notice of meeting and management information

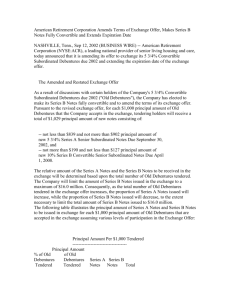

advertisement