An Exercise in Comparative Advantage

advertisement

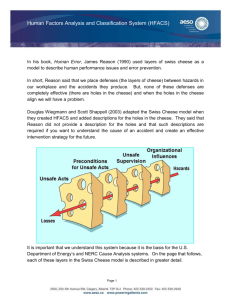

An Exercise in Comparative Advantage Assumptions: 2 countries: Holland and Belgium 2 goods: Cheese and Beer 1 input (i.e. factor of production): Labor, immobile between countries Labor requirements: Holland Labor required to make 1 cheese 50 Labor required to make 1 beer 5 Belgium 90 6 Analysis: From the labor requirements, opportunity cost can be calculated: Holland Opportunity cost of producing 1 cheese 50/5 = 10 beers Opportunity cost of producing 1 beer 1/10 of a cheese Belgium 90/6 = 15 beers 1/15 of a cheese When Holland produces 1 cheese, it could have produced 10 beers instead. Those 10 foregone beers are Holland’s opportunity cost of producing 1 cheese. Note that the opportunity cost (in terms of beers) of producing 1 cheese can be calculated by dividing the labor required to make 1 cheese by the labor required to make 1 beer. If the 50 units of labor required to make 1 cheese were instead allocated to beer production, then those 50 units of labor would produce 10 beers. Holland has an absolute advantage in production of both goods. That is, Holland can produce 1 cheese with fewer units of labor than Belgium, and the same for beer. Holland has a comparative advantage only in the production of cheese, and Belgium has a comparative advantage in the production of beer: Each country has a comparative advantage in the good that it can produce at a lower opportunity cost than the other country, by definition. Note that if a country has a comparative advantage in some good, this does not necessarily mean that the country can produce this good more cheaply in terms of the input (in this exercise, labor) than the other country. For example, Belgium has a comparative advantage in making beer even though it requires more labor to produce a beer than Holland (i.e. even though Holland has an absolute advantage in making beer). Suppose that each country has 900 units of labor. Then each country’s production possibility frontier (i.e. map of all possible combinations of production of the two goods, if all labor is employed; i.e. frontier of the map of all possible combinations of production of the two goods), or PPF, can be drawn as: The diagonal lines are the PPFs. Note that the absolute value of the slope of a country’s PPF equals the opportunity cost of producing one unit of the good measured on the horizontal axis (cheese), as measured in foregone units of the other good (beer). Note that 900/5=180; 900/50=18; 900/6=150; 900/90=10. These are the endpoints of the PPFs because they are quantities of a good that a country can produce if it uses all of its labor to produce that good, that is if it specializes completely in producing that good. Suppose that before trade is opened, Holland and Belgium are producing at points A and C on their PPFs. Both countries can gain, each consuming more of both goods at points beyond their PPFs, by specializing and trading: Suppose that each country completely specializes in the good in which it has a comparative advantage, so that Holland produces 18 cheeses and Belgium produces 150 beers. They agree on a price between their opportunity costs (more than 10 beers per cheese, less than 15 beers per cheese), and trade goods at that price. Suppose a price of 12 beers per cheese. Suppose that Holland trades 7 of its 18 cheeses for 84 of Belgium’s 150 beers. Then Holland has 11 cheeses and 84 beers, and Belgium has 7 cheeses and 66 beers. They consume at points B and D, which would not be possible without trading (i.e. these points are beyond the PPFs). Note that joint production under autarky (which means “no trade”) was 140 beers and 16 cheeses, but under trade is 150 beers and 18 cheeses. By specializing and trading, both countries can consume more of both goods, and thus are both better off than under autarky. This is despite that Holland has an absolute advantage in the production of both goods. The insight underlying this exercise is due to David Ricardo, The Principles of Political Economy and Taxation, first published in 1817.