An Econometric Analysis of the Demand for RTE Cereal

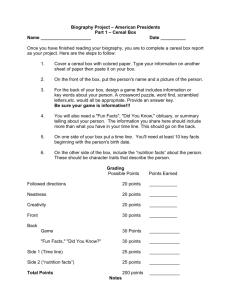

advertisement