Henry Sy, Sr - SM Investments Corporation

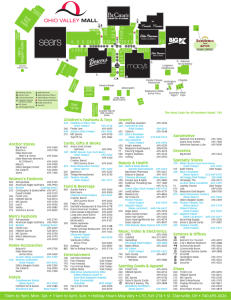

advertisement