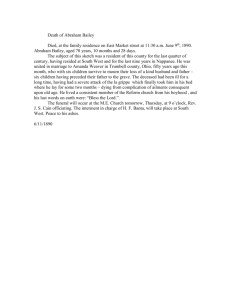

REAL ESTATE TRANSACTIONS AND FINANCE Fall Semester 2014 Assignment #13 Rents and Leases of Mortgaged Property and Security in Rents Reading Assignment: NWBF pp. 389-413. Questions to focus on in anticipation of class discussion include the following: 1. Under UCC Article 9, a security interest in personal property extends automatically to any “proceeds” of the collateral. U.C.C. § 9-315(a)(2). Under Article 9, “proceeds” includes anything that is received upon the “sale, lease, license, exchange, or other disposition of the collateral.” U.C.C. § 9-102(a)(64). Thus, suppose that Bank has a security interest in a crane owned by Uphoff, and that Uphoff leases the crane to Cathy Contractor for six months at a rental of $10,000 per month. Even if Uphoff’s security agreement with the Bank did not explicitly state that Bank would have a security interest in any rentals that Cathy paid under the lease of the crane, Bank gets a security interest in those rents automatically under U.C.C. § 9-315(a)(2), because they are “proceeds.” This means that if Uphoff defaulted to the Bank, Bank could choose to enforce its security interest by collecting the monthly rent payments Cathy Contractor would make to Uphoff, either through a garnishment action or by giving a notification to Cathy to begin paying her rent payments to the Bank. U.C.C. § 9-607. By contrast, assume that Bank has a mortgage on a small office building that Uphoff also owns and rents to tenants (most of whom are solo law practitioners). The mortgage Uphoff signed does not have any provisions regarding leases of office space within the building or the rents payable under those leases. [This is atypical; most commercial mortgage documents contain a provision called an “Assignment of Leases and Rents.”] If Uphoff defaults to the Bank, should the Bank be able to claim that it also has a lien against the rents that the tenants have to pay to Uphoff under their leases? Can the Bank direct Uphoff’s tenants to pay their rent to the Bank rather than to Uphoff, without first having to reduce its claim against Uphoff to judgment and conducting a foreclosure sale)? To what extent does the applicable “theory” of mortgage law matter? Should “rents” from real estate be subject to the same basic rules as “proceeds” of personal property? 2. Assume that Bailey owns the Tiger Shopping Center (“Center”), which has 10 existing tenants. Bailey financed the purchase of the Center by obtaining a mortgage from Equitable Life Assurance Company (“Equitable”). Bailey has defaulted on the mortgage (assume he didn’t make the monthly payments due for December and January). The Center is in a state that permits only judicial foreclosure; the foreclosure process in the state takes (on average) 12-18 months to complete. Assume that the mortgage also contains an “assignment of leases and rents” provision that purports to assign the rents to Equitable as additional security for the mortgage loan. The mortgage is properly recorded. (a) Based on the reading, why would Equitable be reluctant to take physical possession of the land before it can complete a foreclosure sale? (b) Suppose that all 10 tenants pay their January 2013 rent to Bailey, and Bailey used the money to pay Lambert Paving to resurface the parking lot. Equitable has now sued Lambert Paving, claiming that the rent used to pay Lambert Paving belonged to Equitable (having been assigned to Equitable) and thus that Lambert Paving had converted Equitable’s property. Should Equitable prevail? Why or why not? (c) Now suppose that Bailey files for bankruptcy on January 30. Further, assume that all of the tenants have now paid their February 2013 rent, into a segregated account under the control of the bankruptcy court. Equitable argues that the rents are its property or, at a minimum, are subject to its security interest. The bankruptcy trustee argues that Equitable’s interest is not properly perfected because Equitable had not taken steps to enforce its right to collect the rents prior to Bailey’s bankruptcy filing, and so the trustee claims that as a result, Equitable’s interest in the rents is unenforceable against the bankruptcy trustee (who plans to take the rents and use them to pay Bailey’s unsecured creditors). How should the court rule, and why? (d) For purposes of this question, assume Bailey did not file bankruptcy. Instead, assume that Equitable notified all of the tenants to pay their rent directly to Equitable. All 10 tenants did so in February. Equitable wants to apply 100% of the rents to reduce the mortgage debt. Bailey argues that Equitable should have to make a portion of the rents available to Bailey to allow him to pay the day-to-day expenses of operating the Center. Can Equitable apply the rents to the mortgage debt, or does it have to allow Bailey to use them to pay the expenses of operating the Center?