Presentation 01-311-4

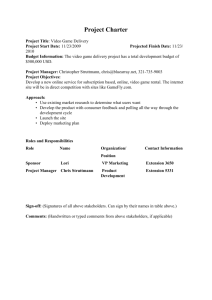

advertisement

Crafting Corporate Strategies Part 4 – Portfolio www.BizIsSimple.com © Chris Stern 01-311-4, v. 9-13 1 4. Phase: Portfolio www.BizIsSimple.com © Chris Stern 01-311-4, v. 9-13 2 Portfolio Decision about Segmentation n n Broadly, markets can be divided according to a number of general criteria, such as by industry or public versus private sector. Small segments are often termed niche markets or specialty markets. However, all segments fall into either consumer or industrial markets. Although it has similar objectives and it overlaps with consumer markets in many ways, the process of Industrial market segmentation is quite different. P S1 S1 P S1 S1 One product to many segments www.BizIsSimple.com © Chris Stern 01-311-4, v. 9-13 n n n n n P P D Differential: it must respond differently to a different marketing mix A Actionable: you must have a product for this segment to be accrued M Measurable: size and purchasing power can be measured A Accessible: it must be possible to reach it efficiently S Substantial: the segment has to be large and profitable enough P S1 Many products to one segment P P S1 S1 P P S1 S1 Many products to many segments 3 Portfolio The Origins of Segmentation In 1526 Mastro Bartolomeo Beretta (1490 – 1565/68) of Gardone received 296 ducats as payment for 185 arquebus barrels sold to the Arsenal of Venice. Already in production in the early 1500s, Beretta products were chosen by the highly discriminating Republic of Venice because of their excellence. As the Beretta name became synonymous with uncompromising quality, design, materials, construction and performance, word spread beyond the Italian borders, establishing a tradition that has carried over, uninterrupted, through fifteen generations of Berettas. www.BizIsSimple.com © Chris Stern 01-311-4, v. 9-13 4 Portfolio Portfolio-Management – Axes (1) www.BizIsSimple.com © Chris Stern 01-311-4, v. 9-13 5 Portfolio Portfolio-Management – Axes (2) www.BizIsSimple.com © Chris Stern 01-311-4, v. 9-13 6 Portfolio Portfolio-Management – Axes (3) www.BizIsSimple.com © Chris Stern 01-311-4, v. 9-13 7 Portfolio Segment Portfolios “Question Mark” Market attractiveness “Star” aggressive strategies 100 high 1: Invest in defense 2: Invest and hold 1 3 67 selective strategies 4 medium 3: Grow qualitatively/quantitatively 4: Selectively invest in promising areas of business, or divest accordingly 5: Segmentation 5 33 2 defensive strategies low 6 7 6: Harvest, Milk the cow 7: Divest, sell the dog “Dog” 0 www.BizIsSimple.com 0 © low 33 medium Chris Stern 01-311-4, v. 9-13 67 high 100 Own Competencies “Cash Cow” 8 Portfolio Classical Life Cycle Positioning Development Introduction Growth Repositioning Survival Rebirth Development Introduction Growth Maturity Decline Dead Time to Market Educate Market and build brand identity Refine product and build brand preference Augment and differentiate product and build brand reputation Phase out weak models, reduce costs and milk the brand Get out, transfer the brand to another product Source: Adapted from Theodore Levitt, HBR, 1965 www.BizIsSimple.com © Chris Stern 01-311-4, v. 9-13 9 Portfolio Product Life-Cycle Strategies Growth Stage • Improve product quality and add new product features and improved styling • Ad new models and flanker products • Enter new market segments • Increase distribution coverage and enter new distribution channels • Shift from productawareness advertising to product-preference advertising • Lower prices to attract next layer of price sensitive buyers www.BizIsSimple.com © Chris Stern 01-311-4, v. 9-13 Maturity Stage Market Modification • Expand number of brand users by - converting nonusers - Entering new market segments - Winning competitors’ customers • Convince current users to increase usage by: - using the product on more occasions - using more of the product on each occasion - Using the product in new ways Product modification • Quality improvement • Feature Improvement Marketing Mix Modification