to view the bulletin in PDF format

advertisement

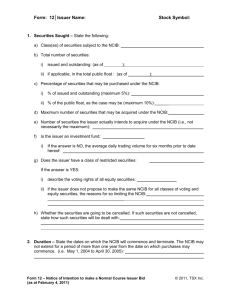

Securities Law Update Bulletin May 2007 Fasken Martineau DuMoulin LLP AMENDMENTS TO TORONTO STOCK EXCHANGE’S RULES ON NORMAL COURSE ISSUER BIDS AND DEBT SUBSTANTIAL ISSUER BIDS COMING INTO FORCE ON JUNE 1, 2007 – A REMINDER Peter Villani, Nicolas Morin, Montréal On April 27, 2007, the Toronto Stock Exchange (the “TSX”) issued a Notice of Approval for Amendments to Toronto Stock Exchange’s Policy on Normal Course Issuer Bids and Debt Substantial Issuer Bids (the “Amendments”). The Amendments will be effective on June 1, 2007. The Amendments will effect a change on how normal course issuer bids (“NCIB”) are conducted. While this newsletter does not purport to be an exhaustive review of the Amendments, we would like to offer highlights in order to reflect the major changes that are implemented by the Amendments. Vancouver Calgary Toronto Ottawa Montréal Québec City New York London Johannesburg www.fasken.com Normal Course Issuer Bids – Sections 628 and 629.1 The most critical aspect of the Amendments is the replacement of the definition of NCIB for listed issuers who are not an investment fund to permit those listed issuers to buy-back during the same trading day the greater of (a) 25% of the average daily trading volume (“ADTV”) of the listed securities of that class, and (b) a total of 1,000 securities. The ADTV is calculated on the basis of a six month period of trading of the listed securities immediately preceding the date of acceptance of the NCIB by the TSX. Issuers (including investment funds) are still entitled to purchase, on a 12-month period, up to 10% of the public float (including the issued and outstanding securities but excluding the securities that are pooled, escrowed or non-transferable and the securities that are held by the issuer itself, senior officers or directors and principal securityholders) calculated on the date of acceptance of the notice of NCIB by the TSX, or 5% of their issued and outstanding securities calculated on the date of acceptance of the notice of NCIB by the TSX. There is however an exception to the above purchase rules. The issuer is entitled to make one block purchase per calendar week which exceeds the above daily restrictions. A “block” is defined in the Amendments as a quantity of securities that are not owned by an insider and that either (a) has a purchase price of $200,000 or more, or (b) constitutes at least 5,000 securities having a purchase price of $50,000, or (c) constitutes at least 20 board lots of the security and total 150% or more of the ADTV for that security. An other interesting change is that any NCIB purchases may be made on the same trading day of the block purchase. However, once the block purchase exception has been relied on, the issuer may not make any other NCIB purchases for the remainder of that trading day. Fasken Martineau DuMoulin LLP SECURITIES LAW BULLETIN (cont’d) In order for the issuer to not be able to abnormally influence the market price of its securities, NCIB purchases have to be made at a price which is not higher than the last independent trade of a board lot of the class of securities which is the subject of the NCIB. The Amendments enumerate the following trades as non-independent : (a) trades directly or indirectly for the account of an insider, (b) trades for the account of a broker making purchases for the bid, (c) trades solicited by the broker making the purchases for the bid, and (d) trades by the broker making in order to facilitate a subsequent block purchase by the issue rat a certain price. Use of Derivatives and Accelerated Buy Backs in Conjunction with Normal Course Issuer Bids – Section 629.1 Undisclosed Material Information The Manual prohibits an issuer from making any purchases of securities pursuant to a NCIB while it possesses any material undisclosed information. However, the Amendments state that this restriction does not apply to an NCIB carried out through automatic securities purchase plans established by the issuer pursuant to applicable securities laws. Under Ontario securities laws, purchases and sales of securities are exempted from the general prohibition from trading with knowledge of an undisclosed material fact or material change and any liabilities related to such trade where the purchases or sales were made through an automatic securities purchase plan that was entered into by the person making the trade prior to the acquisition of knowledge of such material fact or material change. We may then conclude that an issuer will be allowed to purchase its own securities under an automatic securities purchase plan conducted under its NCIB even if it possesses undisclosed material fact or material change at the time of the actual purchase. The important thing to remember is that at the time the decision to purchase was made (reflected by the instructions to the broker to proceed with the purchase), the issuer is not to have been in possession of undisclosed material fact or material change. 2 The TSX has decided not to integrate the proposed amendments as set forth in the October 2005 draft version to the Amendments. Therefore, Section 629.1 will not be in effect and will be published at an undisclosed later date. Debt Substantial Issuer Bids – Section 629.2 A debt substantial issuer bid (“DSIB”) is an issuer bid, other than a NCIB, for debt securities that are not convertible into securities other than debt securities. An issuer making a DSIB must file with the TSX a notice in the form of new Form 13 of Appendix H of the Manual which must be accepted by the TSX. After such notice has been accepted by the TSX, a book for receipt of tenders to the DSIB must be opened on the TSX not sooner than the thirty-fifth calendar day after the date of such acceptance and for such length of time, as may be determined by the TSX. A DSIB must be made to all the debt securityholders for identical consideration. If more debt securities are tendered than the issuer originally sought, the issuer must take up the debt securities on a pro rata basis. Effective Date and Transition As stated in the beginning of this newsletter, the Amendments will take effect on June 1, 2007. Notwithstanding the effective date, a bid whose commencement date was prior to June 1, 2007 or whose notice have been accepted by the TSX, but have not yet commenced, may comply with the former rules. The issuers who are eligible to be grandfathered under the former rules may still elect to comply with the Amendments, provided that, a notice of intention is filed in compliance with new Form 12 of the Manual, and upon acceptance by the TSX, a press release reflecting the revisions to the bid is filed. Fasken Martineau DuMoulin LLP SECURITIES LAW BULLETIN (cont’d) For more information, please contact Peter Villani or your Fasken Martineau professional. 3 Peter Villani 514 397 4316 pvillani@mtl.fasken.com Nicolas Morin 514 397 7471 nmorin@mtl.fasken.com The texts included in this collection are intended to provide general comments on Securities Law. They reflect the point of view of their respective author and are not opinions expressed on behalf of Fasken Martineau DuMoulin LLP or other member corporations. These texts are not intended to provide legal advice. Therefore, readers should seek out advice on issues specific to them before acting on any information set out in these texts. We would be pleased to provide additional information on request. © 2007 Fasken Martineau DuMoulin LLP Vancouver Calgary Toronto Ottawa Montréal 604 631 3131 info@van.fasken.com 403 261 5350 info@cgy.fasken.com 416 366 8381 info@tor.fasken.com 613 236 3882 info@ott.fasken 514 397 7400 info@mtl.fasken.com Québec New York Londres Johannesburg 418 640 2000 info@qc.fasken.com 212 935 3203 info@nyc.fasken.com 44 20 7917 8500 info@fasken.co.uk 27 11 685 0800 info@jnb.fasken.com