caveat emptor - lessee beware - Leasewright Commercial Realtor

advertisement

CAVEAT EMPTOR - LESSEE BEWARE Contrary to popular belief, most retail Landlords are willing to modify their boilerplate lease to provide tenants with some level of comfort and recourse should problems arise. While you will never get everything you ask for, you won't get anything without asking. Amazingly, many retail tenants or their representatives will fight tooth and nail to save $.50/s.f on their basic rent, leaving themselves vulnerable to excessive charges and other potentially damaging circumstances that could ultimately put them out of business. While there are over 150 specific areas of concern for reasonableness in the typical retail lease, here are some critical clauses that tenants should insist be part of their lease document: Shell Condition - Vacant retail spaces can be leased as a "plain vanilla shell", or a "cold-dark shell", or a "warm-lighted-powered shell", or "as-is." There are plenty of variations in between as well. Be sure your lease clearly defines in writing exactly what condition the Landlord is going to deliver the space to you in. Insist on a detailed drawing if possible that denotes the Landlord's responsibilities. Most Landlord's leases will state that when you take occupancy of the space, you are accepting its' condition at that time. Don't! Modify the terms defining "Ready for Occupancy" to be after you have completed an inspection of the premises and the Landlord has completed any punch list items to your satisfaction. Your $10,000 renovation budget could quickly double or triple if you are not careful here. Method of Measurement - Put three architects in the same space and they will inevitably arrive at three different calculations of square footage. CAD drawings (computer-aided design), which calculate square footage automatically, have improved this situation dramatically, but are still based on field measurements which could be subject to error. Before you sign a retail lease, make sure you check the measurement yourself or with an architect of your own. Ask the Landlord to specifically define how the space has been measured. There are many variations, including some that count the sidewalk outside your space! Most measurement errors are inadvertent, honest mistakes. Others are viewed by a few landlords as take-what-you can-get profit centers. Either way, slight mismeasurements can cost you thousands of dollars over the life of a lease. Surprisingly, less than 5% of all tenants field-measure their spaces. Landlord's Warranty - Whenever you take over an existing space, you have no idea what condition its mechanical, electrical and plumbing system will be in. You may not have the time or money to hire an engineer or contractor to inspect those systems. And you certainly don't know how well they will be working after you move in, especially if they have not been in use for an extended period. Standard retail leases make you responsible for repairs the moment you accept the premises. Insist that the Landlord give you a 90-day warranty on the proper operation of those systems. If you are taking over your space in the summer, specifically request a 180day warranty on the heating system. You don't know what you have inherited, and it could cost you a fortune in repairs unexpectedly. Gross Sales Exclusions - Most retail leases require the tenant to report gross sales every month and pay to the Landlord a percentage of those sales over a certain negotiated amount. Landlord's leases usually insist that any and all monies you collect are to be included in their definition of gross sales. This shouldn't necessarily be the case. Insist on exclusions for such things as: discounted sales to employees; wholesale transactions to other vendors; penalty charges you receive for foiling a returned check; interest, service or carrying charges in excess of the sales price of any merchandise; and accounts receivable charged off as bad debt. Credit card sales and layaways should be counted as gross sales when you are actually paid, not when the sale is completed. Be sure you define this carefully in your lease, or you may be paying the Landlord percentage rent on sales you yourself haven't been paid on yet! Exclusives - Nothing can be more damaging to a retailers business than when the Landlord allows another tenant in the shopping center to sell similar merchandise. Most Landlords are very careful with their tenant mix, and insist they would never lease to a competing business. Get it in writing. Your Landlord may not be your Landlord tomorrow! You would be surprised how many retailers have trusted their Landlord's word, only to be forced out of business when a better deal can be completed with a "bigger name" retailer in later years. Others have found out the hard way that some Landlords will intentionally do this to retaliate against them over some unrelated dispute. Small retailers without deep pockets are particularly vulnerable to this. Many Landlords will take a very hard line about exclusives because it can be very problematic for them. If you can't get them to budge, interview other tenants in the Mall or strip center to ferret out any horror stories that would indicate a pattern of disrespect that could affect your livelihood. Expense Exclusions - The direct pass-through of operating expenses and common area charges is the smoking gun of all retailers. You never know exactly what you'll be hit with, and surprises abound. You can protect yourself and minimize your exposure several ways. First, request a cap on year-to-year increases so that they do not exceed the relative inflation rate. Some Landlords will agree to restrict your exposure to no more than a 5% maximum increase. Second, define the things the Landlord cannot pass through to you. A list of legitimate and reasonable exclusions can run over 25 items. Important ones to exclude are: capital repairs and replacement costs; severance payments to terminated employees; the Landlord's pursuit of or defense of any legal action; brokerage commissions; and any costs related to marketing vacant spaces. These are just a few of the many potholes to watch for on the road to retail riches. Carefully and thoroughly negotiating around them will cost you a pittance compared to the financial and emotional ruin that might unknowingly await you. Darrell Nevin of LeaseWright Commercial Real Estate, LLC, is a tenant advocacy broker and advisor for office, retail, and industrial businesses. He is located in Columbia, Maryland and can be reached at 410-953-6370.

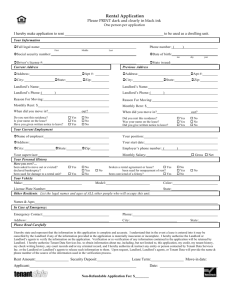

![[Date] [Name of Landlord I`m Applying to] [Landlord I`m Applying to](http://s3.studylib.net/store/data/006797608_2-3bf07d32e3f6a0a58c5d937b12404929-300x300.png)