Declining Stage • Increase firm’s investment to dominate market and strengthen its competitive position • Maintain the firm’s investment level until the uncertainties about the industry are resolved • Decrease the firm’s investment level selectively by dropping unprofitable customer groups, while simultaneously strengthening the firm’s investment into lucrative niches • Harvesting the firm’s investment to recover cash quickly • Divesting the business quickly 10 Portfolio Life Cycle Patterns 1. Growth-Slump-Maturity Pattern 2. Cycle-recycle pattern 3. Scalloped pattern Common for drugs. Second Push of the product in an attempt to recover development cots Sales Volume Sales Volume Time to market rewards, followed by a severe slump. Sales are maintained by late adopters and replacements by the initial purchasers Time 4. Style Pattern Secondary cycle Time Sales Volume Style is a basic mode of expression. Clothing: Formal, traditional, casual, hip, etc. Sales Volume Result from the identification of new uses for the product Time www.BizIsSimple.com Primary cycle © Chris Stern 01-311-4, v. 9-13 Time 11 Portfolio Industry Life Cycle Situation Industry Sales Total Industry Sales Sales of Company Time www.BizIsSimple.com © Chris Stern 01-311-4, v. 9-13 12 Portfolio Value Chains show options for growth Contribution Margin = Sales – Raw Material Costs $ Key Elements today Options for future growth Innovation (Build new business) Evolution of Current Portfolio (Expand existing business) Totally new product lines needing significant R&D New products currently in final stage of development Modifications to existing product lines and continuous product development Existing Portfolio (Defend existing business) 2011 www.BizIsSimple.com 2012 © Chris Stern 01-311-4, v. 9-13 2013 2014 2015 13 www.BizIsSimple.com © Chris Stern 01-311-4, v. 9-13 Cautious Live-for Today Slow Comfortably Well-off Stop Pained-but-Patient Slam-on-the Brakes Four New Customer Segments Unconcerned 14 Segment 1: Slam-on-the-Brakes www.BizIsSimple.com © Chris Stern 01-311-4, v. 9-13 Cautious Live-for Today Slow Comfortably Well-off Stop Pained-butPatient Slam-on-the Brakes n Will reduce purchases overall and seek lower-cost substitutes for essentials n Reduces all types of spending by eliminating, postponing, decreasing, or substituting purchases n Eliminate purchases of expendables Unconcerne d 15 Segment 2: Pained-but-Patient www.BizIsSimple.com © Chris Stern 01-311-4, v. 9-13 Cautious Live-for Today Slow Comfortably Well-off Stop Pained-butPatient Slam-on-the Brakes n Tend to be resilient and optimistic about the long-term, but less confident about the prospects for recovery in the near future n Economize in all areas, though less aggressively n As news get worse, they migrate into the slam-on-the-brakes customers Unconcerne d 16 Segment 3: Comfortably Well Off www.BizIsSimple.com © Chris Stern 01-311-4, v. 9-13 Cautious Live-for Today Slow Comfortably Well-off Stop Pained-butPatient Slam-on-the Brakes n Feel secure about their ability to ride out current and future bumps in the economy n Spend at near-prerecession levels, though now they tend to be a little more selective about their purchases Unconcerne d 17 Segment 4: Live-for-Today www.BizIsSimple.com © Chris Stern 01-311-4, v. 9-13 Cautious Live-for Today Slow Comfortably Well-off Stop Pained-butPatient Slam-on-the Brakes n Carries on as usual and for the most part remains unconcerned about spending n Respond to the recession mainly by extending their timetables for making major purchases or decisions Unconcerne d 18 Four Product and Service Categories www.BizIsSimple.com © Chris Stern 01-311-4, v. 9-13 Perceived as unnecessary or unjustifiable Expendables Needed or desired items whose purchase can be reasonably put off Postponables Indulgences whose immediate purchase is considered justifiable Necessities Essentials Necessary for survival or perceived as central 19 Postponables Expendables Slam-on-theBrakes Will seek lower-cost product and brand substitutes such as private labels Will deeply reduce or eliminate treats or seek lower-cost substitutes Will put off all durable purchases unless forced to make emergency replacements. Will delay repairs and services Will eliminate purchases in this category Will seek out favorite brands at lower prices but settle for cheaper, less-preferred alternatives, will stock up on good deals Will cut back somewhat on frequency and quantity and emphasize value Will delay major purchases, repair rather than replace, seek value and low ownership costs rather than extra features, and negotiate at point of sale Will deeply curtail expendables Will seek better quality for the price; will negotiate harder at point of sale Rarely regards any purchase as unjustifiable but may reduce the most conspicuous consumption in this category May buy if there is a great deal; otherwise may postpone Is reluctant to regard and customary purchase as unjustified. May not want to expand consumption to new types of purchases Live-for-Today Will continue to buy favorite brands at prerecession levels Will continue to buy favorite brands at prerecession levels www.BizIsSimple.com © Will be more selective in purchasing luxuries or expensive services Will continue to buy favorite brands at prerecession levels Chris Stern 01-311-4, v. 9-13 Risk of Sales Downturn Behavior Change Necessities Comfortably Well-Off Essentials Pained-butPatient Customer Segment’s Changing Behavior 20 Tailoring Your Tactics •Emphasize price •Offer smaller pack sizes for lower price •Expand private labels •Promote low-cost value product •Introduce fighter brand •Shrink sizes •Hold prices down •Market as a “needed treat or indulgence” •Offer layaway plans •Provide low-cost financing •Promote exceptional deals •Challenge penny-wise, pound-foolish behavior (maintenance, service) •Offer do-it-yourself alternatives to doing without •Continue awareness marketing •Offer a lower-priced option •Hit competitive price points •Promote bonus packs to encourage stock-piling •Emphasize dependability of branded product or service •Reward loyal customers, even if they buy less •Advertise products as morale raisers •Advertise products as affordable alternatives to more expensive brands •Offer simpler models, lower prices •Promote loweroperation-cost models •Promote repair services •Continue awareness marketing •Invest in core product improvements that will accelerate customers’ reentry into market •Continue awareness marketing •Emphasize outstanding quality •Market as a product you need because you are successful •Promote savings from buying now •Advise customers they are missing out by postponing •Enable discreet purchasing that avoids the appearance of flaunting •Advertise benefits of impressing competition •Continue awareness marketing •Remind customers, “You can’t make it without it” •Offer convenient and automatic billing •Promote as opportunity to seize the moment •Offer monthly payment plans •Promote quality-of-life benefits of buying now •Offer exciting new products and promote as “must have” •Market as products you aspire to buy when the world changes again © Risk of Sales Downturn •Behavior Change Slam-on-theBrakes Expendables Pained-butPatient Postponables Comfortably Well-Off Necessities Live-for-Today Essentials 21 References n Michael Porter, Competitive Strategy: Techniques for Analyzing Industries and Competitors (1980, New York, The Free Press) n Philip Kotler, Marketing Management (2002, Upper Saddle River, Prentice Hall) n Chris Stern, Total Customer Focus (2005, Philadelphia, Xlibris) n Cynthia A. Montgomery, Putting Leadership Back into Strategy, HBR 1/2008 n Robert Kaplan, David Norton, Mastering the Management System, HBR 1/2008 n Michael Porter, The Five Competitive Forces That Shape Strategy, HBR 1/2008 n Joan Magretta, Understanding Michael Porter, (2012, Boston, Harvard Business School Press) n John A. Quelch, Katherine E. Jocz, HBR April 2009, p;. 52ff n Chris Stern, Business is Simple, 2013, Raleigh, Webbook on http://www.bizIsSimple.com www.BizIsSimple.com © Chris Stern 01-311-4, v. 9-13 22